If Your Financial Situation Has Changed Or You Just Want Better Car Loan Terms Refinancing Your Car Loan May Be A Good Move

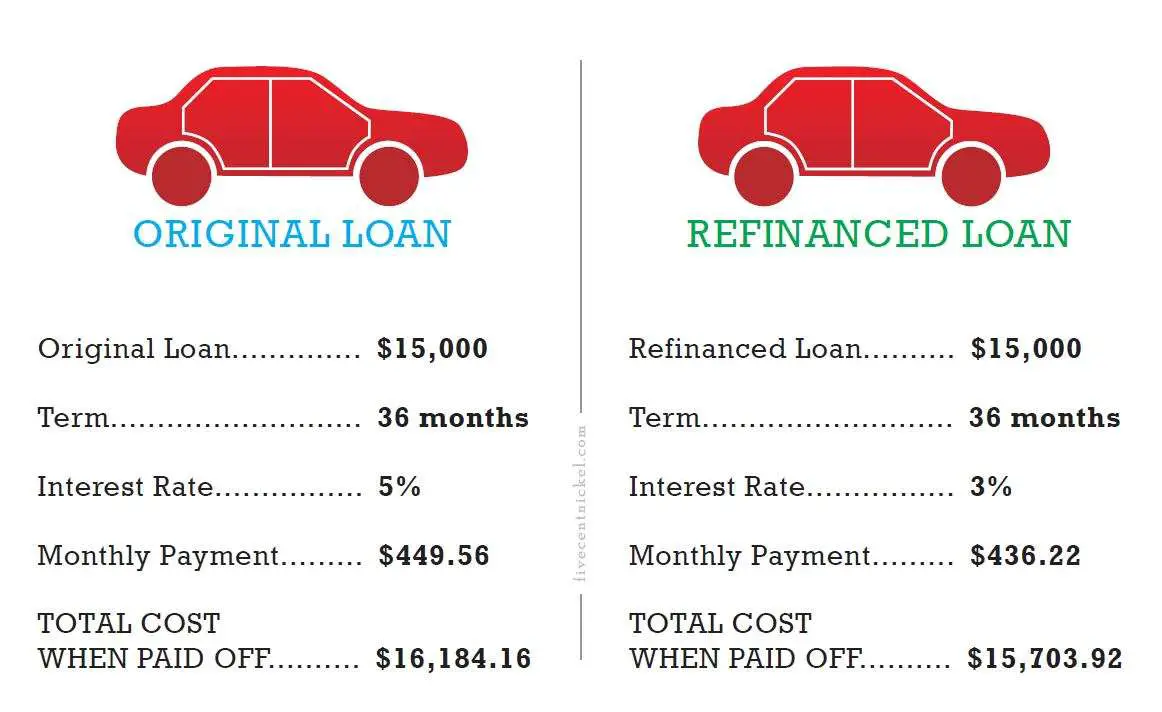

When you refinance your car, you take on a new loan to pay off the balance on your current car loan. Maybe your credit has improved and you might qualify for a lower interest rate, or your financial situation has gotten better and you want to remove the co-signer from your original loan. Refinancing with a new loan could mean getting better terms and rates that are more in line with your current financial needs and long-term plans.

Read on for tips to help you determine if a refinance is right for you, and to learn how to refinance a car loan.

Have You Taken Out An Auto Loan To Pay For Your Car You May Be Able To Refinance That Loan To Lessen Your Financial Burden

Refinancing acar loan involves taking on a new loan to pay off the balance of your existingcar loan. Most of these loans are secured by a car and paid off in fixedmonthly payments over a predetermined period of time usually a few years.

Peoplegenerally refinance their auto loans to save money, as refinancing could scoreyou a lower interest rate. As a result, it could decrease your monthly paymentsand free up cash for other financial obligations.

Even if youcant find a more favorable rate, you may be able to find another loan with alonger repayment period, which might also result in a lower monthly payment .

Risks Of Refinancing Multiple Times

Remember financing your first auto loan? Refinancing your auto loan often comes with many of the same pitfalls, plus a few new ones.

Lowering your credit score. You have a 14-day window in which you can apply to multiple lenders and it counts as a single credit inquiry, resulting in a slight, temporary drop to your credit score. If you wait longer than that to complete your loan shopping or to accept an offer, youll have to fill out another application, which could count as another inquiry.

Becoming upside down in your loan. If you refinance to a longer term, you risk owing more than what the car is worth or becoming upside down or underwater on your loan. An upside down car loan can create problems if you later decide you want to sell the car.

Paying more in the long run. If you keep extending your auto loan, the interest charges may add up to much more than what you would have paid for your original loan.

Also Check: Will Refinancing My Auto Loan Help My Credit

Look Out For Prepayment Penalties

A prepayment penalty is a fee that some lenders charge if you pay off your loan earlier than the agreed payment schedule.;

Check your loan documentation or call up your lender to find out if there is a prepayment penalty on your loan. In most cases, there won’t be. But you’ll want to make sure before moving forward.;

What You Need To Refinance

To refinance an existing loan, you need the following :

You May Like: What’s Better Refinance Or Home Equity Loan

How Often Can You Refinance Your Home

Are you having trouble making your mortgage payment each month? A refinance can help you manage your money more effectively and help lower your interest rate, remove private mortgage insurance or take cash out of your equity.

But heres a twist: What if youve already refinanced your home loan? Can you, or should you, do it again? Well look at how often you can refinance and help you decide whether doing so more than once is the best decision.

How Many Times Can I Refinance My Auto Loan Carsdirect

Oct 1, 2020 There isnt a limit on how many times you can refinance your auto loan, but there are requirements you need to meet to do so.

Jan 15, 2021 Theres no limit on how many times you can refinance your car loan, but it may not be a good idea to do it more than once.

Nov 16, 2018 Good news: Consumers can refinance their car as many times as they want and as often as they can find a lender willing to approve them for a new;

Read Also: Can You Get Personal Loan From Bank

How Soon Can You Actually Refinance A Car Loan

If youre interested in refinancing your car loan, you may start looking for new lenders so as soon as youd like. Many lenders will require you to wait at least one month before refinancing, along with their specific requirements to take out a new loan. Some lenders may require three to six months of on-time payments before refinancing.

Believe it or not, you may be able to refinance right after you buy your car. If you are, just make sure its in your best interest to do so. You dont want to go through the refinancing process and later find out that it actually costs you money or takes a toll on your long-term financial plan.

Compare Auto Refinance Rates

How Refinancing Affects Your Credit Score

Refinancing can also negatively affect your , since lenders verify your credit via a hard credit pull when you refinance, says Bellingham. Multiple credit inquires remain on your credit report for up to two years and could cause your credit score to drop, depending on your borrowing habits.

If youre thinking about refinancing twice within a 12-month period, youll want to ensure that your credit score is in good enough shape to withstand another minor dip when you apply for your next refinance, Bellingham says.

Read Also: How To Get Sba 7a Loan

How Refinancing Can Cost You More Over The Life Of The Loan

Refinancing may lower your monthly mortgage payment, but it could also extend the length of time youre paying your mortgage.

If youre five years into paying off your current 30-year mortgage and you refinance to a new 30-year term, youre essentially adding five more years of payments, Bellingham says. And, extra payments mean youll likely be paying more interest over the life of the loan, even if the interest rate is lower.

Plus, when you refinance frequently and lengthen the loan term each time, youll build equity more slowly.

In such cases, it may make sense to consider a shorter term loan, like one you can pay off over 10, 15, or 20 years. This leads to higher monthly payments, of course, but it also means youll likely pay lower interest rates and less interest over the life of the loan.

If your goal is to reduce your monthly payments as much as possible, you will want a loan with the lowest interest rate for the longest term, McDaniels explains. If you want to pay less interest over the length of the loan, you may want to look for the lowest interest rate and at the shortest term.

How Many Times Can You Refinance Valley Bank

The longer your loan term, the more interest they collect. Some loans are structured with prepayment penalties that will charge extra if you try to pay off the;

Jan 27, 2021 Refinancing could potentially save you money, make your monthly home loan payments more manageable, and even give you more control over your;

3 days ago Refinancing Your Auto Loan Could Lower Your Monthly Payments monthly car payments; Can save you money in the long run if you refinance;How do I refinance a car?When should I refinance my car?

You May Like: How To Get Lowest Interest Rate On Personal Loan

What Are The Pros And Cons Of Refinancing

If youre on a tight budget or you see a better interest rate advertised, refinancing a car loan can be very attractive. Althought you can save a lot of money with an auto refinance, it is important to take a close look to make sure you will benefit from refinancing. Refinancing has pros and cons, and the best choice will depend on your personal circumstances.

Here is a list of the benefits and the drawbacks to consider when refinancing an auto loan.

Pros

- Tap into your auto equity

Cons

- Some lenders charge origination fees.

- Your current lender may charge prepayment fees.

- A refinance can increase the cost of your auto loan.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

You May Like: What Car Loan Can I Afford Calculator

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Is A Refi The Right Choice For Me

If you have a high interest rate on your car loan, and current market rates have dropped, you may want to consider refinancing. Interest rates are at near-historic lows right now, and you may qualify for a better rate.

Borrowers whose credit has improved significantly since they first took out the loan may also be eligible for a better rate. For example, if you had a bankruptcy or default fall off your credit report, your credit score may be much higher now.

If you can refinance with a co-signer or co-borrower, then you may receive better rates if you were the only borrower on the original loan.

Recommended Reading: What Kind Of Loan For Land

Exactly How Many Times Can You Refinance Your Car Loan

Theres no legal limit on how many times you can refinance a car. That said, the lender you want to refinance with must agree, and each has its own rules. Lenders are in the business to make money, and if a lender sees that youve already refinanced your car several times, it might decide not to issue a loan offer.

How Does An Auto Refinance Work And Is It A Good Plan For

Sep 3, 2020 But did you know you can refinance your auto loan, too? but overall, the refinance could cost you more in the long run.

The longer your loan term, the more interest they collect. Some loans are structured with prepayment penalties that will charge extra if you try to pay off the;

Jan 27, 2021 Refinancing could potentially save you money, make your monthly home loan payments more manageable, and even give you more control over your;

Recommended Reading: Is Homeowners Insurance Included In Fha Loan

Your Guide To Auto Loan Refinancing

No doubt you’ve heard about the benefits of refinancing a home loan. Frankly, it’s pretty hard to avoid those mid-afternoon and late night television ads championing the benefits of home equity loans, and promoting the financial advantages of refinancing an existing mortgage. But did you know that you can also refinance an existing auto loan?

Auto loan refinancing offers many of the same benefits as home loan refinancing , and under the right circumstances can be a real boon to anyone diligently working away at a high interest car loan. Refinancing allows you to secure a lower interest rate on your loan, reduce your monthly payments, and even free up some much needed ready cash. However, refinancing a car loan does have a downside, and it is important to understand both the advantages and disadvantages before you put pen to paper.

Your Credit Score Has Improved

Even within the first 12 months or so, your credit score may have improved enough to make you eligible for a significantly lower rate. Perhaps you corrected a mistake on your credit report or paid off most of your outstanding debt. Maybe youve demonstrated that youre responsible by paying all of your bills on time, or youve had a big increase in income. Whatever the reason, an improved credit score can make getting a better loan deal far easier.

You May Like: What Credit Score Do You Need For An Fha Loan

Where Can I Refinance My Current Auto Loan

You can refinance your auto loan by visiting your local OneAZ Credit Union branch. If you do not have time to visit a branch, you can request an appointment with a banker on your computer, phone or tablet, or call the OneAZ Virtual Team at to apply. Or to apply online in five minutes or less.

In addition, you do not have to be a current member at OneAZ Credit Union to apply for a loan. to learn what it means to be a OneAZ member.

Taking A Lower Interest Rate

Have interest rates lowered since you got your refinance? You may want to refinance again to take advantage. You can almost always save money if youre able to lower your interest rate without changing the term of your loan.

Just a small change in your interest rate can save you hundreds, or even thousands, of dollars. For example, lets say you currently have a 20-year mortgage loan with $150,000 left on your principal and you pay an interest rate of 4.5%.

You have the chance to refinance your loan with the same terms and an interest rate of 4% APR. If you dont refinance, you pay $77,753.84 in interest by the time your loan matures. If you take the refinance, you pay $68,152.95 total in interest. Lowering your rate just 0.5% means youll save over $9,601 in interest.

You May Like: Is Jumbo Loan Rates Higher

How Refinancing A Car Loan Affects Your Credit

Each time you refinance an auto loan, it affects your credit.;If you refinance a car loan, the bank or credit union youre applying to will need to run a new inquiry on your credit history, which results in a hard inquiry on your credit report.

A hard inquiry has a negative impact on your credit score ;it drops your score by a few points. Although the immediate impact of a hard inquiry lessens after a few months, it does remain on your credit report.

If you have strong credit, such an inquiry will have less of an impact; however, if youre struggling to rebuild your credit score, its advisable not to apply with too many credit lenders because it can negatively impact your credit score.

The Best Reason To Refinance: Pay Less Interest

The ability to borrow at a lower interest rate is a primary reason to refinance a loan. That lower rate means you pay less for your car after taking all of your borrowing costs into account. Because the interest rate is also part of your monthly payment calculation, your required payment should also decrease. As a result, managing your monthly cash flow becomes an easier task.

When you can replace your existing loan at a lower rate, its best to refinance as early as possible. Most auto loans are amortizing loans, which means you pay a fixed monthly payment with interest costs built into the payment.

Over time, you pay down your debt, but you pay most of your interest costs at the beginning of the loanso get that rate down sooner than later to start cutting costs. An amortization table can show you exactly how much you can save by refinancing.

Also Check: Should I Pick Variable Or Fixed Rate Student Loan

You Financed Your Current Auto Loan Through A Dealership

Dealerships may not offer you the best rates available. If you took out your loan through a dealer especially without negotiating the interest rate refinancing could potentially save you thousands of dollars over the remaining life of the loan.

If youre shopping around for the best interest rate, consider checking out auto refinance rates at a financial institution where you already do business. For many bank members, this could mean accessing special discounts.

For example, Chase offers a 0.25% interest-rate discount if youre a Chase Private Client. And Bank of America Preferred Rewards customers may qualify for a rate discount of up to 0.50%.

Does Refinancing Hurt Your Credit Score

When you refinance a loan, you are closing out an old loan account and replacing it with a new one. This can affect your credit score because, among many factors, most scoring models take into account the age of the credit accounts on your credit reports. The longer your credit history, the better.

In addition, if the credit bureaus see too many hits to your credit in a short amount of time, your score may be impacted.

Read Also: How Much Home Loan Can I Get On 70000 Salary