What Are Fha Closing Costs

The closing costs on FHA loans are the fees charged by the mortgage lender and the various other players involved in the loan process, and typically total between 2 percent and 6 percent of the homes sale price. These fees also include an upfront mortgage insurance premium and prepaid items.

Closing costs vary by state, however, and are higher in states with higher tax rates. When you apply for a mortgage, youll get a closing costs estimate from your mortgage lender specific to your loan.

Sellers are allowed to pay some of a buyers closing costs, usually capped at 6 percent of the sale price. Whether the seller decides to grant this concession to the buyer depends on the local housing market, how many other buyers are interested in the property and other factors. If a seller has many offers to choose from, for example, there wont be as much incentive to offer to pay some of the costs.

How Much Are Closing Costs For A Buyer

Not every buyer will pay the same amount in closing costs. Some costs are lender requirements, some are government requirements and others may be optional will vary depending on the situation. What youll need to pay for will depend on where you live, your specific lender and what type of loan you take.

At least 3 days before you attend your closing meeting, your lender will give you a document called your Closing Disclosure. This will list out every closing cost you need to cover and how much you owe. Here are some of the most common closing costs you might see on your disclosure.

Can All Mortgage Companies Such As Banks Lenders And Mortgage Brokers Offer A No Closing Costs Mortgage

No. Most mortgage companies set the backend yield on their rates so high that there is not enough credit available from the rate to offer a no closing costs mortgage.

For example, the average closing costs and pre-paids associated with buying a home is about 3% of the purchase price. Since the rates typically yield no more than 5% on the backend of the loan there is not enough credit available to cover the closing costs if the lender has set to make 3-5% yield. Thus, only low priced mortgage companies which have set their yield at 2% or lower can do a no closing cost mortgage.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Ask The Seller To Foot The Bill

With an FHA loan, you can ask the seller to pay for some of your closing costs to help cut down your expense. This can be a tough demand to make in todays housing market, however, since sellers are garnering lots of offers these days. Every neighborhood is different, though, so, if the seller doesnt have other fish on the line and really wants to make a deal, you have some leverage that you might be able to convert to savings.

Va Loan Seller Contribution Maximum

The seller may contribute up to 4% of the sale price, plus reasonable and customary loan costs on VA home loans. Total contributions may exceed 4% because standard closing costs do not count toward the total.

According to VA guidelines, the 4% rule only applies to items such as:

- Prepayment of property taxes and insurance

- Appliances and other gifts from the builder

- Discount points above 2% of the loan amount

- Payoff of the buyers judgments and debts

- Payment of the VA funding fee

For example, a buyers core closing costs for things like appraisal, loan origination, and the title equal 2% of the purchase price. The seller agrees to prepay taxes, insurance, the VA funding fee, and a credit card balance equal to 3% of the sales price.

This 5% contribution would be allowed because 2% is going toward the core loan closing costs.

You May Like: Can I Refinance My Car Loan With The Same Lender

Is Rolling Closing Costs Into Your Loan The Same Thing As A No

Rolling closing costs into your mortgage is usually not the same thing as a no-closing-cost mortgage.

Generally, when lenders advertise no closing cost or zero closing cost mortgages they are referring to the process of trading a slightly higher interest rate in return for a lender credit.

A lender credit means the mortgage company will cover part or all of your closing costs.

With these mortgages, the lender will front many of the initialclosing costs and fees, while charging a slightly higher interest rate over theduration of the loan.

The downside is youll pay a larger monthly payment over the long haul. And, youre likely to pay significantly more in interest overall.

However, the idea is that you dont have to come up with as much cash up front. This can be helpful when you are also having to come up with a large down payment.

Why Are Closing Costs Necessary

Youre probably already paying a down payment, not to mention an earnest money deposit to show good faith and a sizable mortgage payment for the foreseeable future. Why do you also have to pay closing costs?

A real estate transaction is a somewhat complex process with many players involved and numerous moving parts. Some states require certain inspections beyond the basic inspection for which you directly pay a home inspector of your choice. Then there are property and transfer taxes, as well as insurance coverage and various additional fees, addressed below.

You May Like: What Is The Maximum Fha Loan Amount In Texas

How To Calculate Your Fha Loan Closing Costs

Sometimes, an FHA loan can give you the opportunity to buy a home when you otherwise wouldn’t get approved for a mortgage loan. The appraisal process is also slightly more complicated than for conventional home loans. Since your home must meet FHA property requirements, the appraisal may be more expensive. Besides these expenses, your closing costs will include the typical costs listed above.

Since there are many factors making each home purchase unique, many facts are included when determining the closing costs for your FHA loan. Luckily, the amount of your closing costs isn’t a secret that you have to wait to be revealed on closing day. Here’s what to expect with your FHA loan closing costs.

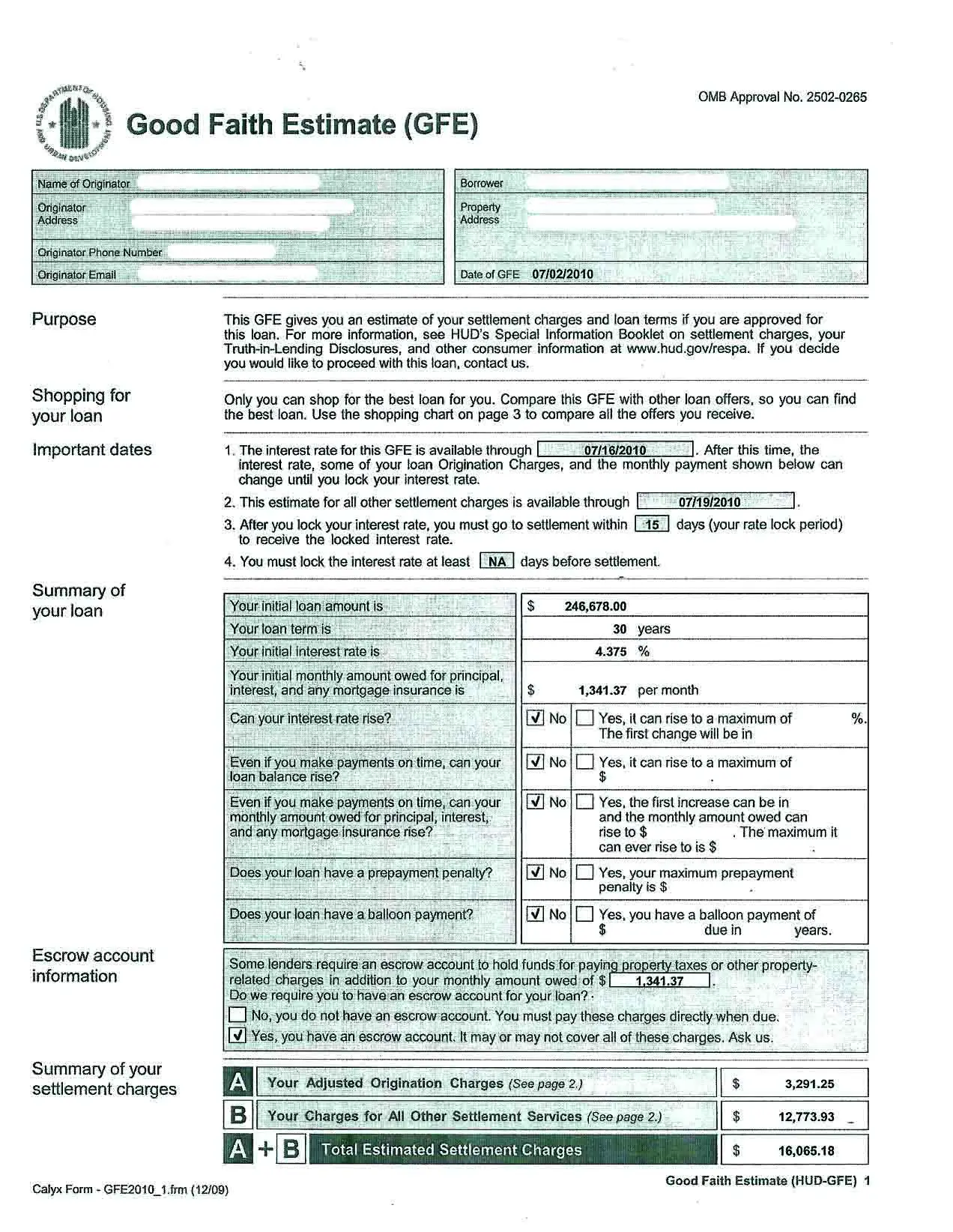

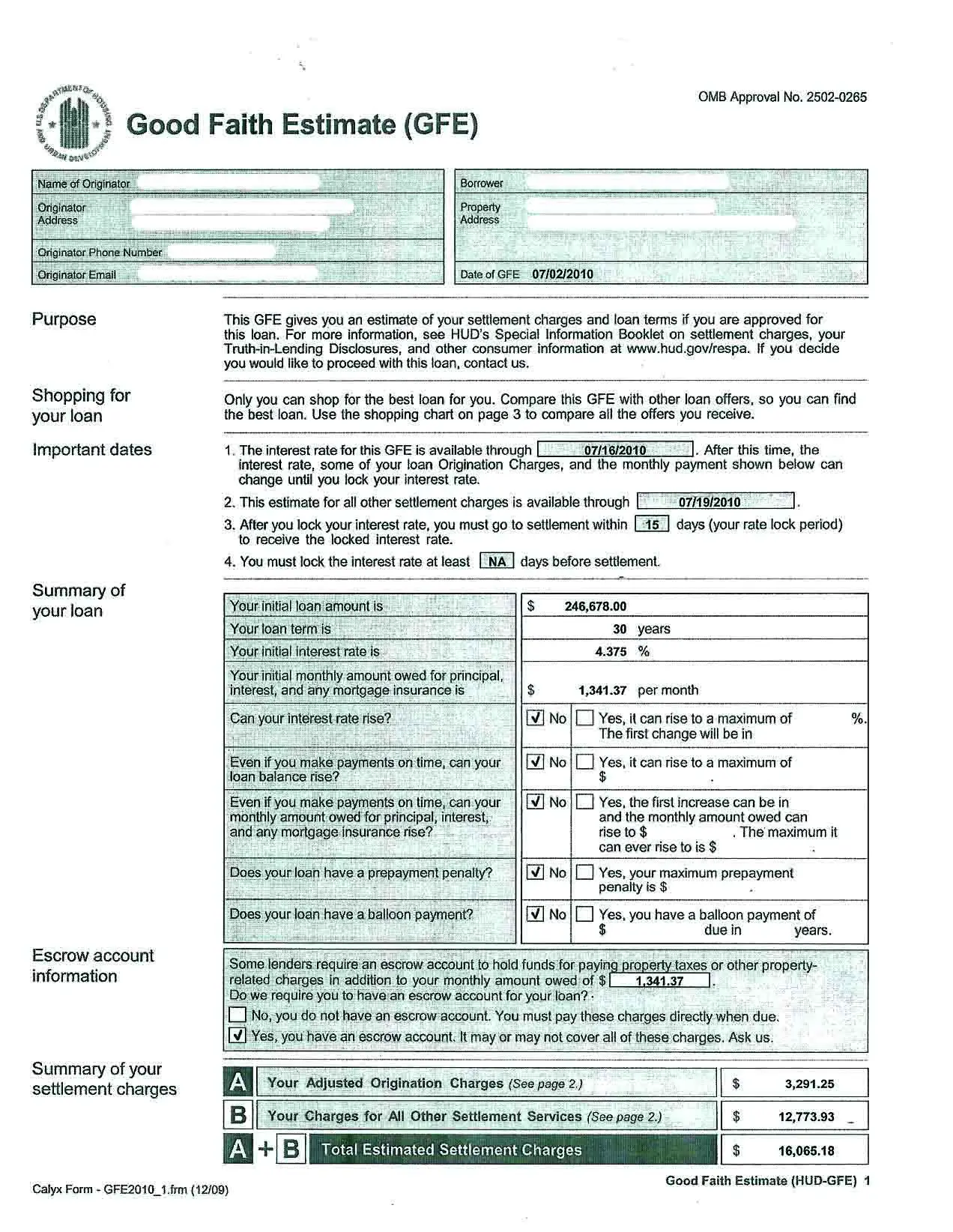

- Loan Estimate: Within 3 days of applying for a loan, your lender must send you a Loan Estimate which will explain details about the terms of your loan and estimated closing costs.

- Closing costs calculator: Using a closing cost calculator can provide an estimate of your potential closing costs.

Increase Your Interest Rate In Exchange For A Credit

Some loans will allow you to increase your interest rate while giving you a credit that offsets some or all of your closing costs. However, keep in mind that this means youll be paying more on all of the money you borrow for the entire life of the loan .

If you hear about zero-down loans, they often work this way. The lender covers your closing costs in exchange for a higher interest rate. Theyre not usually the fantastic deal they seem to be.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Pay A Higher Mortgage Rate And Use The Rebate To Pay For Closing Costs

While we do not always recommend paying a higher mortgage rate to pay for closing costs it may be the only option for some borrowers. In short, if you agree to pay a higher interest rate the lender provides you with a rebate that can be applied to your closing costs. There are several downsides to this approach. First, paying a higher mortgage rate usually costs you more in the long run because you pay a higher payment every month. You could end up paying thousands of dollars in extra interest expense over the course of your mortgage.

Additionally, because there is a limit to how much your mortgage rate can increase , there is also a limit to the size of the rebate you receive. Your mortgage amount usually must be $200,000 or higher for the rebate to cover your costs. If you are considering paying a higher mortgage rate to pay for closing costs be sure to weigh the positives with the negatives and understand the long term interest expense.

Use ourMORTGAGE COMPARISON CALCULATORto compare loans with different mortgage rates and costs

How Do I Avoid Paying Closing Costs

There are two ways to avoid paying closing costs on a mortgage. You can ask the seller of the property that you are buying to contribute 3% of the purchase price towards your closing costs or pre-paids or contact a mortgage broker that has their compensation level set to no more than 2%. Preferably, your first goal should be to have the seller cover the closing costs so you can receive a lower mortgage rate.

You May Like: Does Va Loan Work For Manufactured Homes

Can You Refinance From An Fha Loan To A Conventional Loan

If you have an FHA loan, its possible to refinance to a conventional loan once you have 5% equity in your home.

If you meet the equity eligibility requirements, refinancing to a conventional loan can give you the benefit of lower interest rates and allow you to get rid of your private mortgage insurance .

But just because its possible to refinance from an FHA loan to a conventional loan, it might not make financial sense for your situation. Youll need to consider the net tangible benefit for your personal finances. Plus, this will require you to provide asset verification and you will probably need to pay for an appraisal.

Meanwhile, an FHA Streamline Refinance can help you quickly drop the monthly payment on your existing FHA loan and without so much documentation or an appraisal.

How Much Are Closing Costs

In general, closing costs average 1-5% of the loan amount. Though, closing costs vary depending on the loan amount, mortgage type, and the area of the country where youre buying or refinancing.

Below is a list of the most common closing cost description and approximate costs. Everyones situation is different. The best way to get an accurate estimate of your loans costs is after your mortgage application is processed, and you receive an itemized closing cost sheet from your lender.

In this article:

Don’t Miss: Usaa Personal Loan Approval Odds

Consider Fha Mortgage Insurance Premiums

FHA loans have an added closing cost ingredient not typically involved in other mortgages: FHA guarantees insurance premiums. The FHA up-front mortgage insurance premium is 1.75 percent of the loan amount. Upfront FHA insurance premiums can get rolled into closing costs. The annual MIP is divided by 12 and added to your monthly payment.

Whats The Limit On Fha Seller Concessions

There are two important limitations on seller concessions for FHA loans. Lets quickly go over these.

The one thing a seller absolutely cannot contribute funds for is your minimum down payment. The Department of Housing and Urban Development calls this 3.5% down payment your minimum required investment. Youre required to come up with this from another source such as your own funds or a gift from a family member.

Seller concessions fall under interested party contributions. Interested parties include sellers, real estate agents, builders and developers and anyone else who has a stake in the transaction.

When it comes to FHA loans, interested parties can contribute up to 6% of the purchase price or appraised value, whichever is less. Any contributions exceeding that limit must take the form of a dollar-for-dollar discount in the sale price.

Recommended Reading: Drb Student Loan Refinancing Review

Phew Thats A Lot Of Potential Fees And Charges

Dont despair. Now that weve talked about some of the closing costs youre likely to face, we have six tips for cutting those costs down to size. Heres our guide on how to reduce closing costs:

With closing costs, a lot of money is on the line. Thats a good reason to shop around for the lender who offers the lowest closing costs. You can also ask a lender to match low closing costs offered elsewhere. Besides getting quotes from multiple lenders, you can get quotes for some services as well. There are some services included in the closing costs that you are allowed to shop around for. In other words, you dont have to go with the provider your lender suggests and you can try to find a lower price elsewhere. The closing cost services you can shop for will be listed as such on your Loan Estimate. Do some research, make some calls and see if you can find cheaper options.

When you get the Loan Estimate, dont just glance at it. Take the time to go through each item with the lender, questioning what each fee coversand why it costs as much as it does. This is a good way to identify padded or unnecessary fees. Also, keep an eye out for fees with similar names, as they may mean the lender is charging twice for doing the same thing. A common example: processing fees and underwriting fees. Closing costs have gotten clearer since the Loan Estimate replaced the GFE, but its still worth reviewing your Loan Estimate carefully.

Shop Around For Lenders

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Real Estate Agent Commission

Sellers usually pay for both the buyers and the sellers real estate agent commissions. Real estate commissions may vary, but the average rate is 5% 6% of the total loan value. The buyer’s agent and the seller’s agent split the fee evenly.

If you buy a home without an agent, remember to write into your offer letter that youre proposing a lower rate in exchange for no agent commission. Sellers consider commissions when they price their home.

Without an extra commission fee, you might have more room to negotiate your home’s price. If you buy a home without an agent and dont tell the seller when you make the offer, the sellers agent may pocket the extra money.

How Much Are Fha Closing Costs

Besides your down payment, youll pay 2% to 6% of the loan amount in closing costs for a typical mortgage, depending on your loan amount. In 2018, FHA borrowers paid an average of $7,402 in closing costs, according to a new report from the Consumer Financial Protection Bureau analyzing Home Mortgage Disclosure data from that year.

Read Also: Caliber Home Loans 1098 Form

Rolling Closing Costs When You Refinance

If youre refinancing an existing home loan, its often possible to include closing costs in the loan amount.

As long as rolling the costs into your mortgage doesnt impact your debt-to-income or loan-to-value ratios too much, you should be able to do it.

- As an example, lets say your new loan amount is $200,000, excluding closing costs

- If your home is valued at $250,000, your LTV is 80%.

- If your maximum approval is 80% LTV, or youre just wanting to stay at or below the 80% mark in order to avoid paying private mortgage insurance , you may not be able to roll the closing costs back into your loan

But if your loan-to-value ratio is low enough, taking on a small extra loan amount might not make too much of a difference.

Common Buyer Closing Costs With A Loan

Closing costs for a buyer usually run between 3% and 4% of the loan amount. This means that if your loan amount is $80,000 your closing costs would normally range between $2,400 and $3,200.

Buyer closing costs with a loan may come from the lender, or from third-parties who provided services in conjunction with buying the home, such as an appraiser or pest control inspector.

Typical closing costs on a home loan include:

- Loan application fee

- Title search fee

- Property tax impounds

- Transfer tax

- HOA monthly fee and transfer fee

- Homeowners insurance

Recommended Reading: How Much Do Mortgage Officers Make

What Are Closing Costs In A Mortgage

Closing costs, including prepaids, are fees that must be paid to finalize your mortgage loan. Your mortgage loan covers a percentage of the sales price of the property youre purchasing while closing costs cover the costs that accumulate during the homebuying and mortgage loan process. Youll receive a Loan Estimate t at time of application and a Closing Disclosure three days before your scheduled closing day from your lender. These documents include details of your loan and an itemized list of closing costs.

How To Reduce Fha Closing Costs

Posted by The Lazy Admin | Oct 22, 2021 | | 0 |

When getting ready to buy a new home, you may not realize the impact that FHA closing costs can have. However, when comparing different loans you may find out that you will be paying more. Closing costs on a mortgage loan is simply the difference between what you will pay for closing and the amount that is left to cover your closing costs. Closing costs are calculated as the amount of money that you will pay to close your mortgage loan. The closing cost typically includes appraisal, insurance, and title, and bank fees.

On virtually every mortgage transaction there are closing costs involved. Whether they are refinance mortgage deals or home purchase, there is always additional closing fees associated with such transactions. Many first time home purchasers dont have an understanding of all the various fees and costs that are charged by their potential lenders. Lenders do these costs according to their policies and guidelines. However, when working with a potential lender, it is wise to have an understanding of these fees and policy before signing any type of agreement.

Read Also: What Credit Score Is Needed For Usaa Auto Loan