What Do I Do With Employees That Refuse To Come Back To Work

If a return to work offer at the same salary/wages/hour was rejected by an employee, the borrower must maintain records documenting the written offer and its rejection and inform the applicable state unemployment insurance office of such employee’s rejected offer of reemployment within 30 days of the employee’s rejection of the offer. The SBA will be posting state unemployment offices on the SBA website.

Duplicate Loans And Other Hold Codes Not Covered In Tables 1 And 2

The SBA has controls in place to identify duplicate loan requests. Duplicate loans may be triggered if the tax ID is already in use on an application or if an applicant applies for more than one first or second draw loan.

Some borrower applications may have hold codes that trigger one of two messages: Internal SBA Hold Details Not Publicly Available or Internal SBA Hold that cannot be cleared at this time Details Not Publicly Available. Lenders can reach out to the SBA through the platform to address Internal SBA Hold Details Not Publicly Available messages. However, lenders are unable to resolve Internal SBA Hold that cannot be cleared at this time Details Not Publicly Available, which may need to be addressed by the SBA.

What Protections Have Been Added To Ppp

Congress has included 3 key provisions designed to support businesses that have been hit the hardest by the coronavirus pandemic. Heres what we know now:

- Restaurants, hotels, or live venues that fall under a NAICS code starting with 72 can apply for 3.5 times their monthly payroll costs on their Second Draw.

- Live event and production companies that have been forced to close may be eligible for a special grant.

- $12 billion have been specifically earmarked for BIPOC-owned businesses.

Read Also: Capital One Subprime Auto Loan

What Are Gross Receipts

SBA defines gross receipts as all revenue in whatever form received or accrued from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees or commissions, reduced by returns or allowances. Generally, receipts are considered âtotal incomeâ plus âcost of goods sold,â and excludes net capital gains or losses as these terms are defined and reported on IRS tax return forms.

Gross receipts do not include the following: taxes collected for and remitted to a taxing authority if included in gross or total income proceeds from transactions between a concern and its domestic or foreign affiliates and amounts collected for another by a travel agent, real estate agent, advertising agent, conference management service provider, freight forwarder or customs broker. All other items, such as subcontractor costs, reimbursements for purchases a contractor makes at a customer’s request, investment income, and employee-based costs such as payroll taxes, may not be excluded from gross receipts.

Which Covered Period Is Right For Me

A borrower should choose a covered period that will allow all eligible payroll and non-payroll expenses to be paid out prior to applying for loan forgiveness. The covered period begins on the day the PPP funds were deposited into your account. It ends on a date selected by you that is at least 8 weeks following the date of loan disbursement and not more than 24 weeks after the date of loan disbursement. The covered period chosen needs to align with use of eligible payroll and non-payroll expenses, payment and documentation.

Example: PPP funds were exhausted during Week 9. The chosen covered period for the PPP loan forgiveness application would be a 9-week covered period.

You May Like: Loan Officer License Ca

How To Complete Your Ppp Loan Application After Submitting Your Sbacom Loan Request

If you already made a PPP Loan request with SBA.com®, your request was moved on to our partner, who will handle your application process through their application portal. You should have received an email from our partner with your account details to access the application portal where you can complete your application. If you cant find this email, you can access your application portal by resetting your password using the email address from your loan request and then logging in. After you reset your password, your login information for the portal will be the same whether you are logging into the portal through SBA.com or through our partner. Once logged in to the portal, follow the instructions to complete your application. Dont hesitate to access our partners live chat option for any questions or call 853-6346.

How Large Of A Loan Can A Business Qualify For Through Ppp

Small businesses can qualify for a potentially-forgivable loan worth up to 2.5 times the businesss monthly payroll costs in their First Draw, as was the case with the initial round of PPP. Qualifying businesses may qualify for a Second Draw up to 3.5 times monthly payroll costs.

The program also includes the following caps:

- Maximum total loan amount: $10 million

- Maximum loan amount for a Second Draw: $2 million

- Maximum loan total for businesses within a corporate group: $20 million

Recommended Reading: Upstart Second Loan

Will You Be Able To Get Another Ppp Loan If You Received One During A Previous Round

Yes, in a manner of speaking. The SBA refers to this as a Second Draw on your PPP loan, as opposed to applying for a second loan . Theres some legal jargon we could go into here, but the short version is: if you previously received a PPP loan, yes, you can apply for additional funding through the program.

What Youll Need To Check Your Status

The information youll need to check the status of your PPP loan application will depend on how you applied for the loan in the first place. If you applied through SBA.com, youll need to enter your login information for the application portal. You should also have whatever information you provided in the application process on hand when you check on the status of your application in case a representative asks for it.

If you applied for a PPP loan directly from your bank or other lender, youll need to follow the specific steps listed by your lender in order to check your application status. As a rule of thumb, when checking on your application status through your bank or another lender, you should have whatever information you provided on your original application on hand in case your lender asks for it again. Youll also likely need to provide your login information to access the online portal that you used to submit your application.

Don’t Miss: Mlo Average Salary

What Can You Expect From The Sba Direct Forgiveness Portal Process

Are There Caps Or Exclusions From The Definition Of Payroll Costs Or Owner Compensation

You must exclude the following:

- Compensation to an employee whose principal place of residence is outside of the United States

- Compensation to an independent contractor . Independent contractors do not count as employees within PPP.

- Qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act

Also, the compensation of any individual employee is capped at an annual salary of $100,000, which translates to $46,154 per employee during a 24-week covered period – the maximums are lower for periods of less than 24 weeks.

For a 24-week covered period, the maximum amount of loan forgiveness you can claim as compensation for owner-employees, self-employed individuals and general partners is the lower of 2.5 months of compensation earned in the year that was used to calculate the loan amount or $20,833, which is the 2.5-month equivalent of $100,000 per year – the maximums are lower for periods of less than 24 weeks.

Read Also: Usaa Loans Auto

Webbank Loan Number For Ppp Loan Forgiveness

Thanks for the replyâ¦actually the problem was that that WebBank loan number was NOT on the final doc. I had to do some sleuthing and found the number that I needed on the LoanBuilders site. Good news is I have some updated info via a direct phone call to WebBank. They gave me a new phonethat connects to a newly set up info desk specifically for the SBA FORGIVENESS LOANS. I spoke with Derrick who was very helpful and reduced my stress level. Hope this helps someone else.

What Documentation Will Be Required To Demonstrate The 25% Revenue Reduction

Quarterly âgross receiptsâ for one calendar quarter in 2020 and the âgross receiptsâ for the corresponding calendar quarter in 2019. Per the U.S. Treasury borrower guidance for Second Draw loans, the following are the primary sets of documentation that can be provided to substantiate your certification of a 25 percent gross receipts reduction :

- Quarterly financial statements for the entity. If the financial statements are not audited, the Applicant must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. If the financial statements do not specifically identify the line item that constitute gross receipts, the Applicant must annotate which line item constitute gross receipts.

- Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. The Applicant must annotate, if it is not clear, which deposits listed on the bank statement constitute gross receipts and which do not .

- Annual IRS income tax filings of the entity . If the entity has not yet filed a tax return for 2020, the Applicant must fill out the return forms, compute the relevant gross receipts value , and sign and date the return, attesting that the values that enter into the gross receipts computation are the same values that will be filed on the entityâs tax return.

Read Also: Bayview Loan Servicing Foreclosure Listings

Contact The Sba Directly

Given the extraordinary volume of SBA loan requests and the problems the SBA has had with meeting business demand for emergency assistance, this option may not bear fruit immediately. Simply put, the institutional capacity of the SBA to effectively respond to a disaster of this magnitude has been inadequate and thats putting it charitably. Nonetheless, Ive seen a few reports from business owners who were able to get meaningful information from an SBA representative concerning the status of their PPP loan application.

Try contacting your local SBA district office for information on the status of your application. You can also try emailing the SBA at [email protected] for information.

How Does A Change In Ownership Affect My Ppp Loan Or Loan Forgiveness

If you are considering a change of ownership for your business, which could include a merger, asset sale, stock sale or transfer due to the death of a business owner, please notify Wells Fargo as far in advance of the change of ownership transaction as possible. You will need to request prior approval from Wells Fargo before you initiate the change of ownership and provide a copy of the proposed change of ownership agreement and other relevant documents. If you do not obtain prior approval of any change of ownership, it will be considered a default event and may affect your ability to apply for PPP loan forgiveness.

To contact us about a change in ownership if you are a Wells Fargo Business Online® user or a Wealth & Investment Management customer, please call 1-844-304-8911. If you are a Commercial Electronic Office® user, please contact your relationship manager for assistance. We will work with you to complete the process as quickly as possible, but we cannot make any assurances regarding the exact timing for completion of your request, due to the many variables involved.

Providing the requested documentation and responding to questions quickly ensures the best outcome. We anticipate that it will likely take a minimum of 30 days to fully complete the request. The timeframe will depend on our evaluation, your responsiveness during each step of the process, and applicable SBA requirements.

Read Also: Refinance Through Usaa

What Is The Difference Between Non

An eligible non-payroll cost must be paid during the covered period or incurred during the covered period and paid on or before the next regular billing date, even if the billing date is after the covered period. Amounts due for services or obligations during the covered period must be prorated to align with the covered period window.

How Do I Calculate My Ppp Loan

How PPP loans are calculated. PPP loans are calculated using the average monthly cost of the salaries of you and your employees. If youâre a sole proprietor, your PPP loan is calculated based on your businessâ net profit. Your salary as an owner is defined by the way your business is taxed.Feb 24, 2021

Also Check: How Much Loan Officer Commission

Finishing Page : Ppp Loan Forgiveness Calculation Form

Line 1: Payroll Costs

From Schedule A, line 10.

Line 2: Business Mortgage Interest Payments

Enter the sum of interest payments on any business mortgages that were in effect before February 15, 2020. Prepayments are not allowed. You do not need to report any expenses you donât want to claim for forgiveness.

Line 3: Business Rent or Lease Payments

Enter the sum of business rent or lease payments, where the rent/lease agreement was in effect before February 15, 2020. You do not need to report any expenses you donât want to claim for forgiveness.

Line 4: Business Utility Payments

Enter the sum of business utility payments, where the utility agreement was in effect before February 15 2020. You do not need to report any expenses you donât want to claim for forgiveness.

Line 5: Covered Operations Expenditures

Enter the sum of any software, cloud computing, or other human resources and accounting needs . You do not need to report any expenses you donât want to claim for forgiveness.

Line 6: Covered Property Damage Costs

Enter the sum of any costs from damages due to public disturbances occurring in 2020 and not covered by insurance. You do not need to report any expenses you donât want to claim for forgiveness.

Line 7: Covered Supplier Costs

Enter the sum of any purchase order or order of goods made prior to receiving a PPP loan essential to operations. You do not need to report any expenses you donât want to claim for forgiveness.

From Schedule A, line 3.

ââ

Accessing The Ppp Portal

Why won’t the application load/why is it displaying incorrectly?For the best experience, Customers should use the Google Chrome browser and clear any cookies/cache before accessing TD’s application portal.

Can I use a third party to complete or submit my PPP Loan application?TD Bank does not permit any third party to complete or submit PPP Loan or forgiveness applications on behalf of Customers, including brokers, agents, attorneys or accountants. TD Bank is not responsible for paying fees to any agent for services unless TD Bank has directly contracted with the agent for those services.

How do I know if I am a “New User” or a “Returning User” when accessing the PPP loan portal?You Are a New User:

- If you have a PPP loan from TD Bank and have not started the PPP forgiveness process

- If you have never received a PPP loan from TD Bank

You Are a Returning User:

- If you have started or completed a PPP forgiveness application for a PPP loan from TD Bank

- When applying for your new PPP loan, you will need the login credentials you established when you applied for PPP forgiveness. Those credentials include your email address, phone number and the PIN you created when submitting your forgiveness application

How do I reset my PIN?If you have attempted to input your PIN and cannot remember it, please click the “I forgot my PIN” link to reset your PIN. If you aren’t sure if you setup a PIN, click “Get Started”.

How can I get my PPP SBA loan number?

Don’t Miss: How Much Car Can I Afford Based On Income Calculator

Contact Your Bank Or Lender

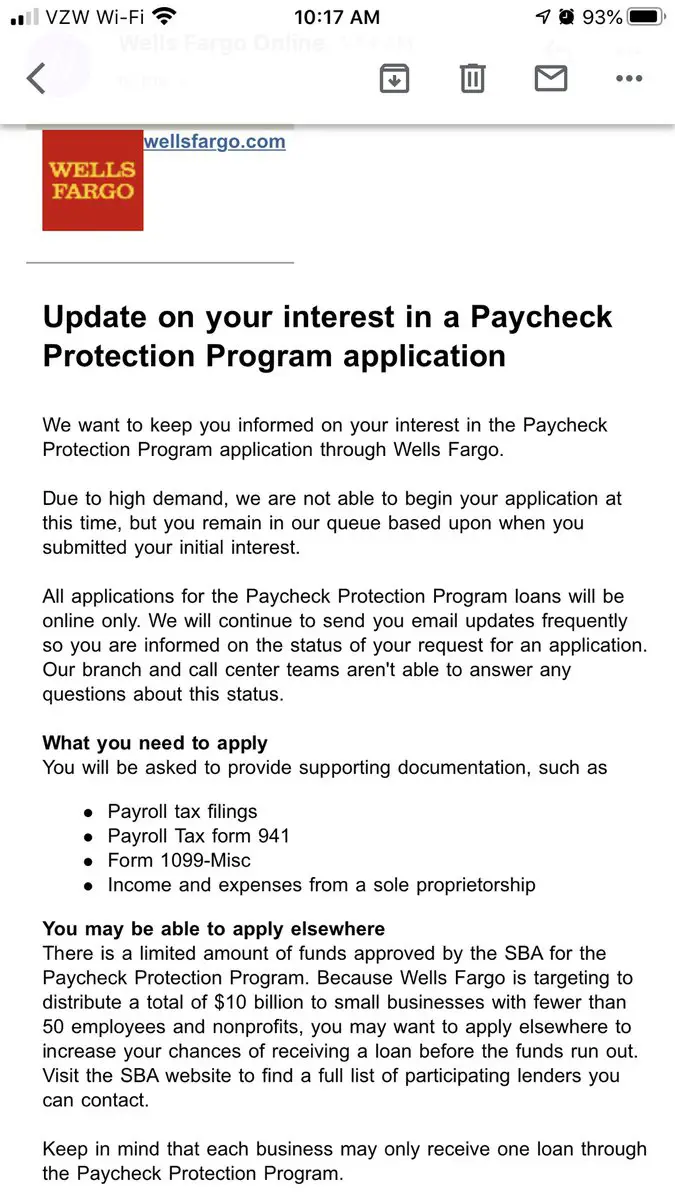

Each lender has its own policies surrounding how PPP loans are tracked, so you will need to contact your specific lender directly for more information. Fortunately, though, many banks and lenders have provided online information and portals to make tracking your PPP loan quick and easy. Heres what to expect from some of the biggest lenders participating in the PPP program:

Each PPP lender will have a somewhat different process for checking the status of your loan application. Asking your lender about the status of your application through normal processes such as contacting a bank branch directly or contacting a customer care center may not work due to the volume of applications being processed. Instead, youll have to follow the specific instructions of your bank or lender concerning PPP loan applications.

Unfortunately, Ive seen reports from business owners who have not been provided any means of checking on the status of their PPP loan application by their lender. If this happens to you, keep trying to contact your lender about the matter through any channel the lender provides. You may eventually find someone who can point you in the right direction.