How To Reduce Your Car Payments Without Getting A Refinancing Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 126,352 times.

It is not uncommon for car-buyers to become trapped in what can seem like an unsustainable car payment. The reasons for this are numerous and can include high interest rates, poor credit, a minimal down-payment, or purchasing from a “buy here, pay here” dealer who extends unfavorable or predatory terms. Couple these conditions with financial hardship such as a job-loss, medical situation, or unexpected bills, and default becomes a possibility. This situation often becomes more complex if the buyer has insufficient credit for refinancing, or the conditions aren’t favorable. In this case, the only option available without refinancing is car-loan modification, which often occurs via the use of financial hardship assistance programs with your lender.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Is A Refi The Right Choice For Me

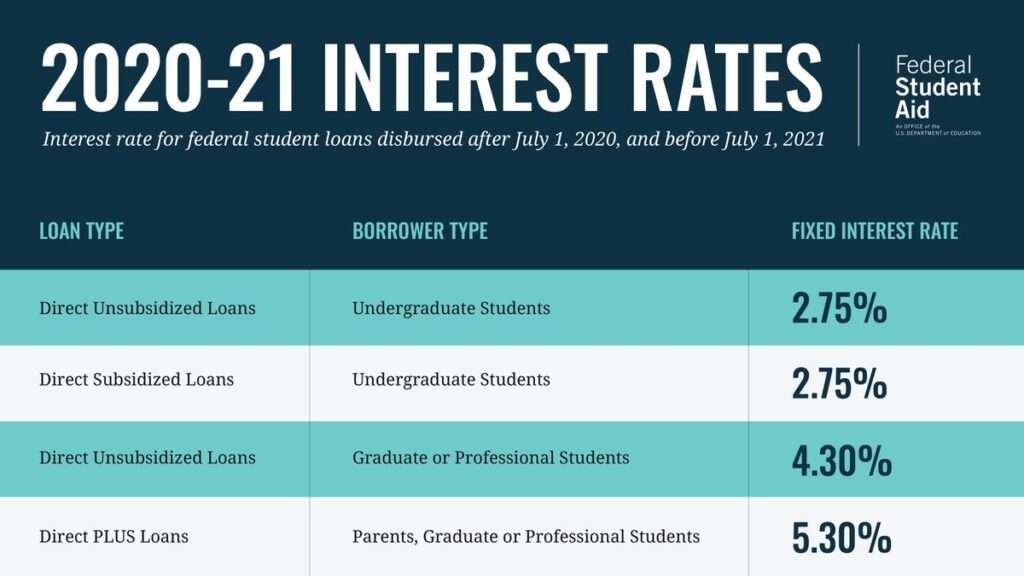

If you have a high interest rate on your car loan, and current market rates have dropped, you may want to consider refinancing. Interest rates are at near-historic lows right now, and you may qualify for a better rate.

Borrowers whose credit has improved significantly since they first took out the loan may also be eligible for a better rate. For example, if you had a bankruptcy or default fall off your credit report, your credit score may be much higher now.

If you can refinance with a co-signer or co-borrower, then you may receive better rates if you were the only borrower on the original loan.

You May Like: How Do I Find Out My Auto Loan Account Number

Cleaning Up Your Score

If you haven’t worked on your credit score since you took out your high interest loan, or you have made some financial missteps since then, you may need to clean up your credit. A small bill thats more than 30 days late is enough to drop your score by a few points.

If you have past due payments or outstanding collections on your credit, pay them off prior to refinancing. Ask for a receipt or letter as proof that you have repaid the debts, for each obligation you pay. Check your credit history 45 to 60 days later to make sure the obligations are marked as paid. Once this happens, your credit score should improve.

Check Your Credit Before Shopping

Pull your credit report from each of the three major credit bureaus before approaching a lender for an auto refinance. Equifax, TransUnion, and Experian all gather information about your financial history and transactions and assign you a credit score.

Although credit is not the only factor lenders consider, your score is one of the main indicators most lenders use to determine the interest rate theyll offer you on a loan: the higher your credit score, the lower your interest rate. Pulling your credit before an auto lender does can allow you to gauge whether you will qualify to refinance and receive a better interest rate, or whether you should work on your credit to get a better rate.

Also Check: Can I Refinance My Sofi Personal Loan

Reduce Car Loan Payments

A loan is a type of debt that you must repay for a set amount of time. To make your car loan payments as low as possible, you should negotiate with your lender on the length of the loan, interest rates, and any other fees. You can also use different tactics like paying off other debts before buying a new car to lower your total car payment.

There are many ways to reduce your car loan payments. You can save money by switching from a new car to an older model, taking a second job, or refinancing your car loan. If you are looking for other options, you can also consider switching to public transportation or selling your car through a company like Autotrader.

Things To Consider Before Refinancing

Don’t Miss: 20/4/10 Rule Calculator

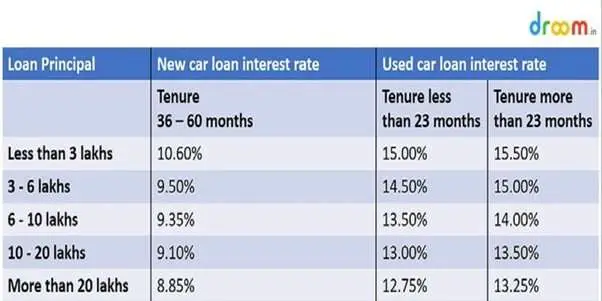

What’s A Normal Interest Rate For A Car Loan

Asked by: Bella Glover

The average auto loan interest rate is 4.09% for new cars and 8.66% for used cars, according to Experian’s State of the Automotive Finance Market report for the second quarter of 2021. With a credit score above 780, you’ll have the best shot to get a rate below 3% for new cars.

sometimes even 0%likely be considered a good APR5.07% for a new carFICO Score 833 related questions found

Reduce Your Interest Rate

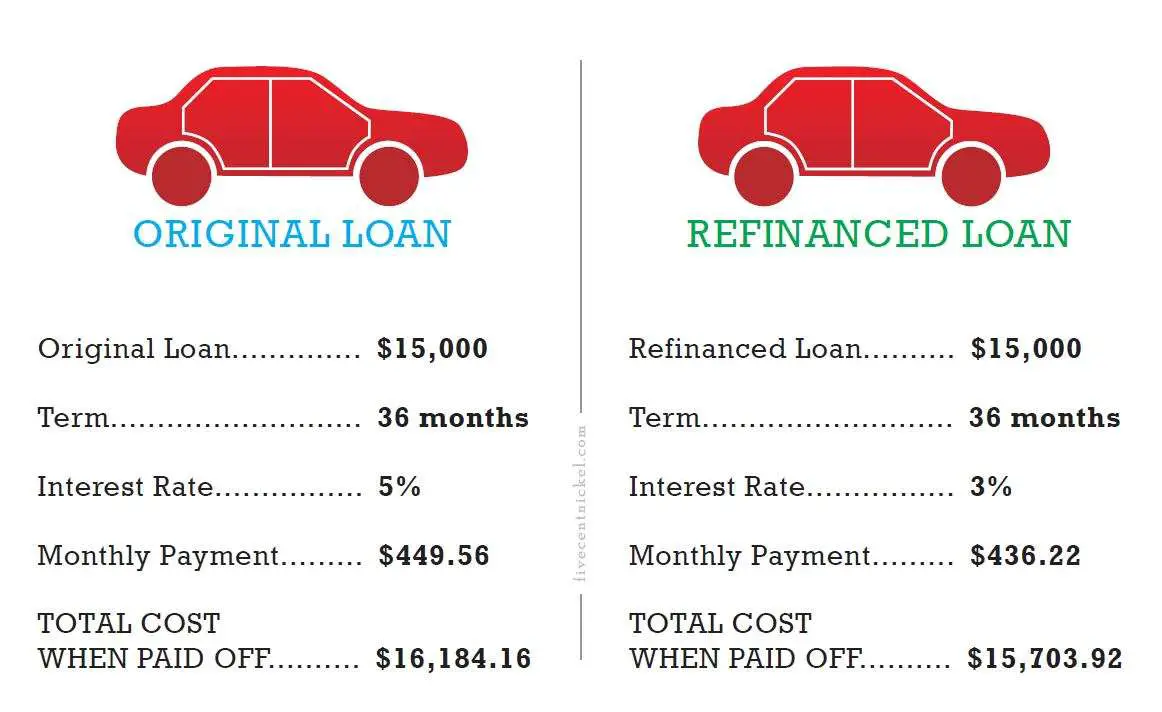

One of the best reasons to refinance a car loan is if you have an opportunity to reduce your interest rate. If you previously had no credit or bad credit, it is worth checking into refinancing your car loan after a couple of years to see if you receive better offers. Your credit score may have improved enough to qualify you for a lower interest rate. With a lower interest rate, you will be able to pay off your loan faster or lower your monthly payment while paying it off at the same pace. In either case, you’ll pay less over the life of the loan.

Read Also: Does Va Loan Work For Manufactured Homes

How Do You Refinance An Auto Loan

To refinance, you can either work with your current lender, or find another one that can approve you. Your old car loan gets paid off by the new lender, and you sign a new loan contract and continue paying on your vehicle with the new terms and conditions.

Refinancing works like this: lower your interest rate or extend your loan term.

If your goal is to save cash throughout your loan term, you should opt to try and qualify for a lower interest rate. Refinancing to a lower interest rate lowers your monthly payment and saves you in interest charges overall.

Your second option in refinancing is typically to stretch your loan term. This also decreases your monthly payment amount, but it won’t save you money in the long run. Adding time to your loan without qualifying for a lower interest rate just makes you accrue more interest charges for longer, meaning your loan becomes more expensive overall.

Since auto loans are almost always simple interest loans, youre charged interest on the remaining balance of your loan the more payments you have left, the more youre going to pay. Sometimes, it may be a good idea to extend your loan term if your car payments are becoming unmanageable. If you can comfortably afford your payment, its advised to not extend your loan term if you can help it.

Refinance Your Auto Loan

Refinancing your existing loan might reduce your monthly payments. If interest rates have dropped since you got your original loan, your credit has improved, or you just arent confident you got the best possible rate to begin with, you may be able to get a new loan with a lower rate and better terms. Keep in mind that refinancing involves opening up a new loan with new terms that means the potential for brand-new loan fees on top of interest youd pay. And if you end up extending your loan term and are able to lower your monthly payments, youll be paying interest for longer.

Recommended Reading: Refinance Car Loan Usaa

Send In Extra Principle In Your Monthly Car Payment

Sending in extra principle has the effect of lowering your interest over the life of the loan.

When I bought my first car, I was a very savvy buyer looking to save money on my financing in every nook and cranny I could squeeze a few incremental dollars out of. I sent in extra principal with my car loan payments, which accelerated the payoff on my car from 42 months down to 36 months.

How do we do that? It’s all in the way mortgages and car loans work. In the early months of the loan you are paying almost no principle back and each monthly payment goes almost all to interest. But lucky for you folks, you can control this formula by forcing more principle down their throat with your monthly payments, which means you are paying the loan off sooner. Since you pay it off early, they don’t get to charge you all that interest anymore.

When I first bought my house, I sent in $300 to $500 extra principle each month. Then, before you know it, I knocked over 10 years off the life of my loan and saved tens of thousands of dollars.

There you have it, I bet you never thought you had so much control over the interest you will pay on your car loan. So remember, be patient and calm. If it takes a few more months, let it happen. Pay off all credit card balances if possible, finance online directly with lenders, refinance your existing car loans to lower rates, choose a shorter term auto loan and allow the lender to deduct your monthly payment directly from your bank.

A Lower Interest Rate Today Can Mean Lower Repayments Tomorrow

Rapid Finance on 19 July 2016

You wouldn’t settle for just any car. So why settle for just any car loan?

Every day Australian car buyers scour car sale websites for a better deal. They walk from car-lot to car-lot. They haggle and negotiate to get the very best value for their dollar. It’s true, Aussies love a bargain.

Yet, when it comes to finance, buyers are often all too eager to sign on the dotted line. And the irony is this decision could potentially cost them more in the long run than their choice of car.

When it comes to purchasing a new vehicle, it can be your choice of car loan and car loan interest rate that makes the biggest difference in terms of overall costs and potential savings.

Here’s seven ways to get a better interest rate on your car loan.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Ways To Cut The Cost Of Your Car Loan

With financial headwinds like rising gas prices, a slowly-recovering economy and continued job scarcity, reducing costs in every corner of our financial lives have become a necessity. Unfortunately, our cars aren’t concerned with our economic troubles. When they break down for the last time and we are forced to buy a new one, finding the best deal on financing becomes a necessity.

Finance Your Mazda With Bob Ross Buick Gmc

No matter if youre looking for new lease deals, financing tips, want to learn if you can lease a car with bad credit, or want to talk to our finance experts to learn more about getting a lower interest rate on auto loans, we can help. Contact our finance team today with any questions about our services or even to learn about the GMC Acadia redesign, and be sure to browse our new vehicle specials to help you save even more on your favorite model.

Recommended Reading: What Do Mortgage Loan Officers Do

Are You Unhappy With Your Current Auto Loan Maybe Its Time To Consider Refinancing

The principle behind auto loan refinancing is simple: You take on a new loan to pay off the balance on your existing auto loan. If youre struggling with a high interest rate or an unaffordable monthly payment, refinancing could be the key to finding better, more favorable terms.

Refinancing your auto loan could help lower your monthly payments by lengthening the term of your repayment. Or it could help you save money through a lower interest rate.

|

$364 |

60 months |

Your expected monthly payment would go down to $364, and youd pay a total of $1,830 in interest.

In this case, refinancing your auto loan would save you $23 per month and a whopping $1,366 over the remaining life of the loan.

Choose A Longer Loan Term

Opting for a longer loan term of 72 months or 84 months could help you reduce your monthly payments but youll end up paying more total interest. And when you stretch out your loan term, you may be charged higher rates, too.

Choosing a longer loan term also puts you at risk of becoming upside down on your loan. Your car could depreciate more quickly than you pay off your loan, and youd end up owing more than the car is worth.

Recommended Reading: Can I Refinance My Sofi Personal Loan

Lower Your Monthly Payment

Sometimes, an expensive occurrence such as having a baby, unexpected medical bills, or a natural disaster can put you in a situation where you have to reduce your monthly expenses. Refinancing might allow you to extend the duration of your loan, thereby lowering your monthly payments. For instance, if you owe two more years on your current loan, it may be possible to refinance and extend the term to four years.

Adding two years onto your loan should substantially lower your monthly payment, depending on the interest rate you get. You will be paying for two years more, but you will free up some cash on a monthly basis, helping you get through a rough patch. Keep in mind, though, that this will also mean that you’ll pay more interest over the total life of the loan.

Changing lenders can be a pro or a con, depending on the relationship you have with your current lender. If your lender has poor customer service, changing lenders could be a benefit. If you like your lender, you can try to refinance with them, but you may need to look elsewhere to get the best rate.

Time Remaining On Your Loan

Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

If your answer to When should I refinance my car loan? is Soon, review our current refinance rates and take a look at our auto loan refinance calculator to get a better understanding of whether refinancing makes sense for you.

You may also like

Read Also: Va Loan Lenders For Mobile Homes

Getting The Best Car Loan Rate

If you decide to refinance after considering the important factors outlined above, there are steps you can take to increase your chances of getting the best rate possible. Research your options online and aim to get a minimum of three quotes to compare interest rates.

Try your current bank first, and be sure to check out a few online banks, which at times offer better interest rates. In the end, getting a great deal comes down to having good credit, in addition to taking the time to educate yourself and think through the decision.

What Happens If I Extend My Loan Term

Extending the length of your loan when you refinance will lower your monthly payments. However, you likely wont save money because youll pay more in interest over the life of your loan.

Extending your term could also put you at risk of becoming upside-down on your loan, meaning you owe more than your car is worth. This is a risky situation to be in. If you get in an accident, and your car is totaled, your insurance might not cover what you owe. Also, if you have to sell your car, youd still owe money on the loan.

To recap our selections…

Don’t Miss: Best Fha Refinance Lenders

Check Your Credit Score

The interest rates you qualify for will largely depend on your credit history, along with other factors, so checking your credit score will give you an idea of where you stand.

The higher your credit score, the more likely you are to qualify for a lower interest rate. To get an idea of what lenders are looking for, familiarize yourself with the different FICO® Score ranges:

If your score is in the very good or exceptional range, you can generally expect to have more negotiating power because lenders are more likely to offer you their lowest rates. If your score is considered good, you may still have some solid options, but loans may be limited if your score is below that. The average interest rate on a new car loan was 3.82% for the best credit scorers, while those with the lowest credit scores carried new car loans with 14.25% interest rates on average, according to Experian’s State of the Automotive Finance Market from the fourth quarter of 2019.

That interest rate difference translated into lower monthly payments for those at the top end of the credit score range. Consumers with the highest credit scores had an average monthly payment of $522, while those with the lowest credit scores had an average monthly payment of $562, a $40 difference, according to Experian data.

As a result, if your credit score isn’t where you want it to be and you don’t have to buy a new car right now, consider taking some time to work on improving your credit before you take the next step.