Our Top Picks For Best Debt Consolidation Loans

- LightStream – Best for excellent credit

- SoFi – Best for no fees

- PenFed – Best for small debt

- Fiona – Best for comparing lenders

- Discover – Best for credit card debt

- – Best for fair to excellent credit

Why we chose it: Lightstream is our top choice for borrowers with good or excellent credit who are looking for a large loan with competitive rates and zero fees.

- No fees for loan application, origination or prepayment penalty

- Rate beat program and satisfaction guarantee

- 0.5 rate discount for setting up autopay

- Full online application

- Doesn’t accept loan information via phone or fax

- Requires several years of credit history and no direct payment to creditors

- Autopay discount only available before loan disbursement

LightStream offers personal loans up to $100,000 annual percentage rates ranging from 5.73% to 19.99% with an autopay discount. This lender processes their completely online application seven days a week until 6 p.m. You can check Lightstream debt consolidation loan lowest rate and payment options just by entering your desired loan amount on their debt consolidation loan calculator. This calculator doesnt require a soft credit pull, and its not a pre-approval. It provides a general calculation based on your desired loan amount. For a more precise rate, a full loan application is required.

One of the downsides to Lightstream is that their customer service is only available through email from Monday to Saturday.

Is Credit Card Debt Consolidation A Good Idea

The goal of credit card debt consolidation usually is to roll your high-interest credit card debts into one easy payment with a lower interest rate. If anything else, it provides a clear path to getting debt-free as the terms tend to have a fixed paydown period. This more structured feel may be exactly what you need to be on your way to being debt-free, even if there are some setup or origination fees.

Advantages Of A Debt Consolidation Loan

The main advantage of a debt consolidation loan is that your current debt is paid off. Those credit cards that youve been struggling to pay, household bills, and even overdrafts on your bank accounts. Unsecured debt consolidation loans take the pressure off of paying lots of different bills each month, even those that are past due. Here are other benefits:

Read Also: Can You Sue Debt Collectors For Harassment

Read Also: How To Find Out How Much Student Loan You Owe

Can You Still Use Credit Cards After Consolidation

Yes with a credit card consolidation loan, you dont have to close your credit cards once youve paid them off. That means youre on your way to becoming debt-free sooner. But its important to make sure you dont fall into bad spending habits with your newly paid-off credit cards.

Here are a few ways to keep your credit card spending manageable so you dont end up with more debt:

-

Make a plan for how to use your cards. If you have multiple credit cards, consider using just one of them for regular spending. You might use your others for recurring payments each month such as a gym membership or streaming subscription so they can continue building your credit history. This way, you can more easily keep track of your spending.

-

Pay off your credit card each month. If you pay off your balance before your due date each month, you can avoid paying interest. Be sure to only spend what you can afford to pay back before your due date.

-

Dont spend for rewards. While credit cards can offer various rewards, dont let these potential perks affect your spending decisions. If you do, you could end up with a large balance to pay off which likely isnt worth whatever rewards you get.

Should I Get A Personal Loan To Pay Off Debt

Falling behind on debt payments can have a damaging effect on your credit score and may ultimately result in repossession of collateral or accounts being sent to collections. If youre struggling to make payments on all of your individual debts, consider taking out a personal loan to streamline your payments and increase the repayment termthereby reducing your monthly payment.

A debt consolidation loan also may be a good option if your credit score has improved since you applied for your loans. By qualifying for a lower interest rate on a debt consolidation loan, youll be able to reduce how much you pay over the life of your loans.

Also Check: Which Bank Gives Lowest Interest For Home Loan

Best For Those Building Credit: Avant

Why Avant stands out: Avant is an online lender that considers people who dont have perfect credit. In fact, Avant says on its website that most of its customers have credit scores between 600 and 700.

- Check your potential rate Avant lets you check your estimated rate and loan term with no effect on your credit scores, so you can compare its offer to loan offers you receive from other debt consolidation lenders.

- Online application process The loan application can be completed online, and the lender says you may receive your loan funds as soon as the next business day.

- Higher interest rates Although Avant considers people with imperfect credit histories, interest rates on Avant loans can be high compared to other lenders.

- Fees that can add up Avant charges fees for late payments and insufficient funds as well as an administration fee of up to 4.75% on its loans.

Read our Avant personal loan review to learn more.

Can I Get A Debt Consolidation Loan With Poor Credit

Youll typically need good to excellent credit to qualify for a personal loan. But several lenders offerdebt consolidation loans for bad credit just keep in mind that youll likely be offered higher interest rates on these loans compared to someone who has good credit.

Another option to get approved more easily is by applying with a cosigner who has good credit. Not all lenders allow cosigners on personal loans, but some do. Even if you dont need a cosigner to qualify, having one could get you a better interest rate than youd get on your own.

If you can wait to consolidate your credit card debt, you could also consider working to build your credit to qualify for better rates in the future. Here are a few ways you might be able to do this:

-

Make on-time payments. Your payment history is the biggest factor that makes up your credit score. If you pay your monthly bills on time, you could see an improvement in your score.

-

Pay down your credit card balances. Your credit utilization is another major factor that determines your credit score. You can lower your credit utilization by paying down your balances, which could help boost your score.

-

Avoid new loans. Whenever you apply for a new loan, the lender will perform a hard credit check, which could cause a drop in your score. While this drop is usually only temporary, its a good idea to avoid taking out new loans when possible if youre focused on building your credit.

Also Check: Direct Lender No Credit Check Loan

How Personal Loan Debt Consolidation Works

Debt consolidation is a term used for a financial plan that combines all your loans into a single one. This is helpful because one monthly payment is a whole lot easier to manage and keep track of than several monthly payments. Lets review an example:

- You have $5,000 worth of credit card debt on your Visa card

- You have $3,000 worth of credit card debt on your American Express card

- You also pay $1,000 each month for a medical procedure you had done a year back

- Finally, youve got a $1,200 monthly auto loan payment to make

That means you are making 4 different payments each month to cover the various forms of debt outstanding on your account. Between the different amounts for each payment, different payment due dates, and varying interest rates, it’s easy to get things confused. When this happens, payments are missed, and you end up paying more unnecessarily. Debt consolidation loans help you pay off all of your combined debt at once and give you a single monthly payment to focus on. That’s one payment date, one APR, and one amount to think about. Much simpler.

And the best part of using a personal loan to consolidate your debt is that there are no strings attached. Unlike other loans that require some form of collateral or need to be used for a specific purpose, personal loans are totally free from any restrictions. You can use the money however you see fit, and you won’t have to put anything down to get the loan. It’s the most flexible type of loan out there.

Keep Up With Payments And Make A Plan To Stay Out Of Debt

Though consolidation can be a smart move, it’s only successful if you pay off the new debt and resist the temptation to run up a balance on your newly freed cards.

Build a budget that prioritizes your new monthly payment so you’re not charged a late fee. Late payments can hurt your credit score if reported to the credit bureaus.

Also, plan how you’ll stay out of debt in the future. Grant says most of her clients aren’t in debt because of poor spending habits but because they couldn’t cover unexpected expenses, such as car repairs or medical bills.

Grant recommends building up to a $1,000 emergency fund to prevent a cash shortage. And don’t wait till you’re out of debt to start, she says, since unexpected expenses can pop up anytime, causing you to backslide.

Instead, set aside whatever cash you can manage into an interest-earning savings account while still making your new monthly payment.

“Maybe it might take a little longer, but you can do both, and in most situations, that’s ideal,” Grant says.

About the author:Jackie Veling covers personal loans for NerdWallet.Read more

Recommended Reading: How To Calculate My Apr On Car Loan

Will A Debt Consolidation Loan Save Me Money

A debt consolidation loan may save you money. You may pay less interest if you’re approved for a lower rate than your existing debt. For example, if you have $2,500 in total debt with a combined APR of 20% and a combined monthly payment of $125, you’ll pay $566 in interest over about two years. But if you were to take out a debt consolidation loan with an 11% APR and a two-year repayment term, the new monthly payment would be $116.50, and you would save $329 in interest.

Keep in mind that access to lower rates is heavily dependent upon a high credit score.

Will Debt Consolidation Hurt My Credit Score

Consolidating your debt with a personal loan can help and hurt your credit score. When you use the loan to pay off your credit cards, you lower your credit utilization, which measures how much of your credit limit is tied up. Lowering your credit utilization can help your credit.

On the other hand, applying for a loan requires a hard credit check, which can temporarily ding your credit score. And if you turn around and rack up new credit card debt, your credit score will suffer.

Making late payments on your new loan can also hurt your credit score, while on-time payments can help.

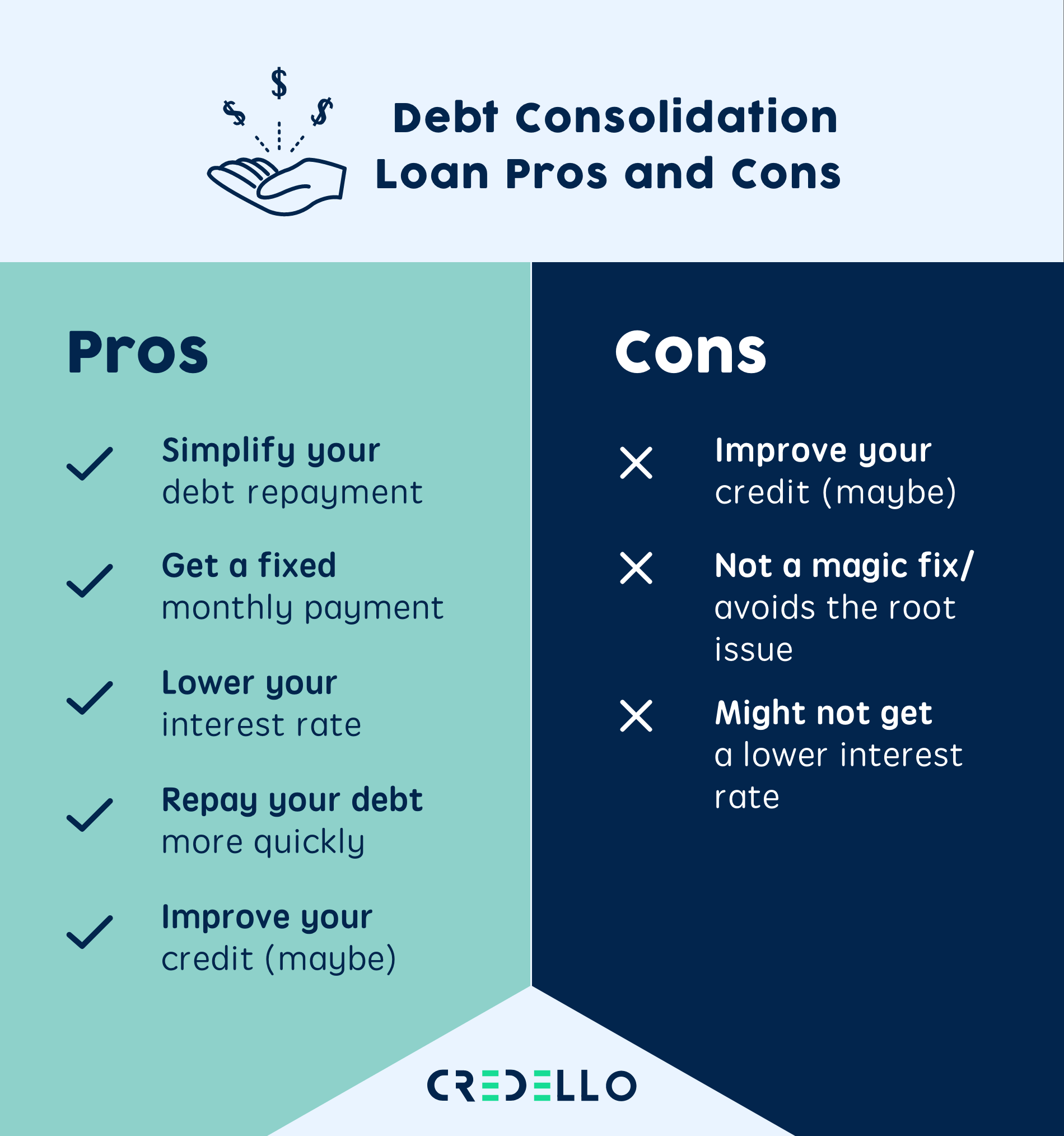

» MORE: Pros and cons of debt consolidation loans

Recommended Reading: Personal Loan For Home Renovation

The Balance Transfer Method

Many credit cards allow you to transfer the balances from other cards to create a single large open balance. The best way to execute credit card consolidation through balance transfers is to get a new card with an introductory 0% APR on transfers for a set period, typically six to 18 months or more.

The following cards earn our top ratings for having the longest 0% intro rates available from major issuers:

+ See More Balance Transfer Offers

Only new cardmembers can take advantage of this lower interest rate. You wont accrue any interest on your transferred credit card balance during the interest-free period. But be aware that each transfer triggers a one-time fee, usually between 3% and 5%.

After the intro period ends, the 0% interest rate will give way to the cards regular APR on any remaining balances.

Consider the following before transferring balances:

- Your new credit card must give you a big enough credit limit to absorb all the transferred balances. Otherwise, you will have to make multiple card payments each month, defeating the benefits of consolidation.

- The issuer of the new credit card will pull your credit, which means a hard inquiry will be on your credit report for two years. New credit is responsible for 10% of your credit score. And opening a new credit card will lower the average age of your credit history, which accounts for another 15% of your credit score.

Whats The Difference Between Debt Settlement And Consolidation

Debt consolidation is when you take all of your existing debt and combine it together. Usually, this involves taking out a personal loan to pay off the current debt you have. Then, you will make monthly payments on the personal loan rather than to all your credit cards separately. It could also involve taking a low-interest credit card and transferring the balance of your current cards to the new one.

The pros for debt consolidation:Simplifies the process of paying your bills. You are only making one payment instead of several at the same time.Lower interest rates. If you are falling behind on credit card payments, you might find yourself stuck with penalty fees and high interest rates. A debt consolidation loan could help you get a lower interest rate and one monthly payment rather than several.Paying off your credit card debt should improve your credit score as long as you donât continue to rack up debt on them.

Debt settlement works a little differently. This is when you will negotiate with creditors to settle a debt for less than what you owe. This is usually used when you have a large amount you owe to one creditor. It can be used for multiple creditors, but is less common.

Recommended Reading: How To Calculate Dti For Home Loan

How To Get Debt Consolidation Loans For Bad Credit

If you have bad credit, you can strengthen your application by improving your debt-to-income ratio. You can do this by increasing your incomewith a side hustle or otherwiseor by paying off some of your smaller, more manageable debts. If you choose to pay down some of your debts, this could also help improve your credit score, accomplishing two things at once.

You may also have better luck applying for secured loans, which are more accessible to applicants with bad credit because they reduce the lenders risk and often come with lower interest rates.

Related:Can I Get A Debt Consolidation Loan With Bad Credit?

Automate Your Payments And Pay Your Full Balance Each Month

The largest factor in your credit score is your history of payments: keep them on time and you’ll see your credit score slowly build. By automating your payments, it becomes even simpler to stay on top of your credit card debt.

Once you hit your zero balancewhether through a debt consolidation strategy or just careful debt managementconvert your mentality of credit cards as free-money-you-don’t-yet-have to monthly-debt-that-earns-rewards by paying off your balance in full at the end of each month.

You May Like: How Do I Pay My Unsubsidized Student Loan

Received Mail From Us

If so, you are in the right place! Get started by entering your personal confirmation number below.

You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website.

What Is A Debt Consolidation Program

Debt consolidation combines high-interest credit card bills into a single monthly payment at a reduced interest rate. Paying less interest saves money and allows you to pay off the debt faster.

Debt consolidation is available with or without a loan. It is an efficient, affordable way to manage credit card debt, either through a debt management plan, a debt consolidation loan or debt settlement program.

If you cant make more than minimum payments on your monthly credit card bills, a debt consolidation program is a very good way to regain control of your finances.

Also Check: What Does Va Loan Stand For

Best For Credit Card Debt Consolidation: Payoff

Why Payoff stands out: Payoffs personal loan is designed specifically for people who want to eliminate or reduce high-interest . The company provides one-on-one support, including welcome calls and first-year quarterly check-ins, to help members as they work to get their finances back on track.

- Potentially lower rates than average credit card Interest rates for Payoff loans start well below the August 2021 average credit card APR of 14.54%, as reported by the Federal Reserve. Paying a lower rate may help minimize interest charges while you pay off debt. But Payoff APRs can be higher, so theres no guarantee that youll get a lower rate than what you were paying on your credit cards.

- No direct debt payments Payoff doesnt offer direct payments to creditors. So if you get a loan from the company, youll need to pay off each of your creditors on your own.

- Payoff provides your FICO® score for free each month, so you can see the impact paying down your debt has on your credit.

- Minimum qualifications The lender notes on its website that youll need to have a minimum FICO® score of 600 and no current delinquent credit accounts to qualify for a Payoff loan.

Read our Payoff personal loan review to learn more.