How Much You Need To Repay

Verify your loan or line of credit contract to figure out the following:

- the total amount you owe

- the interest rate that will be applied to your debt

- how youll repay your debt

- how much youll pay

- how long it will take to pay back your debt

Contact the organization that provided your student loan or line of credit if you dont have the information listed above.

How To Rehabilitate Your Loan

To rehabilitate a federal student loan, you and the Department of Education must reach an agreement on a reasonable and affordable repayment plan in which youll have to make nine out of 10 on-time payments. Any garnished wages, tax returns or social security earnings will not count toward these payments.

Note: You are only able to rehabilitate your loan once.

Here is what you need to do and be aware of in the rehabilitation process:

Tracking Down Your Lender Or Loan Servicer

You can find contact information for your private student loan lender on the emails or billing statements they should be sending you on a monthly basis when you enter repayment.

Some private lenders also send you a welcome packet or call you once you begin repayment. You can also look for their contact details on the documents you received when you first took out the loan, such as a promissory note.

If youve completely lost sight of your private student loan lender, you can confirm who they are by checking your credit report. You can request one free credit report annually from each of the three major credit reporting agenciesEquifax, Experian, and TransUnion. The financial aid office at your school may also be able to help you track down your lender.

For federal student loans, one option for how to find your student loan lender is to check the National Student Loan Data System .

This Department of Education database is a centralized repository of information about your student loans, aggregating data from universities, federal loan programs, and more. You can also log in to My Federal Student Aid in order to confirm the name of your loan servicers and retrieve their contact information.

For federal student loans outside of the Direct Loan and FFEL programs, you can find out information about your loan servicer in other ways.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Rehabilitate Your Canada Student Loan

If your loan is in collection, Contact the CRA to:

- see if you qualify to have your federal student loan brought up to date

- make payments equal to 2 regular monthly payments and choose one of the following options:

- pay off all outstanding interest on your loan, or

- add all unpaid interest to the balance of your loan

Once you make your payments, contact the NSLSC. You should receive a new repayment schedule within 1 month.

Find Out What’s Available Then Figure Out What You Can Pay Back

There are limits to almost everything in life, including how much you can borrow on student loans. Student loan limits are based on a variety of factors, including the type of loan , your year in school, and how much it costs to attend your school of choice.

Its important to keep in mind that the maximum amount you can borrow isnt necessarily the amount you should borrow. You should only borrow as much as you can expect to be able to pay back under the terms of the loanand the interest rate is part of that calculation. All this makes for a tricky landscape, which starts with knowing whats available.

Note that as a result of the 2020 economic crisis, the U.S. Department of Education has suspended loan payments, waived interest, and stopped collections through September 30, 2021.

You May Like: Can You Buy A Mobile Home With A Va Loan

Use Found Money Wisely

If you receive money as a gift, earn a bonus at work or receive extra money you didnt expect, use this found money to make additional payments on your loans. Although you may be tempted to use this money for something more fun, putting it towards your student loans can help you eliminate debt more quickly.

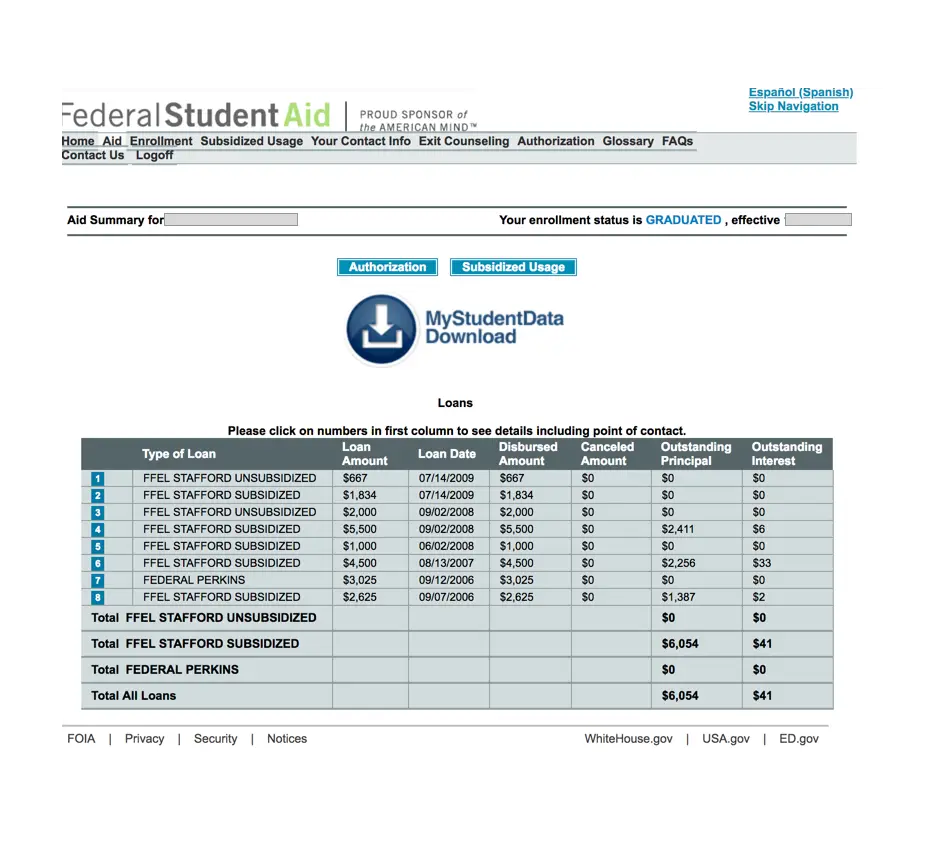

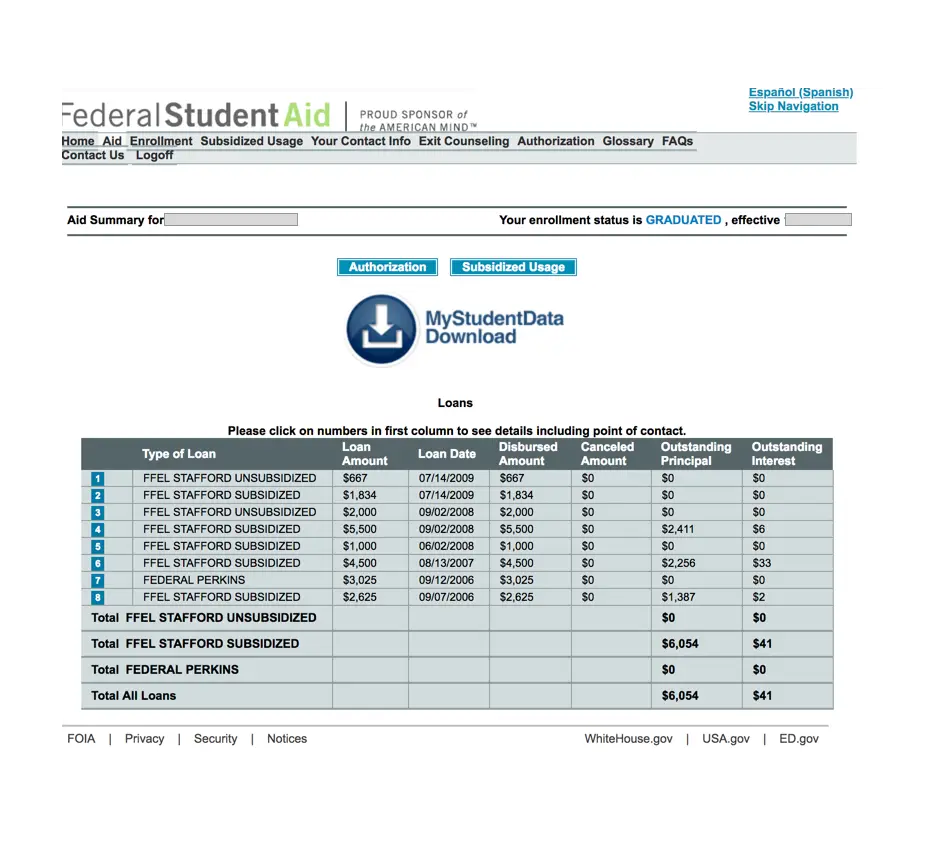

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies, loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

Don’t Miss: What Is The Maximum Fha Loan Amount In Texas

Can I Change The Day That Auto Pay Withdraws Money From My Account

We withdraw money from the checking or savings account you select on your payment due date. You canselect a new payment due date for eligible Great Lakes accounts. If your loans don’t have a payment due, you can select which day of the month you want Great Lakes to withdraw money from your checking or savings account.

Will You Need Other Borrowing In Future

Anyone with other expensive debts should certainly pay them off before touching the student loan. Though even if you’re debt-free elsewhere, remember…

Use money to overpay your student loan now and you risk needing to borrow it back elsewhere in future.

You might have no debts right now. But it’s possible you will have in future, likely for a mortgage or perhaps a car loan, or to set up a business.

It’s worth noting, if you unwittingly overpay your student loan, for example as the deductions were taken wrongly, you can reclaim that money. However, if you voluntarily overpay – you cannot ever get that cash back.

Structurally, student loans are the best possible type of lending. You pay in proportion to your income, and if your income drops, so do your repayments. There’s no impact on your credit score. They’re paid via the payroll , so there are no debt collectors chasing and it ends after 30 years regardless. No mortgage, credit card or other loan comes close.

Looking purely at the interest rate as opposed to the interest you actually repay since September, many mortgage rates will undercut the maximum student loan interest rate . Yet the student loan rate changes annually and it isn’t always like this. In recent years, for many with middle incomes, the student loan has often been cheaper than most mortgage Standard Variable Rates, though costlier than the best new mortgage deals.

You May Like: Usaa Auto Loan Rates

What’s A Payment Schedule Where Can I Find It

Your payment schedule is a plan for paying back your loan. You have one payment schedule for each of the accounts in your Account Summary that you’re making payments on.

It provides monthly payment amounts, due dates, and other important information that you need to keep track of. We’ll send you a new payment schedule when certain conditions on your account change, like when you start to make payments, have a change in repayment terms, add a new loan, or come out of a deferment or forbearance.

Manage Your Student Loan Balance

Sign in to your student loan repayment account to:

- check your balance

- see how much youve repaid towards your loan

- see how much interest has been applied to your loan so far

- make a one-off repayment

- set up and amend Direct Debits

- tell the Student Loans Company if youve changed your contact details

- tell SLC if youre going overseas for more than 3 months

This service is also available in Welsh .

You can also make one-off repayments towards your student loan, or towards someone elses loan, without signing in.

To sign in youll need your:

- customer reference number or email address

- password

- secret answer, for example your mothers maiden name

If you do not know these, you can reset them using the email address you had when you applied for your loan. Contact SLC if youve changed your email address.

Don’t Miss: Does Va Loan Work For Manufactured Homes

How To Find Student Loan Account Number

The only surefire way to stay current with your student loan information is to know your student loan account number.

When you apply for a student loan, your account number will be issued to you. Finding it out wont be a difficult process.

After you apply for student aid via the federal website Studentaid.gov, youll go through an application process to find qualifying loans.

Youll receive an official letter detailing your imminent student loan and future repayment processes after approval.

Your student account number should be highlighted, boldfaced, or plainly identifiable in such a letter.

There are several ways for you to find your 10-digit student loan account number.

Cares Act Automatic Federal Student Loan Forbearance

If you have a student loan owned by the U.S. Department of Education, the government has granted you automatic forbearance on this loan under the Coronavirus Aid, Relief, and Economic Security Act. The forbearance was set to expire on Jan. 31, 2021, under the previous administration, then it was extended under the Biden administration until Sept. 30, 2021.

The administration extended the forbearance period again on Aug. 6, allowing loans to stay in forbearance until Jan. 31, 2022.

Between March 13, 2020, and January 31, 2022, no interest will accrue, and you don’t need to make any payments. No late fees will apply if you stop paying during this period. You’ll know you have this benefit if you see a 0% interest rate when you log in to your student loan account. On March 30, 2021, the Department of Education extended this benefit to defaulted privately held loans under the Federal Family Education Loan Program.

Under normal circumstances, you can’t make progress toward loan forgiveness during forbearance. But under the CARES Act, you can. You’ll receive credit toward income-driven repayment forgiveness or public service loan forgiveness for the payments you normally would have made during this period.

There may be tax obligations tied to any loan forgiveness.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

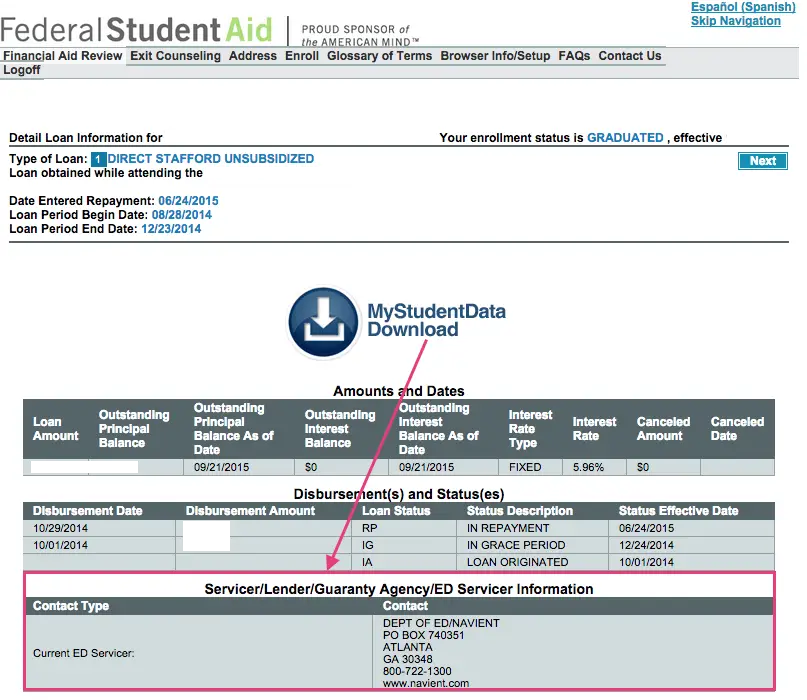

Who Is My Student Loan Servicer

Your student loan servicer is the company that manages your student loans. Essentially, its a third party that acts as a middleman between you and your lender. When you make a payment toward your student loan, it is managed by your loan servicer.

Student loan servicers work with borrowers to help manage their student loan repayment. If borrowers would like to change their repayment plan or apply for deferment or forbearance, they should discuss their options with their loan servicer first.

Borrowers do not choose their loan servicer, but rather, are assigned one. If you have federal student loans, your loan servicer is assigned by the Department of Education.

Below are nine loan servicers that currently manage federal loans, plus an additional loan servicer that deals with default resolution though be aware that this list may soon change.

Originally, the Department of Education had planned to change its roster of servicers in 2020, but while some new contracts have been announced, the only change as of December 2020 has been the departure of former servicer CornerStone.

| Loan servicer | |

|---|---|

| Default Resolution Group | 1-800-621-3115 |

If you have federal student loans, your answer to, Who is my student loan servicer? will be one of the companies on the list above. Note also that your loan servicer can change during the life of your loan, so make sure to check your student loan accounts for the most current information.

Recommended Reading: Usaa Car Loans Bad Credit

Where Can I Find My Loan Information : :

An important factor in keeping up with your student loan payments is knowing where to find all of your student loan information. StudentAid.gov is the U.S. Department of Educationâs comprehensive database for all federal student aid information. This is one-stop-shopping for all of your federal student loan information.

At StudentAid.gov, you can find:

- Your student loan amounts and balances

- Your loan servicer and their contact information

- Your interest rates

- Your current loan status

To access StudentAid.gov:

Go to StudentAid.gov Have your FSA ID available. This is the same username and password you used to electronically sign your FAFSA. To learn more about the FSA ID, visit studentaid.gov. If prompted, enter your name, Social Security number, your date of birth and your FSA ID. Read the privacy statement. You must accept these terms to use StudentAid.gov. Select âSubmitâ

StudentAid.gov can be a valuable tool for you in keeping track of your student loan information. Checking StudentAid.gov and communicating with your loan servicer will give you the information you need to get back on track for your student loan repayment.

Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education

How To Find Your Student Loan Balance

The dreaded question of every college graduate: How much do I owe in student loans?

Kat TretinaUpdated April 30, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

With the typical graduate having up to 12 different federal and private student loans, it can be difficult to keep track of them all. But finding out exactly how much you owe is essential for managing and paying off your debt.

In this post:

Recommended Reading: Sss Housing Loan

How Much Can You Borrow

In addition to private loans, there are three main types of federal student loans: Direct Subsidized, Direct Unsubsidized, and Direct PLUS.

First, consider a Direct Subsidized Loan. Subsidized federal loans are simple to obtain, usually less expensive than PLUS or private loans, dont require a or cosigner, and have built-in protections and repayment options that unsubsidized, PLUS, and private loans don’t have. Subsidized federal loans are available for undergraduate students only. Unsubsidized federal loans can be taken out by both undergrads and graduate/professional students.

Student Loan Forgiveness: Which Loans Are Eligible

Only direct loans made by the federal government are eligible for forgiveness. Stafford loans, which were replaced by direct loans in 2010, are also eligible. If you have other federal loans, you may be able to consolidate them into one direct consolidation loan that would make you eligible. Non-federal loans do not qualify for forgiveness.

In addition, borrowers with federal student loans who attended for-profit colleges and seek loan forgiveness because their school defrauded them or broke specific laws were recently dealt with a setback. On May 29, 2020, former President Trump vetoed a bipartisan resolution that overturned new regulations that make it much more difficult to access loan forgiveness. The new, more onerous regulations went into effect on July 1, 2020.

Also Check: What Kind Of Loan Do I Need To Buy Land

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

The 5 Things To Consider Before Overpaying Your Student Loan

You’re allowed to pay extra off your student loan, without penalties, whenever you want. And with what looks scary interest added to statements, this is superficially appealing to many who have spare cash.

The decision for previous generations of students was pretty easy. Most could simply compare the interest rate with what they would earn saving. Yet as I hope you’ve understood so far, that doesn’t apply to most post-2012 starters…

It’s dangerous to use the headline rate of 4.2% to compare student loans to savings as most graduates won’t pay this.

So if you can overpay the loan, here’s what you need to consider first .

Read Also: What Credit Score Is Needed For Usaa Auto Loan