How Does Mip Work

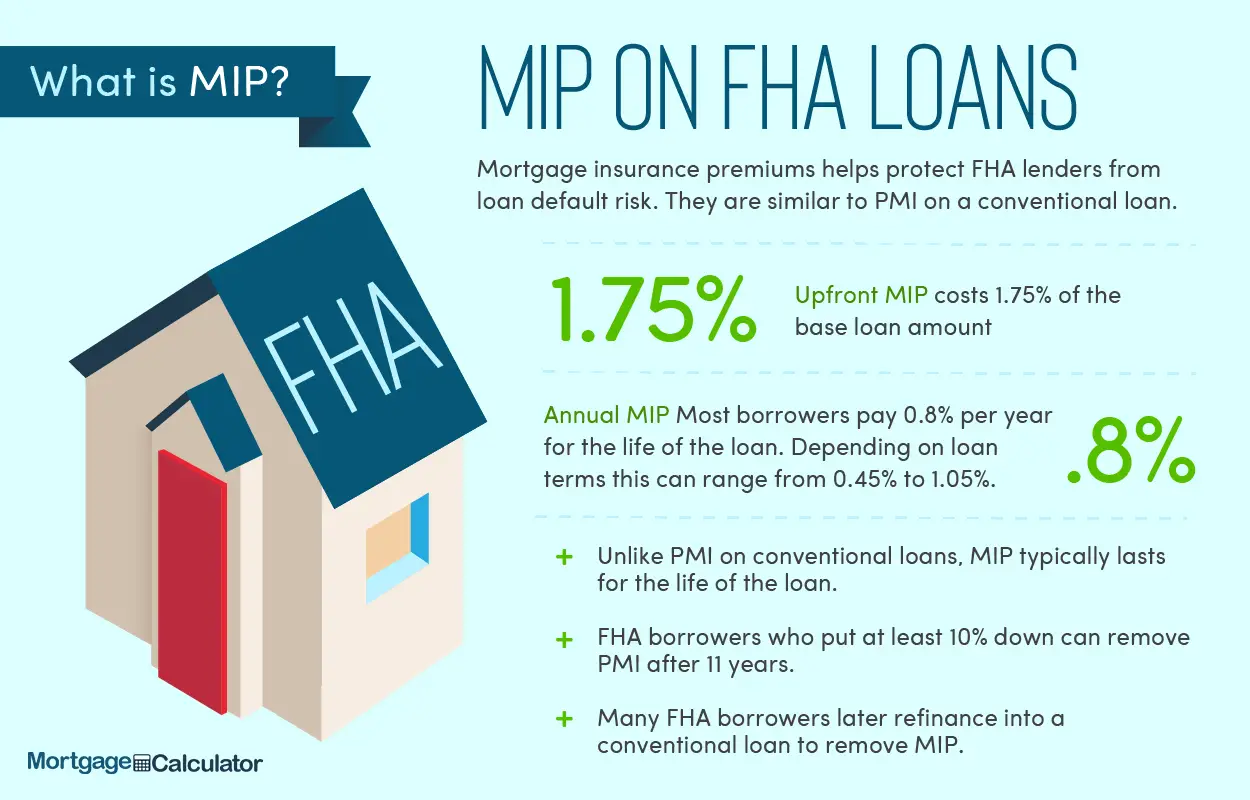

If you have an FHA loan, you pay a portion of the premium up front at the close of the loan and then continue to pay mortgage insurance premiums on a monthly basis. The upfront premium is always 1.75% of the loan amount. If you cant afford to pay this at closing, it can be financed into your loan amount.

In addition to the upfront premium, theres an annual premium thats based on your loan type as well as your down payment or equity amount. If you have a standard FHA loan with a 3.5% down payment on a loan of no more than $625,500, the annual MIP is 0.85% broken into monthly payments.

If you have an FHA Streamline where you go from one FHA loan to another for the purpose of lowering your rate and/or changing your term, the MIP rates are a little better. In this case, theres an upfront rate of 0.01% of your loan amount and an annual MIP rate of 0.55%.

Get Your Home Reappraised

Last is how you can drop PMI without refinancing. Ask yourself, Do you live in a hot real estate market where home prices have rapidly increased? If so, your homes appraised value may be significantly higher than what it was when you first purchased it.

Homeowners whove owned their homes for at least 5 years and have a new appraised value that gives them at least 20% equity can contact their lender, send them the new appraisal, and ask the lender to remove PMI.

When And How Can Pmi Be Removed From My Loan

Fortunately for homeowners with conventional loans, private mortgage insurance wont be part of your mortgage payment forever.

The Homeowners Protection Act requires that lenders send homeowners annual notices that remind you that you have the right to request cancellation of your PMI.

As a homeowner, you can request that the mortgage insurance be removed when you have reached the date when the principal balance of your mortgage falls to 80 percent of the original value of your home.

Even if you do not request it be removed, lenders are required to cancel PMI automatically on conventional loans once youve reached the date when your principal balance reaches 78 percent of the original value of your home.

You should be able to locate these dates on your closing paperwork. More specifically, you should have a PMI disclosure form that you signed when you closed on your home loan.

You can request that your PMI be dropped earlier than these dates if you meet the following criteria:

- You must be up-to-date on your monthly payments.

- Your request must be in writing.

- You may need to certify that you do not have any 2nd mortgages on your home.

- It may be necessary that you provide an appraisal to support the value of your home.

Generally, assuming you meet these requirements, your lender must cancel your PMI.

It is important to note that some lenders have a minimum requirement. That means you will have to wait at least two years before being able to get rid of your mortgage insurance.

Also Check: Transfer Car Loan To Someone Else

The Basics Of Pmi: Does It Stop Automatically

First, its important to understand whether you actually have PMI or notthe question of how and when you can take off PMI is only relevant to some homeowners. PMI is not the same thing as homeowners insurance mortgage insurance is for certain kinds of mortgages, typically those that allow a low down payment.

If your mortgage payments include PMI, youll know it. Its a monthly add-on to your mortgage payment, typically between .005-6% of your principal. It will be made clear on the account statements and bills your mortgage servicer sends to you on a regular basis.

The second most important thing to know about PMI is that, in most cases, it doesnt need to be part of your mortgage payments forever. In fact, PMI automatically cancels for many people who have it. According to the Consumer Finance Protection Bureau, automatic PMI cancellation kicks in on the date when your principal balance is scheduled to reach 78% of the original value of your home, but only if youre current on your payments on that date. If you arent current on your payments by the time you reach that 78% threshold, automatic PMI cancellation will still happen once you catch up.

How Can I Remove PMI Early?

Step 1: Ensure a good payment history and no outstanding balance on your mortgage payments.

Step 2: Submit a written request to your servicer asking to cancel your mortgage insurance. Weve created a sample letter that you can copy and use yourself.

What You Should Do Now

Remember all those documents you signed when you bought your home? Dig them out and find the closing statement. This will tell you what you paid for your home and the date you closed escrow. If you closed escrow before June 2013, go to the next step.

Multiply the purchase price by 78 percent. That will tell you the point at which you can drop the MIbut remember, you cant drop it earlier than 60 months.

Next, look at your most recent mortgage statement to find the loan balance. The difference between the 78 percent figure you calculated, and the current balance is the amount you would reduce your balance to eliminate MI.

Finally, get some idea of your homes value. This will tell you whether you have enough equity to get a HELOC to pay down your mortgage to the 78 percent level. Your total financing should not exceed 80 percent of the current value.

You May Like: What To Do If Lender Rejects Your Loan Application

How To Remove Mortgage Insurance Premiums From Fha Loans

FHA loans are mortgages offered by private lenders and backed by the Federal Housing Administration . Every homeowner who gets an FHA loan is required to pay an upfront mortgage insurance premium as well as annual mortgage insurance premiums.

If you made a down payment of 10% or more on most recent FHA loans, you may be able to cancel the MIP payments after 11 years. If you made a down payment of less than 10%, you will need to pay MIP for the full term of the mortgage. The rules for MIP are different for FHA loans that closed before June 3, 2013. You can find details about the older MIP rules on the HUD website.

The value of your home equity does not affect your FHA mortgage insurance premiums and having 20% home equity will not allow you to cancel it. As a result, homeowners with FHA loans sometimes think about refinancing their mortgages to remove mortgage insurance premiums.

One way you can do this is to refinance your FHA loan to a conventional mortgage. As discussed above, you need to have at least 20% home equity when you refinance with a conventional loan or you will need to pay for private mortgage insurance. So check the value of your home equity before considering this refinance.

How To Remove Pmi And Lower Your Interest Rate

Requesting early cancellation is one way to stop paying for PMI before automatic cancellation kicks in. But there is another way to cancel PMI early: refinancing. This option is only suitable for some people, though.

Lets say you want to get rid of PMI, but you also think you can get a better interest rate. When interest conditions are favorable, a refinance to get rid of PMI might help you save even more on your monthly payments.

The first step is to make sure you meet the right qualifications for refinancing. Youll also want to think and act carefully before taking this step. The question to ask isnt just can you get PMI removed by refinancing? The better question to ask yourself is will I save money by refinancing my mortgage to get rid of PMI?

The answer to this question depends on a number of factors, from interest rates to closing costs. Youll want to do the math to ensure that a refinance will be financially beneficial in the long term. Make sure to look at the big picture.

For example, if interest rates are higher than they were when you bought your home, refinancing might actually cause you to spend more over time. However, if your credit score has improved significantly since you bought your house, you could actually end up with a lower rate than you do now, even if the overall market interest rate has gone up. This is why its so important to consider all factors before making a decision.

When to Cancel PMI

Also Check: How Much Do Loan Officers Make In Commission

How To Remove Pmi: Everything You Need To Know

If you opted for a low down payment loan option when you bought your house, chances are your monthly mortgage payments include private mortgage insurance . This simple guide will help you understand more about when you can take off PMI and how its done.

How Long Do I Have To Carry Pmi

You must pay BPMI until you have 20% equity in your property. Equity refers to the percentage of your principal balance that youve paid off. For example, lets say you borrow $100,000 to buy a home and you pay off $30,000 of principal. This means you have 30% equity in your home.

Keep in mind that payments that only go toward your principal balance count toward your equity. Paying interest doesnt help you build equity. Contact your lender and request a mortgage statement if you dont know how much equity you have. Many lenders also make this information available to you online.

You can contact your lender and request that they cancel your BPMI once youve built 20% equity in your home. Many lenders will automatically do this once you reach 22% equity.

You may want to make extra payments on your loan if you want to stop paying for PMI as soon as possible. Your money can go directly to reduce your principal balance when you make an extra payment, but you have to tell your lender specifically thats where youd like it credited. Many lenders will automatically apply extra money toward next months payment instead.

You must pay PMI for the duration of your loan if you have LPMI or MIP. The only way to cancel PMI is to refinance your mortgage loans interest rate or loan type.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Pay The Mortgage Down To The Midpoint Of The Term

This is another automatic PMI elimination process. Even if the amount of the outstanding mortgage does not fall to the 78% level, the lender is still required to remove PMI when at least half of the mortgage term has elapsed. On a 30-year mortgage, for example, PMI must be removed 15 years into the loan. This is true even if the mortgage balance exceeds 78% of the original purchase price of the house.

Typically, the mortgage balance is paid to something less than 78% before the halfway mark, at least on self-amortizing loans. However, if you have an alternative mortgage, such as a balloon type, or an interest-only loan, you may not reach 78% even halfway through the term. But the lender still required to automatically remove the PMI. Again, though, this will only occur automatically if you are up-to-date on your mortgage payments.

Accept It As Permanent

As of 2015, the FHA requires mortgage insurance premiums on homes bought with less than a 10 percent down payment for the entire life of the loan. If less than 5 percent is put down on a home of $625,500 or less, your monthly payment will include 0.85 percent annual mortgage insurance premium on a 30-year fixed mortgage for the entire life of the loan. If buying a home that requires the maximum FHA loan amount in San Francisco of $679,650, the mortgage insurance premium will be one percent for the entire 30 years. Loans amortized over 15 years pay a lower mortgage insurance premium of about 0.15 percent for loans of $625,500 or less and 0.05 percent less for those above.

You May Like: Becu Auto Loan Phone Number

How Can Arbor Help You Remove Your Mortgage Insurance

If you would like help in determining your type of loan and eligibility for mortgage insurance removal our team at ARBOR is here to help you.

The first step would be for you to provide us with a copy of your curent mortgage statement and the date your original loan funded. We can then analyze your properties current value and advise you whether or not you have options to remove your mortgage insurance.

If there is a way to remove your mortgage insurance, we can help!

Wait For Pmi To Terminate Automatically

When does PMI drop off? According to the PMI Cancellation Act, your PMI payment drops off when your loan balance reaches 78% of the original value of your home. You dont need a new appraisal because the homes value is based on the appraised value when you purchased it or when refinanced into a new loan.

Your PMI termination will also happen when you reach the midpoint of your loan, even if your loan balance isnt 78% of your homes original value. This can happen if you had an interest-only period or perhaps a stretch of loan forbearance. On a 30-year loan, the midpoint would be at 15 years.

In both cases, you must be up-to-date on your loan payments to have your PMI removed. If you have late payments, your PMI will be cancelled once your loan is in good standing.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Cost Of Private Mortgage Insurance

The cost of your PMI premiums will depend on several factors.

- Which premium plan you choose

- Whether your interest rate is fixed or adjustable

- Your loan term

- Your down payment or loan-to-value ratio

- The amount of mortgage insurance coverage required by the lender or investor

- Whether the premium is refundable or not

- Your credit score

- Any additional risk factors, such as the loan being for a jumbo mortgage, investment property, cash-out refinance, or second home

In general, the riskier you look according to any of these factors , the higher your premiums will be. For example, the lower your credit score and the lower your down payment, the higher your premiums will be.

According to data from Ginnie Mae and the Urban Institute, the average annual PMI typically ranges from .55% to 2.25% of the original loan amount each year. Here are some scenarios: If you put down 15% on a 15-year fixed-rate mortgage and have a credit score of 760 or higher, for example, youâd pay 0.17% because youâd likely be considered a low-risk borrower. If you put down 3% on a 30-year adjustable-rate mortgage for which the introductory rate is fixed for only three years and you have a credit score of 630, your rate will be 2.81%. That happens because youâd be considered a high-risk borrower at most financial institutions.

How Much A No

A no-PMI refinance can yield big savings, depending on your current rate and loan balance. Take a look at one example:

| $220/month |

*Monthly payments shown here include principal and interest only, and are meant for sample purposes. Your own payments will vary.

Lets say your current home value is $250,000, says Mike Scott, senior mortgage loan originator for Independent Bank.

You have an FHA loan with a current balance of $195,000 and a rate of 4.25%. And you have 27 years left on the loan.

The monthly principal and interest you pay on this loan is just over $1,000, Scott points out. But the MIP you are required to pay adds another $140 a month.

You decide to refinance to a new conventional loan in the amount of $200,000. Your rate is 3.75% for 30 years. Assume the new mortgage rolls closing costs and other prepaid items into the loan.

Youre starting over with another 30-year loan. But now your principal and interest monthly payment is $930 a month, with no MIP required. Thats a savings of a month at least initially, Scott says.

Also Check: What Do Mortgage Loan Officers Do

Who Cant Get Rid Of Pmi

Its possible that your lender has marked you as a high-risk borrower. A high-risk borrower is someone who doesnt pay off parts of the loan on time or at all. The property owned by the borrower then gets marked as a high-risk property.

If you no longer wish to have this title, make sure all of your payments are on time. After that is when you can ask your lender for a PMI removal.

Types Of Private Mortgage Insurance

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

If you’re making a down payment of less than 20% on a home, it’s essential to understand your options for private mortgage insurance . Some people simply cannot afford a down payment in the amount of 20%. Others may elect to put down a smaller down payment in favor of having more cash on hand for repairs, remodeling, furnishings, and emergencies.

Private Mortgage Insurance

Read Also: Becu Car Repossession

Private Mortgage Insurance Coverage

First, you should understand how PMI works. For example, suppose you put down 10% and get a loan for the remaining 90% of the propertys value$20,000 down and a $180,000 loan. With mortgage insurance, the lender’s losses are limited if the lender has to foreclose on your mortgage. That could happen if you lose your job and can’t make your payments for several months.

The mortgage insurance company covers a certain percentage of the lenders loss. For our example, lets say that percentage is 25%. So if you still owed 85% of your homes $200,000 purchase price at the time you were foreclosed on, instead of losing the full $170,000, the lender would only lose 75% of $170,000, or $127,500 on the homes principal. PMI would cover the other 25%, or $42,500. It would also cover 25% of the delinquent interest you had accrued and 25% of the lenders foreclosure costs.

If PMI protects the lender, you may be wondering why the borrower has to pay for it. Essentially, the borrower is compensating the lender for taking on the higher risk of lending to youversus lending to someone willing to put down a larger down payment.