Interest Rates On Student Loans From September 2022

Student loans are part of the governments financial support package for students in higher education in the UK. They are available to help students meet their expenses while they are studying. It is HMRCs responsibility to collect repayments where the borrower is working in the UK. The Student Loans Company is responsible for collecting the loans of borrowers outside the UK tax system.

The interest rates that will apply for the 2022-23 academic year were announced last month. Earlier in the summer, the government had announced that student loan borrowers faced a 12% interest rate from September 2022. The government announced in June that there would be a cap of 7.3% on student loan interest rates for current graduate borrowers to protect them from a rise in inflation. This interest rate was calculating using predicted market rates. The actual market rate reduced to 6.3%, so the cap has been lowered to this figure.

The 6.3% rate will apply to student loan borrowers on Plan 2 and Plan 3 loans. This change will impact the total value of the loan, but there is no difference in the monthly repayments paid.

A spokesperson for the Student Loans Company said:

‘The change in interest rates is automatically applied so customers dont need to take any action. We encourage customers to use SLCs online repayment service to regularly check their loan balance and repayment information, as well as ensure their contact information is up-to-date.’

Interest Rates On New Federal Student Loans Going Up For 2022

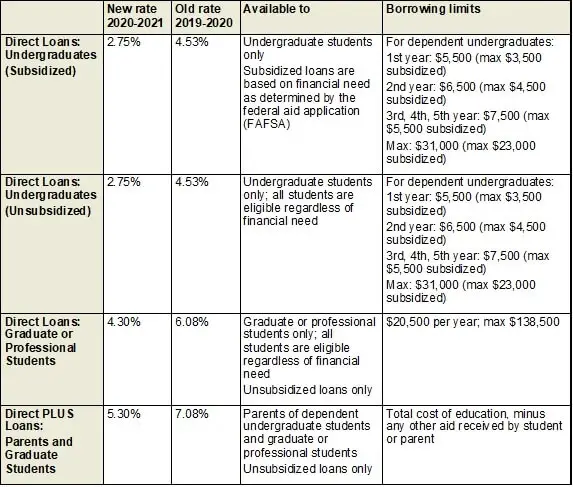

Two years ago, federal student loan borrowers enjoyed the lowest interest rates ever on their loans. This fall, rates for undergraduate borrowers will be nearly double what they were in 2020-21.

The interest rates for new undergraduate direct federal student loans are set to increase to 4.99% for the 2022-23 academic year, up from 3.73% last year and 2.75% in 2020-21. The interest rates on graduate direct loans are also set to increase to 6.54% parent and grad PLUS loans will rise to 7.54%.

Since the new interest rates go into effect beginning July 1, any new loans taken out before then will carry the interest rates from the 2021-22 academic year.

Rising rates make college more expensive

Higher interest rates mean paying off loans will be more costly. For a dependent first-year undergraduate student, a $5,500 loan the maximum this student could borrow will cost $6,997 over the standard 10-year repayment term with an interest rate of 4.99%. At the 2020-21 rate of 2.75%, this loan would cost $6,297.

Those taking on graduate direct and PLUS loans will see the cost of borrowing swell even more. On top of higher interest rates, PLUS loans carry an origination fee of 4.23% and dont have any borrowing limits.

Interest rates for federal student loans are set by the Treasury Departments May auction of 10-year notes. The interest rate on the May 10-year notes, 2.94%, is added to margins set by Congress, and those margins differ between types of federal student loans.

What Are The Requirements To Refinance Student Loans

Once you find a lender that best suits your financial situation, check the specific refinancing requirements. These can vary from lender to lender, but here are a few general criteria to be aware of:

- Debt-to-income ratio: Your debt-to-income ratio is a measurement of how much debt you’ve accumulated in comparison to your monthly earnings. You have a better chance of getting approved if your debt-to-income ratio is below 43 percent.

- When you apply for any loan, your credit score has a large impact. Check your lender’s credit score requirements before applying. If your credit score is in the mid-600s or lower, you may need to add a co-signer to your loan in order to qualify.

- Income: Lenders may impose a minimum income threshold, and they will likely want to see proof of employment this tells them that you have the cash to make your monthly payments.

- Refinancing amount: You will likely need to have a minimum of $5,000 in student loans outstanding if you’d like to refinance. If you have less than that, most lenders won’t work with you.

- Degree: You’ll typically need a degree to be eligible for student loan refinancing, though some lenders accept borrowers regardless of degree status.

If the lender you’re considering offers a prequalification tool, you can see your estimated rate based on your general financial history with a soft credit inquiry, which won’t hurt your credit score.

Learn more: Requirements for student loan refinancing

Read Also: Is 10 Interest High For Auto Loan

What Affects Private Student Loan Rates

With private student loan fixed rates ranging from 4.25% up to 12.59%, it can be tricky to know what you can expect to pay. The following factors can impact private student loan rates:

Which lender you choose. While many lenders offer comparable and competitive rates, some can provide a better deal than others. Collecting rate quotes can help you find the lender offering the best deal for you.

How creditworthy you are. Youll typically need a good credit score to qualify for a private student loan. Lenders also tie student loan rate offers to your credit score, so having better credit will net you lower rates. If your credit score doesnt meet this standard, you can add a co-signer to your application.

The private student loan terms you choose. The options you select for your loan will impact the interest you pay. Variable-rate student loans tend to have lower rates initially, for example, but can rise or fall in repayment. Fixed rates, on the other hand, can be higher at first but are locked in through repayment and wont change. Many lenders also offer lower rates on shorter student loan terms.

The general rates environment when you originate a loan. Similar to how federal student loan rates are tied to U.S. Treasury yields, private student loan rates are also affected by whats happening in the larger markets and economy. As overall rates rise or fall, you can expect private student loans to reflect those trends.

Average Student Loan Interest Rates In 2022

Edited byAshley HarrisonUpdated May 13, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

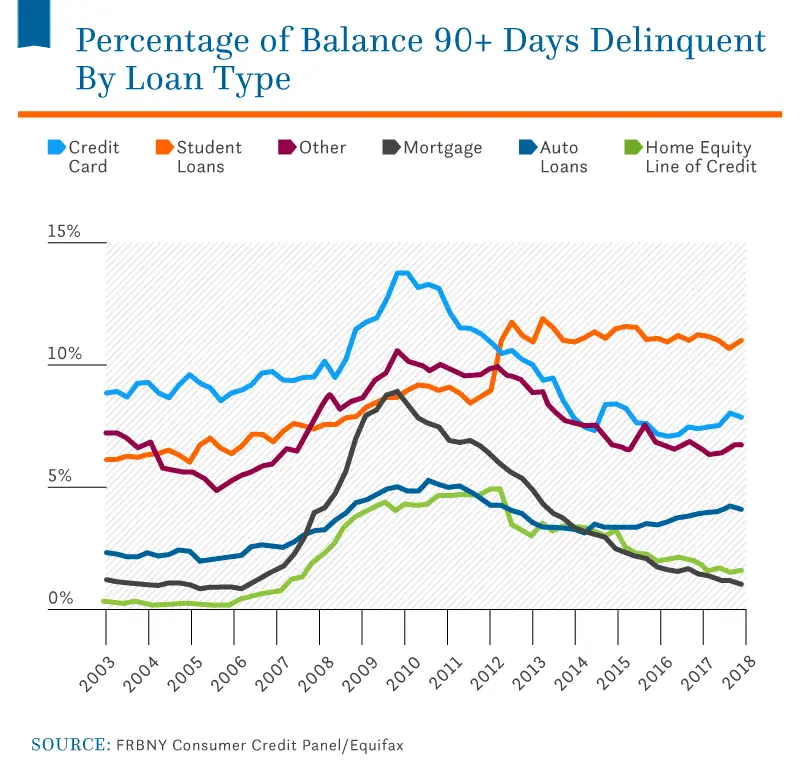

From 2006 through 2022, average federal student loan interest rates were:

- 4.60% for undergraduates

- 7.20% for parents and graduate students taking out PLUS loans

Are your rates higher than average?

See what rates you could get using Credibles rate estimator

*Rates displayed above are estimates based on your self-reported credit score and should only be used for informational purposes.

Read Also: Which Is Better Balance Transfer Or Personal Loan

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

How Do You Find A Student Loan With The Lowest Rate

To find a low interest rate on a student loan, you should compare rates among multiple lenders. You never know which company will be able to offer you a better rate based on your financial profile.

In general, choosing the shortest repayment term available will also result in a lower rate. Lenders may also offer better rates if you have a cosigner. And, the lower the loan amount, the lower the interest rate.

Recommended Reading: Can I Loan My Business Money And Charge Interest

Current Student Loan Refinancing Interest Rates

Refinancing your student loans is a smart option if you can qualify for a lower interest rate, which will help you pay less interest over the life of the loan. Interest rates for student loan refinancing are often lower than rates for private student loans because borrowers become better loan candidates.

Refinancing is only available through private lenders, not the federal government. Federal borrowers who refinance their loans with a private lender will have to give up benefits like income-driven repayment plans, long forbearance options, and student loan forgiveness programs.

Here are the student loan refinance rates from several private lenders:

| Lender |

To compare your options, check out our picks for the best student loan refinance companies.

The Most Valuable College Majors

College is a big investment regardless of how you pay for it, and some forward-planning will help ensure that your investment pays off. A Bankrate study of the most valuable college majors found that STEM degrees have consistently high median incomes and low unemployment rates, while arts degrees rank near the bottom in terms of overall value.

Of course, there are plenty of factors that influence the value of your degree, including the cost of your school, the likelihood that youll need an advanced degree and the fulfillment you find in your chosen career path. A performing arts degree may not be as financially rewarding as a degree in computer engineering, but it allows many graduates to pursue their dreams and land a satisfying job after college.

If youre looking for the most bang for your buck, these five college majors at the top of our rankings are a good place to start your search:

| Degree |

|---|

Read Also: How Much House Loan Do I Qualify For

Student Loan Interest Rates Set To Rise This Fall

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Interest rates on new federal student loans will jump by more than a full percentage point on July 1, 2022. This is the second time interest rates on federal student loans have increased during the pandemic.

Key Terms In This Story

Fixed interest: An interest rate that does not change during the life of a loan. All federal student loans have fixed interest rates, but private loans can offer fixed or variable interest rates. Fixed interest is the safer option because you dont have to worry about your rate and payment increasing.

Variable interest:Variable interest rates can change monthly or quarterly depending on the loan contract and come with rates caps as high as 25%. Variable interest loans are riskier than fixed interest loans, but can save you money if the timing is right.

Private student loan: Education funding from banks, credit unions and online lenders instead of the federal government. Private loans are best used to fill funding gaps after maxing out federal loans.

About the author:Anna Helhoski is a writer and NerdWallet’s authority on student loans. Her work has appeared in The Associated Press, The New York Times, The Washington Post and USA Today. Read more

Recommended Reading: How Do You Get An Unsubsidized Student Loan

What Kind Of Loan Do You Have And When Were The Funds Disbursed

The interest rate on your federal student loan will depend on the type of loan that you have and when the funds were disbursed.

Once you take out a federal student loan, the rate is set for life. But rates for new borrowers are adjusted annually, tracking yields on 10-year Treasury notes that reflect the governments cost of borrowing.

As the chart below demonstrates, you can expect to have different interest rates on the loans you take out each year youre in school.

Its important to remember that these federal student loans all have upfront fees associated with them. The upfront fee on PLUS loans can increase the annual percentage rate by more than 1 percentage point!

Find out: Test Your Knowledge of Student Loan Interest Rates

Does The Government Provide Relief For Borrowers Affected By Covid

In March 2020, the office of Federal Student Aid introduced a temporary 0.0% interest rate.

This rate was originally intended to last from March 13, 2020 through September 30, 2020. But it was extended through December 31, 2020, and then again through January 31, 2021, and most recently the student loan relief program was extended through at least May 1, 2022.

In addition to the temporary rate relief, the Department of Education has also suspended student loan payments and stopped all collections on defaulted loans. These measures are also in effect through at least May 1, 2022.

The 0.0% interest rate applies only to existing federally held student loans, although borrowers can still choose to make interest payments on their loans if they wish.

Recommended Reading: How Do I Apply For Home Equity Loan

Where Can I Learn More

Before you borrow, its important to understand student loans, whether theyre the right fit for you, and their impact on your college financial planning. To learn more about federal loans and other ways to borrow, read my article on the Best Student Loan Options for 2021-22.

You can also learn a lot more about student loans, federal financial aid, and the best ways to plan and pay for college by taking my College Planning Jumpstart video course.

Its a paid course, but the strategies and advice youll learn could potentially save you thousands of dollars on your college costs. For an affordable cost designed for families, I show you how to get and maximize financial aid, avoid or minimize student loans, save more money for college, and create a winning college financial plan.

To learn more or sign up now, check out the College Planning Jumpstart.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: How To Get Pre Approved Auto Loan

Indiana Mississippi And North Carolina Will Tax Your Canceled Student Loan Debt

Find out where your state stands on taxing forgiven student loans.

Courtney Johnston

Editor

Courtney Johnston is an editor for CNET Money, where she manages the team’s editorial calendar, and focuses on taxes, student debt and loans. Passionate about financial literacy and inclusion, she has prior experience as a freelance journalist covering investing, policy and real estate. A New Jersey native, she currently resides in Indianapolis, but continues to pine for East Coast pizza and bagels.

Indiana is the latest state to announce that it plans to tax forgiven student loan balances next year. According to AP, Indiana’s Department of Revenue confirmed Indiana residents eligible for President Joe Biden’s recent widespread federal student loan forgiveness plan and other forms of student loan cancellation should expect to pay taxes on this eliminated debt.

In addition to state taxes, Indiana residents will also owe county taxes on forgiven student debt. Since Indiana’s state tax rate is 3.23%, residents who receive $10,000 in forgiveness can expect to pay $323 in state taxes. County tax rates in Indiana vary, but Indianapolis residents in Marion County where the county tax rate is 2.02% will owe another $202 in taxes.

This announcement marks the third state to declare its plans to tax forgiven student loan balances, along with North Carolina and Mississippi.