Benefits & Disadvantages Of Fha Loans

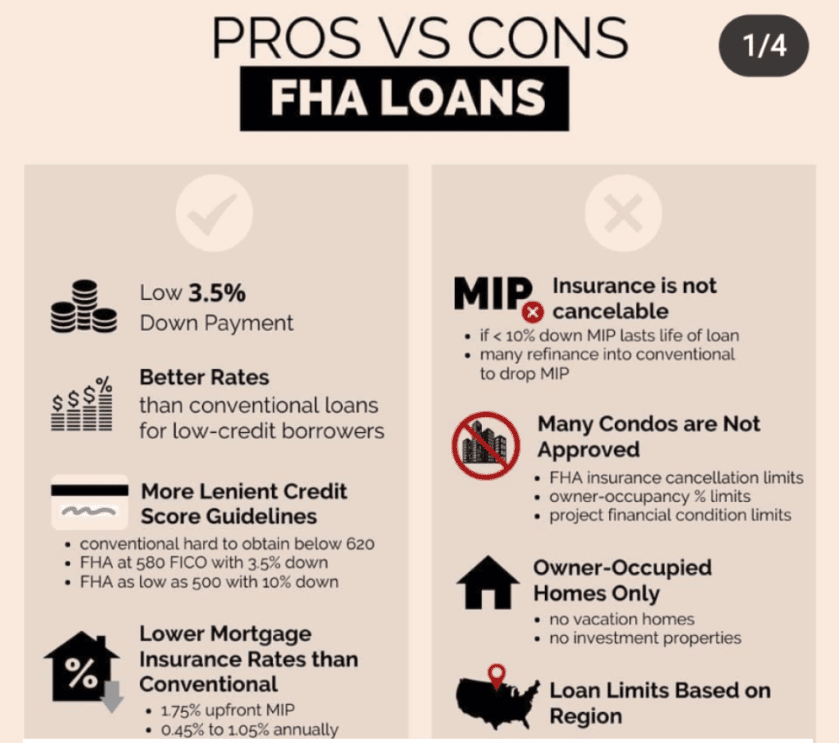

There are several benefits to FHA loans. They have lower credit score requirements, lower down payment requirements, and their overall qualifications and standards are easier for more individuals to meet. Conventional loan terms are set by private mortgage lenders. That means they tend to be harder to achieve.

However, FHA loans do require mortgage insurance. This is an added cost to your loan purchase and should factor into your monthly payment.

Youll likely benefit from an FHA loan if:

- You can afford the FHA minimum down payment requirement

- You have a credit score under 680

- You have little experience with mortgage loans

An FHA loan may not be right for everyone, especially those with a high credit score and a sizable down payment.

Fha Loans Allow Lower Credit Scores

FHA loans feature some of the most flexible and forgiving credit standards of any available loan type. With an FHA-backed loan, you dont need perfect credit.

In fact, the FHA expressly instructs lenders to consider a borrowers complete credit history not just isolated instances of bad financial luck or an occasional late payment.

FHA interest rates are often lower than those of conventional loans for people in the same credit bucket. Thats because FHA does not add risk-based surcharges for things like lower credit scores, higher loan-to-value ratios , or condos and manufactured homes.

This doesnt mean youre guaranteed to qualify. But borrowers with a banged-up history have a much better chance of getting loan approval via the FHA than other loan options.

Even if youve been turned down for other types of credit, such as an auto loan, credit card, or other home loan program, an FHA-backed loan may open the door to homeownership for you.

Fha Loans Dont Have Income Or Geographic Limits

Other low-down-payment mortgage programs may have special eligibility requirements. Many are limited to those with low, very low, or moderate income. Or they are available to only certain groups.

The VA loan, for example, allows 100% financing. But you must be an eligible military borrower to use it.

The USDA Rural Development loan also allows 100% financing, but the program requires you to buy in a designated rural area and imposes income limits, too.

For most buyers, FHA mortgages require a 3.5% down payment. This makes the FHA mortgage one of the most lenient mortgage types available nationwide.

Your down payment money could be a gift from a family member, employer, charitable organization, or government homebuyer program.

Recommended Reading: First Midwest Bank Loan Payment

Fha Rehab Loan History

The United States Department of Housing and Urban Development is the parent of the Federal Housing Administration, also known by many as FHA. FHA has implemented the FHA 203k Loans to promote the revitalization of neighborhoods where homes need rehabilitation and repairs for one to four-unit residential units. With 203k Loans, borrowers can use a single mortgage loan for the acquisition and/or refinance of their home plus the cost of repairs of rehabbing their home.

What If You Don’t Meet Fha Requirements

If you don’t meet the FHA requirements right now, you might want to consider doing the following:

- Pay your bills and credit cards on time, as this will help improve your credit score.

- Lower your DTI ratio by paying off some of your debts. Also, remember to check your credit report for errors.

- Increase your cash reserves. Although this might be easier said than done, especially now due to the pandemic, you can start by spending less than you can afford.

- As mentioned above, shop around for lenders. The FHA market is competitive, and lenders have different approaches to their loan requirements.

You May Like: Your Application Is Being Processed Sba Loan

Lenders Can Set Their Own Fha Loan Requirements

All FHA loans are not the same. There are many types of FHA loans, and mortgage rates vary by lender.

The FHA sets minimum eligibility requirements for all the loans it insures. But each FHA lender can enforce its own rules. The FHA calls these lender-specific rules overlays.

For example, a lender could have higher credit score requirements than the FHAs. Or, a lender could enforce stricter rules about previous foreclosures in your credit report.

It works the other way around, too.

For instance, one FHA lender could allow a higher DTI than another one. Or, one lender could let you use tax returns to show your income while another may insist on pay stubs to prove your employment history.

Because of these variations, when youve been turned down for an FHA mortgage by one lender, you should always try to apply with another which may approve your FHA loan request. Plus, mortgage rates can be very different from bank to bank.

In addition, the FHA offers special refinance loans, cash-out refinance loans, home construction loans, and other benefits to its applicants.

If youve been turned down for an FHA loan with your lender, consider applying somewhere else. Your loan may be approved once you re-apply.

Fha Minimum Down Payment: 35%

With an FHA loan, the minimum down payment depends on your credit score. If you have a credit score that’s 580 or higher, the minimum down payment is 3.5%.

If your score falls between 500 to 579, the minimum down payment required is 10%. FHA guidelines sometimes refer to this as the Minimum Required Investment it just means the down payment.

You May Like: Is Bayview Loan Servicing Legitimate

Fha 203k Lending Experts

Alex Carlucci is not just an expert mortgage banking professional but also a real estate expert and real estate technology guru. Alex Carlucci has hundreds of awards and certificates for his expertise in being a leader in the mortgage lending industry. Capital Lending Network, Inc. is a mortgage company licensed in 48 states with no lender overlays on government and conventional loans. CLN Mortgage has its main office in Oakbrook Terrace, Illinois. Capital Lending Network, Inc. is licensed in multiple states and has a national reputation for its no overlays on government and conforming loans.

Birth Of The New Fha 203k Rehab Mortgage Program

The real estate brokerage community did not want to market and sell 1-to-4-unit homes and wait nine months for closing, and mortgage companies decided there were too many moving parts to close and fund them in any reasonable time frame. Believe me, I tried. I saw the value. There was a glut of properties on the market that were not financeable without some repair money. So nobody specialized in the product and it was for all intents and purposes shelved until the regulation could be changed.

You May Like: How Much Student Loan Can I Get Per Year

Benefits Of An Fha Loan

- Easier to Qualify FHA provides mortgage programs with lower requirements. This makes it easier for most borrowers to qualify, even those with questionable credit history and low credit scores.

- Competitive Interest Rates FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages.

- Bankruptcy / Foreclosure Having a bankruptcy or foreclosure in the past few years doesn’t mean you can’t qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements.

- Determining Credit History There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

Fha Home Appraisal In Mecklenburg County

To see if a home qualifies for an FHA loan, the property must be appraised by an approved FHA appraiser.Find FHA-approved appraisers in Mecklenburg County.If you need a home inspector, click here to find FHA-approved inspectors in Mecklenburg County.You can also save time by looking for FHA Condos that have already been approved.

Don’t Miss: Bad Credit Personal Loan Direct Lenders

First Time Homebuyer’s Mortgage

5-Year Adjustable Rate Mortgage

Taxes and insurance are not included in the estimated monthly payment amount. Your actual monthly payment will be greater. Future rates are subject to change, so the rates for months 61-final month of loan term are estimated by adding the margin to the current index rate. Future rates and payments determined based on adding a margin of 2.50% to the future index at the time of the future index. Subject to a floor rate of %. This is a variable rate loan, and the interest rate can increase over the life of the loan. SECU ARMs can increase or decrease a maximum of 2% every 60 months up to 6% over your initial rate during the life of the loan. Contact your local branch for additional information.

*Expand for additional information specific to this program and to calculate payment and APR2.

- Amount financed limited to the lesser of the sales price or appraised value, plus up to $2,000 for closing costs1

- Origination fee 1.00% of loan amount

- No application fees or credit report fees

- Home must be primary residence for the borrower

- Private mortgage insurance not required

- Available for terms up to 30 years

Fha Loan Debt Ratio Limits

In order to qualify for an FHA loan, youll need to meet certain limits regarding your debts. First, there is a maximum monthly housing expenses ratio limit of 31% of your gross monthly income. The category of housing expenses includes rent or mortgage, insurance, property taxes etc.

Then, there is a debt-to-income limit of 43%. This means that your total debt burden cannot exceed 43% of your gross monthly income.

Recommended Reading: How To Get Fixer Upper Loan

Fha Foreclosure Waiting Period

If you have previously lost a home to foreclosure, you’ll have to wait three years before applying for an FHA loan. There are some exceptions, however, for circumstances like a serious illness.

Those who have experienced bankruptcy can also qualify for an FHA loan, though you’ll have to demonstrate that you’re now on better financial footing. Some allowances may be made on an individual basis, but in general, you’ll need to wait two years after a Chapter 7 bankruptcy and at least a year after a Chapter 13 bankruptcy to apply for an FHA mortgage.

Nc & Sc Fha Loan Faqs

What is an FHA loan?

An FHA loan is a type of mortgage loan³ that allows people to buy a home with federal loan backing. That means, if you default on the home loan, the lender is able to file a claim for any lost principal paid to you.

While this does not help you, it does help to reduce the amount of risk you are to lenders. In turn, that reduces what you have to pay in interest to your lender. There are several types of FHA loans as well. If youd like more information on which types are available to you, contact us.

What does FHA stand for?

FHA is an abbreviation for Federal Housing Administration, a branch of the US Department of Housing and Urban Development.

Are FHA loans bad?

No. FHA loans are a great option for many individuals and families who want to buy a home. While FHA loan rules can sometimes make them seem hard to obtain, they are actually very accessible to many people. They are also an excellent way to help you to secure a home when you otherwise would not qualify for a home loan.

Who can qualify for an FHA loan?

FHA loan qualification is easier to obtain than most people realize. You need to meet the FICO®* score guidelines noted . You also need to have at least 3.5% down, verifiable employment history over the last two years, and meet the required debt-to-income ratio of up to 57% with compensating factors.

What are South Carolina FHA loan requirements?

When can you drop PMI on an FHA loan?

Legal information

Also Check: What Are The Qualifications For First Time Home Buyers Loan

S To Purchasing A Home In Dare County

Are you interested in buying a home in Dare County? This is a step-by-step guide to all the ins and outs of the homebuying process. For more detail about FHA loans, be sure to check out our complete guide. We also have an in-depth guide to VA loans and the USDAs Rural Development home loan program.For now, lets look at the basic steps to buying a home and what youll have to look out for in Dare County.

Appropriate Documentation That Is Necessary For Approval:

- 2 years of Pay stubs and or W-2s provided by your current or former employers.

- Social Security Card and Drivers License.

- If you have received gift money for use as a down payment, you must obtain signed and dated letters from the donors showing that the money is a gift and no repayment is expected.

Don’t Miss: Interest Rates For Car Loans

Is There A Cost To Have A Real Estate Agent Represent Me

The seller must pay the real estate professionals commission, not the buyer. This means that, as a homebuyer, there is no cost to have a real estate agent represent you. In fact, its a good idea to get your own agent in order to have someone in your corner during the negotiation process. For more information about real estate agents,

Frequently Asked Fha Questions

Can I get an FHA loan with a bankruptcy?In general, you will need to wait two years before applying for an FHA loan after a bankruptcy. However, there are some exceptions which may allow you to apply sooner. Read our article on the bankruptcy waiting period.

Are all FHA lenders the same?Not all lenders who offer FHA loans are the same. They all do not offer all of the FHA programs and their rates and fees may also vary. Most importantly, the individuals who help to process and underwrite your loan will have a huge impact on your FHA loan experience.

Can I use gift funds for an FHA loan?FHA loans do allow for gift funds to cover your down payment as well as your closing costs. The gift funds must come from a relative or a close friend as approved by the lender. You will need to provide the lender with a gift letter that is signed by the donor.

Do I need an appraisal for an FHA loan?The FHA does require an appraisal and inspection before your loan can be approved. The FHA inspection has clear guidelines on what needs to be repaired before your loan can close. They want to make sure home buyers are moving into a home that is safe and operational.

You May Like: How Do You Refinance Your Home Loan

Down Payment Requirement On Fha 203k Loans

Minimum down payment requirements are 3.5% down payment on the after improved value. For example, if the home buyer is purchasing a home for $100,000:

- The cost of construction is $200,000 to yield after the improved appraised value of $200,000

- The home buyer needs to come up with a 3.5% down payment of $200,000

Fha 203k Loan Programs And Lending Guidelines

For homebuyers planning on buying a home that needs renovations or currently own a home needing renovations work, HUDs FHA 203k Loan Program may be the solution. Getting a construction loan these days is extremely difficult. Many construction lenders will make borrowers go through red tape. Getting a second mortgage and/or home equity line of credit requires equity in a home. HELOC requires credit scores of over 700 and DTI caps of 45%.

You May Like: Is Refinancing Fha Loan Worth It

Benefits Of 203k Loans

Construction loans have been popular prior to the 2008 Real Estate and Credit Collapse. Now it is next to impossible for a homeowner to get a construction or bridge loan unless the homeowner has a lot of equity in their home. With an FHA 203k Rehab Loan, a homeowner can get construction financing at the same time they get a home purchase loan. Or can do an FHA 203k Rehab Refinance Mortgage Loan with only a 3.5% down payment or 96.5% Loan to Value

What Are The Fha Loan Requirements For 2021

Federal Housing Administration loans are a government-insurance mortgage product offered to qualified borrowers across the country. These loans, which are offered by private lenders and secured by the FHA, may make homeownership more accessible and affordable. This is especially true for borrowers with lower credit scores or a smaller down payment contribution. If youre considering an FHA loan for your next home purchase, there are a few personal and property requirements to keep in mind first. Consider working with a financial advisor as you weigh your options for getting a mortgage.

You May Like: What Is The Maximum Student Loan