How Do I Deposit Funds Into My Paytm Payment Bank Savings Account

You can fund your Paytm Payments Bank Savings Account by clicking the Add Money button on the banks homepage. You can add money from the following sources:

- Your UPI-Connected Bank Accounts

- Debit Cards that have been saved.

- Your Account at a Different Bank.

You can also make a cash deposit into your account at any of our Banking locations.

Should You Refinance Or Consolidate To Simplify Repayment

Staying on top of all your loans is like a part-time job. You have to keep tabs on your borrowed amount, interest rate, due date and the minimum amount due every month.

To streamline your payments, you might want to think about consolidating or refinancing your loans.

Federal Loan Consolidation

A federal direct consolidation loan brings all your federal loans together into one easy-to-manage loan. Your interest rate is fixed and averaged out between all your loans, then rounded up to the nearest one-eighth of a percentage point. This is only available for federal student loans; private student loans arent eligible.

You should consolidate if:

- You have many different loan servicers.

- You want to enroll in an income-driven repayment plan or Public Service Loan Forgiveness , and you must consolidate certain loans to make them eligible.

- You want to lower your payments. Repayment terms on consolidation loans stretch up to 30 years.

You should skip consolidation if:

- You want to pay off your loans sooner.

- You want a lower interest rate.

- You have interest rate discounts or other repayment perks with your current lenders.

- Youre already on track for an IDR plan or PSLF; consolidation will restart your clock on these programs.

Factors Affecting Personal Loan Application

Apart from the eligibility criteria there are certain factors that affect your loan application mainly the minimum salary expectation and your loan amount eligibility. They are

1. Location: the place where you stay plays an important part in your loan application. This determines the minimum salary amount for you to be eligible for a personal loan. The minimum salary is higher in the cities and more so in the case of metropolitan cities like Mumbai.

2. Income: The higher the income the better loan amount you will get. This also shows that your repayment capability is excellent.

3. Housing situation: Whether you stay in your own house or in a rental property also play a part in determining your loan amount. This is because staying in a rental property reduces the disposable income, which means that your repayable capacity is reduced.

4. Company of employment: Working for a reputed company close to a year could indicate to the lender you are in a stable job, the better the rating of the company the better the interest rate can be negotiated.

5. Existing credit: If you already have another loan or credit card debt will play a major factor in determining your loan amount and interest rate.

6. Credit history: Your based on which your credit score is calculated is very important. It is a primary factor upon which the loan amount, interest rate and tenure depend upon. If there is any discrepancy in your credit history, there are chances of your loan being rejected outright.

Also Check: Are Jumbo Loan Rates Higher Than Conventional

How Can I Clear My Student Loan Balance More Quickly

If you want to clear your student loan balance more quickly, you can make single extra payments directly to the SLC on top of the standard repayments you must make when your income is over the threshold amount for your repayment plan.

You can make these extra repayments at any time using your online account, by cheque or by bank transfer.

You also have the right to pay off your outstanding student loan balance in full at any time.

However, before choosing this route, make sure you have first considered how this will affect your financial wellbeing and whether there is another way to make better use of your money.

Why Does Most Or All Of My Student Loan Payment Go To Interest

Payments must be applied first to interest, then to loan unpaid balance. This means that only the amount that exceeds interest owed is applied to the unpaid balance. There are common situations in which all, or most, of your payments will be applied to interest. For example, when you’re on a Graduated repayment plan, if you’ve missed or skipped a few payments and then make a payment, if you’re on an income-driven repayment plan, or if you don’t make a payment within 30 days of entering repayment. Find out more about how payments are applied.

You May Like: How Long Until You Can Refinance An Fha Loan

Extend Your Grace Period By Another Six Months If You:

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9;½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an;OSAP;loan.

You can make payments on your loan at any time to repay it faster.

Get repayment assistance:

If youre having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you cant attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9;½ up to 14;½ years. Log in to your National Student Loans Service Centre account.

How Can You Transfer Funds From Your Payment Payments Bank Account

- Tap the Money Transfer icon in the Paytm Apps Bank section.

- Fill in the receivers information or choose an already-added receiver from the list.

- Enter the amount to be transferred and press the Proceed button.

- You will now see an estimate of how long it will take the receivers bank to credit the receivers account.

- The transaction confirmation screen will now appear.

Adhar Card Loan : How to Apply, Eligibility, Documents

Recommended Reading: How Much Home Loan Can I Get On 70000 Salary

Paytm Payments Bank Balance Check Via Sms & Missed Call Number

Do you want to use Paytms services in an offline mode?

Paytms recharge and balance inquiry services are now available offline. Paytm users will be able to check their balance or recharge by using missed call or SMS services. Paytm is currently a very popular service provider in India. Paytms services were entirely online and could only be accessed by internet users. Users will still be unable to add money to their wallets offline. Once you have money in your wallet, you will be able to check your balance or use these methods to recharge offline.

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies,;loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

Read Also: How Are Student Loan Rates Determined

What Do I Need To Do To Receive A Military Deferment

If you would like to receive a military deferment during the first 12 months you are eligible, you are only required to submit a verbal request.

After the 12 months, you are required to submit documentation to enter the program. When you’re on active duty, it can be difficult to provide documentation. Having someone act as your Power of Attorney will allow them to complete necessary documentation to make the process smoother and continue your deferment without interruption.

How To Check Sss Loan Balance Online In 3 Easy Steps

Here are the 3 easy steps to check your SSS loan balance online at the official website of SSS. The process is almost the same as when viewing your contribution online. This is hassle-free since it will only take you less than 5 minutes to accomplish plus you do not need to leave your home.

The requirement only is you need to have a desktop, laptop, or smartphone and an internet connection.

Read Also: How To Cancel My Student Loan Debt

Estimate Your Monthly Payments

The interest rates on your first payment date are used to figure out the monthly payment for your loan .;

If interest rates change, your monthly payment stays the same. However, the amount applied to your loan balance will change.

With your account, you can:

What Do I Do If I Can’t Get My Federal Student Aid Id To Work

There may be several reasons why your Federal Student Aid ID isn’t working.

You may be entering something incorrectly. To use your FSA ID, you must enter your user name and password exactly as you entered them when you created your ID.

The U.S. Department of Education may not have completed their match with the Social Security Administration . Your FSA ID is considered to be conditional until your information is verified with the SSA. You may use your FSA ID to:

Sign an initial Free Application for Federal Student Aid , and

Participate in the Internal Revenue Service data retrieval and transfer process.

Once they complete verification with the SSA , you’ll be able to use your FSA ID to access your personal information on Federal Student Aid websites.

Their records show that the SSN, name, and date of birth you provided on your FSA ID application do not match the information on file with the SSA.

Apply for an FSA ID again if you believe you entered incorrect information when you applied the first time.

Contact the SSA if you believe their information is incorrect.

You haven’t created your FSA ID yet. If you previously used your FSA Personal Identification Number to access information on FSA websites, you’ll need to create an FSA ID. To create an FSA ID, select Create Account

Learn more about IDR recertification requirements and what happens if you don’t recertify.

Read Also: How To Get Low Interest On Car Loan

Establish A Repayment Plan

Prepare a strong repayment plan before applying for a business loan. Online business loan EMI calculators can be highly beneficial when developing a payment schedule. While lenders offer customers flexible repayment options to make repayment easier, you may use this calculator to calculate your EMIs and then choose a loan term with an EMI you can comfortably afford each month.

Create and adhere to a budget to make EMI repayment easier. Increase your income and reduce your expenses to save enough money and remain current on your EMI payments. Paying your EMIs on time will not only save you money on late fees but will also enhance your credit score over time.

Checking Your Private Student Loan Balance

When it comes to checking the balance on any private student loans, there is no convenient national database like there is for federal loans. If you remember the name of the lender for your private loans, you can contact them directly, and they should be able to help you out.;

If you do not remember who the lender or servicer is for your private student loans, you can obtain a list of your outstanding debts by getting a copy of your credit report. You can get a free copy of your report from each of the three major credit reporting bureaus once a year.;

Also Check: What To Do If Lender Rejects Your Loan Application

What If There Isn’t Enough Money In My Checking Or Savings Account On My Due Date Or Withdrawal Date

If there’s not enough money in your account to cover your automatic payment, we’ll attempt to withdraw the money twice, just like we would if it were a returned check.

Your financial institution may apply overdraft fees if you don’t have enough money in your account on your due date or withdrawal date. We are not responsible for any overdraft fees assessed by your financial institution. If you have three consecutive failed payment attempts, we’ll automatically deactivate your Auto Pay. If you’re receiving an interest rate reduction for using Auto Pay, you’ll lose the incentive. Depending on the type of loan you have, you may be able to regain this benefit by re-enrolling in Auto Pay.

Prevent A Negative Balance

A stable cash flow considerably increases your chances of obtaining a company loan quickly. Lenders are not interested in spotting irregularities in your balance sheet. Cash flow represents your businesss financial potential and ability to repay the business loan you borrow to a lender.

If your balance sheet has unfavorable balance entries, it may become more difficult for you to obtain a loan. Therefore, before applying for unsecured business loans, ensure that your organization operates on a consistent cash flow basis.

Also Check: Can I Get An Auto Loan While In Chapter 13

Keep Track Of Your Loans Hesc

Loan amounts disbursed and current balances; Schools attended and their contact information; Your student loan holder and contact information; Grace period;

Manage your Navient student loan account through repayment, deferment, Find out where to mail your payment Get the status of a recent payment.

Check your loan balances to make sure you have enough funding to complete your BoiseState.edu and navigate to your Student View; Select My Account;

Use The National Student Loan Data System

To find your current federal student loan balance, you can use the National Student Loan Data System , a database run by the Department of Education.

When you enroll into a college or university, the schools administration will send your loan information to the NSLDS. The database also pulls information from loan servicers and government agencies, so its a comprehensive outline of all federal student aid youve received.

To find your federal student loan balance on NSLDS:

While the NSLDS is useful, there are some limitations:

- Not always up to date: Information on the NSLDS can be as much as 120 days old, so it may not be the most up to date view of your loans.

- Not all loans are listed: The NSLDS only contains information about Title-IV eligible loans and grants, so if you took out other federal loans such as loans for medical or nursing school programs they wont show up on the NSLDS. Private student loans also wont be listed.

Recommended Reading: How Do I Get My Student Loan Number

Finding Your Private Student Loan Balances

Finding information about your private student loans can be a bit more difficult than getting your federal loan balances since private lenders sometimes sell their loans to other companies. If you’re not sure who your lender is for private student loans, call your school’s financial aid office for help or call your original lender if you know it.

If neither of those options works for you, you can figure out your private student loan lenders by reviewing your;. The report should show all of your current debts and accounts, including all student loans.

You can safely get a free annual credit report from all three reporting agenciesEquifax, TransUnion, and Experianat AnnualCreditReport.com.

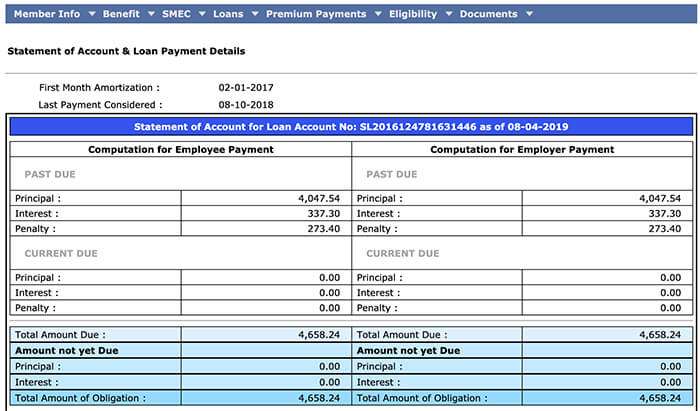

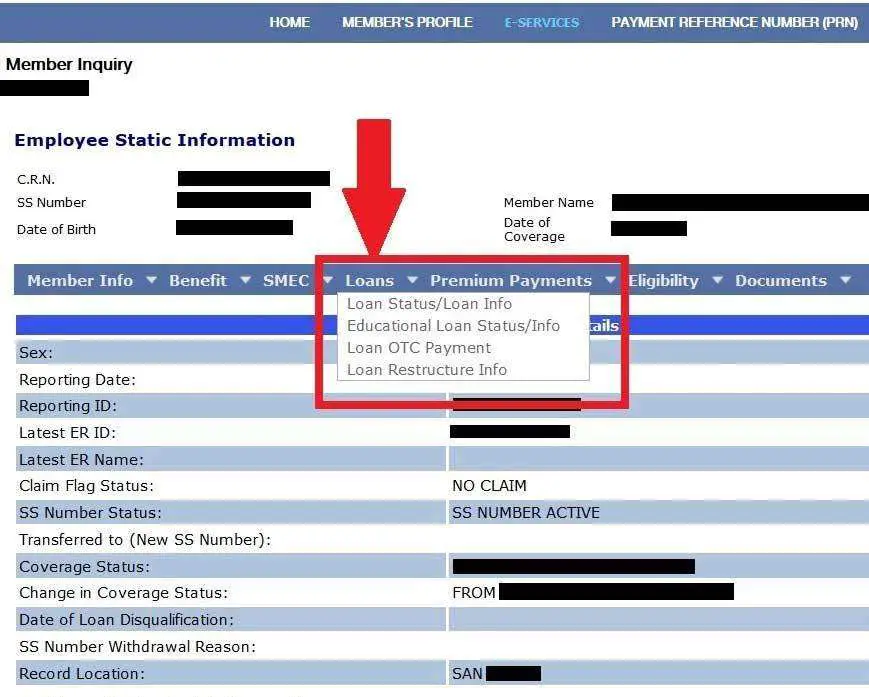

Hover Your Mouse To Loans Info Tab

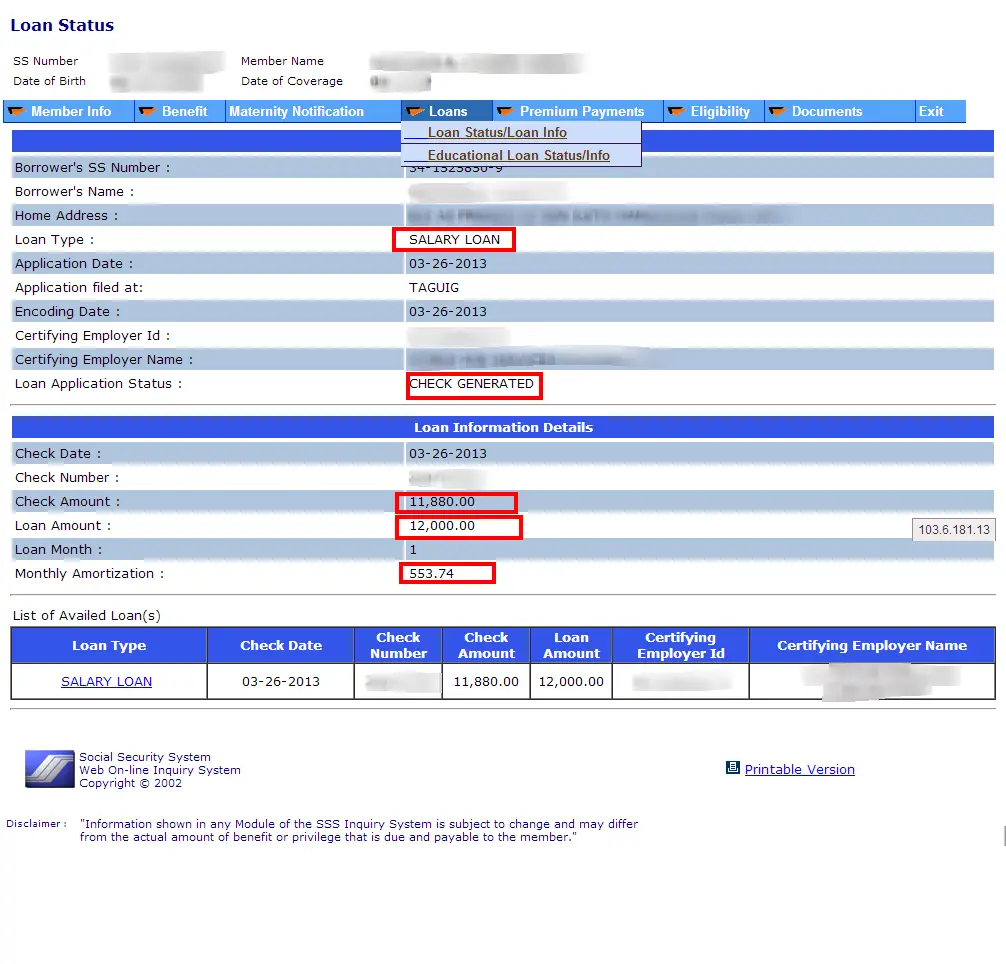

While at the Inquiry page, hover your mouse at the Loans Info tab. There will be 4 tabs for you to choose from. Among the available options, is whether you want to check the balance on your Salary Loan,Calamity Loan, Educational Loan Status, or check the application status of your Loan Restructuring Program.Under the Loans Info page, you will view your loan application details such as your Social Security member number, your complete name, Common Reference Number , and type of membership such Employee, Self-Employed / Voluntary, and Overseas Contract Worker .

You can view your Salary Loan, Calamity Loan, Educational Loan, and Loan Restructuring Program.

It will also show your loan application details , and the history of your list of availed loans for each type of SSS loan. If you do not have previous loans, it will show you No Results Found.;

Note: Since I was not able to process any loan application, that note is what I saw when I try to check my SSS loan balance online. It says the No Results Found under loan application details, and also No Results Found under the list of availed loans.

Recommended Reading: What Is Portfolio Loan In Real Estate

Borrow Money Early To Drive Growth

When a business is ready to expand, the lack of available capital may be the only impediment. Whether youre considering purchasing another firm, expanding into new markets, or scaling to serve more clients, speaking with a bank sooner rather than later will help you overcome any financial roadblocks to achieving your future business goals.

Refinancing And Consolidating Could Simplify The Repayment Process

If you are frustrated with keeping track of multiple student loans serviced by different lenders, you may want to refinance and consolidate your debt.

Consolidation loans are actually a specific type of loan you can get from the Department of Education to roll all of your existing federal loans into one big loan. When you consolidate using a Direct Consolidation Loan from the Department of Education, your new loan will have an interest rate equal to a weighted average of your old rates. In other words, you won’t change the total amount of interest you pay on your loans just by consolidating. Direct Consolidation Loans can give you access to different payment plans, and you’ll have just one big loan to pay down.

It’s also possible to refinance loans with a private lender. You can refinance just your private loans, taking one new loan to pay them all off. Or you can refinance both private and federal loans in one big loan. While this solution may seem simplest, you lose many important borrower protections by refinancing federal loans — including flexibility in repayment, deferment and forbearance options, and loan forgiveness options. So before you make this move, you need to consider all you’re giving up by refinancing to just one loan.

If you can refinance to a lower rate loan, you can save substantial interest costs. And having just one lender for all your loans definitely makes life a lot easier.

Also Check: What Size Mortgage Loan Can I Qualify For