Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Special One Time Restoration Of Entitlement

Michelle had a VA Loan, paid it off, and asked the VA to restore her entitlement – before she sold the house.

The VA restored her full entitlement as she requested. She used her restored entitlement for additional VA Loan that ;to an another property.

The VA will grant a veteran a special one-time restoration of entitlement only once. Afterward, they add the one-time restoration condition you see on Michelle’s COE. It reads, Any future restoration requires disposal of all property obtained with a VA loan.;;

Michelle must sell both her properties and give proof to the VA before she asks for the basic restoration of her entitlement as I outlined in # 6 above.

Who Qualifies For A Va Loan

For those who are eligible, VA loans are attractive because they dont require a down payment. They also have lower interest rates than many other types of mortgage loans you can get for similar terms. They dont have monthly mortgage insurance.

Although lenders set their own requirements for certain aspects of qualification, VA loans have more lenient credit requirements than many other mortgage programs.

Not all who have served in the Armed Forces qualify for a VA loan. You must meet at least one of the following criteria to qualify:

- Served 181 days of active service during peacetime.

- Served 90 consecutive days of active service during wartime.

- Served more than 6 years of service with the National Guard or Reserves or 90 days under Title 32 with at least 30 of those days being consecutive.

- Are the spouse of a service member who lost their life in the line of duty or as the result of a service-connected disability. You generally cannot have remarried, although there are exceptions.

Read Also: How To Get 150k Business Loan

Va Loan Certificate Of Qualification Have You Any Idea Exactly What It Methods To Get A Va Loan Certificates Of Eligibility

VA Loan Certificate of Qualification . Have you any idea exactly what it methods to get a VA Loan certificates of Eligibility ?

This crucial file is needed into the lending steps whenever using your VA mortgage assistance to invest in, construct, or re-finance home.

Qualified veterans that fulfilled the minimum time-in-service obligations are qualified to apply for a VA money can apply internet based through the VA with their COE, or talk to the lender to help you.

Interest Rate Reduction Refinance Loan

Often referred to as streamline refinance, an interest rate reduction refinance loan can help you refinance an existing VA-backed loan.

Borrowers often refinance to lower their interest rate and monthly payment or change from a variable to a fixed rate.

IRRRL loans often require less paperwork, and some homeowners can secure a new loan without an appraisal.

Don’t Miss: When Do Student Loan Payments Start After Graduation

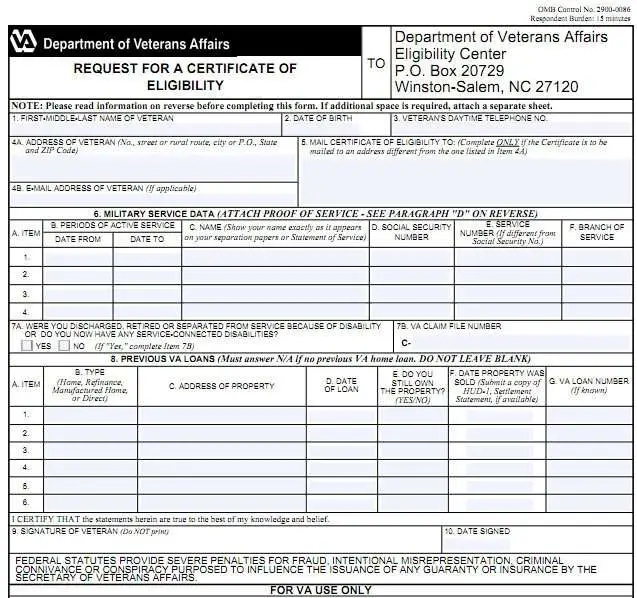

Request A Certificate Of Eligibility

If you are an eligible military, veteran, or active-duty member of the National Guard or Reserve, you can obtain a COE by:

The fastest way is often to go through a VA approved lender. Most VA mortgage lenders have access to an internet application that can issue a certificate of eligibility on the spot if there is sufficient information in the systemâs database.

This ability can simplify and speed up the process for many VA borrowers, says Kevin Parker, vice president of field mortgage initiations at the Navy Federal Credit Union.

Where Can I Apply For A Va Home Loan

If youre thinking about getting a VA home loan, understand you dont get one directly from the Department of Veterans Affairs.;

Although a government-backed loan, youll need to contact a private lender for funding.

A good starting point is your personal bank or credit union. But dont stop here. You should also contact at least three other VA-approved lenders to compare rates and terms.

Getting a low interest rate can save thousands over the life of the loan, and lower fees help reduce your out-of-pocket costs at closing.

Read Also: Is Jumbo Loan Rates Higher

How To Get Your Coe As A Military Spouse

To receive a Certificate of Eligibility as a surviving spouse, you’ll need first to receive Dependency and Indemnity Compensation benefits. If you currently aren’t receiving Dependency and Indemnity Compensation benefits, you’ll need to fill out VA Form 21P-534EZ, Survivors Pension and/or Accrued Benefits. Once approved, follow the below steps.

If you are receiving Dependency and Indemnity Compensation benefits, you’ll need to fill out a Request for Determination of Loan Guaranty Eligibility – Unmarried Surviving Spouses . You’ll also need a copy of the Veteran’s DD-214 or other acceptable separation papers.

Let Us Do This For You

There are 5 application options:

We would love to help you acquire your certificate of eligibility, and fortunately, the process typically only takes a few minutes to complete. Obtaining your COE may require you to fill out a proof of your military service form for completion. However, after this piece of the process is done, your;home financing can move forward;without any obstacles!

Read Also: How To Take Loan From 401k To Buy House

The Criteria For Eligibility Is As Follows:

- Active service members may qualify if.

- they served 90 days in a row during wartime or

- 181 consecutive days during peacetime.

Let Hawaii VA Loans help you obtain your COE by completing the Request For A Certificate of Eligibility: .

Access To Specially Adapted Housing Grants

Do you have a disability that affects your mobility or sight? You may qualify for a SAH grant.

SAH grants can go toward constructing a special home designed to fit the needs of the disabled individual. Or they allow you to modify an existing home to make it more accessible. SAH grants can also pay the unpaid balance of an adapted home already purchased without VA grant assistance.

In 2020, you may qualify for a grant of up to $90,364, and you may use the grant up to three times as long as your disability qualifies. Because the SAH is a grant and not a loan, you dont need to pay it back.

Recommended Reading: How To Calculate Amortization Schedule For Car Loan

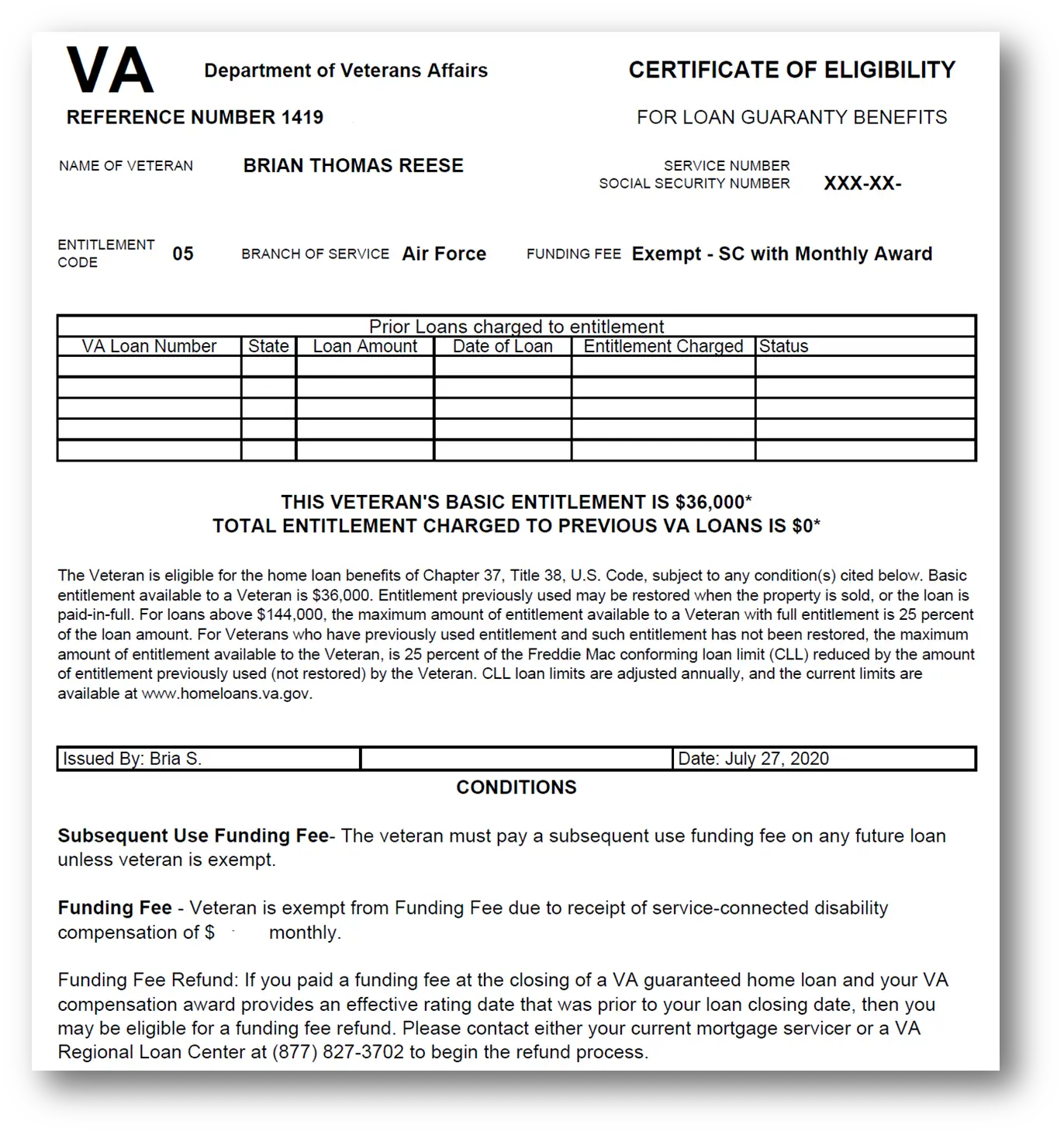

How To Read A Certificate Of Eligibility

Once you obtain your Certificate of Eligibility, you’ll notice an array of information, including your name, Social Security number, branch of service and even the name of the VA employee who issued your COE.

Most of it is clear and straightforward, but some items you may not recognize. The one part that often leads to questions from prospective VA borrowers is what’s known as an entitlement code.

This two-digit number gives VA lenders more information about your military service history and whether you may be exempt from paying the VA Funding Fee, an upfront cost that goes directly to the Department of Veterans Affairs.

Borrowers receiving compensation for a service-connected disability, Purple Heart recipients on active duty, and eligible surviving spouses do not have to pay this fee.

There are 11 possible VA entitlement codes, which you can learn about here. Most of the entitlement codes relate to a period of military service. But an important one for Veterans who’ve used their VA loan benefit in the past is Entitlement Code 05.

This entitlement code notes that a borrower has previously obtained a VA loan, repaid the loan in full and restored the entitlement used on the property. Borrowers who’ve used a VA loan before are subject to paying a higher funding fee on future VA purchases unless their Certificate of Eligibility indicates they are exempt from the fee.

Learn More About Va Loans From Your Community Mortgage Lender

Since 1919, BTC Bank has provided personal customer service to local communities in Northwest Missouri. We have a rich history of helping our customers become homeowners and we can help you, too. To explore the benefits of VA loans and verify your eligibility, visit a BTC Bank branch near you or contact us today. Our friendly mortgage lenders are waiting to serve you at 12 convenient locations in Albany, Beaman, Bethany, Boonville, Carrollton, Chillicothe, Gallatin, Maysville, Osborn, Pattonsburg, and Trenton, MO; and Lamoni, IA.

You May Like: How To Get Sba 7a Loan

What Are The Eligibility Requirements For A Va Home

To obtain a VA loan, the law requires that:

The veteran’s and spouse’s income, if any, must be shown to be steady and adequate to make mortgage payments, cover the costs of house ownership, meet other responsibilities and expenditures, and have enough left over for family support. The veteran must be a good credit risk.The veteran must occupy or plan to occupy the property as a primary residence within a reasonable time after the loan is closed. The loan must be used for a permissible purpose.The candidate must be a qualified veteran with mortgage entitlement.

Q. What are the current VA loan rates?A. See rate chart below

Q. What are the benefits of a VA home-loan?A. The VA home-loan does not require a down payment and the seller is permitted to pay all allowable closing-costs and prepaid costs up to 4% of the sales price.

Q. What Can A VA Loan Be Used For?

A. See certificate of eligibilityQ. What is a VA loan funding fee?A. The funding fee is a percentage of the loan amount. The accumulation of the funding fees from VA loan applicants is used to support the VA home-loan program. The pot of money is there to reimburse lenders who have foreclosed on defaulted VA loans.Veterans and eligible borrowers do not have to pay the VA funding fee if any of the below descriptions is true:

Q. What is the loan limit on a VA loan?A. There is no maximum loan limit on a VA loan, however, the lender may have a maximum loan limit.

If You Have Full Entitlement You Dont Have A Home Loan Limit

Eligible Veterans, service members, and survivors with full entitlement no longer have limits on loans over $144,000. This means you wont have to pay a down payment, and we guarantee to your lender that if you default on a loan thats over $144,000, well pay them up to 25% of the loan amount.;You have full entitlement if you meet either of the requirements listed below.

At least one of these must be true. Youve:;;;Never used your home loan benefit, or;;;Paid a previous VA loan in full and sold the property , or;;;Used your home loan benefit, but had a foreclosure or compromise claim and;repaid us in full

Note: You may have heard the terms additional entitlement, bonus entitlement, or tier 2 entitlement. We use these terms when we communicate with lenders about VA-backed loans over $144,000. You wont need to use these terms when applying for a loan.

It depends. If you apply and are eligible for a VA-backed home loan, youll receive a Certificate of Eligibility . This is the document that tells private lenders that you have VA home loan eligibility and entitlement.;

But your lender will still need to approve you for a loan. The lender will determine the size of loan you can afford based on your:;;;Credit history;;;Income;;;Assets

We dont require a minimum credit score, but some lenders may have different credit score requirements. Be sure to contact more than one lender to compare.

You May Like: Is My Home Loan Secured

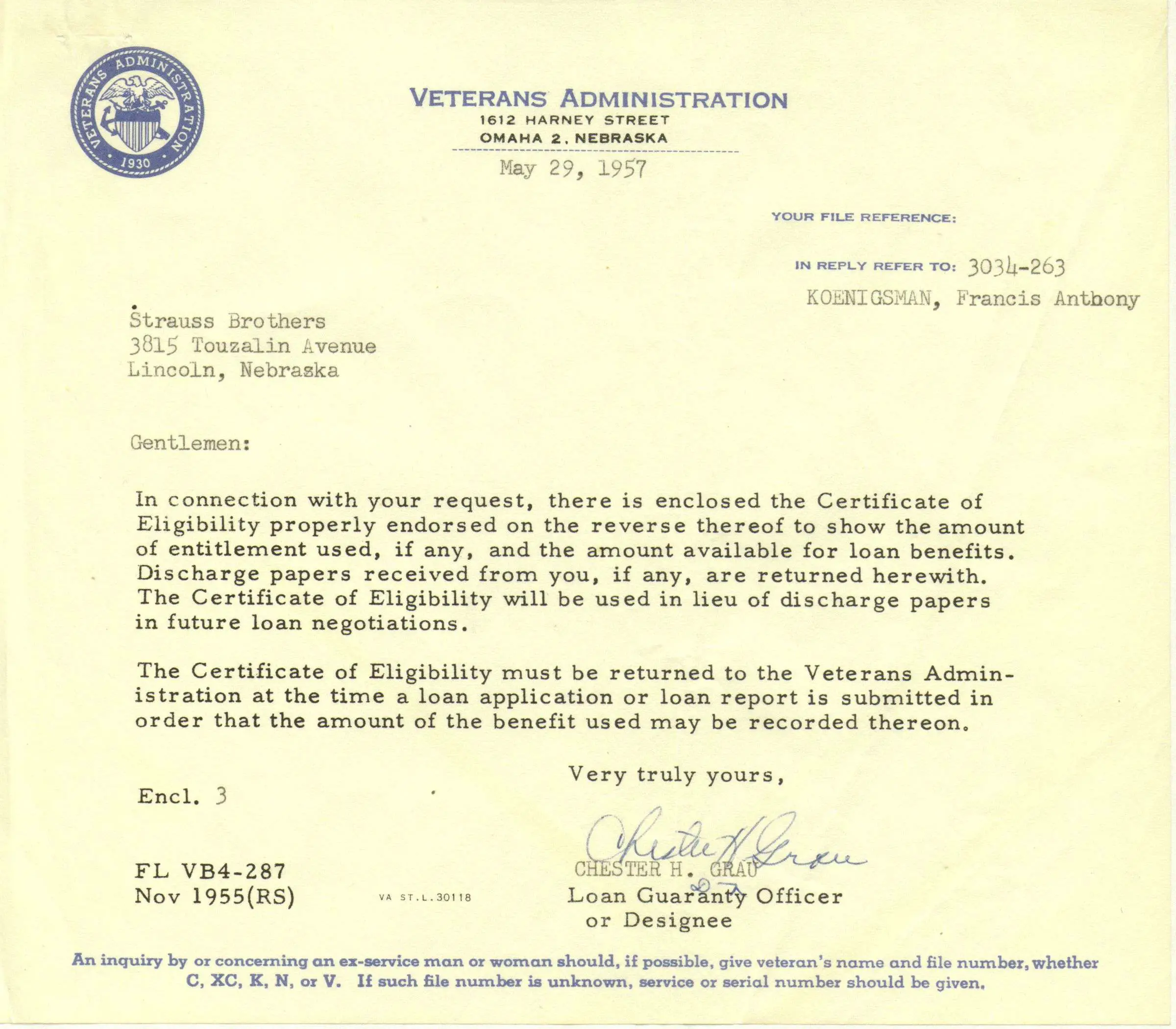

Verifying Your Va Loan Eligibility Status

To verify you meet the basic service requirements, lenders will need what’s known as a Certificate of Eligibility . Your COE provides the lender with confirmation that you qualify for VA loan benefits.

For most Veterans, this is an easy step. Your lender can typically pull your COE with only your social security number and date of birth.

In some cases, the process may be more complex. However, the important piece is you don’t need this document before applying for a VA loan.

Speak with a Home Loan Specialist to get your COE today. The process typically takes minutes to complete and ensures your home financing moves forward without delays.

Va Jumbo Loans And The Certificate Of Eligibility

When a veteran or current military member wants to apply for a VA home loan, the first step is to request a Certificate of Eligibility or COE from the Department of Veterans Affairs. The COE tells the lender several things.

The first is the VA loan applicants basic eligibility for a VA home loan. The COE is required in most cases as proof that the borrower is able to use this military benefit. In addition, the COE has a section which states how much the borrowers basic entitlement is, and how much remains if the entitlement has been used before.

The amount of a basic VA home loan entitlement, the amount that the VA promises to pay the lender should the borrower default or go into foreclosure on the mortgage, is $36,000. That information is found on the COE. What the VA certificate of eligibility does not say sometimes leads to confusion for a first-time borrower who wants to apply for a VA Jumbo Loan.

In areas where high-cost housing is typical, the VA has higher loan limits than for other areas. These loan limits can exceed one million dollars in some counties. But a borrower who sees the $36,000 in VA loan entitlement on the COE could wrongly assume thats all they are eligible for. The VA Lenders Handbook states otherwise.

The important part of all this comes next;

Recommended Reading: How Much House Can I Afford Physician Loan

Va Loan Step By Step #: Obtain Your Coe

Following 6 easy steps to a VA mortgage can prevent slipups and delays. Learn the DOS and DONTS of the second step: obtaining your COE.

COE stands for Certificate of Eligibility. Its a document generated by the Department of Veterans Affairs that tells your VA-approved lender if you meet certain requirements for home loan benefits based on your military service. It also contains important information that can help your loan officer calculate your entitlement and fees .

If youve served in one of the seven uniformed services, or are a surviving spouse, you may have earned home loan benefits. Obtaining your COE will help you know for sure.

To help you obtain this important document, here are some dos and donts to consider at this second step in the VA loan process.

Do Ask Your Lender For Help

Common delays may be prevented if you go straight to your VA-approved lender to get your COE. Most approved lenders have access to the VA online system and can print most COEs on the spot in a matter of seconds. Not all COEs can be obtained this way, but many can. If your document cannot be obtained instantly, its still a very good idea to enlist your lenders help in obtaining it another way.

Read Also: How Much Is Va Loan Entitlement

Does The Certificate Of Eligibility Guarantee That I’ll Get A Va Loan

If there’s one thing the Certificate of Eligibility is not, it’s a guarantee. The word “guarantee” frequently gets tossed into VA loan discussions, but to be clear, no one is guaranteed to receive a VA loan just by meeting basic service requirements.

The COE simply signifies that you’ve cleared one hurdle on the track – namely, that you’ve met the military service requirement. Your property still has to measure up to VA criteria, and your borrower qualifications must meet VA and lender standards.

Exemption From Funding Fees

Disabled veterans are exempted from the VA funding fee, so they dont have to pay the VA funding fee during closing. To qualify for the exemption, you must currently receive some form of disability benefits. Your level of disability is irrelevant.

This this exemption can save veterans or their surviving spouse thousands. For example, if you buy a home worth $200,000, you might pay as much as $2,500 $6,600 in VA funding fees when you close. Disabled veterans can avoid this fee.

Read Also: What Size Mortgage Loan Can I Qualify For

If You Have Remaining Entitlement You Do Have A Home Loan Limit

With remaining entitlement, your VA home loan limit is based on the county loan limit where you live. This means that if you default on your loan, well pay your lender up to 25% of the county loan limit minus the amount of your entitlement youve already used.

You can use your remaining entitlementeither on its own or together with a down paymentto take out another VA home loan.;

You may have remaining entitlement if any of these are true. You:;;;Have an active VA loan youre still paying back, or;;;Paid a previous VA loan in full and still own the home, or;;;Refinanced your VA loan into a non-VA loan and still own the home, or;;;Had a compromise claim on a previous VA loan and didnt repay us in full, or;;;Had a deed in lieu of foreclosure on a previous VA loan , or;;;Had a foreclosure on a previous VA loan and didnt repay us in full