How Do Fha Loans Work

FHA loans essentially work the same as other home loan programs. Youll need to qualify based on your income, credit history, employment history and verify you have or can get a gift for the down payment and closing costs.

However, the flexibility of FHA loans may work best if:

- Your credit score is between 500 and 619.

- Your total debt-to-income ratio is higher than the 50% conventional DTI ratio maximum.

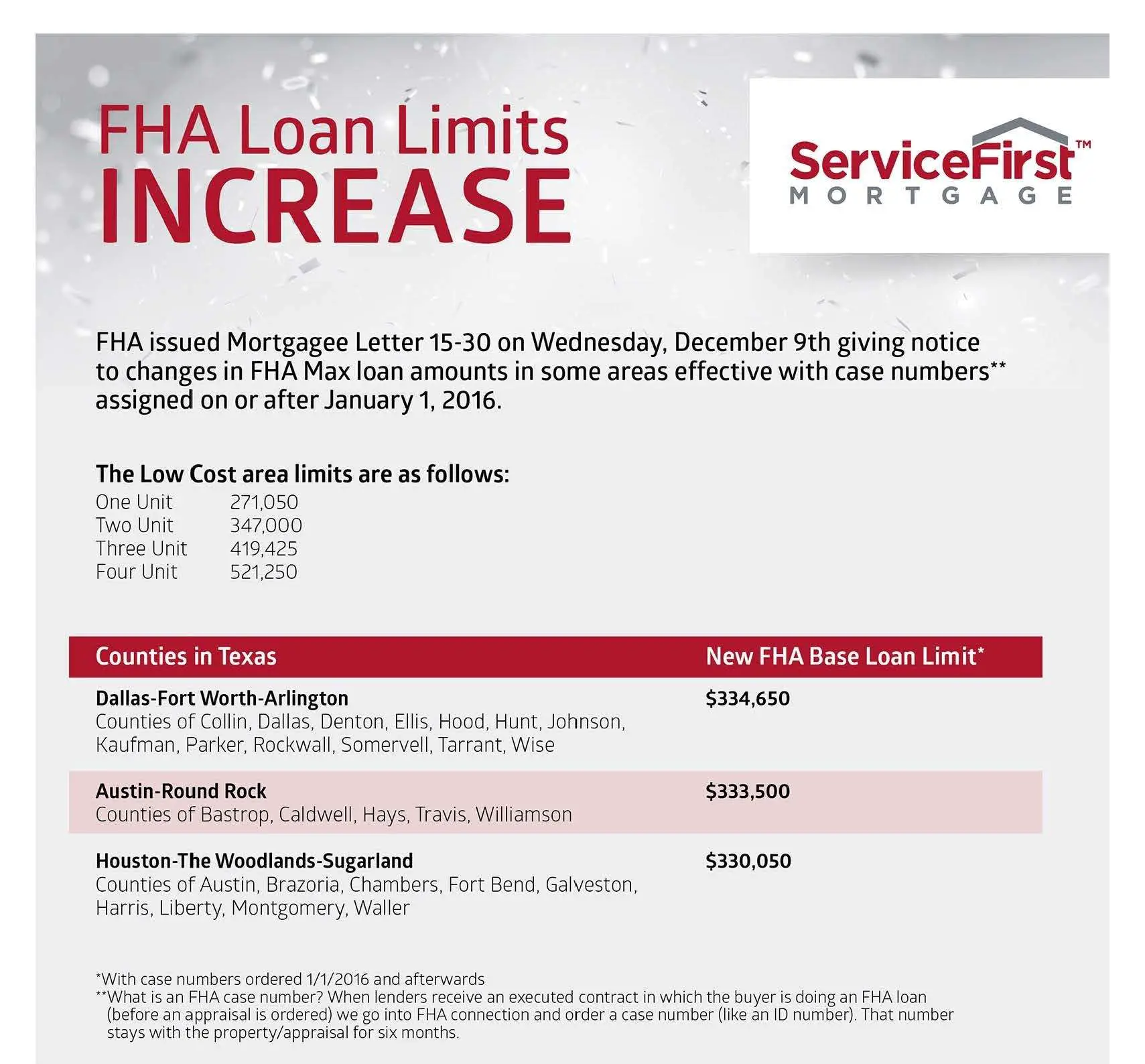

- You need a loan amount at or below the current FHA loan limit in the county youre buying in.

- You want to buy and live in a two-to-four unit, multifamily home with a 3.5% down payment, and use rental income to help you qualify.

- You want to buy a fixer-upper home with a 3.5% down payment and roll the renovation costs into your loan amount.

- You need to qualify for a mortgage with the income of a co-borrower who wont live in the home.

- Youve had a bankruptcy in the past two or more years.

- Youve had a foreclosure in the past three or more years.

- You cant qualify for a conventional loan.

How Much Debt Is Average

Outstanding consumer debt in the U.S. currently stands at about $ 14.88 trillion, representing an average individual debt of nearly $ 93,000, according to data from the Experian Consumer Debt Study.

How much debt does a 25 year old have?

Federal Student Loan Debt by Age Federal borrowers aged 24 and under owe an average of $ 14,434. Federal debt among borrowers under the age of 24 has fallen 3.6% since 2017. Federal borrowers between the ages of 25 and 34 owe an average debt of $ 33,570. Debt among people aged 25 to 34 has increased by 6.1% since 2017.

How much debt does average person have?

While the average American has $ 90,460 in debt, this includes all types of consumer debt, from credit cards to personal loans, mortgages and student debt.

What Are Fha Loan Requirements In Nc And Sc

FHA loans in Charlotte, NC or other areas in the Carolinas are available to buyers as long as they meet FHA loan requirements. North and South Carolina FHA loan requirements include:

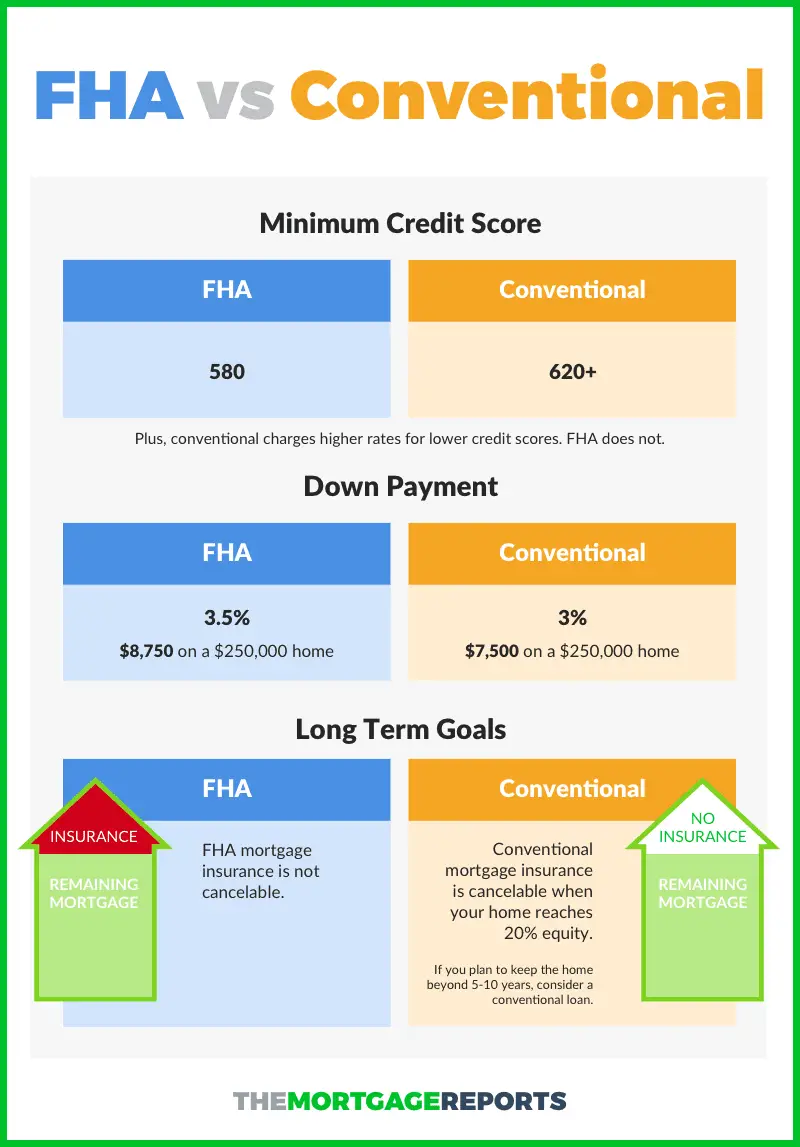

- A credit score of at least 580. However, if your score is between 500 and 579, you may still be eligible for an FHA loan if you make a down payment of at least 10% of the homes purchase price.

- Borrowing no more than 96.5% of the homes value through the loan, meaning you need to have at least 3.5 percent of the sale price of the home as a down payment.

- Choosing a home loan with a 15-year or 30-year term.

- Purchasing mortgage insurance, paying 1.75% upfront and 0.45% to 1.05% annually in premiums. This can be rolled into the loan rather than paying out of pocket.

- A debt-to-income ratio less than 57% in some circumstances.

- A housing ratio of 31% or less.

FHA lenders in NC and SC will provide you with all the information you need and can help determine if you qualify for an FHA loan.

Income Requirements for FHA Loans

Theres a common misconception that FHA loan requirements include income restrictions. While FHA income guidelines can be confusing, FHA loans are available to those who have any type of income. There are no minimum or maximum income requirements.

You May Like: Drb Vs Sofi

What Is The Fha Waiting Period For Borrowers With Previous Bankruptcy

Bankruptcy does not automatically disqualify a borrower from obtaining an FHA loan. Minimum 2 years since discharge of chapter 7 bankruptcy. Borrower with less than 2 years discharge may qualify for financing so long as they meet the extenuating circumstances as defined by FHA/HUD. Same rule applies for borrower with chapter 13 bankruptcy.

However, borrower with chapter 13 bankruptcy may still qualify if the bankruptcy has been discharged less than 2 years if the lender is willing to do a manual underwrite with satisfactory payment history under the chapter 13 plan.

Fha Loan Requirements For 2021

To qualify for an FHA loan, youll need to meet specific credit score, down payment, DTI, and property requirements.

Edited byChris JenningsUpdated September 10, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youre considering using an FHA loan to make your home purchase, use this guide to understand what requirements youll need to meet to qualify:

Also Check: Transfer Loan To Another Person

How Do I Apply For An Fha Loan

An FHA mortgage is a great way to buy a house without needing a big down payment or perfect credit score.

While theyre backed by the federal government, FHA mortgages are available from just about any private lender. So its easy to apply and shop around for low rates.

You can start your application online and even close online in some cases. Or you can work oneonone with a loan officer for extra guidance. You get to choose your lender and how you want to apply.

How Much Do I Need To Make To Qualify For A $300 000 Mortgage

What income is needed for a 300k mortgage? + A $300k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $74,581 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator.

Read Also: Bayview Mortgage Modification

New Fha Student Loan Guidelines

In a move to help more Americans become homeowners, the Federal Housing Administration . The change to the guidelines removed the requirement that lenders calculate a homebuyer’s monthly student loan payment at either 1% of the outstanding loan balance or an amortization-based payment. In its place, the new FHA student loan guidelines allow the lender to use either:

- The actual payment amount for the student loan.

- The monthly student loan payment reported on the borrower’s credit report.

- A .5% of the student loan balance if the reported payment status is zero.

This new guidance can be used for loans made after August 15, 2021.

“Homeownership is the cornerstone of the American Dream and the best way to build generational wealth,” said Housing Secretary Marcia L. Fudge in a press release.

What Will Deny A Fha Loan

There are three main reasons you were fired for an FHA loan bad luck, high income debt, and the amount of lack of money to pay the minimum wage. and closing costs.

Can an FHA loan be denied?

But its important to remember that an FHA loan can still be denied upon approval, even if youve already approved it. Although it does not happen very often, it is a fact that can affect some borrowers.

Why would FHA not approve a home?

Loan Limits A home that is too expensive may not qualify for an FHA loan. HUD sets loan limits each year, which vary by area and number of units. The FHA can cover an amount up to this limit. A high -end homeowner, with an FHA admission of 3.5 percent, is more likely to have an amount of loans that exceed the limit.

You May Like: How Long Before Sba Loan Is Approved

How Do I Qualify For A Fha Loan In Missouri

Can I Get A Mortgage With A High Dti

According to the Bureau of Consumer Finance , 43% is often the largest DTI a borrower can have and still receive a qualified mortgage. However, depending on the loan program, borrowers may in some cases qualify for a mortgage loan with a DTI of up to 50%.

Can I get a mortgage with 46% DTI?

Brian Martucci, a mortgage expert from Money Crashers, notes that a 36 percent ratio is often cited as the limit below which your DTI is considered good. However, you do not need a DTI below 36% to qualify. In fact, it is more common for lenders to allow DTIs of up to 43%.

Can I get a mortgage with 50 DTI?

There is no single set of applications for conventional loans, so DTI requirements will depend on your personal situation and the exact loan you are applying for. However, you will generally need a DTI of 50% or less to qualify for a conventional loan.

You May Like: Capital One Pre Approved Car Loan

What Income Qualifies For Fha

4.3/5FHArequirementsincome

There are no minimum or maximum income requirements for FHA home loans Rules do not say that it’s possible to earn too much to qualify for an FHA loan. Regarding minimums, regulations focus more on the borrower’s ability to afford the mortgage loan.

Likewise, what is the minimum credit score for an FHA loan? 580

Also to know, what are the requirements to qualify for an FHA loan?

FHA Loan Requirements

- Borrowers must have a steady employment history or worked for the same employer for the past two years.

- Borrowers must have a valid Social Security number, lawful residency in the U.S. and be of legal age to sign a mortgage in your state.

- Borrowers must pay a minimum down payment of 3.5 percent.

Why are FHA loans bad?

Since the FHA insures these loans, that means if borrowers default on the loan, the government will pay the lender for any losses. FHA-backed loans usually have more lenient requirements than conventional loanslower credit scores are required and your down payment can be as low as 3.5 percent.

How To Apply For An Fha Loan

Here are six basic steps to follow to apply for an FHA loan:

Don’t Miss: Is Carmax Pre Approval A Hard Inquiry

Can You Borrow With Your Current Income

Though you may feel that your finances are ready for a new home, the bank may not feel the same way. Mortgage lenders use a complex set of criteria to determine whether you qualify for a home loan and how much you qualify for, including your income, the price of the home, and your other debts.

The pre-qualification process can provide you with a pretty good idea of how much home lenders think you can afford given your current salary, but you can also come up with some figures on your own by learning the criteria that lenders use to evaluate you.

What Is The Minimal Credit Score Ranking Required For An Fha Loan

Whether you are a first-time home buyer applying for an FHA loan or you will have purchased a dozen properties before, you’ll be able to need to meet a minimum credit ranking to qualify. The required is 580 or upper. However, if you’ll make a ten% down cost, a lender might accept a score within the vary of 500 to 579.

Also Check: How Much Land Can You Buy With A Va Loan

How Does An Fha Loan Work

Like other types of mortgages, FHA loans are issued by banks, credit unions and private lenders for the purpose of borrowers buying a home however these loans are backed by the Federal Housing Administration , a government agency that protects lenders if a borrower defaults on their mortgage.

Due to this guarantee, FHA loans typically come with less stringent approval criteria. With lower credit and down payment requirements, FHA loans are a popular option for first-time home buyers who may not be eligible for conventional mortgages.

Why Is An Fha Loan Bad

FHA loans often come with higher interest rates than other loans, because they are more risky. Because they have a low credit score, there is a high chance that the borrower will not be able to default on the loan. To protect themselves from this additional risk, lenders will pay a higher interest rate.

What is the catch with an FHA loan?

Mortgage insurance protects a creditor if you fail to pay your mortgage on the road. If your down payment is less than 20%, you will usually pay off this insurance regardless of what type of loan you get.

Why you should not get an FHA loan?

There are many reasons to avoid an FHA loan, including high upfront costs and on all payments. Not ready to take out a mortgage: A low mortgage can be a red flag. Advance insurance: When you put less than 20%, you have to pay mortgage insurance. FHA loans come with two types of insurance.

Read Also: Capital One Auto Loan Minimum Credit Score

Must Be A Primary Home Purchase

When choosing a mortgage type, one of the most important things to consider is the type of property being purchased. This is especially true with FHA loans, as they must be used toward a primary home purchase. An FHA loan will not work for you if you’re planning to buy a second home or investment property. The buyer must also occupy the property within 60 days of the loan closing.

What Will Fail An Fha Loan

This means that significant structural damage, runoff, moisture, decay or damage to the mound can disrupt the visit. In such a case, it must be repaired in order for the FHA loan to move forward.

Is it hard to pass FHA appraisal?

To pass an FHA test, however, your foundation must be free of major cracks as well as water damage or damage. evidence of such things. FHA visitors look up and down. Your roof and your roof need to be properly maintained. The FHA test will require you to repair any water contamination or holes in the roof.

Why would FHA not approve a home?

Loan Limits A home that is too expensive may not qualify for an FHA loan. HUD sets loan limits each year, which vary by area and number of units. The FHA can cover an amount up to this limit. A high -end homeowner, with an FHA admission of 3.5 percent, is more likely to have an amount of loans that exceed the limit.

You May Like: Va Business Loan For Rental Property

Fha Appraisal And Inspection

Homes must meet certain requirements to qualify for FHA loans, which means you’ll need an appraisal and home inspection through FHA-certified professionals to buy a home. These professionals consider the Department of Housing and Urban Development ‘s minimum property requirements and examine the home’s overall condition as well as any necessary repairs.

The results are reported back to HUD along with the approximate cost of fixing any necessary issues with the home. If the home is not compliant with FHA standards, these repairs must be made prior to closing. The seller is typically responsible for home repairs, but not all sellers are created equal, and some may not be willing to pay to bring the home up to FHA standards. In this case, the buyer must resume their search for an FHA-compliant property.

What Is The Max Front End Ratio For Fha

The FHA guidelines state that the maximum forward ratio will be 31% -40% depending on the borrowers credit score.

What is Max front end ratio?

Lenders generally require that the ideal front-end ratio be no more than 28 percent and the back-end ratio, including all monthly debt, not more than 36 percent.

Can you get a mortgage with 55 DTI?

FHA loans require only a 3.5% down payment. High DTI. If you have a high debt-to-income ratio , the FHA provides more flexibility and usually allows you to increase the ratio by up to 55% .

You May Like: How Long For Sba Loan Approval

What Is A Federal Housing Administration Loan Loan

A Federal Housing Administration loan is a mortgage that is insured by the FHA and issued by an FHA-approved lender. FHA loans are designed for low- to moderate-income borrowers. They require a lower minimum down payment and lower than many conventional loans do.

Because of their many benefits, FHA loans are popular with first-time homebuyers.

What Is The Minimum Credit Score Required For Fha Loans And First Time Home Buyers

A tri-merged credit report score of 640 is preferred. Depending on overall credit, sometimes borrowers may qualify with middle scores as low as 580.

In some instances, where a co-borrower does not have any credit scores, FHA will consider approval so long as the primary borrower meets the minimum credit score requirements and has more than 50% of the qualifying income with a minimum of 3 tradelines active for last 24 months.

Regardless of credit scores, FHA still evaluates overall credit history to determine if borrower gets approved eligible findings that meet FHA approval guidelines.

You May Like: Bayview Mortgage Reviews