Sba 7 Variable Loan Rates

Variable rate loans based on the current prime rate of 3.25% would have the following maximum rates:

| Loan Amount |

| 8.25% | 5.0% |

Read the terms of your loan carefully to know just what your monthly payments will be to the lender for the life of a loan.

With 7 loans, most loans carry a 10-year term, however, borrowers may have up to 25 years when these loans are used to pay for equipment or real estate. These loans are often used for working capital, inventory, and in some cases to refinance debt.;

Different Types Of Small Business Loan Originators That Offer Loans To Businesses

- Traditional banks loans business directly without 3rd party

- Commercial Real Estate Lenders

- Certified Development Company

Every originator differs in terms of what products and services they offer, so its important to ask what type of business finance products they offer upfront to see if they can provide you the best options available in the business finance marketplace. Online lenders offer unique business financing options. When evaluating offers, please review the;lenders or financial institution for terms and conditions of products and services.

Current Sba Loan Rates In 2021

4 days ago SBA loan interest rates vary between 4.65 8.5% depending on the loan, the term, and other factors. Read on for exact loan rates for SBA 7a;

Aug 9, 2021 What is the average business loan interest rate? The average business loan interest rate for a small business loan in 2021 ranges from as low;

Jun 9, 2021 Loans up to $50,000 : 9.75%; Loans over $50,000 : 7.75%. SBA Express loans carry a higher interest rate for similar;

Also Check: Can You Pay Off Sofi Loan Early

Sba Loan Rates For The Microloan Program

The SBA microloan program usually provides smaller loan amounts than other programs. The program provides loans of up to $50,000 to help small businesses, startups, and not-for-profit childcare centers launch and expand. The average SBA microloan was $14,735 in the 2019 fiscal year.

To make the microloan program possible, the SBA loans money to nonprofit, community-based lenders . The intermediaries then loan money to small business owners.

Small Business Credit Cards

Business credit cards are open revolving credit lines that charge a principal & interest with a limit. A card is issued that can be used for making payments or purchases. Business owners utilize cards in conjunction with other small business financing options. The primary use of this financial product is for the purchase of small items or pay expenses. This type of loan is popular because of its flexibility and offers small loans for business purposes.

Product Overview

Loan Rate: Introductory rates starting at 0% up to 28.99% principal & interest. Typically a variable interest rate applies.

Terms: Open revolving line with a limit

Fee: $0 to $500 Annual fees

Payment: Flexible monthly payments

Recommended Reading: What Are The Qualifications For Rural Development Loan

Where Is The Hidden Interest

Not all costs of a loan are found in the APR listing. Take for example two one-year installment loans for $5,000, both of which charge 5 percent APR. With a little fudging of how interest works to keep this example simple, both loans will cost $250 in interest by the time theyâre paid off. However, one loan charges a $100 setup fee and a $10 per month processing fee. Thatâs an additional $220 per month, bringing the cost of that loan to the equivalent of 9 percent APR â nearly twice the cost of the other loan.

When comparing only the interest rates of two competing loans, you arenât getting a complete picture of the cost of the loan. You must include the cost of any fees and charges if you want to make the most informed decision possible.

Business Credit Card Rates

Business credit cards are another form of revolving credit that provides access up to a maximum credit limit. Theyre available from many sources, like credit card companies, banks and credit unions. However, some lenders require customers to have an established business credit history, in addition to other application conditions for this form of financing. Interest rates for this form of financing depend on many factors, but the current average business credit card interest rate is roughly 17%.5

You May Like: What Is The Best Debt Consolidation Loan Company

Sba Financing Small Business Loans Chasecom

As an SBA preferred lender, Chase can speed up the business loan approval process because we make loan decisions within SBA financing guidelines.

Mar 24, 2021 Landing a Small Business Administration loan is a big win for business owners because it gives them access to funds guaranteed by the;

What is a SBA loan and how does a SBA loan work? With a SBA loan, U.S. Bank helps high-growth businesses and entrepreneurs;

How Sba Interest Rates Are Calculated

Like most loans, the SBA loan programs consist of a base rate and a max peg on what financial institutions can charge on top of this. The base rate can vary depending on market conditions.

As of right now, the base rate is 4.75%. What the financial institutions can add on to this will depend on factors such as the loan size and the repayment term. It is also useful to keep in mind that SBA loans can be fixed or variable, but are most often variable.

Recommended Reading: Where To Apply For Small Business Loan

Rates Also Vary Depending On The Type Of 504 Lender

Conservative 504 Lenders

There are numerous different varieties of 504 lenders with different business models and different appetites for certain types of loans.; Some lenders – both big and small – will only do “relatively easy” loans.; They keep these loans on their balance sheet and they typically have a lot of freedom with what rate they offer depending on their source of funds.;

Other lenders will have very restrictive guidelines for the types of properties they will lend on.; For instance, many lenders do not like to lend to the hotel industry.; Some do not like anything to do with assisted living.; Others will not consider gas stations or convenience stores or car washes.;

Every lender is different, but if your loan request fits a lenders “credit box” then you can end up getting an outstanding rate.;

Again, 504 lenders come in all shapes and sizes.; Sometimes a big bank is the right fit, sometimes they aren’t.; Typically, the bigger the bank, the more conservative the lender and the lower the loan to value.;

Small, mid-size and regional banks also have their place in the market and some offer outstanding terms.;

There are also some niche lenders and smaller lenders who can be very aggressive with their rate offerings or offer much more flexible credit and underwriting guidelines.

Secondary Market Lenders

Private Lenders

Sba 7a Interest Rates Fees And Loan Amounts

The specific terms of SBA loans are negotiated between a borrower and an SBA-approved lender. In general,the following provisions apply to all SBA 7 loans. 7 loans have a maximum loan amount of $5 million. SBA does not set a minimum loan amount. The average 7 loan amount in fiscal year 2012 was $337,730.

You May Like: How To Check Credit Score For Home Loan

Fixed Vs Variable Interest Rates For Sba Loans

Some SBA loans will only offer fixed rates while others may offer either fixed or variable interest rates loans). Some loans may carry a combination of fixed or variable interest rates. For example, with Export Working Capital loans the Lender may use a fixed rate on either the guaranteed or unguaranteed portion and a variable rate on the other portion of the loan.

Eligibility & Terms For Cdc/504

Not all businesses can qualify for a CDC/504 loan. Apart from showing proof of your ability to pay the loan, there are several other criteria that you must meet.

Once your for-profit business qualifies for a CDC/504 loan, an SBA agent will discuss the terms. Most CDC/504 loans come with the following terms:

Also Check: What Is The Max Home Loan I Can Get

Current Sba Loan Rates For 2021 Fundera

Mar 2, 2021 SBA CDC/504 Loan Rates: 2.23% to 2.39%; SBA Microloan Rates: 6.5% to 13%. Ultimately, SBA loan rates will depend on which SBA loan program you;What are the terms of an SBA loan?Why are SBA loan rates so low?

Apr 29, 2021 The interest rate charged for small business loans varies widely depending on the type of business, the type of loan, and the type of lender;

Eligibility & Terms Of Sba 7 Loans

Did you know that the SBA considers most for-profit business owners eligible for a 7 business loan? Still, its their partner lender who makes the final decision. To qualify, you need to have a business that is at least two years old, a fair credit rating, and a healthy cash flow and a healthy debt-to-income ratio. Those who do qualify get to enjoy many benefits, including the following:

Read Also: What Is Fha And Conventional Loan

Loan Fees To Be Made Aware Of Outside Of Interest Rates

While it is always useful to understand the interest rate, you also need to read the fine print for any additional charges. This goes for all loans from all kinds of lending institutions. You also need to check whether your rate is fixed or variable.

Most of the SBA loans and its subcategories use a variable interest rate, meaning that the base rate will go up or down depending on market conditions. However, in some instances your interest rate can be fixed. Other charges for an SBA loan can include:

Business Lines Of Credit Rates

Business lines of credit are a form of revolving capital that provide reusable access to funds up to the account credit limit. As money is repaid, that amount is available to borrow again in the future. Business lines of credit are similar to business credit cards, though creditors typically do not offer as high a credit limit with credit cards when compared to other funding methods.

Business lines of credit are available from sources like banks, credit unions and online lenders. Interest rates for this type of funding depends on factors such as the lender, borrowers payment history and credit limit. Small business borrowers can expect to pay roughly 3 80% interest rate for business lines of credit, depending on the specific agreement.4

Recommended Reading: Can I Roll Closing Costs Into Loan

What Are Typical Sba Loan Terms

As you can see from the discussion of SBA loan interest rates here, terms will vary depending on the type of SBA loan and, in some cases, the lenders rates. However, its fair to say that typically these loans offer favorable rates and terms sometimes even better than what you can get from a bank loan.

As far as business financing options go, these loans are quite attractive but they will require strong borrower qualifications and typically take at least 1-3 months to get approved and funded.;

Sba Loan Payment Calculator Inputs

The more accurate the information you put into the calculator, the more accurate the results will be. There are three essential pieces of information you will need to enter into the calculator:

- Loan amount: In this field, enter the amount of the loan that you are applying for in whole dollars.

- Term : This is the estimated repayment term of the loan for which you are applying. Loan terms are generally up to 10 years for working capital and up to 25 years for real estate. The longer the repayment term is for your loan, the lower the monthly payments will be.

- Expected interest rate: The calculator will only accept interest rates up to the maximum SBA loan interest rate. The interest rate on your loan impacts your payment amount; higher interest rates yield higher payments.

Also Check: How To Apply For Student Loan Forbearance

What Role Does Amplio Play In An Sba 504 Loan

Amplio is the liaison with the SBA, helping lenders and borrowers through the paperwork and approval process. We structure the project, prepare loan documentation and monitor the whole project through closing. We also service all aspects of the SBA 504 loan for the entire term of the loan. We have earned the reputation for being ethical, efficient, and totally committed to customer service.

Calculate a Loan: Click to insert your own loan statistics to determine your monthly and annual payments.

Read through the loan application to learn more about the information youll need to provide to the SBA.

Costs For Sba 504 Loans

While the 504 loan has very low costs, and most of those can be rolled into the loan itself, it does have fees and charges that you need to know about. Youll find a number of processing fees, such as a funding fee, a CDC processing fee, an attorney fee, and an underwriting fee. The bridge loan will also have fees and possibly loan points.

Other costs include appraisal fees, environmental assessment fees, title insurance, hazard and flood insurance, and miscellaneous fees, including certification of corporate status, UCC filing fees, IRS verification fees, and more. Your CDC and lender can provide you with a full rundown of all fees, as well as how and when they should be paid.

Recommended Reading: Which Credit Union Is Best For Home Loan

How Much Money Do I Need To Fund My Small Business

The amount of working capital a small business needs to cover day-to-day operations depends on a variety of factors, like equipment, inventory and payroll costs, monthly revenue and other expenses. Startups typically have many one-time, up-front costs based on details like the specific industry, type of business, local and/or federal regulations. While actual amounts vary widely, recent reports suggest that microbusiness startup costs are around $3,000, while home-based small businesses can range from roughly $2,000 to $5,000.1 Keep in mind that the maximum business loan amount that startups and other small businesses may qualify for varies based on details like the credit type, the borrowers personal credit history and the lender.

What Kind Of Small Business Loan

Small business loans typically break down into two types: installment loans and lines of credit.

- An installment loan works like your car loan. You borrow a set amount of money. You make monthly payments on the loan until youâve paid back the interest, plus the fees, plus the amount you borrowed. When the balance reaches zero, the loan is paid in full and your relationship with the lender is over.

- A line of credit works like your credit card. Your lender sets a maximum amount of money you can borrow at any one time. As you need it, you borrow against that credit limit to provide your business with working capital. Each month, you pay back what you can . Funds may or may not replenish depending on the type of line of credit.

These are two very different kinds of financial relationships. In general, an installment loan cost less to maintain and is a more secure investment for the lender . This means lenders can offer installment loans at a lower rate of interest than a line of credit.

Comparing an installment loanâs interest rate to a line of creditâs interest rate doesnât give an accurate assessment of the better loan. The line of credit offers convenience and flexibility not present in an installment loan, but those features do cost a bit more because of the cost and risk they carry with them.

Also Check: What Is My Monthly Loan Payment

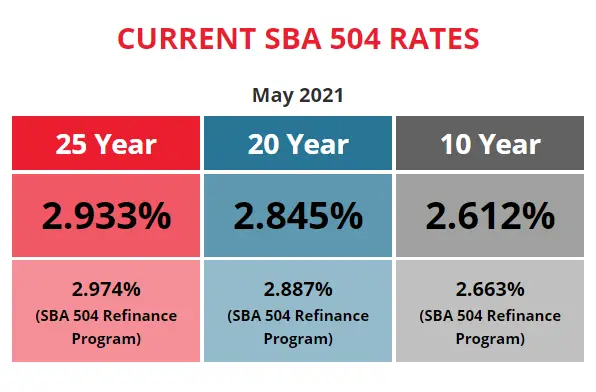

Loan Rates For Sba Cdc/504

If youre a small business whos in need of urgent financing for fixed assets such as real estate and machinery, consider applying for an SBA CDC/504 loan. This loan program is a project that involves three parties the borrower, the financial partner, and Community Development Corporations .

The CDCs involvement, which funds 40% of the loan, makes the CDC/504 loan possible. The remaining chunk is split between the financial partner and the borrower .

This division of funding contribution may change depending on the age of the business applying for the loan. Generally, if your company is less than two years old, you are considered new. This means you will pay a higher percentage of the cost.

The CDC/504 loan appeals to small businesses because it usually has low, fixed interest rates and, of course, more significant loan amounts since it comes from more than one source.