Department Of Education’s Federal Student Aid Information Center

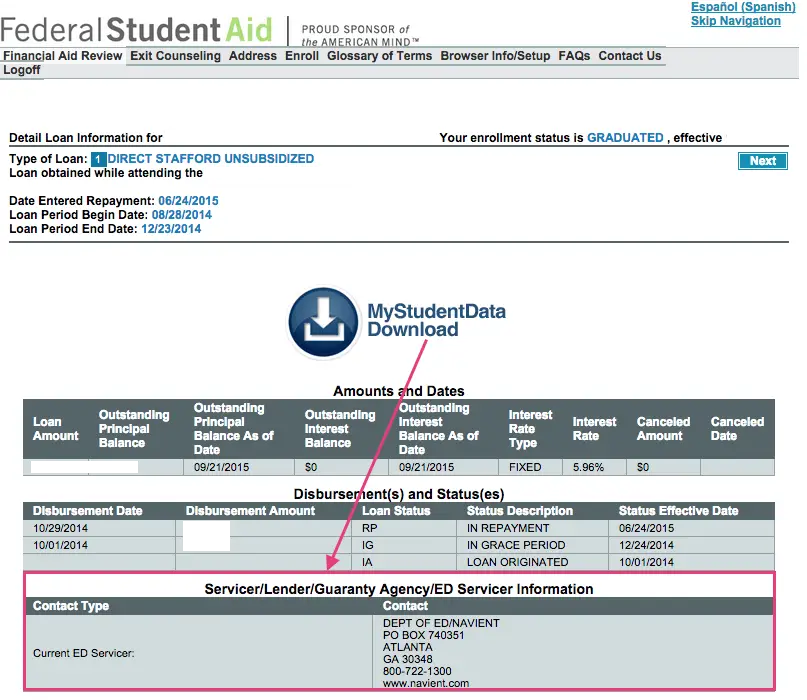

For help accessing the National Student Loan Data System and to find information about the holder of your loan, as well as other information on your loans, call the Department of Education’s Federal Student Aid Information Center at 800-433-3243 or 800-730-8913 . For loans in default, contact the Department of Education’s Default Resolution Group at 800-621-3115 or 877-825-9923 .

Servicer Of Your Federal Student Loans

Your federal student loans may or may not all be with Nelnet or another servicer. It’s important that you know which servicer provides customer service for each of your student loansand it’s simple to verify. You can access all of your federal student loan data at StudentAid.gov by logging in with your FSA ID. To create or update an FSA ID, visit FSAID.ed.gov.

How To Find Out Who Your Student Loan Lender Is

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Who owns your student loans? It seems like a simple question, but the answer can be less than straightforward. If youve taken out loans from a variety of lenders, it can be difficult to keep track of all the institutions youve borrowed from.

And if you have federal student loans, those actually arent administered directly by the government but rather several different companies.

Its important to know who your lenders and/or loan servicers are for several reasons. You need to know which institutions are overseeing your loans so that you can actually pay them. You need to know which website to visit or whom to call in order to find out how much you owe each month and ensure you pay it on time.

If you lose track of these details, you may risk falling behind on your payments andif you fall behind for too longeven defaulting on your loans, which can have serious financial consequences.

Also Check: How Much Loan Officer Commission

But What If Navient Sold My Loan To Aidvantage

If your loans were moved from Navient to Aidvantage, then those are federal student loans. And those loans arenât eligible for debt cancellation under the settlement.

Although your federal loans wonât be forgiven as part of the Navient student loan settlement, you may receive restitution payments of $260 because your loans were placed into forbearances for long periods of time instead of being placed into an income-driven repayment plan. Go to your studentaid.gov account and update your contact information with your current address to receive the postcard notification.

Learn More:Aidvantage Student Loans: Forgiveness & Repayment Options

Student Loan Forgiveness: Which Loans Are Eligible

Only direct loans made by the federal government are eligible for forgiveness. Stafford loans, which were replaced by direct loans in 2010, are also eligible. If you have other federal loans, you may be able to consolidate them into one direct consolidation loan that would make you eligible. Non-federal loans do not qualify for forgiveness.

In addition, borrowers with federal student loans who attended for-profit colleges and seek loan forgiveness because their school defrauded them or broke specific laws were recently dealt with a setback. On May 29, 2020, former President Trump vetoed a bipartisan resolution that overturned new regulations that make it much more difficult to access loan forgiveness. The new, more onerous regulations went into effect on July 1, 2020.

Also Check: What Kind Of Loan Do I Need To Buy Land

Don’t Miss: How To Get Mlo License California

Who Is The Creditor For Sallie Mae Student Loans

These loans are made by Sallie Mae Bank or a lender partner. GreenLeaf Bank is not the creditor for these loans and is compensated by Sallie Mae for the referral of loan customers. Smart Option Student Loan and graduate loan products: This information is for students attending participating degree-granting schools.

If You’re Unemployed Try Deferring Your Student Loans

Deferment can pause your student loan payments for up to three years. Your loans might still accrue interest during that time. This may be a valid option if you’re unemployed and other income-driven repayment plans won’t work for you.

Unemployment is only one reason you may qualify for deferment. Other qualifiers include undergoing cancer treatment, facing economic hardship, or serving in the military. To apply, you have to file a specific request on the Department of Education’s website.

Also Check: Usaa Bad Credit Auto Loans

Can I Change The Day That Auto Pay Withdraws Money From My Account

We withdraw money from the checking or savings account you select on your payment due date. You canselect a new payment due date for eligible Great Lakes accounts. If your loans donât have a payment due, you can select which day of the month you want Great Lakes to withdraw money from your checking or savings account.

Is Navient Private Or Federal

Are Navient Federal or Private, depending on your opinion?? The original purpose of Sallie Mae, created by Congress as a partner in the federal student loan program, was eventually privatized. A U.S. corporation, Navient provides data mining services. Borrowers loans was handled once by the Education Department.

Read Also: Loan Officer License California

Title Iv Credit Arrangements

Oakland Community College does not have a contractual agreement with financial services providers/third-party vendors to offer Tier One and/or Tier Two Arrangements. Student refunds are processed as follows:

- deposited into the student’s banking account,

- processed as a paper check and mailed to the address on file, or

Expanded Eligibility For Pslf

The forgiveness program for public servants was temporarily relaxed so more full-time government and nonprofit employees could qualify to have their student loan debt erased. The department will use a one-time waiver that will give credit toward forgiveness for a broader range of past student loan payments on both FFEL and Direct Loans. These rules are set to expire Oct. 31, 2022.

Over 110 thousand people have gotten around $.8 billion in relief under this limited waiver.

If you still have federal student loans with Navient, you will need to consolidate your loans into a Direct Consolidation Loan. You will also need to complete an Employment Certification form for each qualifying employer youâve worked for since Oct. 2007.

Visit studentaid.gov to apply.

Learn More:How to Apply for the PSLF Limited Waiver Opportunity

You May Like: Usaa Pre Approval Auto Loan

Difference Between The Federal Family Education Loan Program And The Federal Direct Loan Program

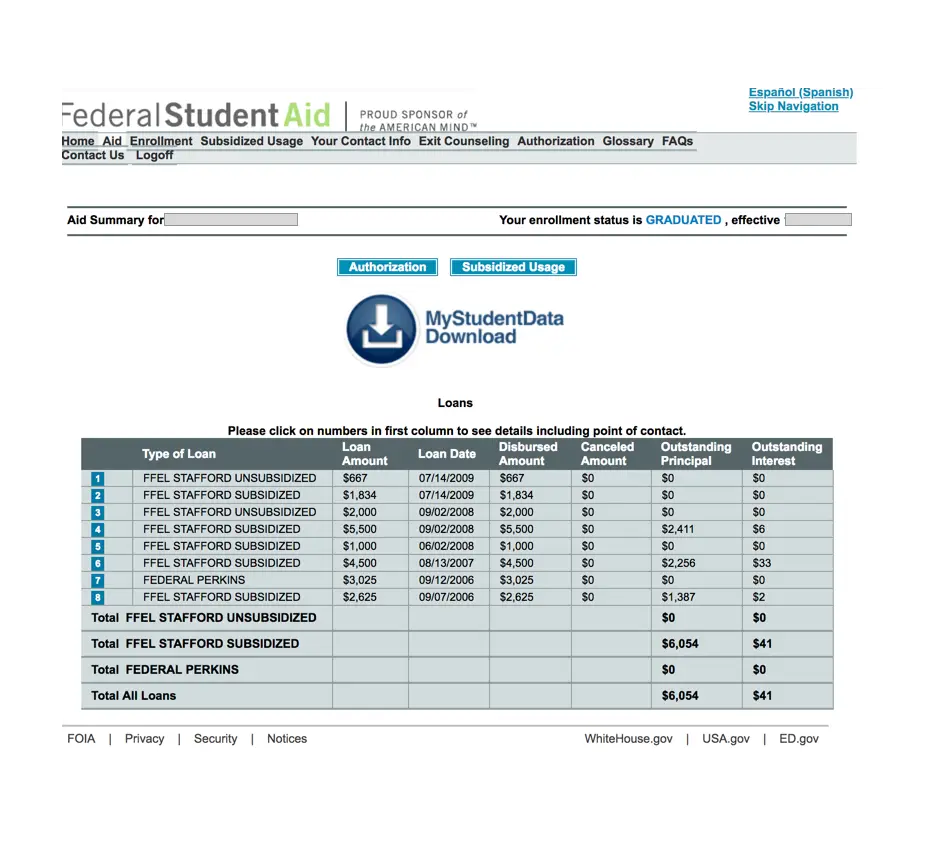

A Federal Direct Loan Program loan is originally borrowed from or currently owned by the Department of Education. A Federal Family Education Loan Program loan was originally borrowed from a company such as a bank, lender, or non-profit organization and could be currently owned by the Department of Education, a bank, lender, or non-profit organization. The FFEL Program ended in June 2010. All federal student loans borrowed after June 2010 are FDLP loans.

How Can I Get My Student Loan Discharged If I Become Disabled

Certain types of student loans may be discharged if you qualify for the Total and Permanent Disability Discharge Program. The loans that qualify are Federal Family Education Loan Program Loans, Perkins Loans, and Direct Loans, and also the Teacher Education Assistance for College and Higher Education Grant service obligations. To apply and to get status information about your application, you can create an account at DisabilityDischarge.com or call 888.303.7818. For more information about the TPD process, visit StudentAid.gov.

Also Check: What Car Can I Afford With My Salary

How Do I Make A Payment Online

Just follow these steps:

Recommended Reading: Usaa Car Loan Application

How Do I Consolidate Student Loans

The process for consolidating your student loans depends on whether you have private or federal student loans. If you have private loans or want to combine private and federal loans into one, you’ll need to refinance them with another private loan. You can consolidate multiple federal loans into one new federal loan through a Direct Consolidation Loan, which you can set up through the Federal Student Aid website.

You May Like: Mlo Average Salary

Whats The Difference Between The William D Ford Direct Loan Program And The Federal Family Education Loan Program

Generally, loans in these programs have the same terms and conditions. There are a few differences, including available repayment plans, borrower benefits , loan forgiveness programs, and interest rates. The primary difference between the two loan programs is that the U.S. Department of Education funds loans under the Direct Loan Program, and private lending institutions funded loans under the FFELP. There are still many FFELP loans in existence, but since July 2010, no new FFELP loans are being made.

Student Debt Relief Loan Refinancing Advertiser Disclosure

Student loan offers that appear on this site are from companies or affiliates from which Student Debt Relief may receive compensation. This compensation may impact how and where products appear on this site . Student Debt Relief does not include all student loan companies or all types of offers available in the marketplace. Student Debt Relief tries to keep all rates offered by lenders up to date. There may be instances where rates have been changed, but Student Debt Relief has not been made aware of those changes, and/or has not yet had a chance to update its website. We make no guarantees as to the rates being offered. For more information see our privacy policy.

Don’t Miss: Fha Building On Own Land

Is Navient The Same As Fedloan Servicing

The eight servicers of federal student loans at present collect and track payment data. The federal loans in the FedLoan portfolio will be divided up and transferred among the other servicers, t loan in the FedLoan portfolio will be split up and transferred to other servicers including EdFinancial, MOHELA, Aidvantage and Nelnet.

Who Actually Owns Student Loan Debt

As of late 2021, American students are on the hook for approximately $1.75 trillion in student loans, according to data compiled by the Education Data Initiative. 43.2 million student borrowers owe an average of $39,351, up significantly from past decades. With that much money on the line, it’s reasonable to be curious about who might ultimately receive all those principal and interest payments. While $1.75 trillion may be a significant liability for the borrowers, it can be an even bigger asset for creditors.

You May Like: Credit Score For Usaa Auto Loan

How To Find Your Student Loan Balance

The dreaded question of every college graduate: How much do I owe in student loans?

Kat TretinaUpdated April 30, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as âCredible.â

With the typical graduate having up to 12 different federal and private student loans, it can be difficult to keep track of them all. But finding out exactly how much you owe is essential for managing and paying off your debt.

In this post:

Recommended Reading: Sss Housing Loan

Tips For Dealing With Your Loan Servicer

The Department of Education Ombudsman gives these tips for staying in touch with loan servicers:

It is usually best to communicate with your loan servicer in writing, because youll have a physical record of what has been said and done.

- Keep careful notes of all conversations you have. Follow up in writing so you have a physical record of what has been said and done.

- Request a copy of your customer service history some loan servicers make available copies of the notes that customer service representatives make on your account.

- When you speak with someone on the phone, make a note of whom you speak to and when, and what was said. When you use mail, keep a copy of your letter and of any replies you receive.

- Save the originals of all receipts, bills, letters, and e-mails regarding your account. Provide copies of the originals if you are asked for them. Send letters via certified mail, with a return receipt requested.

- Dont let the emotion of the moment get to you. If you are not getting a proper response to your questions, calmly explain again what information or resolution you are seeking.

- Be polite and courteous, but dont be afraid to give the detail of any incident and to state your concerns. Write down the facts in the order they took place and stick to what is relevant. Include important details such as your account number at the top of your letter.

- Ask for a response in a reasonable time, and be sure to tell the customer service representative how you can be reached.

Don’t Miss: How Long Does Stilt Loan Take

Loan Servicers For Private Student Loans

If you have private student loans, your loan information wont show up in the NSLDS. Private institutions such as banks, credit unions and online lenders originate these loans and hire loan servicers to manage the accounts, much like federal student loans.

To find out who services your private student loan, log in to your lender website or app. You should be able to find details about your loans, including the loan balance, interest rates and loan servicer.

If you have no idea who the loan servicer is, check your credit reports. The loan servicer should be listed next to the account, along with any contact information.

Will You Need Other Borrowing In Future

Anyone with other expensive debts should certainly pay them off before touching the student loan. Though even if youâre debt-free elsewhere, rememberâ¦

Use money to overpay your student loan now and you risk needing to borrow it back elsewhere in future.

You might have no debts right now. But itâs possible you will have in future, likely for a mortgage or perhaps a car loan, or to set up a business.

Itâs worth noting, if you unwittingly overpay your student loan, for example as the deductions were taken wrongly, you can reclaim that money. However, if you voluntarily overpay â you cannot ever get that cash back.

Structurally, student loans are the best possible type of lending. You pay in proportion to your income, and if your income drops, so do your repayments. Thereâs no impact on your credit score. Theyâre paid via the payroll , so there are no debt collectors chasing and it ends after 30 years regardless. No mortgage, credit card or other loan comes close.

Looking purely at the interest rate as opposed to the interest you actually repay since September, many mortgage rates will undercut the maximum student loan interest rate . Yet the student loan rate changes annually and it isnât always like this. In recent years, for many with middle incomes, the student loan has often been cheaper than most mortgage Standard Variable Rates, though costlier than the best new mortgage deals.

You May Like: Usaa Auto Loan Rates

Read Also: How Long Does Sba Loan Take To Process

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Who Owns Your Federal Student Loans

Although the federal government technically owns your student loans, it doesnt manage them. That would be far too big of a task. Instead, the Department of Education has loan servicers who help manage payments for its borrowers.

Loan servicers act as a middleman between the borrower and the Department of Education by managing the student loan repayment process. They manage all types of loans held by the federal government, including Direct Loans and PLUS Loans taken out for undergraduate, graduate and professional degrees.

Federal loan servicers also service Direct Consolidation Loans, Federal Family Education Loans and Federal Perkins Loans. However, some FFEL Program Loans and Perkins Loans arent held by the Department of Education, so this can add to the confusion of figuring out each of your new servicers.

Federal loan servicers include FedLoan Servicing , Higher Education Services Corporation , Navient and more.

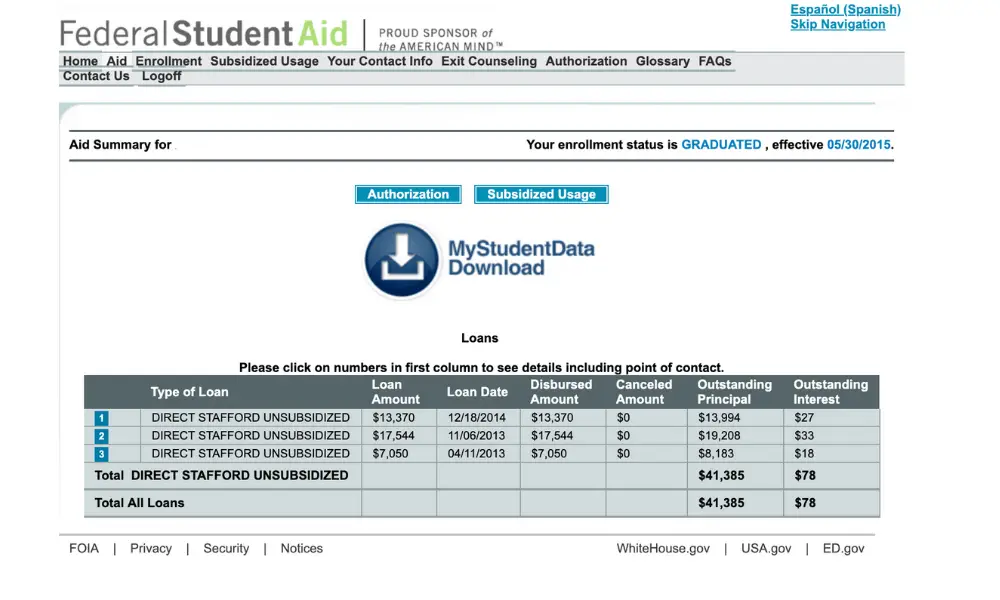

If youre wondering, Who is my student loan servicer?, the best place to start is the Studentaid.gov website. In the past, you could access your federal student loans using the National Student Loan Data System . But this database has been merged to streamline managing student loans.

Once youre on the Studentaid.gov homepage, youll be prompted to log in with your Federal Student Aid ID. If you dont have an FSA ID, youll have the option to create a login, including a username and password.

Recommended Reading: Usaa Rv Loan Rates Calculator