How To Apply For The Master’s Student Loan

If you already have an account with Student Finance England , you can apply for your Postgraduate Master’s Loan online here.

If you don’t already have an SFE account, you can set one up now;and follow the application instructions on their site to get started.

Or, if you’d rather do it the old-school way, you can download an application form to fill out and send to the SFE by post .

Canada Student Grant For Part

This grant is available to part-time students who are in financial need. You are automatically assessed when you apply for student aid with your province or territory.

If you are in school full-time, see grant for full-time students.

Note: This grant is not available to students from the Northwest Territories, Nunavut and Quebec. They have their own student aid programs.

Benefits And Rewards Of Applying For A Graduate Student Loan

The greatest benefit to taking out a graduate student loan is the ability to pay for the graduate education that’s important to you. Most grad students see the expense of getting a degree as an investment in their future. Many believe that it can help them enter or advance in their chosen career field, and potentially reward them with higher earnings.

77% of graduate students borrow federal and/or private loans to help pay for school expenses

Also Check: Can I Loan Money To My S Corp

Can You Get A Master’s Loan If You Already Have A Student Loan

You can still apply for the Postgraduate Master’s Loan if you already have an undergraduate Student Loan to pay off but it’s worth knowing that you might have to start making repayments on both at the same time, depending on your salary after uni.

Once you meet the salary thresholds, you’ll pay 9% on anything above that to your undergraduate Student Loan, plus 6% towards your Postgraduate Loan. However, as the undergraduate threshold for English students is higher than the postgraduate one , there is a bit of a buffer between the two.

What’s more, even if you’re repaying your undergraduate Student Loan and Postgraduate Loan at the same time, both will be treated as separate loans and will not be joined together at any point.

Here’s a rough idea of what your monthly repayments may be on the postgraduate and/or undergraduate Student Loan :

Dutch Student Finance For International Students

If you are an EU/EER national and you have a job for 56 hours per month, then you could be eligible for Dutch Study Finance or as of September 2015 Study Advance . If you have the nationality of an EER-country or Switzerland, you will qualify for student finance if you have been living in the Netherlands for 5 consecutive years or more. Or if you work in the Netherlands for at least 56 hours a month. If you live in the Netherlands but are not a Dutch citizen, it is possible to qualify for student finance from the Dutch government in certain situations.

Recommended Reading: How Much Can We Borrow Home Loan

Postgraduate Loans In England 2021

The government is now offering over £11,000 in Postgraduate Loans to English master’s students looking to study at a UK university. But are you eligible for the loan?

Unsurprisingly, the Postgraduate Loan comes with its fair share of small print that can be hard to get your head around at first.

There’s a lot of info to take in about funding a masters for students from England, but luckily we’ve done the hard work for you by simmering it all down to the cold hard facts.

So, if you’re considering doing a master’s degree now or in the future, or you’re already on a postgrad course, read on to find out exactly what masters degree funding is on offer, and whether the Postgraduate Loan is right for you.

Will The Government Change The Repayment Terms Of Your Master’s Student Loan

The government can change the terms of Student Loans at any point.

This means it’s not completely impossible for the repayment percentages to get a lot worse, or that the repayment threshold could decrease at some point .

However, despite some horrendous changes certainly being possible, it’s ultimately pretty unlikely. If anything does change, it should be minimal.

Read Also: Which Bank Gives Loan For Land Purchase

Postgraduate Loans Application Guides

Getting ready to apply for a postgraduate loan? Got questions about what you’ll need and when you’ll need it? Not actually sure which loan to apply for? This page is here to help.

We’ve put together some general information on the application process for a postgraduate loan, plus specific tips and things to bear in mind for the different UK systems.

Coronavirus information: Postgraduate loan applications are open as normal this year. See our FAQ for general information about coronavirus and postgraduate study.

Gather All Your Financial Information

Whether you plan on applying for federal or private student loans, youll need to collect some information before you complete the process to help it go more quickly.

- Tax returns: While you can use the;IRS Data Retrieval Tool, its helpful to have a paper tax return as well. You should have the tax return from two years ago. Youll need your parents tax returns as well as your own, if you filed taxes.

- Adjusted gross income: Youll need the adjusted gross income of both yourself and your parents.

- Asset information: Youll need to provide information about your assets, such as account balances.

- Social Security numbers and birthdates: Youll need your birthdate and Social Security number.

- A list of schools youre interested in: Include all schools that youre even thinking of applying to on the application.

- Information on grants or scholarships youve received: If youve received any grants or scholarships, youll need to enter how much aid you got.

You May Like: When To Take Home Equity Loan

How Much Can You Get

The amount you can receive depends on several factors, including:

- your province or territory of residence

- your family income

- your tuition fees and living expenses

- if you have a disability

The amount you can receive in grants and loans is calculated when you apply with your province or territory.

To find out if you can receive Canada Student Grants or Loans, use the federal student aid estimator. Note that this estimator doesn’t take into account the provincial and territorial student grants and loans.

How Student Loans Can Affect Your Credit

When you apply for a private student loan, lenders will review your credit worthiness before they loan you money. Your credit score will also determine your interest rate. In other words, borrowers with stable income and good credit history will pay less for their loans.

Undergraduate federal student loans dont require a cosigner or a credit check.

Having student loan debt affects your credit the same way your other loans do. This is important to know if youre planning to borrow money from another source. For example, student loan debt increases your debt-to-income ratio, which can hurt your chances of getting approved for a mortgage or other loan.

However, student loan debt can also help you build your credit. Making on-time regular payments could improve your credit score another measure lenders use to determine your ability to make payments.

And of course, the opposite is true if you miss a payment so be sure to stay on top of your loan payment every month.

You May Like: Who Can Loan Me Money

Masters Loan For Uk / Eu Students

Postgraduate Masters Loans to help with course fees and living costs are now available through the government for students from the UK and EU studying taught or research Masters programmes.

For full time study you can get up to:

- £11,222, if your course starts on or after 1 August 2020

- £10,906, if your course starts on or after 1 August 2019

- £10,609, if your course started between 1 August 2018 and 31 July 2019

How Can I Get An Education Loan To Study Abroad Without Collateral

Education loan has come as a big relief to those who want to pursue quality education but face a big challenge while arranging the funds. Now students can avail of a loan of up to INR 4 lacs without collateral. For loans, up to INR 7.5 lacs, parents or guardians are made joint borrower and third party guarantee is obtained. For loan exceeding INR 7.5 lacs property or any other asset is required as collateral.

Also Check: Can I Get An Emergency Loan With Bad Credit

Which Student Loans Are Available For Graduate Students

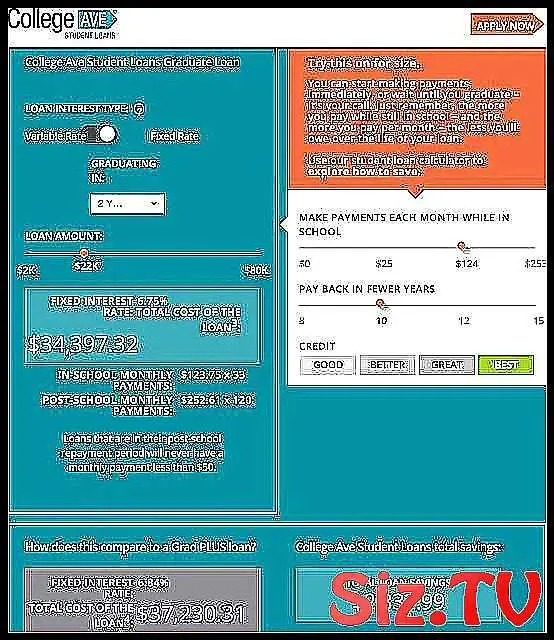

There are two types of graduate student loans: federal and private. Federal loans are funded by the federal government, and you apply for Federal Direct Loans and Direct Graduate PLUS Loans by filling out a FAFSA. Private student loans are offered by banks and credit unions, and you apply directly from the lender. We offer private student loans.

Depending on the professional field that you’re planning to enter, you may have different needs from a graduate student loan. For instance, medical and dental degrees often require residencies, so it can be helpful to have a deferment period. That is why we offer graduate student loans designed with features for specific degree types: , , , , and . We also have a , which is designed for humanities, sciences, and other degrees.

Learn more about the .

Am I Eligible For A Postgraduate Loan

You must:

- be a UK national or have settled status

- normally live in England

- have lived in the UK, Channel Islands or Isle of Man for the past three years

- be under the age of 60 on the first day of the first academic year of your course

- not already have a Masters degree or higher qualification.

If you’re a European Union national, you may be eligible if you:

- have normally lived in the European Economic Area or Switzerland for the past three years

- study at a university or college in England.

For EU, Swiss, Norwegian, Icelandic or Liechtenstein nationals starting a course on or after 1 August 2021, this eligibility information is due to change. To get student finance, you must have settled or pre-settled status under the EU Settlement Scheme.

You may also be eligible for Masters funding in the UK if you’re a refugee , an EEA or Swiss migrant worker, a child of a Swiss national or the child of a Turkish worker, if you’re under humanitarian protection, or if you’re 18 or over and have lived in the UK for at least 20 years or at least half of your life.

If you can’t get a Masters student loan, considerother sources of funding, including scholarships and bursaries.

Also Check: Can I Get An Auto Loan While In Chapter 13

Financing Your Masters In The Netherlands

Studying in the Netherlands proves to be relatively affordable. The annual tuition fee for Masters students from the EU/EEA countries, Switzerland or Surinam is 2,087 for the 2019/2020 academic year. Internationals from other than these countries should expect a yearly payment in the range from 8,000 to 20,000 for their postgraduate studies. There are a lot of different ways to finance your studies and stay in the Netherlands scholarships, grants, financial aid from the Dutch government, student loans and accessible and well paid full-time or part-time jobs for international students.

How To Get Student Loans For Study Abroad

In recent years, the number of Americans wishing to enroll in educational institutions abroad has overgrown. There are many reasons for this:

However, in some cases, students do not have enough funds to enroll in a foreign college or university. One of the best solutions, in this case, is to obtain loans to study abroad, but such options are a little more difficult to find than loans for American colleges. Lets review how to look for the best study abroad loans properly.

Also Check: What Is An Sba 504 Loan

Student Finance In 2021

THE COMPLETE GUIDE

Money: it’s great to have but hard to keep. In all seriousness, though you may not be entirely broke, as a student you may be feeling some financial pressure. It is a known fact that university can be expensive, from the tuition fee to the textbooks. However, that is why the concept of financial aid was created. In the case of financial aid in the Netherlands, it can sometimes be a bit tricky to find the right information. Most of the government websites are in Dutch and the information can seem quite confusing, abstract and incomplete. Not to mention that most study advisors will direct you towards resources that aren’t that helpful. Luckily College Life is here to bring you this ultimate guide to financial aid in the Netherlands! Whether you are looking to apply for student finance, find a scholarship, or learn more about alternatives to finding funding, this is the place to start.

To read your way through the guide, pick the category you are most interested in or simply follow along the whole way through!

CHAPTER 1:

Maximum Lifetime Limit For Student Aid

There are lifetime limits on the number of weeks you can receive student aid. This includes interest-free periods while you are in school. Once a lifetime limit has been reached, interest starts to accumulate. You will also have to start paying back the loan 6 months after you graduate or finish your studies.

Full-time students can receive student aid for no more than 340 weeks, except:

- students enrolled in doctoral studies can receive student aid for up to 400 weeks

- students with permanent disability can receive student aid for up to 520 weeks

Read Also: How To Pay Home Loan Faster

Is My Course Eligible

Your course should be a full standalone taught or researchMasters degree studied at an eligible UK university, or by distance learning . If you study by distance learning you must be living in England on the first day of the first academic year of your course and live in the UK for the whole of your course.

Full-time courses should take one or two academic years to complete. Part-time courses can be for two to four years, but no more than twice the length of the equivalent full-time programme – or a maximum of three years if no equivalent full-time course is available.

You can’t get an English postgraduate loan forpostgraduate diplomas or postgraduate certificates . This means they’re not on offer for those studying theLegal Practice Course to qualify as a solicitor – or for theGraduate Diploma in Law conversion course.

SeparatePhD loansare available for Doctoral-level study.

Courses that qualify for undergraduate funding, such as integrated Masters and the Master of Architecture , aren’t eligible for postgraduate loans. This applies toteacher training. You also can’t get a postgraduate loan if you’re eligible for NHS funding or a Social Work Bursary – unless you only get a Placement Travel Allowance.

The loan can only be used for full postgraduate degree courses, not to top-up a lower-level qualification to a Masters.

Grants And Loans For Full

The Canada Student Financial Assistance Program offers student grants and loans to full-time and part-time students. Grants and loans help students pay for their post-secondary education.

- Apply for grants and loans in one application, directly with your province of residence

- You don’t need to repay grants you receive

- You need to repay loans after finishing school, with interest

- You may be eligible for more than 1 type of grant – when you apply with your province, they will assess your eligibility for all available grants

You May Like: What Is The Maximum Va Loan Entitlement

Master’s Loans For 2022

If you are undertaking your first master’s degree, Postgraduate Master’s Finance may be available to you from the UK government to contribute towards your course fees, your living costs, or both.

Please note that details for students starting in 2022 have not yet been released in full by the UK government. All figures and eligibility criteria on these pages refer to those who started in 2021, unless stated otherwise, and will be updated when further information is available.

What Is The Procedure For Getting An Education Loan For Studying Abroad

From loan application to approval and disbursement, the entire loan process is time taking, so it is always advisable to apply for a loan a little early. Follow these steps for applying for a student loan:

- Check the course in which you are going to study is recognized by the banks or not.

- Figure out how much loan amount you require and how much you are going to arrange on your own.

- Compare the student loan provided by different banks;for studying abroad and go for the one which caters best to your needs.

- After finalizing the bank and the loan amount, fill out the;loan application form;and approach your bank.

- As soon as your loan is approved, the bank will issue a loan document that includes various elements of the loan.

- After signing the loan document, the bank will disburse the amount in;installments;or as asked by the university.

Read Also: When Can I Apply For Second Ppp Loan

How Much Do Grad Students Make

A graduate student’s salary can vary depending on the type of employment they have. If you become a graduate teaching assistant, which is a common job for grad students, the average salary is $36,390, according to the;Bureau of Labor Statistics;.

But depending on the school, the subject matter, your experience, how many hours you work and other factors, your salary can vary. According to BLS, the 90% percentile of graduate teaching assistants earns $59,290 per year, while the 10% percentile earns just $18,320.

If you decide to do a fellowship or an assistantship program, stipends are generally less lucrative. According to;Inside Higher Ed, the average graduate student stipend can range from $13,000 to $34,000. How much you earn with a stipend will depend on the program, educational institution and location.