A Home Equity Loan Is A Secured Loan That Allows A Homeowner To Borrow Against The Equity Theyve Built Up In Their Property

A home equity loan is a secured loan that allows a homeowner to borrow against the equity theyve built up in their property through regular mortgage payments and growth in the value of their home.

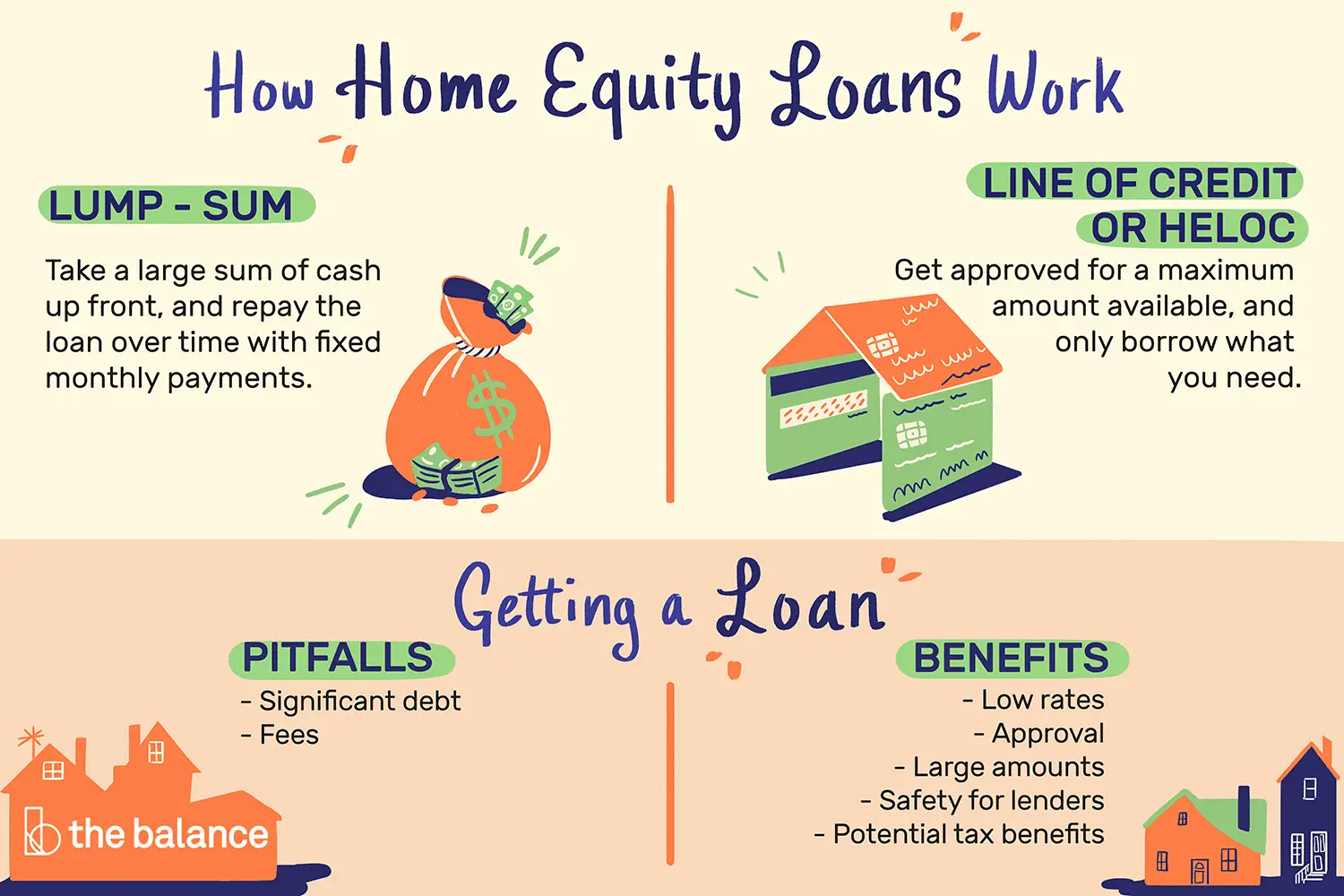

A home equity loan can be a relatively low-cost option for covering a big one-time expense. However, there are risks involved, so its important to learn how these loans work and what to expect before applying.

This guide will help you understand the pros and cons of taking out a home equity loan compared to other loan types and provide tips on finding the best home equity lender for you.

Some Of The Disadvantages Of Using Your Home Equity

- You need to pay for various fees before you can borrow There are a number of costs that you have to pay for before you are allowed access to it, such as fees for the appraisal, the application, and legal documents.

- Variable rates = variable interest costs You might choose to borrow at a variable rate because initially, the rate might be cheaper than that of the fixed-rate option. However, be aware that if you choose a variable rate your interest rate can change.

- Using your equity for investment purposes comes with its own risks If you decide to use your home equity to make unsheltered investments, not only is it likely that you will have to pay taxes on them, but like any unsheltered investment, theres the possibility that you could lose your money because of how the stock market fluctuates.

- Failure to make your payments can result in your home being taken Defaulting on your payments can lead to your home being foreclosed. So, before taking out a second mortgage, you need to be absolutely certain youll be able to make regular payments.

Is A Home Equity Loan Considered A Second Mortgage

Yes. Its considered a second mortgage when your home is used as collateral for the loan, just like the first mortgage.

Thats what helps make a home equity loan cheaper than other types of loans. Its a secured loan thats secured by your home. Worst case, if you dont make payments on the second loan, the lender can foreclose on the loan and repossess your house.

The first loan from your original lender, however, takes legal precedence so any proceeds from selling the home would first go to pay off the first loan before the second loan is paid. If anything is left, you would receive it.

With up to 30 years to repay, a home equity loan can be equal to or even longer than your first mortgage. If you dont borrow too much, it may take a lot less time to pay it off than the first mortgage.

This is one reason why its important to make sure you can afford both mortgages. Find out how much the monthly payment and other possible costs are of a second mortgage and make sure it fits in your budget. Having a new kitchen or living room remodeled is great, but wont be so enjoyable if you cant afford the loans.

You May Like: Credit Score For Usaa Auto Loan

When Does It Make Sense To Get A Home Equity Loan

If you plan to cash out the equity in your home so you can try your luck at the local casino, you should probably avoid getting a home equity loan or any loan for that matter. However, there are many ways to use home equity loans for a practical purpose, and even to save money over the long run.

Here are some instances where home equity loans can make sense:

- Debt consolidation: If youre sitting on high-interest credit card debt or a personal loan with a high interest rate, you may want to consider using a home equity loan to consolidate those debts. A home equity loan will typically have a much lower interest rate than a credit card or personal loan, so you can save money on interest and repay your debts at a fixed interest rate over a preset time frame.

- Major home improvements: Many consumers use home equity loans to pay for important projects like a kitchen remodel, a room addition or new flooring. The low fixed interest rates that home equity loans offer can make this a good option.

- Emergency expenses: If you dont have the money to take care of a sudden emergency expense, using a home equity loan can help you get the cash you need without having to pay an arm and a leg.

- College expenses: Many people also use home equity loans to partially cover college expenses, and to help their dependents avoid costly student loans and long-term debt.

Related: How can you check your credit score?

How Much Can You Borrow With A Heloc

The amount you can borrow with any home equity loan is determined by how much equity you have that is, the current value of your home minus the balance owed on your mortgage. So if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

That doesn’t mean you’ll be able to borrow up to $100,000, though. Few, if any, lenders these days will allow you to borrow against the full amount of your home equity, although that was common during the pre-crash days.

As a rule of thumb, lenders will generally allow you to borrow up to 75-90 percent of your available equity, depending on the lender and your credit and income. So in the example above, you’d be able to establish a line of credit of up to $80,000-$90,000 with a home equity line of credit. A home equity loan calculator like this one takes that all into account to figure how just how much of a line of credit you may be able to obtain, depending on all those factors.

Of course, the line of credit you can set up will vary depending on the value of your home and the balance on your mortgage .

Recommended Reading: Is Loan Lease Payoff Worth It

Should You Get A Home Equity Loan Or Heloc

If you need money to fund a home improvement project or consolidate high-interest debt, taking out a home equity loan or HELOC can be a wise decision. Since the loans are secured by your home, the interest rate is usually lower compared to unsecured loan products such as credit cards or personal loans. For example, home equity loan rates range between 3 percent and 12 percent, depending on the lender, loan amount and the creditworthiness of the borrower, while the average credit card rate is above 16 percent.

In addition, if you use the money from a home equity loan to buy, build or substantially improve your home, you may be able to deduct the interest on the loan from your taxes.

However, one major downside to consider is that if you default on the home equity loan, the lender can foreclose on your home. Before you get a loan that uses your home as collateral, make sure you have a solid repayment plan.

Check Your Credit Score

Before you apply for a home equity loan, its a good idea to find out where your credit currently stands. Free sites such as Credit Karma provide educational credit scores, which can be helpful for getting a ballpark idea of your current credit score. However, most lenders rely on your FICO credit score, which sometimes requires a payment to see the scorethough some credit card companies allow customers to get their FICO scores for free.

Most lenders require a score of at least 680 in order to get approved for a home equity loan. Thats considered a good score. However, you may still be able to qualify for a home equity loan with bad credit. Since home equity loans are secured by your property, meaning your home serves as collateral if you default on the loan, theres less risk to the lender. And it can help if your other financial qualifications are strong.

Also Check: Apply For A Capital One Auto Loan

Home Equity Loan Costs

Like other financial products, home equity loans often have fees that may not be obvious unless youre looking for them. According to the Federal Trade Commission , you could be asked to pay an application or loan processing fee, as well as an origination fee of up to 5% of your loan amount.

You will also likely need to pay for an appraisal to prove your home has enough value to support the loan, and you may also face document preparation fees, recording fees or broker fees as well. So its important to ask about fees up front and look for lenders who offer home equity loans with very limited extra fees and closing costs.

If youre considering a home equity loan, make sure to shop around and compare lenders, their rates and the fees they charge. One way to do that is through an online marketplace such as LendingTree, which offers the convenience of only having to submit your details once, and then getting offers from multiple lenders that you can compare and consider.

Bottom Line: Should I Get A Home Equity Loan

To qualify for a home equity loan with the best rates youll need a relatively high credit score, a loan-to-value ratio of less than 80 percent and a debt-to-income ratio below 43 percent. A lender will also evaluate your payment and credit history to determine how likely you are to pay the loan back.

If you qualify for a home equity loan, you can make renovations, pay off credit card debts and more. But, if you default on the loan then you will lose your house. Since the stakes are so high, it isnt necessarily in your best interest to take out the maximum amount available to you.

You May Like: When Can You Refinance Fha Loan

Will I Have A Variable Rate Or A Fixed Interest Rate

Home equity loans come with a fixed interest rate. Its an installment loan thats paid with regular monthly payments for a set period of time, just like the first mortgage on a home. Terms range from five to 30 years.

A home equity line of credit, however, will likely have a variable interest rate that can change from month to month. Some HELOCs have a set rate for six months to a year, so you can have a steady payment amount for a while.

Payments may change based on your balance and interest rate fluctuations and can drop if you make additional principal payments. The variable interest rate is usually tied to the U.S. Prime Rate.

Some lenders, including Bank of America, allow a portion of the outstanding variable-rate balance on a HELOC to be converted to a fixed rate.

Why Your Credit Score Matters

Your credit score is a reflection of how you handle credit and debt. An exceptional credit score is a sign to prospective lenders that they can trust you to repay your loan on time. A score in the good range might be enough to get approved for a home equity loan, as long as you’re working with the right lender and your overall financial profile is satisfactory. However, the lender may still view you as a risk and charge a higher interest rate.

But if your credit score is in the poor to fair ranges, it may signify that you’re new to credit or have made credit missteps in the past.

Before you apply for a home equity loan, check your credit score to see where you stand. If it needs work, get a copy of your credit report to see where you can improve.

If there are any errors, report them to Experian and the other credit bureaus as soon as possible. If not, focus on areas of weakness.

For example, if you have outstanding delinquencies, get current on your payments quickly. If your credit card balances are high, create a strategy to pay them down. With each issue you find, work on a solution sooner than later.

Read Also: Usaa Car Loan Apr

Home Equity Loans: How To Qualify

The first step in applying for a home equity loan is having enough equity in your home to qualify. Generally speaking, most home equity lenders will only let you borrow up to 85% of your homes value in total between your mortgage and a home equity loan.

For example, if your home is currently worth $400,000, you could owe a total of $340,000 on your mortgage and a home equity loan. So if you already owe $300,000 on your home, you could qualify to cash out another $40,000 with a home equity loan.

Depending on your situation, its likely youll need to have your property appraised to determine how much its worth in todays market. Your home equity lender will usually facilitate this process for you, although an appraisal fee is typically required.

Your is another factor that comes into play if you want to qualify for a home equity loan. While each lender has their own qualification criteria, youll have the best chance at approval if your FICO score is at least good meaning 670 or higher. And youre more likely to get the best rates and terms on a home equity loan if your FICO score is very good, which is generally 740 and higher.

Related: How to instantly improve your credit scores for free with Experian Boost.

Finally, a home equity lender will consider your debt-to-income ratio, which is how much debt you already have in relation to the income you bring in. Generally speaking, lenders prefer consumers with debt-to-income ratios of 43% or below.

Can I Shop Around For Better Terms And Cheaper Closing Costs

Definitely. It is best to shop around and compare lenders as well as things like terms and rates, Kumar says. Furthermore, if you refinance, your closing costs will often be less. Lastly, before applying for home equity financing, if you work to increase your credit score, you can qualify for better terms, including lower closing costs. Overall, it is always in your best interest to research the available options before deciding which is best for you and your family.

Don’t Miss: Alberta Student Loan Login

Why Lenders Are Strict About Heloc Credit Requirements

Lenders look at a few factors in your financial profile to assess whether theyâll approve your application and what terms they will offer you:

- Loan-to-value ratio , or how much equity you have in your home

- Debt-to-income ratio

- Payment history

- Income

Borrowers who own their own businesses or work as 1099 contractors may face even more requirements.

âThe challenge for 1099 contractors and business owners is that their income profiles are inconsistent in nature. Due to the nature of the work, they may get paid varied amounts each month. As a result, computing their income is not as straightforward as a W-2 employee who gets paid the same amount each month and has more predictability,â Gupta said.

As a result, lenders often ask for several yearsâ worth of bank statements and tax returns and may even factor in a discount in case the borrower has a lean year. This can lead to an applicant profile ending up with a conservatively calculated DTI that looks less favorable than might really be the case .

Some mortgage lenders may be okay with a 43% or even 50% DTI ratio for borrowers, while others wonât work with someone with higher than 36% DTI. Credit matters a lot because lenders want assurance that borrowers will make second mortgage payments faithfully over the life of the loan.

What Are The Disadvantages Of Using A Heloc Rather Than A Home Equity Loan

When it comes to the credit score required for a home equity loan, HELOCs present disadvantages like credit and debt servicing ratios. This can significantly reduce the amount you qualify for.

Also, a HELOC wont work for consumers who dont have considerable equity and require good credit to qualify. Another disadvantage of HELOCs is that it lets borrowers make interest-only payments during the draw period, making it too easy to access cash without feeling the pain of decisions right away.

Don’t Miss: Capital One Preapproved Auto Financing

Home Equity Lineplus Rate

The advertised rate is shown for loans on a primary residence with a combined loan-to-value of 80% of your homes market value.

| Rate IndexRate Index |

|---|

| 4.49% |

Rates are effective .

¹APR = Annual Percentage Rate is variable, tied to the Prime Rate, and can change monthly with a minimum rate of 4.49% and a maximum rate of 18%. The Prime Rate is currently 3.25% as of March 16, 2020. 40-year term . To open a line of credit there may be certain fees paid to third parties at closing, unless otherwise noted, these fees generally total between $0 and $3,500.00. If you ask, we will give you an itemization of the these you may have to pay to third parties. Property and flood insurance may be required for the life of the loan. All loans are subject to approval, other conditions may apply.

Please refer to DCU’s Early Federal Disclosure for more information on Home Equity rates, including historical rate examples. You may obtain this information by contacting DCU.

When You Cant Pay Back Your Loan

Sometimes, even if youre granted a loan, you may encounter financial problems later on that make it difficult to pay it back. Though losing your home is a risk if you cant pay back your home equity loan or line of credit, it isnt a foregone conclusion. However, even if you can avoid losing your home, you will face serious financial consequences.

If the real estate market takes a dip, those with higher combined loan-to-value ratios run the risk of going underwater on their loan.

Also Check: Sss Loan Eligibility