What Is The Longest Loan Term Allowed For A Used Car

Every lender chooses where to set the minimum and maximum loan term allowed for used car financing.

Generally, the longest loan term youll find is seven years, or 84 months. There are, however, some lenders that will extend used car financing to 92 or 96 months, or up to eight years. In 2018, 55% of new car loans originated were for 84 months.

At a minimum, used vehicle financing loans typically start at two years or 24 months.

How Long Do I Plan To Keep This Car

Do you drive your cars until the wheels fall off, or are you addicted to that new car smell?

The average lifespan of a vehicle is over 11 years. With proper care and maintenance, cars these days are built to last 200,000 miles or more which can take about 15 years for the average driver.

However, just because cars are lasting longer doesnt mean people are holding onto them that long. A 2019 iSeeCars.com study found that average length of car ownership is 8.4 years.

If youre getting rid of your next car sooner rather than later, it may make sense to get a shorter loan term. That way, you can use your positive equity to buy your next vehicle .

It May Free Up Cash You Can Use To Pay Off More

Lets say youre deciding between a 60-month car loan and an 84-month car loan. The smaller monthly payment that comes with the longer loan term may free up resources to pay down other high-interest debt more quickly. But this only makes sense if the interest rate on your debt is significantly higher than your car loans interest rate.

Say youre buying that new vehicle at 3% APR, and you also happen to have a credit card balance of $10,000 with a 20% APR. If you choose the seven-year loan term on the car and apply the extra $143 that youd have available each month to your credit card debt, you could save on interest overall. Because even though youd end up paying more interest on the longer-term loan than on the shorter, youd be able to pay off your higher-interest credit card debt in less time, potentially saving you more interest in the end.

Read Also: Apply For Capital One Auto Loan

What Are The Disadvantages Of Long

When youre signing the paperwork at the dealer, youll face the temptation to accept longer loan terms. Theres a reason for that: Monthly payments become lower when stretching them out over a more extended period. Initially, that might seem like its more cash in your pocket, a good thing.

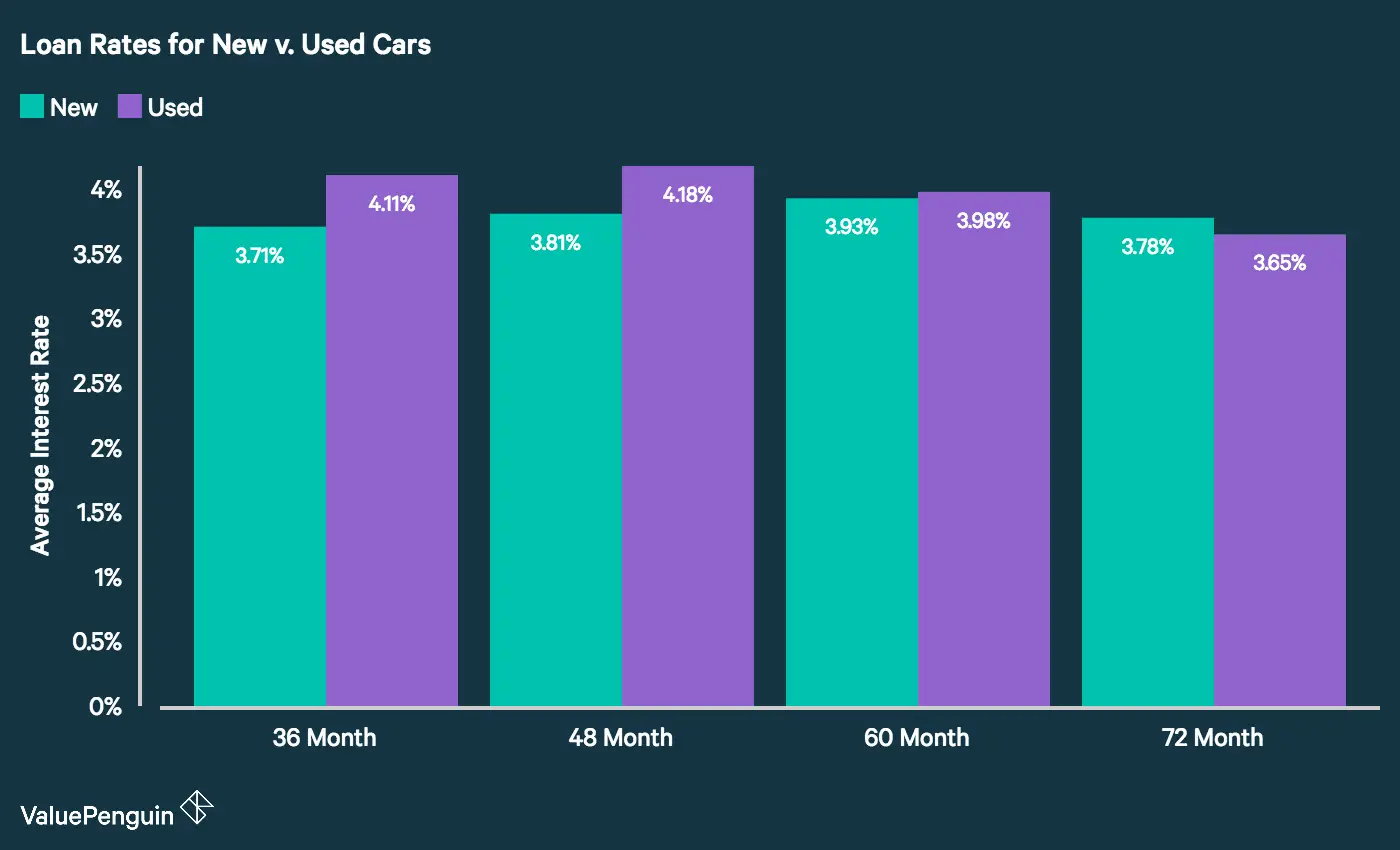

Not so fast. Remember: The longer the term, the higher the rate of interest. Thats the extra money you have to pay the lender for giving you the loan. So while a lower monthly payment might seem like its benefiting you, its usually the more expensive decision.

Another long-term issue is never really building any measurable equity in your car. That is, with those loans spanning six, seven, or more years, your vehicle wont be worth more than you owe until close to the end of the loan. The typical car loan length is 6 years. But with a 7- or 8-year loan, not only will you still be making payments at the loans end, but you might also be paying to make repairs to the car.

Where Longer Loans Are More Common

While the average auto loan across metros analyzed sits at just more than five years, some metros have notable shares of auto borrowers who finance their vehicles for longer than six years.

RELATED:

Across the 48 metros, an average of 7.6% of borrowers took out auto loans with terms longer than six years, but that share nearly doubled in Hartford, Conn. .

Auto borrowers in Charleston, S.C., take out extra-long auto loans at the next highest rate , followed by Phoenix at 12.0%.

| Metros where the highest share of auto loan terms are longer than 6 years |

| Rank |

| 49.5% |

Read Also: Flex Modification Calculator

Youre Likely To Finance More Money

The average loan amount for a six-year loan was $25,300, compared to $20,100 for a five-year loan, the CFPB writes. The average size of loans with terms of seven years or more was even larger at $32,200.

Keep in mind that right now because of the unprecedented economic disruption accompanying the pandemic money expert Clark Howard is warning consumers away from making most big purchases.

Unless you are sitting there with tons of cash, you dont want to be in a position where youre taking on new debt obligations. I dont care how good the deal is and Im the deal guy, Clark says. Dont buy deals that would put you into debt.

Average Loan Terms Were Getting Shorter Before 2021

The coronavirus pandemic has sent shockwaves throughout the autos industry, quickly driving up prices for new and used cars. Consumers may be responding by taking out longer auto loans along with looking for older cars and bigger loans, as LendingTree reported earlier this year.

Throughout 2019, consumers financed vehicles for an average of 62.8 months, then got slightly shorter loans 61.1 months, on average throughout 2020. But through the first 10 months of 2021, auto loan terms have averaged 64.6 months, peaking in July, when terms averaged 65.6 months. November 2020 was the only month in three years to see average auto loan terms drop below 60 months, but just down to 59.9.

The most popular loan term for borrowers through the LendingTree platform since 2018 is 72 months, or six years, with 36.5% of borrowers financing for this term. But the share of 60-month auto loans is only slightly smaller at 34.8%. Only 7.8% of loan terms are 73 months or longer, while a notable 19.2% of auto loan terms are shorter than 60 months.

Also Check: Usaa Used Car Loan Rate

For A Long Time Three

According to the Consumer Financial Protection Bureau, 42% of auto loans funded in 2017 carried a term of six years or more, compared to just 26% in 2009. And that trend has continued since. In the second quarter of 2020, the average loan term for new-car loans was nearly 72 months, according to the Q2 2020 Experian State of the Automotive Finance Market report.

There are a couple of possible benefits to getting longer-term loans, depending on your financial situation. But there are also notable risks to longer-term loans that may make a five-year car loan, or other options, a better choice.

What Is A Fair Term For A Customer

One might think it’s better to go with a plan that has cheaper monthly payments, but it’s actually best to keep loans short. Less time owing anybody money for anything is always a good move â it usually reduces the interest rate, lowers the total amount of interest paid, and lets you own it outright sooner. It’s therefore best to aim for a 36- to 60-month loan as it should deliver the best overall deal â lower total interest payments, a lower interest rate, and a term that better fits the length of time most people own a car. Frankly, if you can’t afford the resulting monthly payment, that car is probably too expensive.

Now, if you think you’ll be ready for a different car within a few years, you’ll want to do a few things. First, consider a lease. If you’re the type of person who likes a new car every two or three years, you’re exactly the type of person for whom leasing makes the most financial sense. That said, before choosing a lease, consider if you might have any upcoming life changes. You’d hate to be in year two of a sports car lease when the triplets are born. There are some ways to get out of a lease, but none are ideal or particularly easy.

Yet, even if you’re sure you’ll keep the car longer than average and get every penny’s worth out of it, consider a shorter loan term and the total costs rather than focusing on monthly payments. It’ll put what you can actually afford in more realistic terms.

Related Video:

You May Like: Refinance Car With Usaa

Can You Refinance A Car Loan

If youre in desperate need of a car and cant shop around, or if your credit is bad, so you have to get a loan with high interest, you can refinance it down the line. This is especially true if your income or credit score improves. So, shop around for refinancing options to shorten the loan term, get a lower interest rate, or both. Your local bank or credit union are good options. There are also a variety of options online. Credit score and payment history will be factors in how good a deal you get, no matter who you go with.

The Pros And Cons Of Short

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Car loans come with a few options. Deciding on the term of your loanalso known as the length of your loanis an important part of the decision-making process. Auto loans come in several different terms, and each one can be beneficial to different consumers. Consumers are typically able to choose between 24- to 72-month loans. The major difference between the terms is the amount of interest you will pay, and the dollar amount of your payments.

Shorter loans will come with less interest over the term and have higher payments. Longer-term loans will have lower monthly payments, but more interest over the term. One key element to keep in mind is that the longer you make payments, the more you are paying for the car this can lead to you paying more for the car than you negotiated or that it is worth.

Read Also: Firstloan Com Legit

Other Auto Loan Options

Use an auto loan calculator to get an idea of what a longer term will cost you. If youre not sure a longer term is right for you even with the best 84-month auto loan rates here are some alternatives to consider:

- Wait and save. If youre stuck on a specific model but cant afford it without a longer term, consider waiting to accumulate enough cash for a higher down payment. Use an auto loan down payment calculator to see how much it can reduce your monthly payment.

- Opt for a cheaper car. If you dont have time to save for a larger down payment, consider changing your expectations to a less expensive vehicle that allows you to finance for a shorter term.

- Find room in your budget. If you havent already, take a look at your income and expenses for the last few months and determine if there are areas where you can cut back to make room for a higher monthly payment.

- Lease instead of buying. Leases have shorter terms than auto loans on average roughly three years, according to Experian. Despite the shorter term, they have lower monthly payments because theyre based on the vehicles depreciation and not its sales price.

Ways To Get Around A Long Loan Term

If youre looking to save money on a vehicle you really want, but the only option for you is a really long loan term, there are four ways you can avoid that long term while keeping the payment affordable:

Also Check: Usaa Car Refinance

The Cost Of Vehicle Financing

Most borrowers dont get to borrow money from an auto lender for free. Lenders charge interest, and borrowers with the lowest credit scores are typically charged more.

If you have great credit, for example, you may qualify for a 0% interest rate for 84 months which means choosing the longest loan term available can benefit you greatly. A low monthly payment and no interest? Great deal!

However, borrowers with credit scores below 700 arent likely to qualify for incentives like this, and its a good idea to plan and account for interest charges. You never really know what your interest rate is going to be until you apply for a car loan, but with a poor credit score, you may have to plan for an interest rate in the double digits.

A good way to lower your interest charges is by choosing an inexpensive vehicle, putting money down, and choosing a shorter loan term. Having a large down payment can also increase your chances of qualifying for a car loan if your credit score is less than stellar. It shows youve some skin in the game and lowers the amount you need to finance.

Reasons To Avoid Long

While a 72-month or 84-month car loan can be convenient to lower your monthly payment, it typically isnt the most financially sound choice. Youll pay more in interest over the life of your loan and you may actually receive a higher interest rate than you would on a shorter term.

1. Youll pay more interest

Long-term car loans are expensive. Despite the low monthly payment, youll end up paying much more overall. For an average new car, that means an interest rate of 4.31% on a loan of $35,000. Heres how it breaks down.

| Loan term | |

|---|---|

| $5,607.17 | $40,607.17 |

While you may be able to find a special deal if you have excellent credit, long-term auto loans tend to have higher interest rates. You can calculate your monthly payment and total interest to see how much more a long-term loan will cost you.

2. Its easier to go upside down on your loan

Upside down, underwater and negative equity all mean the same thing: You owe more on your car than its worth. This is a high risk, low reward scenario. Even if you keep your car the full six or seven years of your loan term, its value will have significantly depreciated.

When you go to sell your car or trade it in at the dealership, you may not recoup your losses. And if you choose to sell before your loan term is finished, it will cost you more wrapping your previous loan into a new car loan will lead to high debt.

3. Your finances might change

4. Newer cars lose value faster

5. Older cars have less resale value

Read Also: Drb Refinance Reviews

How Long Is A Car Loan Term

Most terms for car loans are between 32-to-72 months, with 12 months being the lowest terms one can get and 96 months the highest. Choosing the terms for your car loan is one of the most important decisions.

A longer term might seem ideal, but you will pay more in fees and interest than a shorter term. Therefore, explore all your options and determine what will work best for your financial situation.

Reasons To Say No To 72

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You have your heart set on that hot new sport coupe but the monthly payments for the auto loan just wont fit in your budget. The salesman sighs sympathetically, and then says, I have an idea of how to make this work.

He recommends you extend the auto loan to 72- or 84-months. He explains that your down payment would remain the same but your monthly payment is lower. As he talks, you begin to picture the coupe in your garage and showing it off to your friends.

But wait just a second! Cancel the daydreams. Long car loan terms are setting you up for a vicious cycle of negative equity, says car buying concierge Oren Weintraub, president of AuthorityAuto.com.

Here are a few stats to show you why 72- and 84-month car loans rob you of financial stability and waste your money.

Also Check: Restoring Va Entitlement After Foreclosure

Auto Approve: Top Choice For Refinance Auto Loans

Starting APR:2.25%Loan amounts:$5,000 to $85,000Loan terms:12 to 84 monthsAvailability:50 statesMinimum credit score:580

Auto Approve has a reputation as a refinance auto loan specialist, but the companys lease buyout option makes it a viable choice for people looking to purchase vehicles. And given the companys strong industry reputation and high customer ratings, our team felt it was worth including.

Auto Approves rates start at 2.25% APR for refinancing, though only borrowers with high credit scores will have access to the best auto loan rates. People who want to buy out their loans or refinance their vehicles need a minimum credit score of 580. That means that while people with fair credit may not get the lowest rates on their auto loans, they may get approved by Auto Approve.

Again, you cant use Auto Approve loans for buying a new or used car, so if thats what youre looking to do, you should consider other lenders. However, if you need to refinance your current auto loan or are considering buying your current lease out, Auto Approve could be a great choice for you.