Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

Youll be making payments to the National Student Loans Service Centre , not to OSAP.

You dont need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program,;learn about repayment for micro-credentials programs.

Get A Loan Out Of Default

| Loan | ||

|---|---|---|

| The collection agency listed on your collection notice |

You can confirm which collection agency holds your account by calling: |

|

| Ontario Student Loans | The collection agency listed on your collection notice | You can confirm which collection agency holds your account by calling the Account Management and Collections Branch, Ministry of Finance: |

Learn how you could be eligible for financial relief and how the deferral may apply to your debt.

Documentation Required For A Student Loan

There is a specific set of documents required by banks for sanction of education loans. This list of documents is similar for all lending entities. Following are the papers that need to be furnished by an education loan applicant.

- Proof of age, school certificates

- Proof of permanent address

- Optional guarantor form, duly filled

- Copy of admission letter to education course

- Bank account statements of co-applicant if required by the bank

You May Like: What Kind Of Loan For Rental Property

If You Dont Repay Your Loans

If you don’t make your loan payments, you will be in;default.

An OSAP loan is considered to be in default when no required payments have been made for 270 days.

Being in default means:

- your debt will be turned over to a collection agency

- you will be reported to a credit bureau

- you could be ineligible for further;OSAP;until the default is cleared

- your ability to get a car loan, mortgage or credit card can be affected

- your income tax refund and;HST;rebate can be withheld

- interest will continue to build up on the unpaid balance of your loan

Your OSAP debt will only be erased when you have paid it off in full.

Number Of Monthly Payments

If you take advantage of the six month non-repayment period, 114 monthly payments represent a total repayment period of 9.5 years .

If you do not take advantage of the six month non-repayment period, 120 monthly payments represent a total repayment period of 10 years .

You can select a shorter repayment period by entering a lower number of monthly payments.

Read Also: Is Prosper Personal Loan Legit

Why You Should Track Your Student Loans

While it might seem complicated, it is essential to keep track of your student loans and the amount of debt you owe, including knowing how much you borrowed and;how much you owe once you add interest. This can be helpful while you are in college, and as you start your budgeting process after graduation. Many options exist for repayment plans, including the following:

- Standard plans: Payments are calculated to guarantee loans are paid off within 1030 years.;

- Graduated plans: These are designed to ensure loans will be repaid within a certain amount of time, but payments will increase gradually over time.

- Income-based: These repayment plans calculate your monthly payments based on how much you earn, with higher wages equaling higher payments.

Once you have a solid number to start with, you can begin to create a repayment plan to get rid of that debt as quickly as possible. You can develop a repayment plan that works for your salary and lifestyle and pays down the debt quickly to save you money over time. You can always contact your loan servicer to update your payment plan if your situation changes. This does not have a negative impact on your credit.

Government Loses Money On Program

Neill says when;you put it all together, not only is the government failing to make a profit; it’s failing to;break even. In other words, it’s losing money.

If you measure revenue and expenses with this criteria;from 2015 to 2021; with the caveat that fully audited numbers are not yet available for the last two fiscal years; she estimates the government lost about;$1.8 billion.

That’s far from $4 billion in profit.

“That doesn’t count the cost of the Canada student grants program, which is another $1.5 billion a year at the moment,” Neill;said.

The NSLSC;still recommends that student make lump-sum payments to their loans even when interest is not being charged during their studies or the six months after graduation.

“Making payments while you are in study or in the non-repayment period ;is a great way to save on interest in the long run,” its;website says.;”It will reduce the principal of your student loan, which will also reduce the total interest you would have to pay later.”

Fact check: False.

You May Like: How To Apply For Fha Loan In Illinois

For Some Graduates Student Loans Are Interest

Yes, you did read that title correctly. Some with a mathematical bent will have probably worked out why from the seven need-to-knows; if not let me explain.

Effectively, you only pay any interest if you earn enough to have cleared the amount you originally borrowed within the 30 years. If not, you’re just repaying the amount borrowed, not the interest.

Let’s work up the income scale here try not to just jump to your expected income level, as the early examples are useful to understand the concept

-

Extremely low-income graduate earnersSalary under £27,295 for their working life.

Someone who went to university and then never earned over the repayment threshold within the 30 years wouldn’t repay a penny of what they borrowed, never mind interest.

- Middle income graduate earnersStarting salaries £20,000 – £30,000, above-inflation pay rises after. As the;interest rate added depends on earnings, it probably won’t be at the maximum rate for the first decade or so of your career, as for that you need to earn above £49,000. Yet more importantly, at this level of earnings you likely won’t repay all of the original borrowing plus the interest added within the 30 years before the debt wipes. This means while you may pay some interest, most won’t come close to paying all the interest added to their account, let alone all of it at the maximum interest rate.

This little graph shows you how it works.

If You Have A Plan 4 Loan And A Plan 2 Loan

You pay back 9% of your income over the Plan 4 threshold .

If your income is under the Plan 2 threshold , your repayments only go towards your Plan 4 loan.

If your income is over the Plan 2 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan 2 threshold of £2,274.

Your income is £317 over the Plan 4 threshold which is the lowest of both plans.

You will pay back £28 and repayments will go towards both plans.

Also Check: How Much Is My Student Loan Payment Going To Be

Repaying The Student Loan

SAAS assess how much loan you are entitled to.; It is the responsibility of the Student Loans Company to make loan payments to you and to work out how much and when you will start repaying your loan.

You normally wont have to make any repayments while you’re studying. Repayment starts after you leave your course and earn over a certain amount a year.

Most students will repay their loans through HM Revenue and Customs either by:;

- employers taking amounts from pay through the PAYE system or

- through the tax self-assessment process

How quickly you repay your loan will generally depend on how much you earn.;

How Are Extra Student Loan Payments Treated

When you make your monthly payment, youre given the option to pay extra. If you do, that extra payment is applied directly to the principal, which will reduce your interest in the future.

Any other extra payments made throughout the month are treated as normal payments. That is, your payment is first applied to interest you accrued since your last payment and then your principal. Double-check your lenders payment policies to make sure any extra payments are really going to pay down your principal.

Dont underestimate the power of early student loan payments. Paying an extra $50 or $100 each month can save you thousands of dollars in interest, depending on your loan terms. Check out the student loan prepayment calculator to see how much you can save by paying a little more every month.

Also Check: How Do I Access My Student Loan Account Number

Managing Your Debt Repayment Assistance Plan

As a borrower, you are required to repay your loan. Missing payments could damage your credit rating. Your student loan could go into default. Contact the National Student Loans Service Centre at 1-888-815-4514 before you miss a payment. There are options available to help you manage your payments and avoid defaulting.

The Repayment Assistance Plan makes it easier to manage your debt. You pay back what you can reasonably afford, based on your family income and size. Monthly payments are limited to no more than 20 per cent of your gross family income. No borrower on RAP will have a repayment period lasting more than 15 years. If you have a permanent disability, your RAP repayment period will not last longer than 10 years. If you earn very little income, you might not be required to make loan payments until your income increases. Contact the National Student Loans Service Centre to apply.

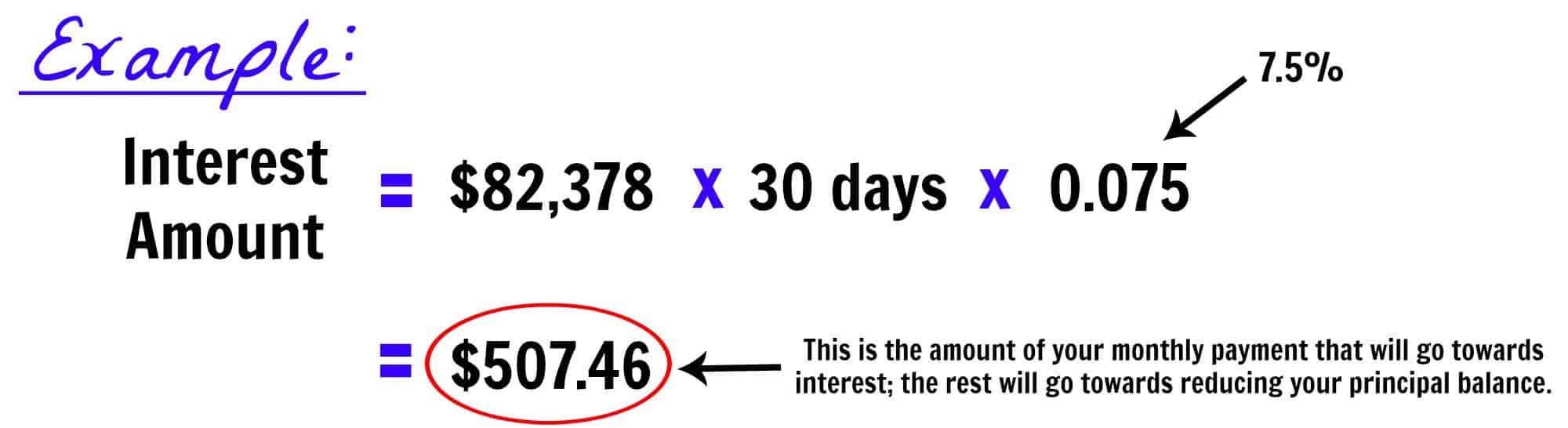

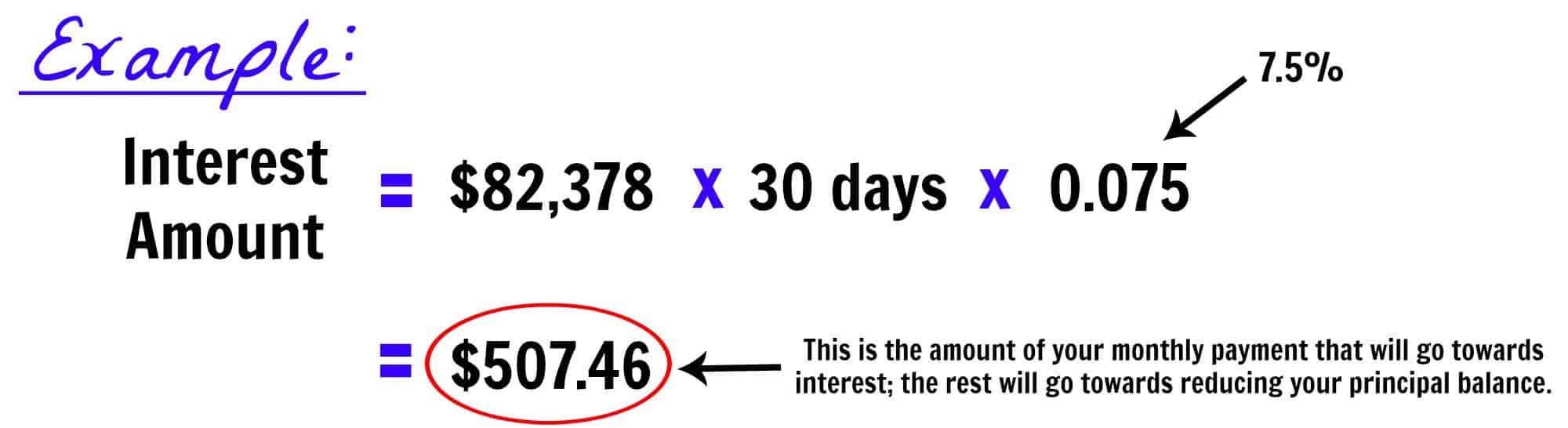

When Do I Start Accruing Interest

Student loan interest typically accrues daily, starting as soon as your loan is disbursed. In other words, student loans generally accrue interest while youre in school.

Subsidized federal loans are the exception the government pays the interest that accrues while the borrower is in school, so borrowers generally dont have to start paying interest on subsidized loans until after the six-month grace period.

Read Also: Can I Refinance My Sallie Mae Loan

Capitalization Increases Interest Costs

In most cases, youll pay off all of the accrued interest each month. But there are a few scenarios in which unpaid interest builds up and is capitalized, or added to your principal loan balance. Capitalization causes you to pay interest on top of interest, increasing the total cost of the loan.

For federal student loans, capitalization of unpaid interest occurs:

-

When the grace period ends on an unsubsidized loan.

-

After a period of forbearance.

-

After a period of deferment, for unsubsidized loans.

-

If you leave the Revised Pay as You Earn , Pay as You Earn or Income-Based-Repayment plan.

-

If you dont recertify your income annually for the REPAYE, PAYE and IBR plans.

-

If you no longer qualify to make payments based on your income under PAYE or IBR.

-

Annually, if youre on the Income-Contingent Repayment plan.

For private student loans, interest capitalization typically happens in the following situations, but check with your lender to confirm.

-

At the end of the grace period.

-

After a period of deferment.

-

After a period of forbearance.

To avoid interest capitalization, make interest-only student loan payments while youre in school before you enter repayment and avoid entering deferment or forbearance. If youre on an income-driven repayment plan for federal student loans, remember to certify your income annually.

How And When Do I Repay

- Full-time courses youll be due to start repaying the April after you finish or leave your course, but only if you’re earning;over the repayment threshold. For example, if you graduate in June 2021, youll be due to start repaying in April 2022, if you’re earning enough.

- Part-time courses; youll be due to start repaying the April four years after the start of your course, or the April after you finish or leave your course, whichever comes first, but only if you’re earning over the repayment threshold.

How you’ll repay depends on what you choose to do after your course:

- If you start work, your employer will automatically take 9% of your income above the threshold from your salary, along with tax and National Insurance.

- If you’re self-employed, youll make repayments at the same time as you pay tax through self-assessment.

- If you move overseas, youll repay directly to the Student Loans Company, instead of having it taken automatically from your pay. The repayment threshold could be different from the UK, which means the amount you repay could be different. Find out more about repaying from overseas.

Read Also: How To Calculate Loan To Debt Ratio

Sign Up For Automatic Payments

Many lenders will give you a small interest rate deduction if you sign up for automatic payments. This means that each month, your payment is automatically deducted from your bank account.;

If you are confident you would have the funds to cover the monthly payment, this could also help you avoid late payments and any fees that go along with that.

Is The Amount Of Interest Higher Than You Expected

Capitalized interest may be counted as interest paid on the 1098E. That capitalized interest and your origination fees may be tax deductible. If you have more questions on your 1098-E, please contact a tax advisor.

Please note: Because fewer loan payments were required and interest rates were at 0% for much of 2020, your interest paid was likely lower than in previous years.

You May Like: Can You Pay Off Mortgage With Home Equity Loan

Completing Your Tax Return

On line 31900 of your return, enter the eligible amount of interest paid on a student loan.

Remember to claim the corresponding provincial or territorial non-refundable tax credit on line 58520 of your provincial or territorial Form 428.

For more information about your student loan and interest paid, visit Student Financial Assistance.

Revenue Not The Same As Profit

Christine Neill, an associate professor of economics at Wilfrid Laurier University in Waterloo, Ont., says the claim is false;;though the finance of student loans, a subject she’s researched extensively,;can get quite;complicated.

“No, I think it’s not really correct as phrased,” she said of Singh’s tweet.

The government obviously generates revenue off of interest on student loans, she says, but revenue is not the same thing as;profit.

“Profit tends to imply that the revenue that you’re raising is greater than the cost,” she said.

The issue with Singh’s claim is that Ottawa is actually losing money on federal student loans and grants, even as interest on the loans produces;some revenue, Neill said.

The government has;generated billions of dollars in revenue on federal student loan interest since 2015, Neill says, but Singh may be slightly overestimating how much; it’s likely around $3.7 billion.

Video: Will Trudeaus promised bank tax hike mean higher fees?

While that may sound like a big number, the federal government still isn’t making any “profit.” Why? Because the student loans program;comes with a price tag for the government, too.

Also Check: How To Cancel My Student Loan Debt

The Interest Rate Changes Every September

This change is based on the RPI rate of inflation in the year to the previous March. The RPI rate was 1.5% in March 2021, so interest is currently charged at 1.5% to 4.2%, depending on whether you’re still studying and how much you earn.

Of course, if in any year March’s RPI is anomalously high, you’ll pay a high rate for the year but if it’s anomalously low, it’ll be cheap for the year. As student loans are repaid over a long period, things usually even themselves out.

How Does Student Loan Interest Work

When new student loans are issued, the borrower signs a promissory note that explains the terms of the loan. Every part of this document is important to read and understand, as it determines how much you owe and when your payments are due. This applies to parent PLUS loans and their interest as well.

The most important terms to look out for are:

- Disbursement date: The date the funds arrive and interest starts accruing

- Amount borrowed: The total amount borrowed in each loan

- Interest rate: How much you have to pay to borrow the funds

- How interest accrues: Whether interest is charged daily or monthly

- How interest capitalizes: When accrued interest is capitalized to your principal balance

- First payment date: When you have to make your first loan payment

- Payment schedule: How many payments you have to make

Lenders understand that most full-time students do not have an income, and if they do, it is not enough to cover payments while in school. As a result, its often possible to avoid making payments while youre in school.

You May Like: How To Get Loan For Property

A Political Hot Potato

Before I get into the grit of this, let me be blunt. My aim isn’t to engage or enrage the wider political debate, just to ensure people don’t make poor personal-finance decisions because of misunderstanding the system.

Some attack me for this. They see an explanation which sets people’s minds at rest akin to a defence of the system. It isn’t. While I do believe, IF we’re going to ask individuals to pay towards their education, repaying loans in proportion to what you earn through the tax system is the best way, I’ve never been a fan of the post-2012 set-up.

I believe charging graduates above-inflation interest to fund their education is wrong in principle, even though in practice it has little impact .;

The fact too that Governments can retrospectively change the system is wrong that should be stopped. Many will know I led the charge against the retrospective hike in student loan repayments, and thankfully we won in the end.

Yet my work and my passion is to explain how to make good decisions based on the system that currently operates. And I am happy to subjugate my own views to do that. I refuse to be a party to inflating the toxicity of a system to make a political point, at the cost of making people make bad decisions. So time to forget politics and get practical…

MSE weekly email