Interests On Federal Student Loans

Most student loans in Canada are gotten from the National Student Loan Service Centre. While many students choose federal loans, it is possible for you to access extra funding from provincial loans every year.

Federal loans allow an interest rate of 2.5% plus prime. This means that the interest on federal student loans is added to the average bank prime rate in Canada. Plus prime varies with time, although it remains at 3.95% as of January 2020. Based on this, the interest on federal students loans sums up to about 6.45%.

Average Student Loan Debt Across Generations

As we previously found in the U.S., more millennial Credit Karma members in Canada carry student loan debt than any other generation. And millennials also have the highest average student loan debt balances among Canadian Credit Karma members, at nearly $19,000.

Gen Z members have the least amount of student loan debt on average, at nearly $12,000. But Gen Z members are almost as likely as millennial members to have student loan debt . And both millennials and Gen Z members are far more likely to have student loans than Gen X or Baby Boomer members.

|

Average student loan debt across generations of Canadian Credit Karma members |

|

Generation |

| $18,648.13 |

What Are The Different Types Of Student Debt Relief Programs

1 debt relief programs for students. Unfortunately, the federal government is not changing the old discount programs. 2 Forgiveness of student loans based on income. 3 professional loan programs. 4 Termination of the student loan. 5 companies that provide debt counseling. 6 Displacement and tolerance.

Student Loan Forgiveness,Student Loan Forgiveness:According to the Credit Bureau Expression, student debt in the United States has recently reached an all-time high, with an average of about 40 million people living at an average of 29 29,000, according to the Credit Bureau Exposition. However, in certain circumstances, part of this loan may be repaid or released.Student loans can be repaid in two ways: working in the public service or repaying through a income-based payment

Also Check: Does Upstart Allow Co Signers

Average Student Loan Debt In The Us 2022 Statistics

Americans now owe more than $1.73 trillion in student loan debt, based on the most current figures available to Nitro. That money is not only owed by young people fresh out of college, but also by borrowers who have been out of school for a decade or more. The standard repayment timetable for federal loans is 10 years, but research suggests it actually takes four-year degree holders an average of 19.7 years to pay off their loans.

Average Graduate School Student Loan Payment

![Average Student Loan Payment [2021]: Cost per Month Average Student Loan Payment [2021]: Cost per Month](https://www.understandloans.net/wp-content/uploads/average-student-loan-payment-2021-cost-per-month.png)

- Standard repayment plan $723

- Graduated repayment plan $824

- REPAYE $613

The average grad school debt is $84,300. But that number skews high because it includes costlier professional degrees in fields like law and medicine. So lets look at what monthly loan payment you might expect if you earned a masters degree and took on the typical level of debt for that degree .

Graduate students not only take on more debt, but typically pay higher interest rates. In addition to $29,000 in federal direct loans for undergraduates at 4.79% interest, lets say you have $37,000 in federal direct loans at 6.36%. Thats a weighted average of 5.7%.

| Repayment plan | |

|---|---|

| 10 years | $83,640 |

| Monthly payments for $29,000 in undergraduate and $37,000 in graduate school debt at weighted average interest rate of 5.7%. REPAYE assumes starting salary of $62,491, the median for younger workers with master’s degrees. |

Don’t Miss: What Interest Rate For Auto Loan With 650 Credit Score

Student Loan Debt From Graduate Programs

Graduate students also deal with student loan debt. Often they face higher debt amounts because of the costs associated with pursuing an advanced degree. Add that to the fact that they probably still have student loan debt from their undergraduate program, they are facing a big student loan debt bill.

Based on statistics compiled by the US Department of Education, here are the average cumulative student loan debts by recent graduates who completed an advanced degree in 2018:

Other Non-PhD: $132,200

How Big Is The Average Monthly Student Loan Payment In Your State

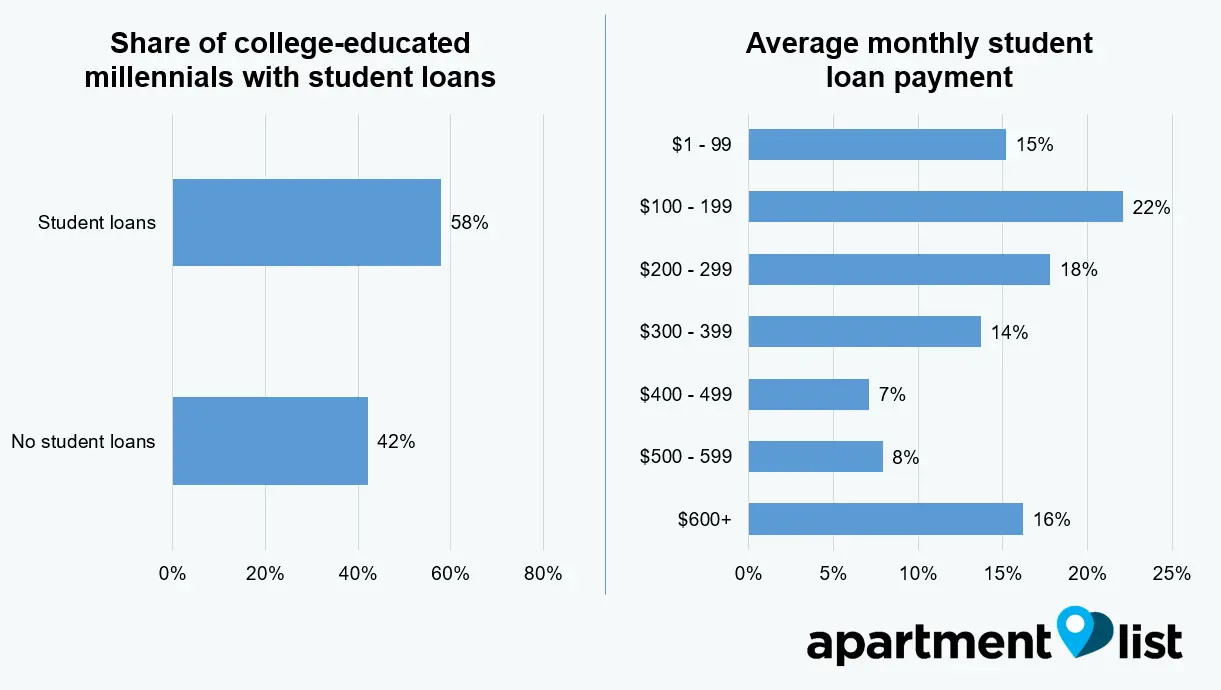

With recent student loan borrowers owing $28,565 in student loan debt, on average, monthly payments have become a sizable financial commitment that most consumers need to account for in their budget for up to a decade and possibly longer.

Pile a monthly student loan payment of a few hundred dollars on top of other recurring expenses, like rent and groceries, and the narrative that todays young Americans are getting hit with a tight financial squeeze comes into focus.

After surveying more than 6,600 Americans in 2016, the Federal Reserve estimated the average monthly student loan payment to be $393, while the median payment was $222.

Financial website LendEDU, with the help of an aggregated analysis of anonymized data from Truebill users, took that studys premise one step further and estimated the average monthly student loan payment in each of the 50 states.

We then estimated the amount of years it should take a borrower from each state to fully repay their student loan debt.

Also Check: Can I Refinance An Fha Loan

Don’t Miss: Loan Officer License California

What Is The Average Student Loan Monthly Payment

Answers vary, but the most recent data says that students between the ages of 20 and 30 paid an average of $393 per month in 2016. Studentaid.gov breaks it down a bit further: for example, on a $10,000 Direct Unsubsidized Loan with a 6.8% interest rate, the amount of interest that accrues per day is $1.86 . If you are in a deferment for six months and you do not pay off the interest as it accrues, the loan will accrue interest totaling $340.

Typical Repayment Cost Of Law School Debt

How much you borrow is only one factor determining how much youll repay over time. Law school student loans tend to have higher interest rates than undergraduate loans even with federal loans and you could take decades to repay your debt, allowing more interest to accrue.

If you had $145,500 in loans with a 10-year repayment term and a 6.28% interest rate, your monthly payment would be $1,636 per month, and your total repayment cost would be $196,306.

But what if you have a longer loan term? Below is what you would pay with a term of 15, 20, or 25 years. As you can see, lengthening the term lowers your monthly payment but increases your total repayment cost.

- If youre eligible for an income-driven repayment plan

- If youre planning on pursuing loan forgiveness.

In general, law school graduates repay their loans over the course of 10 to 25 years.

Don’t Miss: Usaa Preferred Car Dealers

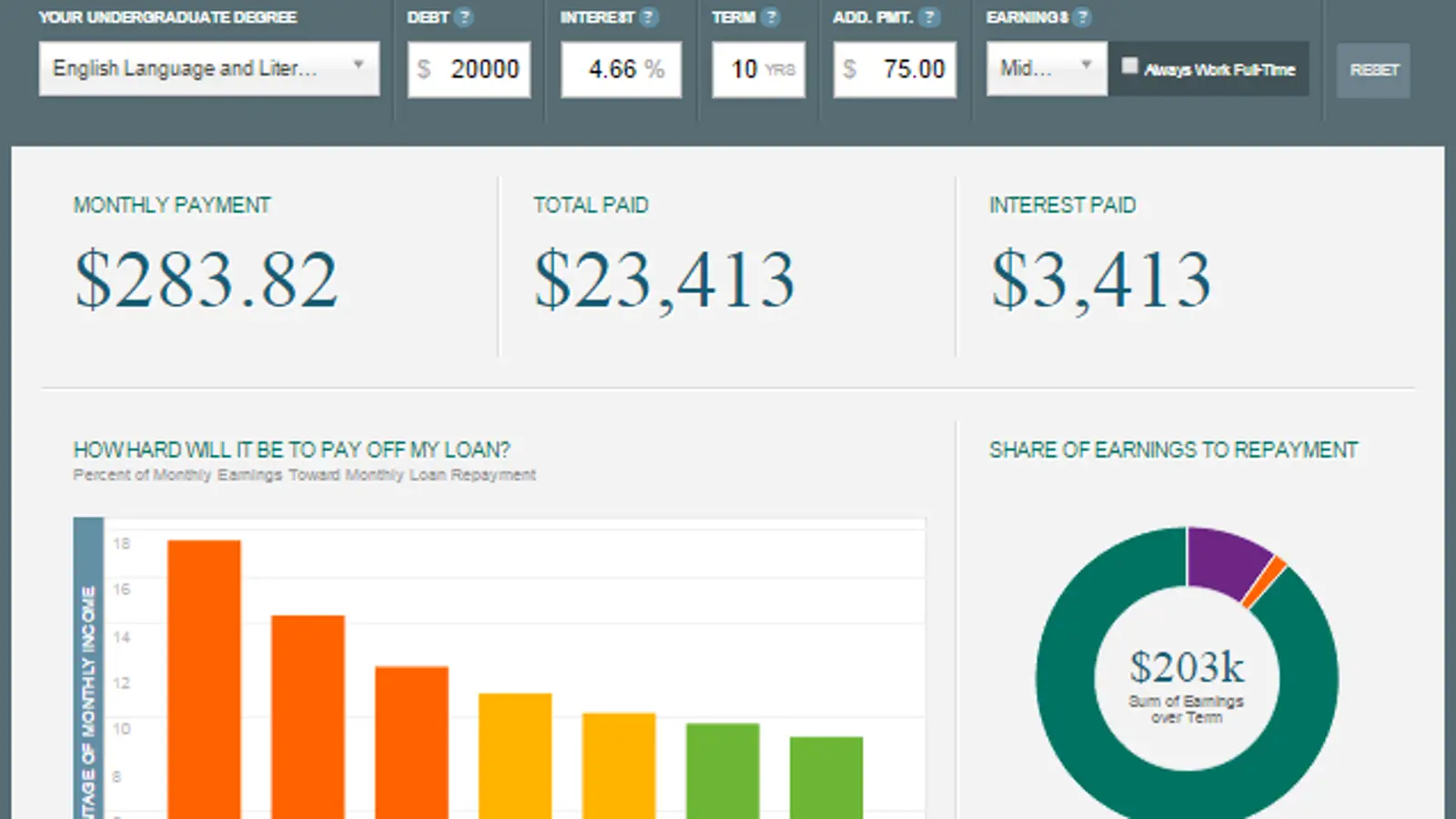

What Is The Average Student Loan Payment Estimate How Much Your Payment Will Be

Want to know how your student loan payment compares to everyone else? This article breaks down the average payment and what yours might be.

Christy Rakoczy Bieber

If you’re thinking about borrowing for school, or if you have already taken out student loans, you may be interested in learning how much the average student loan payment is. Understanding what the typical student pays — and knowing how to estimate your own monthly payments — is important to make sure your loans are affordable.

Here’s the average college loan payment amount, as well as some tips on figuring out how much your loans could cost you.

Your Student Loan Repayment Term

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 years.2 For , the repayment term can range anywhere from 5-20 years, depending on the loan. You’ll be given a definite term for your loan when you apply.

Interest rates for federal and private student loans

The average interest rate will be different for federal student loans and private student loans. Federal student loans have a single, fixed interest rate, which means that your loan’s rate doesn’t change over time.

You may have noticed that there’s a range of interest rates associated with a private student loan. Private student loans are . That means the rate you’ll be offered depends on your creditworthinessand that of your cosigner, if you have onetogether with several other factors. When you apply for a loan, you’ll be given an interest rate, either , depending on which is offered and which type of rate you’ve chosen.

How much you’ll need to borrow for college

If you’re wondering for collegewhether it’s a public university or private universitythe can help. You can search for college costs and also build a customized plan based on your own situation.

Read Also: Specialized Loan Servicing Ceo

Average Medical School Student Loan Payment

- Standard repayment plan $3,533

- Refinance into 10-year loan at 5% $2,912

- Refinance into a 5-year loan at 4% $5,057

With an average medical school debt of $251,600, new doctors must cope with sizable monthly student loan payments. But they typically earn a lot, too, once they have completed their residencies.

If you tried to start paying off your medical school loans right after graduation on the standard 10-year repayment plan, youd be looking at monthly payments of $2,870. Many doctors cant afford to do that, and put their loans in forbearance or enroll in an income-driven repayment plan like REPAYE during residency.

| Repayment plan | |

|---|---|

| 10 years | $361,645 |

| Average monthly payment for $251,600 in medical school debt with a weighted average 6.6% interest rate at graduation. REPAYE estimates based on $56,000 salary during residency, $211,000 after residency. |

If You Enroll In Repaye

Your payments in an income-driven repayment program like REPAYE will depend on your income. Lets say youre making $55,660, the median income for workers who are just starting out and have a bachelors degree. Your monthly payments in REPAYE would start at $308 and gradually increase to $469. Thats an average monthly payment of $389.

Also Check: Fafsa Entrance Counseling Quiz Answers

Do Student Loans Go To Your Bank Account

When it comes to disbursement of private student loans, each lender sets its own policy. Some lenders transfer the loan directly to your bank account shortly after your application is approved. In this case, it’s your responsibility to send the funds to your school’s financial aid office to pay your tuition bill.

How Helpful Is This Pause To Individual Borrowers

It depends. 18.1 million borrowers out of 43.4 million borrowers were making federal student loan payments prior to the current loan pause.

Now, these borrowers will continue to get a break on making payments until May 1, 2022. With an average monthly payment of US$393, the collective direct benefits to these 18.1 million borrowers have been over $7.1 billion per month, or over $85 billion annually, to save, pay down other debts or spend on goods and services.

In contrast, the 25 million borrowers who werent already making payments before the loan pause those in college, recent graduates and those in default do not immediately benefit, as they do not have extra money to spend.

Although most borrowers are not directly benefiting from the payment pause since they were not making payments, the vast majority are benefiting from the suspension of interest accruing on their federal student loans.

At an average interest rate of 5.8% on all outstanding federal student loans, this saves all 43.4 million borrowers a total of over $93 billion per year in interest, or an average of $179 per month.

Don’t Miss: Stilt Personal Loans

Average Student Loan Debt In America: 2019 Facts & Figures

The average student debt in the United States is $32,731, while the median student loan debt amount is $17,000. With the rising costs of tuition and total student loan debt up around 302% since 2004, we decided to break down the data to get a better understanding of the different levels of student loan debt across different types of borrowers.

Student Loans Vs Credit Cards And Auto Loans

In the past decade, total U.S. student loan debt has surpassed credit card debt and auto loan debt. In the third quarter of 2018, Americans owed $840 billion on their credit cards and $1.21 trillion in auto loans. Currently, U.S. student loan obligations are larger than both, trailing only mortgages in scope and impact.

You May Like: Refi Conventional Loan

Read Also: Auto Calculator Usaa

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

Average Number Of Student Loans Per Borrower

Of undergraduate students who borrow federal student loans to pay for a Bachelors degree, more than 95% borrow for at least four years.

On average, 85% of undergraduate students who borrowed a subsidized Federal Direct Stafford loan also borrowed an unsubsidized subsidized Federal Direct Stafford loan, based on data from the 2015-2016 NPSAS. Likewise, 85% of undergraduate students who borrowed an unsubsidized Federal Direct Stafford loan also borrowed a subsidized Federal Direct Stafford loan.

Thus, the typical student who borrows for a Bachelors degree will graduate with 7.5 or more Federal Direct Stafford loans, including both subsidized and unsubsidized loans.

About 11% also borrow institutional or private student loans and about 6% borrow institutional or private student loans without federal student loans. That brings the average number of student loans to 8.2 loans.

Thus, the typical number of student loans at graduation with a Bachelors degree will range from 8 to 12. This does not count Federal Parent PLUS loans.

Recommended Reading: Stilt Loan Processing Time

Federal Vs Private Student Loans

The overwhelming majority of outstanding student loan debt is owed to the federal government. The remaining 19% is owed to private banks. Historically, federal loans were the first stop for most students because they were relatively easy to get and carried reasonable interest rates. However, as market conditions have shifted from the early 1990s until today, so have the interest rates on federal student loans. In recent years, new competition among private lenders has led to more options and better customer service. Especially after graduation, many students find they can get a better deal by refinancing federal loans with private lenders.

The Types Of Loans You Have

Federal student loans offer a wide variety of payment options, including a standard repayment plan as well as income-driven plans that cap payments as a percentage of income. If you want the most flexibility in the amount of your monthly student loan payment, focus on exhausting eligibility for federal loans before taking on other kinds of educational debt.

Private student loans don’t offer as much flexibility as federal loans once you’ve borrowed since you’re committing to your repayment plan for the duration of the time you have your loan. But when you are choosing a lender, you have a wide variety of different repayment timelines you can choose from, such as loans with five-year, seven year, or 10-year terms.

Read Also: Do Private Student Loans Accrue Interest While In School

If You Have A Plan 4 Loan And A Plan 2 Loan

You pay back 9% of your income over the Plan 4 threshold .

If your income is under the Plan 2 threshold , your repayments only go towards your Plan 4 loan.

If your income is over the Plan 2 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan 2 threshold of £2,274.

Your income is £317 over the Plan 4 threshold which is the lowest of both plans.

You will pay back £28 and repayments will go towards both plans.

What Is The Minimum Monthly Payment On Student Loans

Student loans typically have a required minimum monthly payment of $50.00. If the estimated monthly payment is less than the minimum, your estimate will reflect $50.00 and your repayment term may be shortened. The amount of time the borrower is scheduled to repay the principal balance and interest on a loan.

Also Check: Capital One/auto Pre Approval

Average Student Loan Payment: Estimate How Much Youll Pay

The average monthly payment for recent graduates is $393 but that could be higher or lower based on your degree.

Edited byAshley HarrisonUpdated November 1, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

When borrowing for college, its important to figure out what your average student loan payment will be after graduation. That way, youll know what to factor in and wont break your budget.

The overall average student loan payment is $393, but yours could be quite different especially depending on your degree. But dont worry, were here to help you figure all that out.

Here are average student loan payments depending on your degree: