Hard Vs Soft Credit Inquiries

The first thing to know is that there are two types of credit inquiries made to get your credit score. The most common is a hard inquiry, which pulls your credit and alerts the credit bureaus that you are looking for a loan. This can be just fine, if you only have one or two inquiries, they are for the same thing, and they happen within a short amount of time . If a loan comes from one of those inquiries, the inquiry itself usually gets forgotten as it has far less impact than the actual loan being approved.

Soft inquiries do not pull full credit reports and usually do not alert the credit bureaus that you are searching for a loan. Soft inquiries can give a lender your likely credit score, thus allowing loan estimates to be made. They have their limits and are not a guarantee of a loan, but they do give both you and the potential lender a good idea of how likely you are to qualify for the loan they are offering.

Most soft inquiries happen as a result of background checks for jobs or apartment rental, for insurance reasons, or in order for a lender to get an idea of your actual financial situation. A soft inquiry can also give you pointers as to what you might do to improve your score before going for the hard loan check. Sometimes a credit score improvement of just 5 or 10 points can mean hundreds in savings over time as interest rates drop.

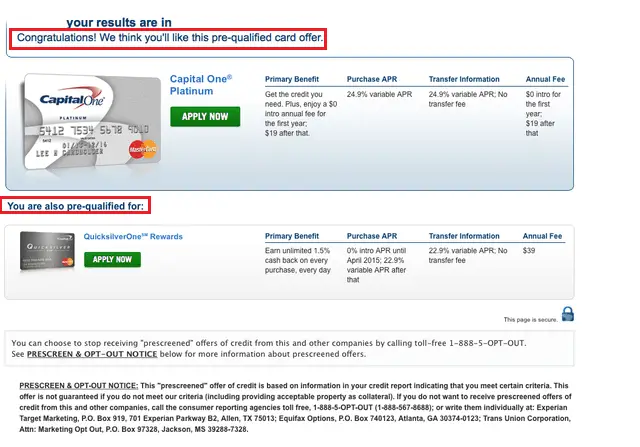

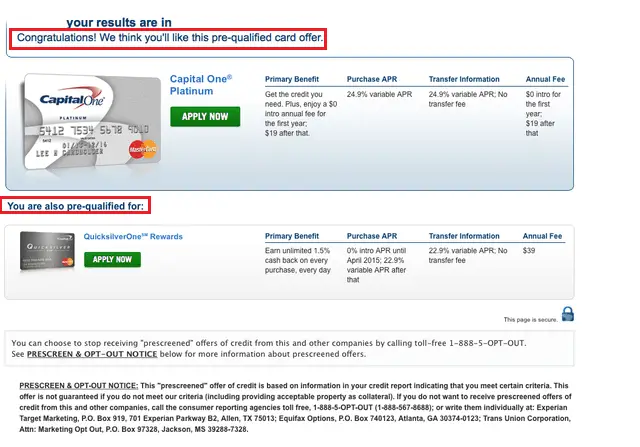

Capital One Pre Approval Is Easy

Hopefully, this guide will help you better navigate the road to pre approved credit card offers and auto financing options from Capital One. Unlike other banks, Capital One offers a fairly straightforward prequalification process, making it that much easier to apply for and receive the rewarding credit card or auto loan youve been looking for.

Applying For A Capital One Auto Loan

Since Capital One Auto Financing is only available through a limited pool of car dealerships, this lender may not be best if youre interested in a wide range of vehicles. However, if you have a credit score between 501 and 600 and are looking for a bad credit car loan, Capital One may be a solid choice.

In 2016, the Washington Post reported that approximately half of Capital Ones auto loans went to subprime borrowers. So if youre worried about qualifying for a loan, Capital One can be more forgiving. Even so, a participating auto dealer can still turn you away for poor credit.

| Capital One Auto Finance Application Details | |

|---|---|

| Minimum Credit Score | |

| Varies by credit score |

The processes for getting a car purchase loan and a refinance loan from Capital One are similar and involve these basic steps:

Read Also: Can I Use Va Loan For Investment Property

Myautoloan: Best For Shopping For Multiple Loan Offers

Overview: If you want to compare multiple loan offers but you dont want to spend a lot of time doing it, myAutoLoan is a great option. This platform lets you enter your information once and receive multiple loan offers in one place.

Perks: After filling out a single online loan application, youll be given up to four quotes from different lenders. To qualify, you must be at least 18 years old, have an annual income of $21,000, have a FICO score of 575 or greater and be purchasing a car with less than 125,000 miles and that is 10 years old or newer. By comparing multiple auto loan offers at once, you can pick the one with the interest rate, loan term and conditions that work for you and your budget without having to shop around.

What to watch out for: If you have poor credit, your interest rate could be on the higher side. Also note that you can use this platform if you live in most states, but not in Alaska or Hawaii.

| Lender |

|---|

What Are The Requirements

The advertised interest rates you’ll see on websites are usually reserved for those with good credit. If you have poor credit, however, there are still options. Lenders such as myAutoloan or SpringboardAuto will lend to consumers with bad credit scores. The rates will be higher, but at least you’ll know what you can afford. NerdWallet has compiled a list of online lenders that focus on people with poor credit.

If you haven’t looked at your credit score in a while, it is a good idea to do so. This will let you know what to expect when you’re applying for a loan. All consumers are entitled to one free credit report per year.

Recommended Reading: Can I Refinance An Fha Loan

Capital One Auto Loan Requirements

Applicant requirements: In order to qualify for a Capital One auto loan, you must be 18 or older and have a valid address within the contiguous 48 states. A minimum monthly income of $1,500 to $1,800 is required, depending on credit qualifications.

Vehicle restrictions: Capital One doesnt finance boats, RVs, ATVs or motorcycles.

- New and used restrictions: In most cases, you may only finance a 2011 or newer vehicle with fewer than 120,000 miles.

- Refinance restrictions: To qualify for a Capital One refinance auto loan, the vehicle must be seven years old or newer, have an established resale value and cannot be currently financed through Capital One.

In addition, you cant buy or refinance an Oldsmobile, Daewoo, Saab, Suzuki or Isuzu with a Capital One auto loan.

Amount financed: Capital One offers car loans from $4,000 and up for new and used vehicle purchases, and loan amounts between $0 and $0 for refinance car loans. Depending on your approval, the amount you finance may exceed the sales price or value of the vehicle and could include:

- Tax, title and licensing fees

- Dealer add-ons, such as guaranteed asset protection coverage or extended warranty

Does A Car Loan Hurt Your Credit

Generally speaking, a car loan is not bad for your credit. Its usually a good thing. The exception, of course, being if you miss payments, go deeply underwater on the loan, or if the loan payment is a large portion of your income.

Your car payment should never be more than a quarter of your income. For example, if you make $3,000 a month, your car payment should not be more than $750. The higher your car payment is above your incomes 25 percent mark, the more it will negatively affect your credit. There are exceptions to this rule of thumb, but its better not to assume you are one of those exceptions. An ideal loan amount is much less than 25 percent of your monthly income.

Bear that in mind while shopping for loans. Unless you have platinum-perfect credit, you are likely to rely on your credit rating, so try to keep it as high as possible, to get good loan terms.

Compare Loan Rates and Save

Don’t settle for dealer financing, get loan quotes from multiple providers

Also Check: Does Upstart Allow Co Signers

How To Apply For A Capital One Auto Loan

Applying for a loan with Capital One is a simple process. Head to the Capital One auto loan site to get started. There, you can enter your information for a prequalification and start shopping right away. If you find a vehicle that matches your criteria, you can reach out to the dealership through the online portal and start the conversation.

You Can Also Obtain Preapproval For An Auto Loan

Capital One Auto Finance is one of the largest lenders of auto loans in the U.S. You can get prequalified for an auto loan in a matter of minutes.

To qualify, you must be looking to finance at least $4,000 for a vehicle that is a 2010 model or newer with fewer than 120,000 miles on it. The vehicle must also come from a participating dealer. Capital One Auto Finance does not provide financing for lease buyouts.

Your loan offer, interest rate, and the monthly payment will be based on several factors, including your credit score, income, the loan amount, and the loan term you choose. Your application and credit report will help the lender determine your financing terms.

Other things to know about obtaining a car loan through Capital One include:

- a minimum credit score of 500 is required

- the purchase must be made through a participating dealership

- you can apply with a cosigner

- you must be at least 18 years old and have a valid street address and Social Security number

- A monthly income of between $1,500 and $1,800 is required, depending on your credit qualifications

But while Capital One is a popular auto financing option, applicants with good credit scores can likely find better interest rates through a credit union. This applies to credit cards too a credit union can almost always beat out the interest rate youll receive from a big bank.

Don’t Miss: Auto Loan Self Employed

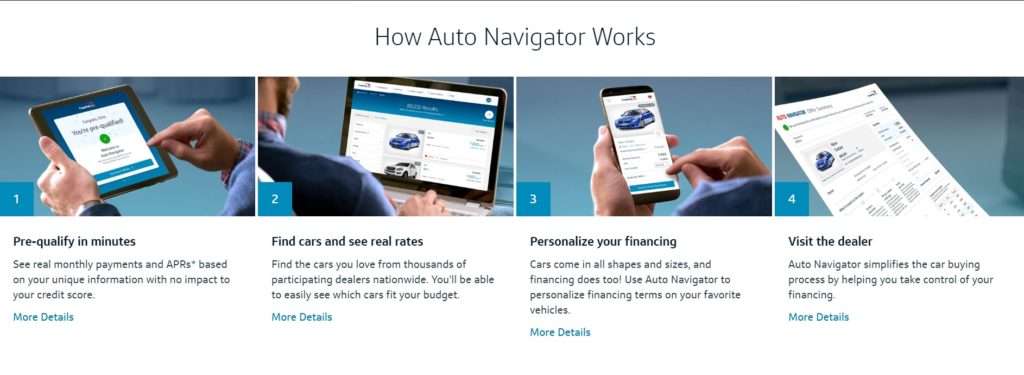

What Does Auto Navigator Show

Auto Navigator clearly shows various specifications of vehicles like the model, mileage, kilometers covered, etc. from its inventory. It also indicates payment options so that you can plan your expenses and savings accordingly before deciding to buy your dream car. It shows monthly payment amount, APR, and other personal terms so that there is transparency in the selected offer.

Apply At Capital One Auto Navigator

On the online form, you will need to supply:

- Personal information: Name, email, phone number and Social Security number.

- Residential information: Address, duration at current address, whether you rent or own and monthly house expenses.

- Employment information: Employer, length of employment and gross annual income.

You may be asked to upload proof of your residence or employment such as a copy of a utility bill or pay stubs.

Also Check: Usaa Auto Loan

What To Do If You Cant Get Preapproved

It can be tough to hear that you dont qualify for preapproval when youre in the market for a vehicle. Preapproval declines happen for a number of reasons, including a lack of consistent and/or sufficient income or some adverse activity in background, says Mark Lucke, chief sales officer, Sunrise Banks.

Fortunately, there are some things you can do to improve your chances of getting preapproved.

Choose Your Vehicle Or Dealership

The first step to getting a Capital One auto loan is to browse the Auto Navigator site for vehicles and dealers in your area. If you narrow your choices down to a single vehicle, you can get prequalified right on that page for an auto loan. You can also simply view dealership inventory in your area and find out which dealers work with Capital One.

Read Also: Refinance Conventional Loan

How Capital One Auto Loans Work

Capital One auto loans are only available at certain dealerships. While this lender does have a wide array of dealers available, there’s no option for other financing for private party purchases, and this could limit your ability to purchase from some independent dealerships. Information on dealers that work with this lender is available on Capital One’s website, and is worth checking out in advance if you want to work with a certain dealership or find a specific vehicle.

Loan terms range from 24 to 84 months and loans are available in the contiguous 48 states.

Other requirements include:

- A minimum income between $1,500 and $1,800 a month, depending on credit

- A minimum financing amount of $4,000

- Used vehicles must be model year 2011 or newer and have less than 120,000 miles. However, Capital One states that financing may be available for vehicles model year 2009 or newer and with 150,000 miles.

A Capital One auto loan might be for you if you have a nonprime or subprime credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates.

Capital One works with borrowers with credit scores as low as 500. Auto loan interest rates at Capital One tend to start lower than the typical interest rates, and could help people in this credit category get lower interest rates, too.

Capital One Auto Finance Application Process

While you can apply for pre-qualification online, youll need to apply for a car loan through a participating dealership. You can bring your pre-qualification letter with you to streamline this process. Remember, its good for 30 days.

When you officially apply for a car loan through a dealership, Capital One will run a hard credit inquiry and give you your official financing terms.

Don’t Miss: Gustan Cho Mortgage Reviews

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. Each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Capital One Auto Loan Review

Unless youve been hiding under a rock for a few years, youve likely heard the Whats in your wallet? catch phrase a few dozen times every day on television for longer than youd like to remember. Capital One, the bank behind these memorable ads, offers credit cards, banking services, and auto loans. In recent months, Capital Ones Auto Navigator service launched with innovative services and an easy interface.

Compare Loan Rates and Save

Don’t settle for dealer financing, get loan quotes from multiple providers

Read Also: Can You Refinance An Fha Loan

Best Way To Buy A Car

I had not so great credit wasnt getting approved for auto loans below 11% got pre approved and found the car I wanted. Called customer service before I went to the auto place to have everything solid. Went to buy the car, the dealer told me it was sopposed to be $71 more dollars than what capital one had said. I called cap 1 customer service back from the dealership and put them on speaker. Suddenly the dealership changed their mind and was ok with my price and payment. Dealers will always try to get money out of you. They will do it in finance. I ended up getting a loan for 6% thru capital one!

How Do Capital One Auto Loans Work

Right off the bat, the biggest advantage of using Capital One Auto Finance is the type of credit inquiry on your credit report.

Capital One does a soft pull, meaning they will not inquire for a hard inquiry, dinging your credit when youre just shopping around for a personal loan.

That means qualifying for a Capital One car loan credit application wont impact your credit score.

When youre ready to get started with Capital One Auto, place in your personal information like your name, social security number, employer, address, and phone number and its Navigator tool will show you all the offer terms.

Additionally, you can search their database for the car you want through their approved participating dealerships. Once youve found your car, take your offer to the dealership to complete the process.

Keep in mind that snagging a pre-approval does not automatically guarantee approval for financing. Additionally, your final terms will depend on the hard credit inquiry performed by the participating dealer.

At this point, you can choose to use either the Capital One Auto Finance option or whatever the company your particular dealership has to offer.

The Capital One Auto Navigator will also help you determine your baseline interest rate before you head to the dealership. This way, youll have a solid idea of what interest rate youll get.

It also helps you estimate your monthly payment, so youll know in advance what works best for your budget.

You May Like: Usaa Refinance Auto Loan

Is Capital One Trustworthy

Capital One is rated an A by the Better Business Bureau. The BBB, a non-profit organization focused on consumer protection and trust, determines its ratings by evaluating a business’ responses to consumer complaints, honesty in advertising, and clarity about business practices.

Keep in mind that a top-notch BBB score doesn’t ensure you’ll have a good relationship with a company.

Capital One does have one recent controversy. The US Treasury Department fined Capital One $80 million after the Office of the Comptroller of the Currency said the bank’s poor security around its cloud-based services helped to account for a 2019 data breach in which a hacker accessed over 140,000 social security numbers and 80,000 bank account numbers.

Tips For A Successful Car

Buying a car today is almost nothing like it was just a few decades ago, with online lending networks and digital loan applications now the new normal. But, even though buying a car is easier today than it used to be, it doesnt mean the process is entirely without hurdles especially for car-buyers with bad credit.

With an average price well into the five figures, a vehicle is no small purchase, so it pays to be careful throughout the process to ensure you dont wind up with a bad deal. And this means more than simply trying to get the best interest rate on your loan here are a few more tips for making your car-buying experience a successful one.

You May Like: Bayview Mortgage Modification