Student Loan Refinance Rates Just Moved Closer To Record Lows

New data shows refinance loan rates remain historically cheap, even deep below 2%.

Interest rates on money-saving student loan refinances are circling around their all-time lows, new data shows, and are promising relief to borrowers who may be buried under tens of thousands of dollars in debt.

That’s a typical balance, in a nation where student loan debt totals $1.73 trillion, according to recent Federal Reserve data.

A refi at lower interest possibly under 2% could cut your monthly payment substantially and slash your lifetime interest costs.

Here’s a closer look at the current rates, plus some tips on how to score a refinance at the lowest rate possible.

Use Caution When Refinancing

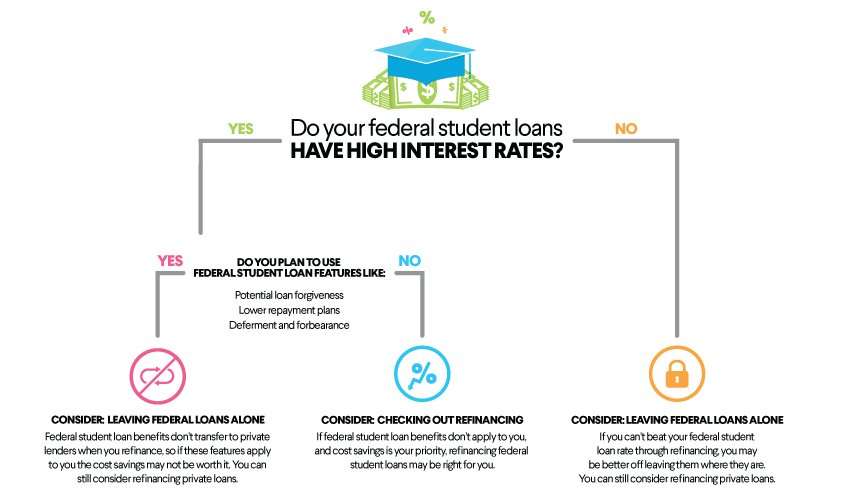

Some borrowers have federal student loans, but they dont see a need for federal perks and protections.

These borrowers may have reviewed the various forgiveness programs available and concluded that they wouldnt qualify. Similarly, their income is high enough that an income-driven repayment plan doesnt help save money.

If student loan elimination is just a matter of time for you, and you have the option to save a bundle by lowering interest rates, it might make sense to refinance your federal loans into a private loan.

However, even in this circumstance, caution is still necessary. Once you refinance your federal loans into a private loan, there is no way to undo the process.

Current & Historic Federal Student Loan Interest Rates

With the passing of the Coronavirus Aid, Relief, and Economic Security Act , no interest will accrue on federal student loans in repayment until January 31, 2022effectively setting the interest rate at 0%. Payments made during this time will first apply to unpaid interest accrued from before March 13, 2020, then directly towards the principal balance of the loan.

In the following table, you will find the current and historic interest rates for federal loans. These rates coincide with the academic year that the loans were taken out .

It should be noted that all of these are fixed rates, meaning that they do not change over time.

| Loan type | |

| 6.31% | 6.84% |

Federal student loans are issued by the Department of Education to eligible students who fill out the Free Application for Federal Student Aid, or FAFSA. The interest rates on these loans are set once a year and are based on the 10-year Treasury note.

Heres how interest works for different borrowers:

An added cost to federal loans worth mentioning comes in the form of an origination fee. Unlike most private lenders, the Department of Education deducts a fee from your loan amount prior to disbursement. This deduction means that your loan amount will be a bit higher than the funds disbursed to your school.

Here are the current and historical origination fees for federal student loans.

| Loan type | |

| 4.27% | 4.29% |

Also Check: Usaa Used Car Loan Interest Rates

Average Student Loan Interest Rates

If youve decided that a refinance is the best move for you, its time to find out where your rates currently stand before you look up any student loan refinance rates.

Congress has the final say on federal loan interest rates. Regardless of the kind of loan you have, interest rates are fixed. That means that the interest rate you had when you first began borrowing will be the same rate youll have years later.

Private student loan interest rates, on the other hand, can be fixed or variable. If you have variable rates, theyll change relative to market fluctuations. Over time, those interest rates could end up being significantly higher than they were when you first took out your loan.

On average, student loan interest rates for private loans sit between 9 and 12%. Federal student loans are cheaper than theyve been in the past. For the 2015 2016 school year, rates are set at 4.29% for undergraduate students with subsidized or unsubsidized Direct Loans.

Should You Refinance Student Loans During The Coronavirus Pandemic

With many Americans currently experiencing reduced income due to the coronavirus pandemic, student loan refinancing is an attractive option for those struggling to make student loan payments. Interest rates on student loans are at record lows, meaning now could be one of the best times to refinance your private student loans if you’ve been considering it.

It’s likely not a good idea to refinance your federal loans now, since interest and payments are currently waived on federal student loans through Jan. 31, 2022 by refinancing your federal loans, you would be required to make payments with interest and lose the ability to take advantage of any future federal relief programs.

The one exception is SoFi, which is currently offering a program that lets you refinance your federal student loans without interest charges until Dec. 20, 2021. However, it’s still wise to take a look at the other federal benefits you’d lose by refinancing.

If you have private student loans, there is little downside to refinancing if you can qualify for a lower rate. Rates are likely to only rise from here as the economy starts to recover, so locking in a fixed rate now could be a good option.

Learn more:Should you refinance your student loans during the COVID-19 pandemic?

You May Like: How Do I Find Out My Auto Loan Account Number

Current Student Loan Refinancing Interest Rates

Refinancing student loans is a smart option if you can receive a lower interest rate than the rate on your existing loans. By receiving a lower rate, you reduce the total interest youll pay over the life of your loan.

Remember, refinancing is done by private lenders, not the federal government. This means that federal borrowers should only refinance their loans if they receive a lower interest rate and dont need the added benefits of federal loans, such as income-driven repayment plans or student loan forgiveness.

Here are the student loan refinance rates from several lenders.

| Lender |

To compare your options, check out our picks for the best student loan refinance companies.

Getting The Best Rates

One big goal of refinancing student loans, for many borrowers, is reducing the amount of interest paid. And that means getting the lowest possible interest rate.

You may find that variable-rate loans start out lower than fixed-rate loans. But because theyre variable, they have the potential to rise in the future.

Fortunately, you can reduce your risk by paying off your new refinance loan quickly, or at least as quickly as possible. Start by picking a loan term thats short but with a payment thats manageable. Then, pay extra whenever you can. This can hedge your risk against potential rate increases.

Also Check: What Does Usaa Certified Dealer Mean

Best For Parent Loans: Laurel Road

- Interest Rate: 2.14%+

- Loan Terms: Up to 20 years

- Maximum Loan Amount: None

Laurel Road is best for parent loans because it allows parents to refinance into a lower interest rate loan.

-

Up to 20 years to pay off

-

Referral reward

-

Minimum loan amount is $5,000

-

Limited to students enrolled in select programs

-

No guarantee of lower rate with co signer

If you took out student loans to pay for your child’s education, you might be stuck with a high interest rate. Federal Parent PLUS Loans have the highest interest rate of any federal loan. If you have this type of loan, refinancing can be a smart decision.

Laurel Road is one of the few lenders that offer refinancing for Parent PLUS Loans and allows you to transfer your loans into your child’s name if you choose. By refinancing your debt into your child’s name, you eliminate your obligation to repay the loan, and your child is responsible for repaying it instead.

As an added perk, you will receive $400 if you refer a friend and they refinance with Laurel Road. You don’t even need to be a customer yourself to be eligible for this referral reward.

You must refinance a minimum of $5,000, and there is no maximum amount. Your term length can be customized to anything under 20 years. Although Laurel Road does not recommend a minimum credit score, they state that their low rates are made possible by the fact that they select the most creditworthy borrowers, particularly “working professionals.”

- Variable: 2.14% to 6.15%

Whats The Difference Between Private Refinancing And Federal Consolidation

Although refinancing can simplify your debt by combining multiple loans into one, its different from federal student loan consolidation. You refinance student loans with a private lender, but you consolidate loans by taking out a direct consolidation loan from the federal government.

Federal consolidation combines federal student loans into one new loan, and it lets you choose new repayment terms. But it doesnt lower your interest rate, so you wont save money on interest-only student loan refinancing helps you lower your rate, if you qualify. You can compare the two with our Student Loan Consolidation vs. Refinancing Calculator.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

What Credit Score Do You Need To Refinance Your Student Loans

Not all lenders publicly list their minimum credit score requirements. Of the lenders that we looked at while researching this article , Earnest has the lowest requirement. To qualify for a loan from Earnest, you’ll need a minimum credit score of 650.

If your credit score is lower than that, you may still be able to qualify for a loan if you have a cosigner on your application.

Current Student Loan Refinancing Rates By Fico Score

To provide relief from the economic impacts of the COVID-19 pandemic, interest and payments on federal student loans have been suspended through at least Jan. 31, 2022. As long as that relief is in place, theres little incentive to refinance federal student loans. But many borrowers with private student loans are taking advantage of the low interest rate environment to refinance their education debt at lower rates.

If you qualify to refinance your student loans, the interest rate you may be offered can depend on factors like your FICO score, the type of loan youre seeking , and the loan repayment term.

The chart above shows that good credit can help you get a lower rate, and that rates tend to be higher on loans with fixed interest rates and longer repayment terms. Because each lender has its own method of evaluating borrowers, its a good idea to request rates from multiple lenders so you can compare your options. A student loan refinancing calculatorcan help you estimate how much you might save.

If you want to refinance with bad credit, you may need to apply with a cosigner. Or, you can work on improving your credit before applying. Many lenders will allow children to refinance Parent PLUS Loans in their own name after graduation.

You can use Credible to compare rates from multiple private lenders at once without affecting your credit score.

Read Also: Usaa Proof Of Residency Request Form

Private Student Loan Vs Federal Student Loans

Both Private and Federal loans are excellent ways for graduate and undergraduate students to pay for their student expenses. Although quite similar, they come with several differences.

A federal student loan is the type of student loan that you can access from the U.S. Department of Education. Federal student loan options give you the ability to have your loan fully discharged if you happen to qualify for a Teacher Loan Forgiveness program or a Public Service Loan Forgiveness program.

Another positive thing is that most federal student loans can reduce your fees to 10-20% if youre a graduate student who doesnt have a high-earning income. They are also cheaper than private student loans, which might be a perfect solution for undergraduate loans.

On the other hand, private student loans work quite similar but with few more benefits. They are the types of student loans that private lenders most commonly offer. This means that credit unions and other online companies are suitable for undergraduate and graduate students that have the ability to pay a much higher price.

The undergraduate and graduate students have access to higher loan amounts thanks to their private lenders. This means that they can borrow a lot more money than they can borrow from federal loans.

Another great benefit is that you can get much lower interest rates with these types of loans. Private lenders allow student loan borrowers to have a lower interest rate if they have good credit.

Refinancing Federal Loans To Private Loans

When you refinance federal student loans to a private loan means youll lose access to some federal loan benefits. Youll no longer have access to features like:

- Generous deferment and forbearance options

You may not need these programs if you have a stable income and plan to pay off your loan quickly. But make sure you wont need these programs if youre thinking about refinancing federal student loans.

If you do need the benefits of those programs, you could refinance only your private loans or just a portion of your federal loans.

Don’t Miss: Avant Refinance Loan Application

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan. Temporary COVID-19 relief

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

Should I Refinance My Student Loans

Refinancing your student loans makes financial sense only if the loan you apply for has a lower interest rate than the current interest rate of your student loans. You can use a loan calculator to determine your current monthly payment versus that of the loan you’re considering. While you may decide to refinance to a longer term in order to lower your monthly payments, keep in mind that a longer term and a higher interest rate will both increase the amount of money you pay.

Whether or not you should refinance also depends on what type of loans you have. Refinancing could be a good idea if you have private loans, but you’ll lose benefits if you refinance federal loans. These benefits include:

- Income-driven repayment plans.

Learn more:Should you refinance your student loans now?

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Finding The Best Refinance Lender

However, the vast majority of borrowers should focus on finding the lender offering the lowest interest rate. Slight differences in customer service and lender reputations usually are not enough to justify paying a higher interest rate.

As of November 2021, the following lenders offer the lowest interest rates:

| Rank |

|---|

Compare Student Refinance Loans

When looking at options to refinance your student loans you want to compare providers to make sure youre getting the best deal. Keep the following important factors in mind:

- Rates: Kow what rates are offered and if they are fixed or variable rates. Typically, the higher your credit score, the lower your rate.

- Terms: Student loan terms generally range from 5-20 years. However, some companies cut off term limits at 15 years. Know how long the term is and make sure its feasible to make timely payments.

- Customer service: Know how to get in touch with customer service whether it be through email, online chat, or email. You may have a question the website doesnt answer.

- Borrower requirements: Do you need to have a certain FICO score to qualify? Know if there are other qualifications such as being a certain age, minimum income, or a particular type of degree program.

Don’t Miss: What Bank Has The Lowest Home Equity Loan Rates

Should You Consider Refinancing Your Student Loan

Many people had to take out student loans to get a degree and want to know if they should consider refinancing their student loan. Before deciding, consider your needs and assess your current situation. Think about if its a good time to refinance and consider what your current rate is, if you could potentially qualify for a lower rate and if any fees will be involved.

However, it may make sense to hold off on refinancing your student loans if your income isnt stable and your Fico score is low.

How Does Refinancing Impact My Credit Score

Applying for any new loan can knock a few points off your credit score, but on-time payments will improve your score over time. New credit applications only account for about 10% of your FICO Score, whereas your payment history makes up 35%.

Many refinancing lenders let you shop around with no impact on your credit score. With this prequalification, you can compare rates before submitting a full application and consenting to a hard credit inquiry.

Since youll be refinancing your current loans rather than taking on new debt, your debt-to-income ratio should not be affected.

Also Check: What Is A Student Loan Account Number

When Should You Refinance Your Student Loans

Here are a few scenarios where refinancing your student loans could be the right move:

-

You can qualify for a better interest rate, which will save you money on your loan

-

You need a lower monthly payment that fits more comfortably in your budgetng

-

You have multiple student loans and want to combine them to simplify your repayment

-

You have private student loans, so wont lose any federal benefits by refinancing

Ultimately, youll have to decide whether refinancing your student loans is a good idea depending on your individual circumstances and financial goals.

Learn more: When to Refinance Student Loans