Costs And Fees Of Home Equity Loans

Its important to be prepared for closing costs and fees when taking out a home equity loan. While these will vary from lender to lender , theyll typically be somewhere between 2% to 6% of your loan amount.

For example, on a $100,000 loan, you could expect to pay $2,000 to $6,000 in closing costs and fees.

Some common expenses include:

- Appraisal fees: A home appraisal determines how much your house is worth and affects your homes equity. A typical appraisal fee is $300 to $400.

- Origination fees: An origination fee is what some lenders will charge to issue you a loan. These can range from $0 to $125.

- Preparation fees: Some lenders will charge you for preparing your loan documents, which might include hiring lawyers and notaries. Preparation fees can range anywhere from $100 to $400.

- Lenders will run a credit check to get your credit score. The fee is usually about $25.

- Title search fees: The lender will do a title search to ensure you own the home and search for liens and other issues with title. The title search fee is usually $75 to $100.

Read more: Fixed-Rate HELOCs: A Cross Between HELOCs and Home Equity Loans

Which Is Better: A Home Equity Allow Or A Home Equity Line Of Credit

That depends on what you need the money for. A home equity allow may be better if you need a lump sum of money at a particular timesuch as to purchase another home. A home equity in harmony of credit could be better if you dont need the money all at once but expect to spend it in stages. Some lines of creditation remain open for as long as 10 years.

From an interest-rate perspective, a home equity loan may be safer because its involved rate is fixed, while the rate on a HELOC is variable. Borrowers with HELOCs have some protection in the build of caps on how quickly their interest rate can rise, although that can vary from lender to lender.

Is Getting A Heloc A Good Idea

With financial discipline, a HELOC can be a great idea and here is why. One of the best uses of HELOC is to improve an existing asset to generate wealth. For example, if you borrow money from a HELOC to do home renovations the return from the improvements could be greater than what needs to be paid on the interest of the HELOC. This is especially worth it if you are selling a home. Another example is financing something long term like a student loan. Again, the interest on the HELOC could be lower than a regular student loan.

A common question generally asked is, can’t I do the above with a loan? You could, but with more restrictions that may not make it worth it. With a HELOC, when carrying a balance, all that needs to be paid is the minimum interest unlike various loans. A lot of the time different forms of loans charge a penalty to pay off the principal. With a HELOC, you pay off the pricinpal without penalty.

You May Like: How To Transfer Car Loan To Another Person

Home Equity Loan Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Use this home equity loan calculator to see if a lender might give you a home equity loan and how much money you might be able to borrow. Home equity refers to how much of the house is actually yours, or how much youve paid off. Every time you make a mortgage payment, or every time the value of your home rises, your equity increases. As you build equity, you may be able to borrow against it.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

Calculate A Home Equity Line Of Credit Payment

See what a HELOC costs per month

Repaying a Home Equity Line of Credit requires payment to the lender, which typically includes both repayment of the loan principal plus monthly interest on the outstanding balance. Some HELOCs allow you to make interest-only payments for a defined period of time, after which a repayment period begins. Interest-only payments are based on the outstanding loan balance and interest rate.

Loan payments for the repayment period are amortized so that the monthly payment remains the same throughout the repayment period, but during that period, the percentage of the payment that goes toward principal will increase as the outstanding mortgage balance decreases. Find out how much a HELOC will cost per month.

Don’t Miss: How Much Do Loan Officers Make In Commission

Other Considerations When Applying For A Heloc

Applying for a HELOC could potentially affect your credit score . It acts as a revolving line of credit, similar to a credit card, and a high utilization rate can negatively impact your credit score.If used correctly, however, it can decrease your total credit utilization rate and act as a positive indicator of good borrowing behaviour.

Home Equity Line Of Credit Rates In October 2021

- The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products. Bankrate does not endorse or recommend any companies.

As of Fri October 1, 2021

A home equity line of credit, or HELOC, is a type of home equity loan that allows you to draw funds as you need them and repay the money at a variable interest rate. Because of this, HELOCs are generally best for people who need funds for ongoing home improvement projects or who need more time to pay down existing debt. HELOCs typically have lower interest rates than home equity loans and personal loans to get the best rates, you’ll have to have a high credit score, a low debt-to-income ratio and a lot of tappable equity in your home.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Is A Second Mortgage Loan Or Junior Lien

A second mortgage or junior lien is a loan you take out using your house as collateral while you still have another loan secured by your home.

Home equity loans and home equity lines of credit are typical examples of second mortgages. Some second mortgages are “open-end” . Other second mortgage loans are “closed-end” .

The term “second” means that if you can no longer pay your mortgages and your home is sold to pay off the debts, this loan is paid off second. If there is not enough equity to pay off both loans, ultimately, your second mortgage loan lender may not get the full amount it is owed. As a result, second mortgage loans often carry higher interest rates than first mortgage loans.

How Big Of A Heloc Can I Get

Your HELOC loan amount will depend on how much equity you have in your home. You’ll need at least 20%. Every lender has their minimum and maximum loan amount. For PenFed, the minimum loan amount is $25,000. The max HELOC amount is $500,000.

Your income, credit score, occupancy, and property type will also make a difference in loan size just like with any type of loan.

Recommended Reading: Rv Loan Calculator Usaa

How To Qualify For A Home Equity Loan

Getting approved for a home equity loan is similar to going through the process for a new mortgage. Your lender will review your application along with your credit report, credit score, debt-to-income ratio, and your homes equity.

While each lender has its own approval criteria, youll typically need the following to qualify for a home equity loan:

- Youll generally need a credit score of at least 680 to qualify for most home equity loans though, the higher your score, the better your interest rate could be. And although you might get a loan with a score of 660, you could end up with a higher interest rate.

- DTI ratio: Your DTI ratio is the percentage of your monthly income that goes toward debt payments, including your mortgage, student loans, credit cards, and car payment. When applying for a home equity loan, your DTI ratio shouldnt exceed 43%.

- Equity: To qualify for a home equity loan, youll need to have at least 15% to 20% equity in your home. If your house is worth $250,000 and you owe $200,000 on your mortgage, your homes equity is $50,000, or 20%.

Learn More: Have Bad Credit and Want a Home Equity Loan? Heres What to Do

How Much Home Equity Do You Have

Your home equity value is the difference between the current market value of your home and the total sum of debts registered against it.

The credit available to you as a borrower through a home equity loan depends on how much equity you have. Suppose that your home is worth $250,000 and you owe $150,000 on your mortgage. Simply subtract your remaining mortgage from the home’s value, and you’ll come up with $100,000 in home equity.

Also Check: Fha Loans In Illinois

Where Can You Get A Home Equity Loan

You can get a home equity loan through a bank, credit union, or online lender. Its a good idea to check out many different offers to compare each one. See which lender offers the lowest interest rates, fewest fees, and best repayment terms. Make sure youre eligible before applying and if you arent eligible on your own, try to find a reliable co-signer to help you qualify.

Using The Home Equity Line Of Credit Calculator

This home equity loan calculator makes it easy to determine what you can borrow, as well as showing how that amount would vary if the appraised value of your home is more or less than you expect.

To use it, enter the estimated value of your home, the amount owed on your mortgage and any second liens, and the maximum loan-to-value ratio allowed by your lender in the boxes indicated. The line of credit available to you will be displayed in the blue box at the top.

Notice that you can vary these figures using the sliding green triangles on the chart if you want to explore a range of values.

The chart with the three colored lines shows you how your available line of credit would vary across a range of appraised home values, given the figures you entered into the calculator. The lines correspond to the loan-to-value ratio your lender will allow.

The home equity line of credit calculator automatically displays lines corresponding to ratios of 80%, 90% and 100% it can also display one additional line based on any value you wish to enter. For example, if your lender will allow a 95% ratio, the calculator can draw that line for you, in addition to the other three.

The range of home values are listed along the bottom and are centered on the value you entered the figures for the available line of credit are listed at left on the vertical axis.

Also Check: What Is An Rv Loan

Home Equity: What It Is And Why It Matters

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

It is often said that homeownership builds wealth. So, what is home equity, and how can it enhance your net worth?

How Long Is A Home Equity Loan

A home equity loan term can range anywhere from 5-30 years. HELOCs generally allow up to 10 years to withdraw funds, and up to 20 years to repay. A cash-out refinance term can be up to 30 years. Repayment options are the various structures a lender provides for you to repay the borrowed funds.

Read Also: Usaa Auto Loan Rates And Terms

The Heloc Stress Test

Although you could potentially qualify for a credit limit of up to 65% of your home’s value, your real limit may be subject to a stress test similar to themortgage stress test. Banks and other federally regulated lenders will use the higher of either:

- theBank of Canada five-year benchmark rate, currently set to 5.25%, and

- your negotiated interest rate plus 2%.

Requirements For Heloc Qualification

Lenders will be seeking some standard things when qualifying an applicant for a HELOC. They are looking to minimize their risk, so it helps to understand how you can help improve your own chances of success.

- : this refers to your CLTV, which most lenders want to see under 80% for a HELOC. To harness home equity, you must have it built-up.

- Solid FICO Score: though it is possible to secure a HELOC with a FICO of 620, it will be tougher than if your score is 720 or higher. Anything under 720, and the lender might impose additional fees or stipulations to feel secure in extending credit.

- Low DTI: your debt-to-income level is of equal measure as your credit score, perhaps even more important to lenders. To understand your DTI, divide your monthly expenses by your gross monthly income. If your DTI is higher than 45%, you will probably struggle to find a willing lender so look for ways to better manage your debt.

Lenders will offer a HELOC at an APR that is using a margin over the prime rate. The margin is usually constant, but the prime rate may change a lot over the life of the loan. If a lender offers a HELOC under prime, chances are that the rate is short term.

Pay attention to the way the lender words their offer it is common for a HELOC to have an introductory rate that is significantly discounted for a short period of time, like six months. This rate is a teaser, and the actual rate may be one that is higher than youd like.

You May Like: Transferring Mortgages To Another Bank

Find Your Maximum Home Equity Loan Amount

A home equity loan is a type of financing option that allows you to borrow money based on how much equity you have in your home. You can use a home equity loan for repairs, renovations, and more, but your loan will have a maximum.

If youre thinking about taking out a home equity loan, start by reviewing how much equity you have in your home. Then, shop around to get the best interest rate and repayment terms for your needs. You can get a home equity loan from a variety of banks, credit unions, or lenders, but each one may have its own maximum loan amount.

Home Equity Loans: How They Work And How To Use Them

A home equity loan can help you pay off debt or finance a major purchase, but there are also risks to keep in mind like foreclosure if you cant pay on the loan.

Kat TretinaUpdated August 16, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youre a homeowner, you could have access to a form of credit you might not know about: your homes equity.

Home equity loans allow you to borrow money using the equity in your home as collateral, possibly at a lower interest rate than a personal loan. Youll get a lump sum loan that you can use for home renovations, paying down debt, or even to finance your childs college education.

But keep in mind that home equity loans come with their own benefits and drawbacks so they arent right for everyone.

Heres what you should know about home equity loans:

Read Also: Mortgage Loan Officer Salary Plus Commission

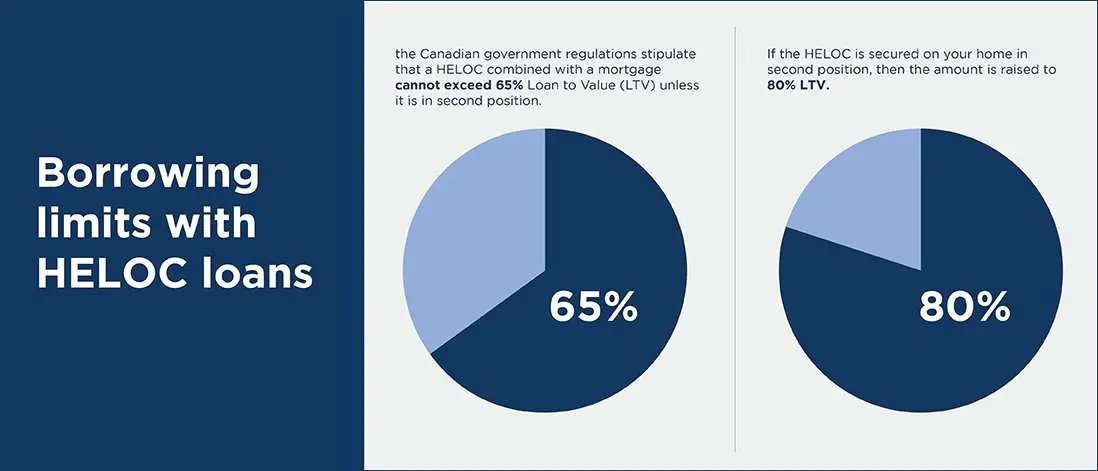

How Is My Heloc Limit Calculated

In Canada, you can only borrow up to 65% of your home’s value with a HELOC. When combined with a mortgage, your Cumulative Loan To Value cannot exceed 80%. This means that your mortgage and HELOC combined cannot exceed 80% of your home’s value. If you owe 50% of your home value on your mortgage, you would be eligible for a HELOC of up to 30%. Below is the formula used:

How Does A Heloc Work

Of the two types of second mortgages, HELOCs work more like a credit card than a traditional installment loan. Instead of receiving a lump sum, youre able to continuously borrow against a line of credit, up to a certain limit and within a certain time period.

Since a HELOC is a second mortgage, youll be adding another loan to your property, on top of your current mortgage loan.

With HELOCs, borrowing and repayment are separated into two distinct periods .

Also Check: Usaa Current Auto Loan Rates