What Is A Student Loan

Perhaps it’s one of the ironies of modern life that while a college education is one of the most expensive purchases you’ll probably ever make, you’re required to pay for it right after you get out of high school. By the age of 18, few of us have earned enough money to make anywhere near the amount that even the first year of the average college education costs.

So how does anyone ever afford to earn a degree? Unless you’ve earned a full scholarship, are an older student, or have a family who offers to pay your way, student loans are one of your best options. A student loan involves finding a lender who is willing to loan you the money for college now and let you pay them back over time.

Repaying Your Student Loan

Student loans must be paid back. Many students have two loans that need to be managed separately. Heres what to expect after you leave school.

On this page:

Most students leave school with an Alberta student loan and a Canada student loan.

Having two loans means you need to handle twodebts and two payment schedules.

Your Alberta loan is managed through MyLoan and your Canada loan is managed through the National Student Loans Service Centre Online Services. You must create individual accounts through these websites and handle your repayments separately.

This is what the lifecycle of student loans looks like:

|

While youre a student |

Loans are interest-free and you dont need to make payments. |

|

Grace period The first 6 months after you leave school, beginning the first day of the month after your end date |

Loans are interest-free, and you dont need to make payments. |

|

Repayment Begins 6 months after you leave school |

Interest is added to your loan balance monthly. |

|

Repayment begins. A monthly repayment schedule is set up for you automatically. |

Does The Forbearance Period Start Repayment Over

No, your student loans are in limbo. If you havent made any voluntary payments toward your student loan debt, youre in the same position you were roughly a year ago.;

For example, if you were on a traditional repayment plan before March 13, 2020, then your repayment status will be for the same total number of months as it would have been before. That means it wont necessarily take longer to pay off your loans, but rather the expected payoff date is pushed back. You always have the option to pay off your student loan debt sooner.;

An income-driven repayment plan operates differently and suspended payments during this forbearance period still count toward forgiveness, so be sure to talk to your loan servicer if you have specific questions regarding your repayment status.

You May Like: How To Apply For Student Loan For Masters

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

What Additional Information Should A Cosigner Consider When Making Payments

Each primary borrower is assigned a single account number. When a loan is funded, it will be added to that account number so a borrower may have multiple loans under the same account number.

All payments made by cosigners through Wells Fargo Online®, at a Wells Fargo banking location, by automatic payment, or by phone will be at the individual loan level. Payments made via any other method will be distributed as described in How payments are distributed across multiple loans.

You May Like: Is My Home Loan Secured

Borrowers Reported Both Positive And Negative Experiences With Servicers

Several borrowers in each category also indicated that they first learned about their options from their servicerstypically when the servicer called after they had missed a paymentthat the servicer gave them the information they needed, and that working with the servicer resulted in favorable outcomes.

Theyre very accommodating, at least in terms of the person you talk to, and theyre very helpful. … They wont just refer you to the website or whatever. Theyll even ask you, do you want me to send you the document?

were very pleasant, very helpful, gave me a wealth of information, didnt make me feel like they were getting ready to come after me, but gave me some solutions as to what I needed to do, gave me the websites, gave me the names, you know.

My company has always been really good. I havent had any complaints with them other than they call me every day. … I found out about the plan Im on now, because I didnt know about that particular income-driven plan. The guy on the phone was really informative, and he said, hey, weve got this plan here. Have you looked at it? And then 20-minute explanation of how it works.

The whole advice-giving process felt like it was somebody who was like really in it for me and like explaining all the parts. Ive found that the loan servicers have worked with me all along the way very well. … If I ran into an issue, they were really good at working with getting the repayment plan that would fit.

Switch To A Standard Repayment Plan

If youre on an IDR plan or graduated repayment plan, consider switching back to a standard repayment plan, which is the default plan. With the standard repayment plan, your payments are spread out evenly over 120 months, meaning youll have your loans paid off in 10 years.

While your payments might be higher, theyll stay constant for the length of your repayment. And, since youre paying off your loans faster, youll pay less in interest than under longer repayment plans where higher interest amounts will accrue.

Read Also: How To Refinance Sba Loan

Annual And Aggregate Loan Amounts

An important limiting factor when it comes to student loans is the total amount you borrow each year and in the aggregate over the course of your college career. Usually, your aggregate limit as a graduate or professional student includes amounts borrowed as an undergrad. Likewise, aggregate loan limits for private loans usually consider amounts borrowed through federal loans.

Federal Direct aggregate limits are affected by your status as well as your parents’ eligibility to take out a Federal Direct Parent PLUS loan. If they are ineligible, your annual and aggregate limits are higher. The amount of any Parent PLUS loan is not subtracted from your Federal Direct loan limit. Your limit is affected by whether your parents are eligible or not. Keep in mind that aggregate limits are not lifetime limits. As you pay down your student loan debt, your cumulative limit is refreshed.

Could My Payment Amount Change

Yes. On variable rate loans, we may recalculate the payment amount periodically to maintain the same number of payments over the life of the loan if:

- The Index used to calculate the interest rate changes

- You have paid more or less than what is due each month

- You have paid earlier or later than your due date;

- You have enrolled in or canceled automatic payments

Any recalculation of the payment amount would follow timing requirements set forth in your loan agreement.

Recommended Reading: Will Student Loan Refinance Rates Go Down

Making A Dent In Your Student Loans

Once youve got a handle on your student loan balance and how interest impacts the balance, make an action plan for tackling your loans. When it comes to student loan repayment, its important to understand your options so you can make the best decisions for your financial future.

One debt payoff strategy is to focus on the highest interest loan firstalso known as the debt avalanche method.

One debt payoff strategy is to focus on the highest interest loan firstalso known as the debt avalanche method. Take a look at your loans and figure out which one has the highest interest rate.

This is where you would focus your payoff efforts, after you make the minimum monthly payments on your other loans every month. By focusing on the loan with the highest interest rate first, borrowers may be able to reduce the amount of money they spend on interest.

Another payoff option to consider is refinancing your student loans. If your financial situation has improved since you initially took out your loans, refinancing may be a way to obtain a lower interest rate.

Refinancing is an option for those with federal loans, private loans, or both. However, refinancing can impact your eligibility for programs like Public Service Loan Forgiveness, so be sure to consider all of your options when deciding whether to refinance.

Thinking about refinancing your student loans? Learn more about how SoFi can help you take charge of your loans.

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

How To Avoid Negative Amortization

Interest is arguably the most important thing to look at when it comes to paying off your loan since it can stand in the way of paying off the money youve borrowed.

Remember that amortization isnt bad; its the process of paying down your loan and coming closer to a zero balance.

Its negative amortization that sends your finances further in the other direction. Essentially, youre paying just to get further into debt.

The key is to pay as much as you can toward your student loans, lower the interest you owe, and tackle your principal for the remainder of your loan. Heres how to get started:

Recommended Reading: How To Cancel My Student Loan Debt

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

How Long Before You Can Refinance Student Loans

You can refinance your student loans as soon as you meet the requirements set by the lender, such as having good credit as well as verifiable income. You might also be required to have graduated before you can refinance, depending on the lender.

Some lenders allow borrowers to refinance their loans without a degree or even while theyre still in school. However, keep in mind that many students dont yet have the required income and credit history to qualify for refinancing. In most cases, youll need to build a good credit history, secure a stable income, and possibly graduate before you can refinance your student loans.

You May Like: How Much Time It Takes To Get Personal Loan

How To Calculate Your Monthly Student Loan Payment

Your monthly payment will depend on how much you borrowed, your interest rate, and the loan repayment term . If you have federal student loans, you can usually enroll in an income-driven repayment plan with monthly payments that are based on a percentage of your income.

Estimate how long itll take to pay off your student loan debt using the calculator below. You can also use the slider to see how increasing your payments can change the payoff date.

Enter loan information

Alternatives To Government Aid

Government-backed student loans are the lowest cost way to finance your education, but sometimes you wont qualify or receive enough to cover all your education costs. For example, if your spouse or parents earn too much money, you may not qualify, or if you have RRSP savings, you may be assessed to have a $0 need for government student loans.

Ideally, only those Canadians who do not need student loans would be denied, but this isnt always the case. If you need loans to finance your education and dont qualify for government student loans, here are your options:

Don’t Miss: How Long Does It Take To Get Student Loan Money

How Much Will Refinancing My Student Loans Save Me

According to a recent analysis of self-reported data provided by borrowers who refinanced their student loans through Credible, Credible users who refinanced into a shorter term loan saved ;an average of $17,344 over the life of your new loan.1

But keep in mind the amount you save will be dependent on your specific situation.

1 to see how this savings was calculated.

Can A Cosigner View The Student Loan Online

Yes. Cosigners can view and manage student loan they are liable for through Wells Fargo Online®. Cosigners can sign up for Wells Fargo Online® if they do not have access.

If cosigners sign on to Wells Fargo Online® and do not see the student loan they are liable for, they can add them by following these steps:

- Select Account Settings

- Select Add Account and follow the instructions to add the student loan

Read Also: Who Do I Talk To About An Fha Loan

Individual To Act On Your Behalf

You have the option to name someone to act on your behalf in the event of your death before your student loan is paid in full. This person can be anyone you choose and would not be responsible for repaying your loan . You are not required to name anyone if you do not want to. If you do want to designate someone, now or in the future, contact us at 1-866-878-1087. We will need the following information about the person you designate: first and last name, address, and primary phone number.

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

Read Also: What Is Certificate Of Eligibility Va Home Loan

Federal Direct Student Loans

The table below shows the breakdown of the maximum amount you can borrow when taking out Direct Subsidized and Unsubsidized student loans. Note that the total for each year, and cumulatively, includes both subsidized and unsubsidized federal loans. If, for example, your subsidized loan total in year one as a dependent undergrad is $3,500, you are limited to $2,000 in unsubsidized loans for that year. If your subsidized total is less than $3,500, the difference between that and $5,500 can be unsubsidized loans.

The amount you can borrow each year and cumulatively as an undergrad is also affected by your parents’ eligibility to help you by taking out a Direct PLUS loan. If they are eligible, the amount you can borrow in your own name is less. If they are ineligible, due to poor credit, for example, you can borrow more. Amounts for independent undergrads also reflect lack of parent supportas do amounts for graduate and professional students, who are always considered to be independent.

| Dependent Undergrads | Subsidized |

|---|---|

| $138,500 |

The aggregate total for each class of borrower includes all unpaid loan balances for all federal student loans taken. This includes subsidized and unsubsidized FFEL loans, which are no longer available, as well as subsidized graduate level loans dispersed before July 1, 2012.

To apply for federal student loans, you’ll need to submit the Free Application for Federal Student Aid .

Seek Deferment Or Forbearance

Deferment and forbearance are two ways to put your loans on hold after graduation.

Borrowers who opt for deferment have up to three years to begin paying off their loans, ample time to begin saving money to front-load your loan payments and tackle interest.

In some cases, such as Direct Subsidized Loans, the federal government may even pay your interest.

Forbearance is a pause in loan payments for up to one year to let you regroup financially, but beware — interest still accrues during this time.

Don’t Miss: What Mortgage Loan Fees Are Negotiable

For Student Loans Received Before August 1 2000

If you received a student loan before August 1, 2000 you have risk-shared and guaranteed loans. Contact the lending institution that holds these outstanding loans for all information on repayment.

Canada and B.C. student loans are repaid separately, however only one payment may be required.

- Canada student loans are repaid to the federal government.

- B.C. student loans are repaid to the Province of British Columbia.

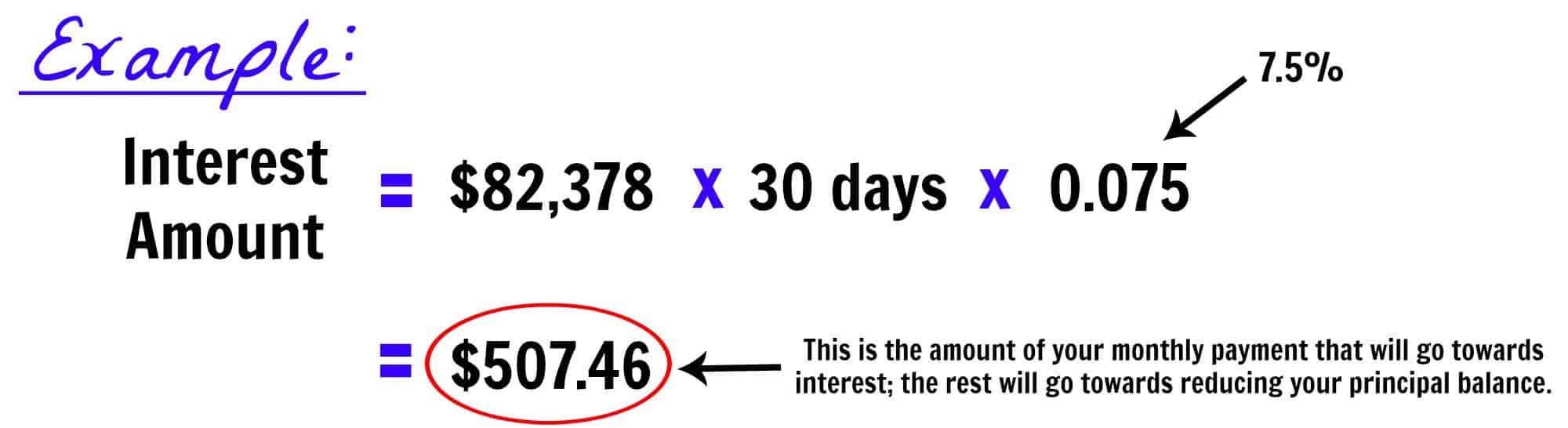

Find Out How Much This Totals Each Month

Take this figure and multiply it by the number of days since your last payment. If you are making monthly payments, this should be 30 days.;

For example: $1.60 x 30 = $48.00

The typical monthly payments for a person who owes $20,000 with 3% interest using a 10-year fixed-interest repayment plan is about $193. This means that $48 of this payment would be going towards interest while the remaining $145 would go towards repaying the principal.;

This math shows just how significantly interest can impact your monthly student loan payments and millions know just how much those payments impact their finances. Even before the pandemic hit and unemployment spiked, more than 20% of student loan borrowers were behind on their payments.

Don’t miss:

Don’t Miss: How Much House Can I Afford Physician Loan