Accessibility Of The Loan

Bank loans take a long time to fund, and theyâre not easy to apply for or qualify for. You have to put together a lot of paperwork, and it can take several weeks or even months for the bank to process your loan.

This being said, however, once the bank does their due diligence and finds you to be a trustworthy borrower, youâll get lower commercial bank loan interest rates.

Not every small business owner has the time to apply for a traditional bank loanâand not every business owner will even qualify for one, either. Luckily, alternative lending offers another solution.

Non-bank lenders offer quick business loans that are easy to apply for. You can get the funding you need in daysâwithout providing lots of information or putting up collateral for your loan. The catch is that in exchange for the ease and speed of your business loan application, lenders will charge high business loan interest rates.

How To Get Your Lowest Mortgage Refinance Rate

If youre interested in refinancing your mortgage, improving your credit score and paying down any other debt could secure you a lower rate. Its also a good idea to compare rates from different lenders if you’re hoping to refinance so you can find the best rate for your situation.

Borrowers can save $1,500 on average over the life of their loan by shopping for just one additional rate quote, and an average of $3,000 by comparing five rate quotes, according to research from Freddie Mac.

Be sure to shop around and compare rates from multiple mortgage lenders if you decide to refinance your mortgage. You can do this easily with Credibles free online tool and see your prequalified rates in only three minutes.

What Is An Arm Commercial Loan

ARM stands for an adjustable-rate mortgage, also known as a Variable Rate. ARMs are often used when borrowers desire lower monthly payments in the short term, but are willing to accept the risk of a higher interest rate. Commercial ARMs can be helpful for borrowers looking at several years of low commercial mortgage rates without taking on additional costs or restrictions of a fixed rate loan, like a prepayment penalty.

Read Also: Fha Loan Limits In Texas

Commercial Real Estate Loan Rates Summary

| Type of Loan | |

|---|---|

| 2.372% to 2.912% on commercial development company portion4% to 10% on lender portion | |

| Conventional Bank Loan | |

| Online Marketplace Loan | 8% to 12% |

If youre looking for a commercial real estate lender, South End Capital is an excellent choice. South End Capital has mortgages for commercial and investment residential properties, rural locations, special-purpose properties, and even land loans. Check out South End Capitals website for more information.

How Sba Disaster Loan Rates Are Determined

Disaster loan rates are determined by these factors:

- If you have the ability to access funds from other, non-federal, sources, the SBA will assign you higher interest rates.

- Type of business or organization: Disaster loans are granted to businesses, private non-profit organizations, small agricultural co-ops, and homeowners. Your interest rate will be dependent on the category you fit into. In general, businesses have the highest interest rates, whereas homeowners have the lowest.

- Type and location of disaster: Interest rates differ based on the disaster and area. To see the rates available in your area, take a look at the fact sheet via the SBAs disaster loan portal.

You May Like: Usaa Prequalify

How Sba Cdc/504 Loan Rates Are Determined

CDC/504 loan rates are based on the 5- and 10-year treasury rates plus a spread to the bond investor. Additionally, there are rate markups to cover fees for the SBA and its various partners, which include ongoing borrower fees, CDC servicing fees, and CSA fees:

- SBA borrower fees: 0.914%

- CDC fees: Minimum 0.625%

- CSA fees: 0.1%

In total, these fees usually add up to about 1.64%. There are some upfront fees included in your loan, but these fees are not rolled into your interest rate. The spread to the bond investor changes month-to-month, but we have averaged out last years spread to estimate the spread for 2021.

Overall, here is how we have come up with our estimated effective rates:

- 10-year loans: The 5-year treasury rate + averaged spread for last years 10-year loans + ongoing fees

- 20-year loans: The 10-year treasury rate + averaged spread for last years 20-year loans + ongoing fees

Let Us Help You Choose Between Fixed And Variable Rate

Our Commercial Mortgage offering can be tailored to your needs. Whether you want stability of a fixed rate, or want to benefit from lower variable rates, we can discuss your options and help you make the decision.

If you want to switch your commercial mortgage with us, simply enquire online. Well be in touch to talk through possible solutions tailored to your business and property.

You May Like: Flex Modification Calculator

Will Current Mortgage Rates Last

This week saw another increase in interest rates as the 30-year rate hit 3.56%.

The consensus among market observers is that the Federal Reserve will signal further changes to its monetary policy at next weeks Federal Open Market Committee meeting. Policy changes could include another pullback of its asset purchases, as well as moving toward the first increase in the federal funds rate beginning as early as March. If these expectations come to pass, rates could continue to climb.

Looking ahead, expect mortgage rates to stay above 3% for the foreseeable future.

Sba 504 Commercial Real Estate Loan Rates

Interest Rates: 3.5% 6%

SBA 504 loans are the most affordable commercial real estate loans, with rates as low as 3.5%. Commercial mortgage rates for this product are favorable because the U.S. Small Business Administration , working through local intermediaries called certified development companies , extends a portion of the loan. With SBA 504 loans, borrowers can finance the purchase, improvement, or renovation of real estate.

A 504 loan can range from $50,000 to $20 million or more and actually comprises three different parts: An SBA-approved CDC extends 40% of the loan, a bank or private lender extends 50%, and the remaining 10% of the loan comes from the borrower as a down payment.

The biggest benefits of SBA 504 loans are the long terms, fixed interest rates, and low down payment. These commercial real estate loan terms go up to 25 years, so you can enjoy low monthly payments and the commercial real estate interest rates here are fixed, so you can lock in a good rate without worrying about future increases. At 10%, the down payment is also very low compared to the equity youll need to provide for other types of commercial real estate loans.

Recommended Reading: How To Get Mortgage License In California

Important Legal Disclosures And Information

Offers available on new business term loans only. Offers may be extended, modified or discontinued at any time without prior notice. All loans and lines of credit are subject to credit approval. Requires automatic deduction from a business checking account. Offer not to be combined with other offers.

Applications must be received by January 31, 2022, and loans must be closed within 90 days of approval. Discount based on loan amount, term, and amortization schedule on a new Secured Small Business Loan and Small Business Commercial Real Estate Loan from $100,001 to $3,000,000, or SBA 504 or 7 Small Business Loans from $100,000 to $5,000,000. Your actual rate will be based upon a review of your credit application. 100% waiver on standard PNC Origination fee. Other fees and charges may apply. May be subject to property appraisal. Offer does not include a waiver on third-party costs or SBA Loan Fees. Refinances of existing PNC business loans are excluded.

All loans and lines of credit subject to credit approval and require automatic payment deduction from a business checking account. Additional fees may apply.

Prime Rate means the highest prime rate published in the “Money Rates” section of the Wall Street Journal for the last day of the preceding calendar month.

Bank deposit, treasury management, and lending products and services are provided by PNC Bank, National Association, a wholly owned subsidiary of PNC and Member FDIC.

Loan Repayment Term Length

The term of your business loan will also have an impact on what your rate will be. Short-term loans have higher APRs, but youâll pay less in total interest since youâre borrowing the money for a shorter period of time. Long-term loans are the opposite. They have lower APRs, but youâll have more in total interest.

If you have a genuinely short-term need for cash , a short-term loan might be a better value than a long-term loan. However, for genuine long-term needs like business expansion, a long-term loan will be better.

Recommended Reading: Fha Refinance Mortgage Insurance

A Line Of Credit To Help Conquer Your Goals

Get convenient access to cash and only pay interest on the funds you use. Enjoy this low introductory rate, equal to CIBC Prime currently at RDS%rate.PRIME.Published%, until July 22, 2022.

All fixed and variable rate loans are based on the CIBC Current Prime Rate.1

Rates as of RDS%SYSTEM_DATE%

| Loans | |

|---|---|

|

Your choice of term, payment frequency and fixed or variable interest rate. |

1 to 5 years |

|

Get terms up to eight years, with the possibility of no down payment. |

1 to 8 years |

|

Borrow $5,000 to $50,000 to take advantage of unused RRSP contribution room. |

1 to 10 years |

|

Get a lower interest rate by using the equity in your home |

Open ended |

|

Get flexible access to funds at interest rates lower than most credit cards. |

Open ended |

|

Borrow up to $40,000 to help with your post-secondary education costs. |

Open ended |

|

Borrow up to $350,000 to help cover costs. |

Open ended |

Recent Commercial Real Estate Loan Closings

- $4,620,000 loan

- $2,660,000 loan

- $5,323,125 loan

- $3,268,000 loan

- $5,950,000 loan

- $3,000,000 loan

- $2,500,000 loan

- $1,250,000 loan

- $1,050,000 loan

- $2,690,000 loan

Recommended Reading: How To Apply For A Second Loan With Upstart

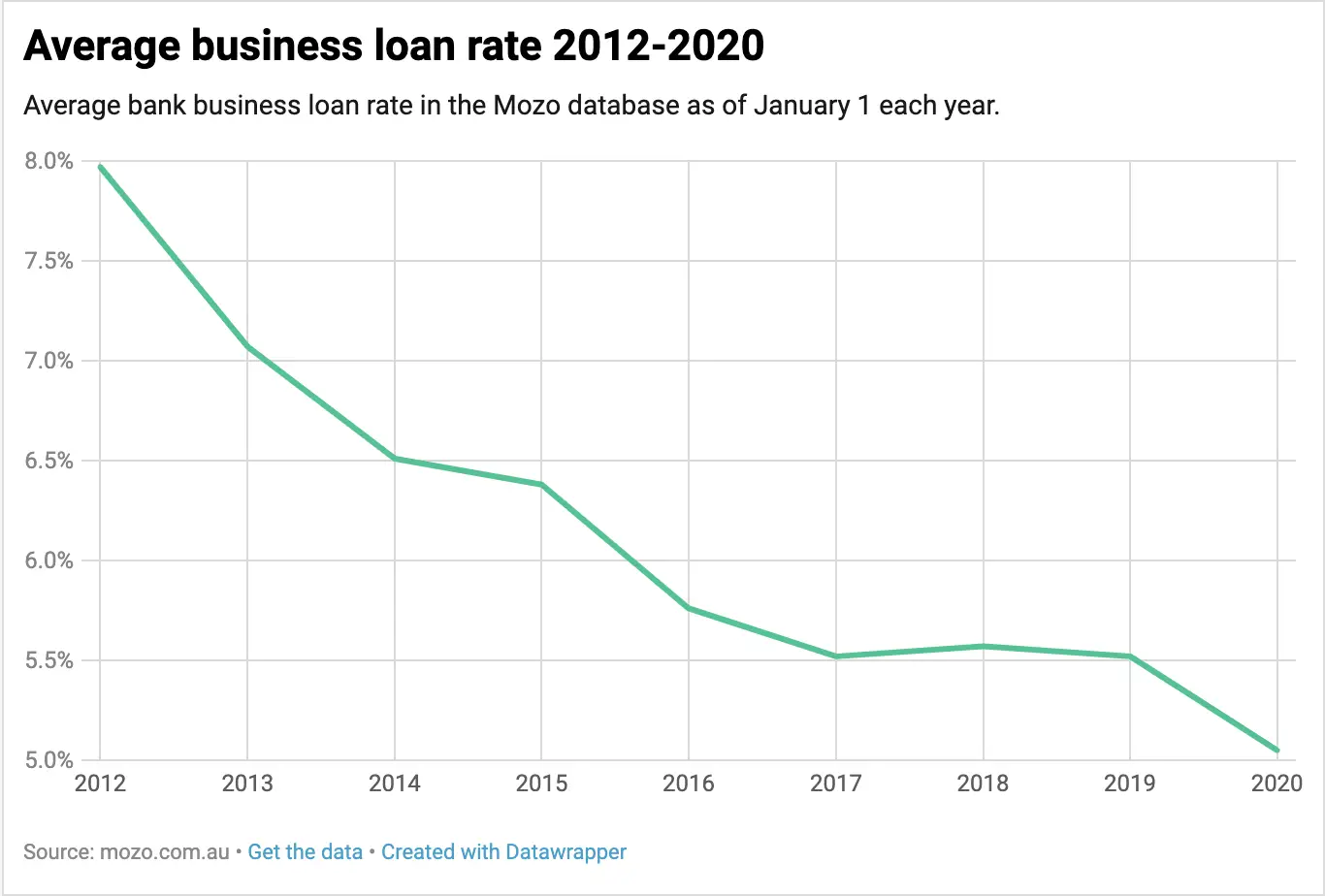

Average Commercial Loan Rates

Commercial real estate loan rates are complex and depend on numerous factors. Average commercial loan rates, therefore, can fluctuate, so check for the most up-to-date numbers. The following are updated as of March 2021.

A recent initiative by the Small Business Association lowered rates for 504 loans in an effort to help the economy recover from COVID-19:

- 10-year: 2.231%

SBA 7 loan rates are currently as follows:

- Variable: 5.50% to 8%

- Fixed: 9.25% to 11.25%

And, as mentioned above, conventional bank loans currently carry rates between 3% and 6.25%, though these rates are not capped and therefore some borrowers will receive commercial real estate loan rates that exceed these numbers, based on their qualifications.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. Its estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didnt get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Recommended Reading: How Much Car Can I Afford Based On Income Calculator

Is Now A Good Time To Refinance

Mortgage refinance rates have been at historic lows all year. Its unlikely theyll go much lower and extremely possible theyll begin to rise in the coming months. But low rates arent the only factors that determine whether now is a good time for you to refinance your home loan.

Everyones situation is different, but generally, it may be a good time to refinance if:

- Youll be able to get a lower interest rate than you currently have.

- Refinancing will save you money over the life of your home loan.

- Your savings from refinancing will ultimately exceed closing costs.

- You know youll be staying in your home long enough to recoup the costs of refinancing.

- You have sufficient equity in your home to avoid private mortgage insurance .

If your home needs significant, costly repairs it might be a good time to refinance in order to withdraw some equity to pay for those repairs. Just be aware that lenders generally limit the amount you can take from your home in a cash-out refinance.

Sba Disaster Loan Rates

SBA Disaster Loans are designed to help businesses stay afloat and rebuild following a disaster. To qualify for a disaster loan, you will need to be a business or consumer in a declared disaster area. A disaster loan is used to cover costs that arent met by your insurance company or FEMA.

If your business has been affected by a disaster, you might qualify for a long-term, low-cost loan for physical or economic damages. Loans for physical damage can be used to repair or replace property damaged by the disaster. Loans for economic damages can be used to help small businesses survive until normal operations resume after a disaster by giving you the working capital necessary to keep your business going.

Read Also: Stilt Interest Rates

The Lse Alumni Turning Their University Into A Startup Powerhouse

How are the funds going to be used?

If the money from the loan is going to be invested into the subject property or the borrowers business and has the potential to generate additional income, the cost of the financing becomes less relevant. Whats more important is the ability to seize an opportunity. In this case, timing is everything.

Consider, for example, an investor who places a competing bid to purchase an underperforming property. The investor has a plan to rehabilitate the property and then sell or operate it at a profit. The investor may shop around for a low-interest loan but will likely be declined because the property is not stabilized. By wasting time chasing lower interest, the investor may lose the purchase contract.

Alternatively, the investor could come to the table with a readily available, higher-interest bridge loan. Because the underwriting requirements for this short-term financing are more liberal, the investor may move through the application process more quickly. Once the property is stabilized and timing is not as critical, the investor can look at refinancing at a lower interest rate. By following this approach, the investor can realize an opportunity to generate a predictable profit.

How long does the investor plan to keep the property?

How much are the payments?

What is being collateralized?

Current Sba 7 Interest Rates

The maximum rate for SBA 7 loans varies based on your term length, the borrowing amount, and the base rate . Below are the current rates for most SBA 7 business loans :

| Loan Amount |

|---|

SBA Express and SBA Export Express loans have slightly different rates. Currently, the maximum rate for Express loans of $50,000 or less is 9.75% the rate for loans above $50,000 is 7.75%.

Also Check: Rv Loan Calculator Usaa

Determine Your Commercial Mortgage Payments

Not sure how much money youd be paying out every month on a commercial real estate loan? Forecast your payments quickly and easily with this commercial mortgage calculator.

Browse hundreds of loan options, custom-tailored to your business and budget needs, from a single, simple platform.

What Determines Commercial Leveraging Finality

The posted mortgage loan rates are very important guidelines. However, one should not interpret these rates as an offer to loan.

Why? The simple answer to this question is that fixed rates and variable rates are hugely deviating items. In other words: they depend on several factors.

Here are some of the several factors that determine the commercial mortgage rates:

- Bank or credit union

- repayment option

- loan term option.

Further, an underlying assumption of all rates as provided is application to a commercial mortgage at 75% LTV. Naturally, lower LTV generally demands lower commercial mortgage rates.

Bottom line: The index rates are dynamic and rely on several factors. You need a professional broker to guide you for commercial real estate loans.

Once again: Our tables reflecting current index rates and spreads apply for today as we see them and they should be regarded strictly as a guideline. We will cover more about why you need a professional broker as a guide for commercial real estate loans in the rest of this article.

Recommended Reading: Car Loan Calculator Usaa

How Commercial Real Estate Loan Rates Work

Commercial real estate loans can help you finance the purchase, improvement, or upgrade of almost any type of commercial propertyâfrom a retail shop to an office to a warehouse and everything in between. There are a few things that you should be aware of about commercial mortgage rates to make sure youre getting the best deal. Heres what you need to know.