Why Use This Personal Loan Calculator

Whatever your reasons for wanting to take out a loan, our personal loan calculator is here to assist you by calculating examples of monthly repayments figures that you might have to make. By providing you with a guide to possible loan repayment figures, you can then feel better informed when you weigh up the risk and reward of taking out a personal loan.

How To Calculate Personal Loan Payments

To begin your calculation, enter the amount you are hoping to borrow along with the yearly interest rate and the number of months that you are intending to borrow the money for. If you wish, you can alter the start loan date and include any additional deposits you are making at the beginning, along with any extra fees or balloon payments. Once you click the ‘calculate’ button, the personal loan calculator will show you:

- Your regular monthly payment figure

- The total interest you will pay

- Your total loan repayment figure

- Your estimated payoff date

You will also be shown graphs and a monthly repayment schedule of your principal and personal loan interest payments. Should you wish to calculate loan figures without compounding, give the simple interest calculator a try.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Also Check: What Do I Need To Get Loan From Bank

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

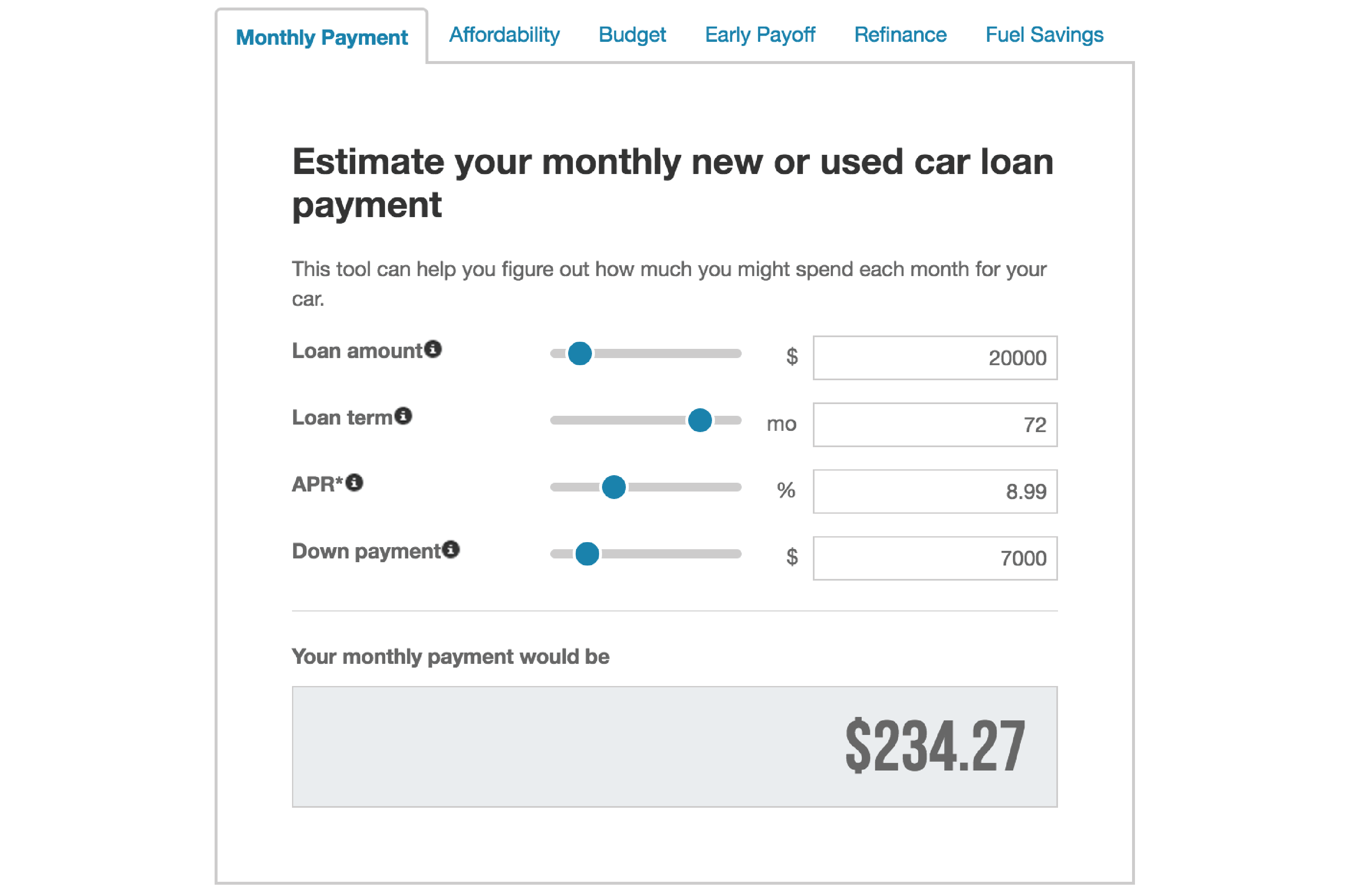

How To Use Credit Karmas Simple Loan Calculator

Whether youre thinking of taking out a personal loan for debt consolidation or a student loan for college costs, you probably want a sense of how much your loan will cost over time.

Our loan calculator can help you understand the costs of borrowing money and how loan payments may fit into your budget. It takes into account your desired loan amount, repayment term and potential interest rate. Youll be able to view an estimated monthly payment, as well as the amortization schedule, which provides a breakdown of the principal and interest you may pay each month.

Keep in mind that this loan payment calculator only gives you an estimate, based on the information you provide. Loan fees like prepayment penalty or origination fee could increase your costs or reduce the loan funds you receive. This loan payment calculator also doesnt account for additional mortgage-related costs, like homeowners insurance or property taxes, that could affect your monthly mortgage payment.

Here are more details on the information youll need to estimate your monthly loan payment.

Read Also: How Much Interest On 10000 Loan

What Are The Requirements I Need To Secure For My Application

The following are the common requirements that lenders look for:

- Income and employment-related documents

- Bank statements

- Collateral

Lenders will want to make sure that applicants are capable of fulfilling their obligations, and one way to reduce the risk of non-payment & fraud is to ensure of this is by securing documents that show proof of income/employment.

Some kinds of loans such as mortgages and auto loans are secured by the title on the property. Lenders can also use other assets to secure financing, lowering their risk & giving consumers lower rates.

Secured Vs Unsecured Loans

Loans come in secured and unsecured options. Secured loans are loans that require you to put up an asset as collateral. This is typically something like a house or vehicle. These loans involve a great deal of risk since you could lose your asset if you do not pay the loan back. However, because the lender is taking on less risk, these loans do tend to come with lower interest rates and better terms over all.Home equity loans and auto loans are typically secured loans.

An unsecured loan does not require collateral, making it a safer option, especially if you have good credit and can qualify for the best interest rates. These loans tend to have stricter borrowing requirements, lower borrowing limits and higher interest rates. Personal loans and student loans are typically unsecured loans.

Also Check: What Is Origination Fee In Personal Loan

How Lenders Decide How Much You Can Afford To Borrow

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

You May Like: Same Day Loans With No Credit Check

How To Use Emi Calculator

With colourful charts and instant results, our EMI Calculator is easy to use, intuitive to understand and is quick to perform. You can calculate EMI for home loan, car loan, personal loan, education loan or any other fully amortizing loan using this calculator.

Enter the following information in the EMI Calculator:

- Principal loan amount you wish to avail

- Loan term

- Rate of interest

- EMI in advance OR EMI in arrears

Use the slider to adjust the values in the EMI calculator form. If you need to enter more precise values, you can type the values directly in the relevant boxes provided above. As soon as the values are changed using the slider , EMI calculator will re-calculate your monthly payment amount.

A pie chart depicting the break-up of total payment is also displayed. It displays the percentage of total interest versus principal amount in the sum total of all payments made against the loan. The payment schedule table showing payments made every month / year for the entire loan duration is displayed along with a chart showing interest and principal components paid each year. A portion of each payment is for the interest while the remaining amount is applied towards the principal balance. During initial loan period, a large portion of each payment is devoted to interest. With passage of time, larger portions pay down the principal. The payment schedule also shows the intermediate outstanding balance for each year which will be carried over to the next year.

What Goes Into Calculating My Mortgage Interest Rate

Mortgage interest rates have been on an upward trend in 2022 due to the Federal Reserves interest rate hikes. Though these rate hikes are for the short-term interest rate that banks use to borrow money, long-term mortgage rates tend to move in the same direction as the short-term rates.

Besides economic trends, there are several other factors that impact how lenders calculate interest rates for potential borrowers:

Factors That Affect Mortgage Rates

- The higher your credit score is, the more trustworthy lenders consider you to be, so you may be able to qualify for a lower interest rate.

- Down payment

- If you can afford to put a larger down payment to purchase the home, then you can generally negotiate a lower interest rate.

- Home location

- Lenders usually offer slightly different interest rates depending on what state you live in. Whether youre looking to buy a home in an urban or rural area is also factored into the interest rate calculation.

- Loan amount

- If youre applying for a loan that is unusually small or large, you may pay a higher interest rate.

- Loan program

Recommended Reading: How Much Loan I Can Get For Business

How Does Rakbank Auto Loan Calculator Works

As mentioned earlier, RAKBANK offers a universal loan calculator to calculate equal monthly payment amounts for all different types of loans. Car loan calculator requires you to enter a few essential details to provide you with the calculated monthly payment amount.

Lets cover all the steps involved in using the RAKBANK car loan calculator properly:

- Open the common calculator page of RAKBANK. You can choose English or Arabic as your user interface language here.

- Scroll down and start filling out the details in the specified spaces. Enter the loan amount as per your plan and move forward to the duration.

- A maximum of 60-month-long repayment tenure is allowed for a RAKBANK car loan in UAE, with the minimum repayment tenure being of 12 months. Thus, you can choose any number of months from 12 to 60.

- Enter a tentative payment as well. This will help the RAKBANK car loan calculator in preparing a complete payment schedule for your loan repayment.

Note: It should be kept in mind that the RAKBANK car loan calculator uses the reducing rate formula for interest and EMI calculation. The minimum available reducing car loan interest rate for the RAKBANK car loan calculator is 2%.

Keep in mind that the RAKBANK car loan calculator only offers an estimate of your loan repayment schedule. All the particulars that you entered in the calculator are subject to change due to bank approvals, your monthly income, debt-to-income ratio, and other factors.

How To Lower Your Monthly Loan Payment

If your monthly loan payments are more than you can comfortably afford or are interfering with other financial goals, such as saving for retirement, finding a way to reduce them may be ideal. You have several options, depending on where you are in the process.

If you havent yet borrowed money, you can get a lower payment by borrowing less. For example, if youre purchasing a house or car, increasing your down payment can mean you end up with a smaller mortgage or car loan. Alternatively, you can look for homes or cars with lower prices to get a loan that better aligns with your budget.

If you already have a loan, there are several ways to reduce the monthly payment. One option is to refinance. When you refinance, you take out a new loan and use the principal from the new loan to pay off the current one. Refinancing often means getting a lower interest rate, giving you a lower monthly payment. You can also extend the loan term with a refinance, giving you more time to repay.

Similarly, you can consolidate your loans to get a lower monthly payment. For example, if you have multiple student loans with different interest rates and terms, consolidating them into a single loan can mean you pay less each month. You also get to enjoy a streamlined loan repayment as you dont have to juggle multiple monthly payments.

Read Also: What Is Loan Forgiveness Program

What Is The Formula Behind This Mortgage Calculator

It is possible to calculate your monthly mortgage payment manually by using the formula the calculator applies. To do so, youll need the same information that you would plug into the calculator. Here is the formula to use:

M = P/

In this formula, M refers to the monthly mortgage payment. P is the principal amount of the loan, i is your monthly interest rate and n is the number of months required to pay off the mortgage.

This calculation only determines how much youll pay towards your mortgage each month. Your actual mortgage payment might include additional fixed costs such as taxes and insurance.

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

Don’t Miss: How To Get Loan For Home Addition

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Personal Loans And Creditworthiness

The creditworthiness of an individual is probably the main determining factor affecting the grant of a personal loan. Good or excellent credit scores are important, especially when seeking personal loans at good rates. People with lower credit scores will find few options when seeking a loan, and loans they may secure usually come with unfavorable rates. Like credit cards or any other loan signed with a lender, defaulting on personal loans can damage a person’s credit score. Lenders that look beyond credit scores do exist they use other factors such as debt-to-income ratios, stable employment history, etc.

You May Like: How To Calculate Loan To Value Mortgage

How To Lower Your Loan Interest Rate

Its a good idea to shop around before taking out any loan. Thorough research gives you an idea of what rates are available and helps you find the lender with the best offer. After youve borrowed the money and have made some payments on your loan, its possible to qualify for a lower rate. An improvement in your credit score or a dip in the market can mean interest rates drop.

You have a few options if you want to try and get a better rate on your loan. One popular method is to refinance, particularly if its a mortgage or car loan. Since mortgages often have lengthy terms, such as 15 or 30 years, its very likely rates will fall over your loan term.

If that happens, refinancing your mortgage means applying for a new one to get a better rate. When you refinance a mortgage, you will end up paying closing costs, much as you did when you got the first loan. Before starting the refinancing process, compare the cost of getting a new mortgage to what youll save over time to see if its worth it.

Another simple way to lower your interest rate is to see if your lender offers a discount if you sign up for automated payments. Student loan lenders often offer a slight discount, such as 0.25%, to borrowers who sign up for automatic payments.

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

Recommended Reading: What Kind Of Loan Can I Get

Total Interest Paid On A Loan

Total amount paid with interest is calculated by multiplying the monthly payment by total months. Total interest paid is calculated by subtracting the loan amount from the total amount paid. This calculation is accurate but not exact to the penny since, in reality, some actual payments may vary by a few cents.

$377.42 × 60 months = $22,645.20 total amount paid with interest $22,645.20 – $20,000.00 = 2,645.20 total interest paid

Furey, Edward “Simple Loan Calculator” at from CalculatorSoup, – Online Calculators