Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines; however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

How Affordability Assessments Work

When deciding how much to lend you, a mortgage provider will do an ‘affordability assessment’.;Essentially, this means looking at the amount you typically earn in a month compared with how much you spend.;

Lenders are also interested in the types of things you spend your money on. Some expenses can be quickly cut back, while others are less flexible – a gym membership, for example, may be easy to cancel whereas childcare costs are likely to be fixed.

Your lender will ask about things such as:;

Income

- Regular income from paid work

- Any benefits that you receive;

- Income from other sources;

- Debt repayments such as student loan or credit card bills

- Regular bills such as gas and electricity;

- Transport costs

Interest Rates And Fees If You Borrow On Amounts You Prepaid

You pay either a blended interest rate or the same interest rate as your mortgage on the amount you borrow. A blended interest rate combines your current interest and the rate currently available for a new term.

Fees vary between lenders. Make sure to ask your lender what fees you have to pay.

You may not have to make any changes to your mortgage term.

Don’t Miss: What Credit Score Is Needed For Best Auto Loan Rates

How Do Lending Multiples Work

When it comes to households with two incomes, some lenders offer a choice:

- The option to add the second income on top of the multiple, so if the main breadwinner earns £30,000 and the second persons income is £15,000 a lender might offer 4x the first income, plus the second income or

- ;A slightly lower multiple for two incomes than for one. So £30,000 + £15,000 = £45,000. Then £45,000 x 3 = £135,000

Many lenders now only use income multiples as an overall maximum that they will lend, conducting a detailed affordability assessment to decide how much they will actually let you borrow. All income you declare in your mortgage application will need to be proven, usually through you providing your latest pay slips, pensions and benefits statements.

Should I Take The Maximum I Can Borrow

Again, this all comes down to your own personal level of affordability, and how comfortable you are with being able to afford the maximum amount. Remember that the bigger the mortgage, the higher your repayments are going to be, so while it can be tempting to take the maximum amount offered particularly if it means you can afford a larger property it may be wise to exercise a bit more caution.

Read Also: Can I Transfer My Mortgage Loan To Another Bank

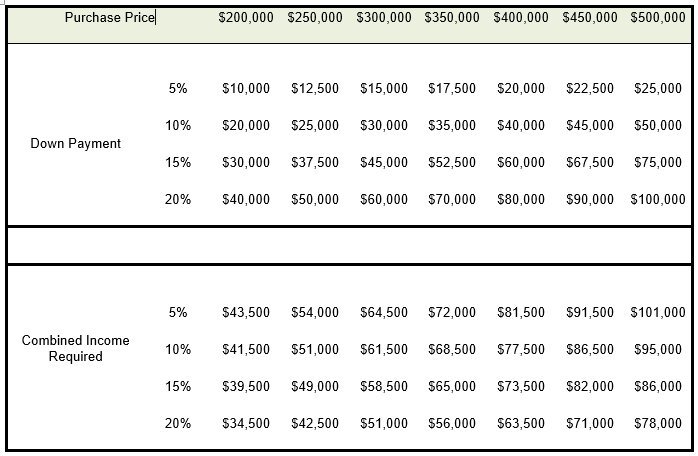

Deposit And Loan To Value Ratio

Loan to value ratio is the size of your mortgage deposit against the size of your loan. This is one of the big deciders for how much you can borrow and how expensive your mortgage will be.

Typically you need at least 10% of value of the home as a deposit to get a mortgage, so to buy;the average UK house of £250,000 you’d normally need at least a £25,000 deposit to borrow £225,000 and pay for the house.

However, with the government’s;Help to Buy scheme;it is possible for first time buyers to get a mortgage with a smaller 5% deposit. So with a £12,500 deposit, it’d be possible to buy a £250,000 home.

It is worth noting that the;bigger the deposit you can put down, the lower your interest rates will be, which could shave thousands of pounds off your mortgage in the long run.

Available LTVs:

-

100% LTV Mortgages ;– a;rare and risky mortgage;that requires no deposit but may require guarantors.

-

95% LTV Mortgages, 90% LTV Mortgages and 85% LTV Mortgagesare at the high end of available LTVs, offering the most expensive rates, but can help first time buyers get onto the property ladder.

-

80% LTV Mortgages, 75% LTV Mortgages, 70% LTV Mortgages and 65% LTV Mortgagesare in the mid range of LTVs, offering competitive rates giving manageable monthly repayments.

-

60% LTV mortgages– the lowest available LTV giving the cheapest rates, raising a 40% deposit might be tough but will deliver some big savings.

Can I Get A Mortgage With Credit Issues

The income needed for a £300k mortgage and the deposit you have is just a couple of the factors that will be taken into account when applying for a mortgage. Your;;will also be considered.

The type of credit issues lenders are willing to accept will differ from one provider to another, based on the exact criteria they require you to meet.

For more information on this see our;bad credit mortgages;section, or make an enquiry and well refer you to one of the experts wholl be able to talk you through the mortgages available for borrowers with bad credit.

Also Check: Can Closing Costs Be Included In Refinance Loan

Shop Around For A Home Loan

Just like all mortgages arent alike, all lenders also are not the same. Its important to shop around for different mortgage options so you can compare interest rates and fees. A difference of even half a percentage point could substantially increase or decrease the amount of interest that you pay for a mortgage over the life of the loan.

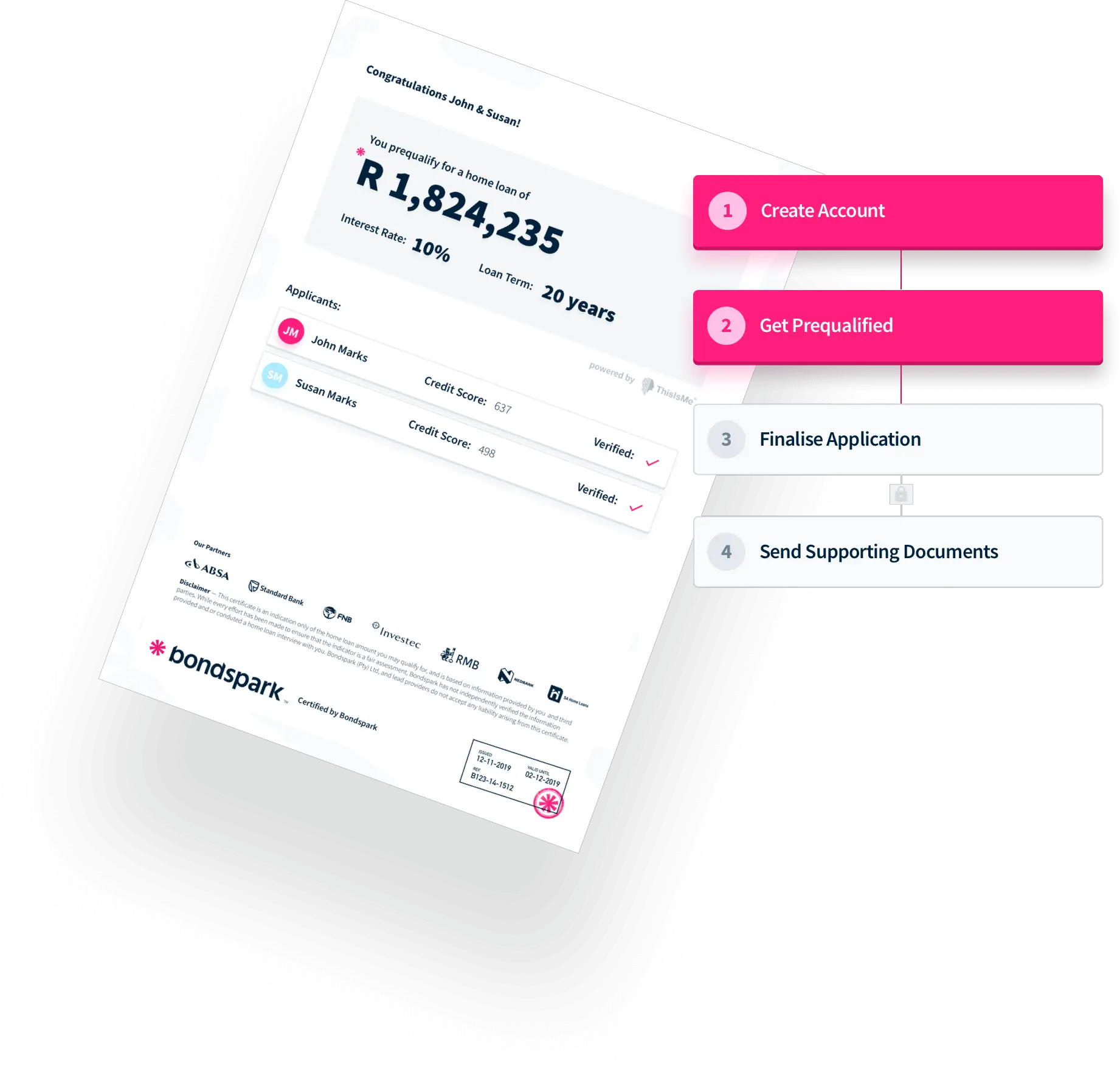

Also, consider getting pre-approved for a mortgage. This process involves having a mortgage lender review your finances and make you a conditional offer for a loan. Pre-approval can make it easier to have your offer accepted when you try to buy a home, which could be especially crucial if youre the youngest bidder.;

How Much Could I Borrow

Mortgage borrowing calculator

Get a quick quote for how much you could borrow for a property youll live in, based on your financial situation. If you want a more accurate quote, use our affordability calculator. Youll need to spend a little longer on this.

If you save for a bit longer and have a bigger deposit, we might be able to lend you more.

Also Check: What Is An Sba 504 Loan

How Much Can I Afford To Borrow

Knowing how much you may be able to borrow is one thing, but knowing how much you can comfortably afford and being confident in your ability to keep up with your repayments is another. This is why youll need to carefully go through your outgoings, making sure to use a mortgage repayment calculator so you get an idea of what your repayments could be and whether you could absorb them in your current salary.

Bear in mind that if youre moving to a bigger property there could be additional expenses to pay, and if youre moving from rented accommodation into homeownership, your outgoings could change again, and thats before we even get to the additional costs of moving . This means its vital to go through everything in advance to make sure youre prepared for the impact on your finances.

Once youve tallied everything up, you can make a decision about the kind of mortgage you can comfortably afford. Though make sure to be realistic its generally recommended that no more than 28% of your household income should go on housing expenses, so if your final total is above this level, it may be worth reconsidering.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Read Also: Where To Get Quick Cash Loan

Will Bad Credit Affect My Application For A 150k Mortgage

If theres previous bad credit showing on your credit file, then this can limit the number of lenders available to you if youre looking to get a;mortgage with bad credit.

Below is a list of potential credit issues that may affect your mortgage application:

- Adverse credit overview

- Bankruptcy

- Repossession

How recent and how severe the issue was will have a bearing. Many lenders tend to favour applications made by people with historically older examples of adverse credit issues , while some will ask clients to reapply for a loan once a certain passage of time has elapsed.

The advisors we work with are experts when it comes to giving the right advice to people with bad credit. They have access to the whole of the market and will do everything they can to find the best mortgage to suit your circumstances.

Estimate What You Can Afford

Before you apply for a mortgage, its important to understand what you can realistically afford to pay. This includes estimating both the up-front and ongoing costs of buying a home in your 20s. Using a mortgage calculator is a good resource to budget these costs.

The main costs of homebuying and homeownership include:

- Home appraisal fees.

- Closing costs.

- Monthly mortgage payments, including private mortgage insurance if youre required to pay it.

- Homeowners insurance, property taxes and homeowners association fees if these are not escrowed into the mortgage payment.

- Basic maintenance and upkeep.

- Home repairs and renovations.

One of the biggest hurdles for first-time homebuyers is the down payment. Youll need a down payment of at least 20% to avoid PMI on a conventional home loan. PMI premiums offer protection to the lender in case you default; they cant be removed until you reach 20% equity in the home. This will add to your homes monthly carrying costs.

Read Also: Can You Switch Your Car Loan To Another Bank

Working Out What You Can Afford

Use our Mortgage Affordability calculator to work out how much you can afford.

Dont stretch yourself if you think youll struggle to keep up repayments.

Also, think about the running costs of owning a home such as household bills, council tax, insurance and maintenance.

Lenders will want to see proof of your income and certain expenditure, and if you have any debts.

They might ask for information about household bills, child maintenance and personal expenses.

Lenders want proof that you will be able to keep up repayments if interest rates rise.

They might refuse to offer you a mortgage if they dont think youll be able to afford it.

What Other Factors Will Impact How Much I Can Borrow

Monthly outgoings

Lenders will want to know how you spend your money as part of an affordability assessment. You are likely to get questions about:

- Debt repayments

- Regular bills

- Transport costs

- Grocery costs

- Spending on leisure activities

Your lender will also want to see recent bank statements and payslips to support your application.

Read our guide to saving for a mortgage deposit to find out more about keeping outgoing costs down.

Interest rates

Though its something you have no control over, interest rates have a part to play when mortgage providers decide how much they might lend you.

In most cases, lenders will stress test any proposed mortgage repayment plan to make sure you could;withstand a rise in interest rates of at least three percentage points. Use our mortgage interest rate;rise calculator to see how your mortgage payments would be affected if your interest rate increased.

If you have a fixed-rate mortgage, interest rate rises wont affect you until the end of your fixed-rate period. But with a variable-rate mortgage, your interest rate could rise or fall at any point during your term.

Recommended Reading: Should I Refinance My Home Equity Loan

What Are The Monthly Repayments

The table below is based on borrowing £150,000 at an interest rate of 3% individual circumstances may affect the rate you can get, but the figures below are designed to give you an indication of the monthly mortgage payment you could expect over different loan terms.

| Loan Term | |

|---|---|

| £632 | £375 |

The above table is for comparative purposes only. You should talk to your lender or broker for the most up-to-date information for your circumstances.

How Much Can I Borrow

We calculate this based on a simple income multiple, but, in reality, itâs much more complex.

When you apply for a mortgage, lenders calculate how much theyâll lend based on both your income and your outgoings â so the more youâre committed to spend each month, the less you can borrow.

This calculator provides useful guidance, but it should be seen as giving a rule-of-thumb result only. Read more about what lenders look at in the How Much Can I Borrow? guide

Your Results

IMPORTANT! Please read…

This information is computer-generated and relies on certain assumptions. It has only been designed to give a useful general indication of costs.

It’s important you always get a specific quote from the lender and double-check the price yourself before acting on the information. We cannot accept responsibility for any errors .

How this site works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

MoneySavingExpert.com is part of the MoneySupermarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-bindingMSE Editorial Code.

Also Check: How To Apply Loan In Sss

How Much House Can I Afford With An Fha Loan

are available to homebuyers with credit scores of 500 or more, and can help you get into a home with less money down. If your credit score is below 580, youll need to put down 10 percent of the purchase price. If your score is 580 or higher, you can put down as little as 3.5 percent.

Youll still need to crunch all the other numbers, but these lower downpayment thresholds should be a shot in the arm for your budget.

Can I Buy A House Making 30k A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Recommended Reading: How Much Is My Student Loan Repayment

What Is A Credit Rating

Your credit rating is a ranking that indicates your financial health at a specific point in time. It compares the risk you pose for lenders to that of other Canadians.

Your overall credit rating is an important factor in determining the type and amount of credit you may be eligible to receive at any given time. That’s why it’s so important to establish and maintain the highest rating possible.

When Is The Right Time To Buy

Figuring out when to take out a mortgage is one of the biggest questions. Unless you somehow already own a home through divine providence, youve probably been paying rent and changing residences every couple of years or so. Here are some factors to consider when deciding when to take out a mortgage.;

You May Like: How To Pay Down Student Loan Debt

First Time Buyer Mortgages

Thinking about buying your first home? Getting onto the property ladder can be a big step. Our range of first time buyer mortgage deals could help you get the keys to your new home.

If youre struggling to save a deposit, our Family Boost mortgage provides a helpful leg-up for first time buyers and their families. Learn about the full Family Boost details and conditions.

We’re proud to support the Government’s mortgage guarantee scheme. You can apply for a first time buyer mortgage of up to 95% of the property’s value. Find out if you qualify.

How To Use A How Much Can I Borrow Mortgage Calculator

With this calculator, you can run some what-if scenarios. For example, you may consider:

-

How long will I live in this home? That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly payment, but youll pay a lot more interest over the long term. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan, but your monthly payment will be considerably more.

-

Is an adjustable-rate mortgage a better option for me? If you plan on being in this home for just a few years, a 5/1 ARM could be a good option. Youll enjoy a lower initial interest rate thats fixed for five years, but the rate changes annually after that.

-

Am I trying to buy too much house? Sure, lenders may be more than happy to put your name on a big loan, but how do you feel about it? Are you comfortable with how it may impact your monthly budget, or are you feeling a bit stretched? Consider how your new home costs may impact your other spending goals, such as travel and savings.

-

How much of a down payment should I make? Its always the big question. Are you putting down as little as possible and having to make up for it with larger monthly payments and possibly having to pay mortgage insurance?

Also Check: Can The Bank Loan You Money