Get Your Documents Together

Much in the same way you applied for your first mortgage loan, youll want to start by gathering all the necessary documentation and shopping around for the lender thats right for you.

To apply for a HELOC, youll need to submit documentation verifying your income, including W-2s, pay stubs and tax returns, as well as documentation that proves you own the home in question. You may also need to provide statements for any accounts that belong to you, such as a savings account or retirement fund.

Why Lenders Are Strict About Heloc Credit Requirements

Lenders look at a few factors in your financial profile to assess whether theyâll approve your application and what terms they will offer you:

- Loan-to-value ratio , or how much equity you have in your home

- Debt-to-income ratio

- Payment history

- Income

Borrowers who own their own businesses or work as 1099 contractors may face even more requirements.

âThe challenge for 1099 contractors and business owners is that their income profiles are inconsistent in nature. Due to the nature of the work, they may get paid varied amounts each month. As a result, computing their income is not as straightforward as a W-2 employee who gets paid the same amount each month and has more predictability,â Gupta said.

As a result, lenders often ask for several yearsâ worth of bank statements and tax returns and may even factor in a discount in case the borrower has a lean year. This can lead to an applicant profile ending up with a conservatively calculated DTI that looks less favorable than might really be the case .

Some mortgage lenders may be okay with a 43% or even 50% DTI ratio for borrowers, while others wonât work with someone with higher than 36% DTI. Credit matters a lot because lenders want assurance that borrowers will make second mortgage payments faithfully over the life of the loan.

How Do I Find Out What Lenders Use My Credit Report

For the majority of general lending decisions, such as personal loans and credit cards, lenders use your FICO Score. Your FICO Score is calculated by the data analytics company Fair Isaac Corporation, and its based on data from your credit reports. VantageScore, another scoring model, is a well-known alternative.

Recommended Reading: Rv Loan With 670 Credit Score

Is A Home Equity Line Of Credit A Good Idea

Whether or not any type of credit is a good idea depends on your personal financial situation. If youre drowning in debt and using your home equity to pay the bills, youre just swapping one type of financial issue for another. But if youre using your HELOC to payoff high-interest credit card debt so you only have a single, lower-interest debt to worry about, this might be a smart move.

Only you can decide if a home equity line of credit is a good idea for you. However, if you have a poor credit score or other negative factors, you may not get approved for a HELOC. Or, the HELOC may come with unfavorable terms that make it too expensive to use as a form of credit. You may want to work on fixing your credit before applying for home equity lending.

Is Overpaying On Your Mortgage Worth It

If youre overpaying your mortgage, you dont just get the advantage of paying interest on a smaller amount of debt. Overpaying also means your loan to value ratio falls faster. And if your LTV falls, it means when it comes to remortgaging, you may be able to get a cheaper deal than if you hadnt overpaid.

Read Also: What Is Chfa Loan Colorado

A Mortgage Diversifies Your Credit

The kinds of credit you use credit cards, auto loans, mortgage also affect your score, but not nearly as much as paying on time. In credit-speak, your credit cards are revolving credit, and your mortgage is an installment loan.

In general, the more credit diversity, the better, and a mortgage adds to the mix.

Td Bank: Best Home Equity Line Of Credit For In

Overview: TD Bank is a great option if you live along the East Coast and prefer to bank in person. With that said, you can also bank by phone, online or via mobile app.

Why TD Bank is the best home equity line of credit for in-person service: TD Bank customers can visit its more than 1,200 branches even on a few federal holidays and, in some locations, weekends.

Perks: TD Bank typically ranks high in customer satisfaction and offers low rates on its HELOCs . Borrowers may also get a 0.25 percent rate discount for having a TD Bank checking account.

What to watch out for: TD Bank charges a few fees, though theyre mostly avoidable. The $50 annual fee applies to draws over $50,000, and if you pay off and close the account within 24 months, you may have to pay a 2 percent termination fee . Theres a $99 origination fee, and you may have to pay closing costs on certain accounts.

| LENDER | |

| Starting at $25,000 | |

| FEES | Theres a $50 annual fee on loans over $50,000 and a $99 origination fee. The 2% termination fee applies if you pay the line of credit off and close it within 24 months. You will also have to pay closing costs on lines over $500,000. |

You May Like: Does Va Loan Work For Manufactured Homes

What Are Todays Current Heloc Rates

|

LOAN TYPE |

|

|

10-year fixed home equity loan |

5.99% |

|

15-year fixed home equity loan |

6.03% |

|

3.88% |

1.74% 6.85% |

To conduct the National Average survey, Bankrate obtains rate information from the 10 largest banks and thrifts in 10 large U.S. markets. The rates shown above are calculated using a loan or line amount of $30,000, with a FICO score of 700 and a combined loan-to-value ratio of 80 percent.

Home Equity Line Of Credit Combined With A Mortgage

Most major financial institutions offer a home equity line of credit combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

It combines a revolving home equity line of credit and a fixed term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender will generally only require you to pay interest on the money you use.

The fixed term mortgage will have an amortization period. You have to make regular payments on the mortgage principal and interest based on a schedule.

The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65% of your homes purchase price or market value. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage.

The following example is for illustration purposes only. Say youve purchased a home for $400,000 and made an $80,000 down payment. Your mortgage balance owing is $320,000. The credit limit of your home equity line of credit will be fixed at a maximum of 65% of the purchase price or $260,000.

This example assumes a 4% interest rate on your mortgage and a 25-year amortization period. Amounts are based on the end of each year.

Figure 1: Home equity line of credit combined with a mortgage

| $260,000 | $260,000 |

Buying a home with a home equity line of credit combined with a mortgage

- personal loans

- car loans

- business loans

Recommended Reading: Does Va Loan Work For Manufactured Homes

Does Having Your Name On A Mortgage Deed Affect Your Credit

Mortgage deeds, deeds of trusts and deeds are three terms often used interchangeably in real estate lingo. In fact, these terms are not synonymous. Each refers to a different instrument you sign in regards to your property. Mortgage deeds or deeds of trust are the loan contracts used to borrow money to purchase your property. The deed is the official paperwork for the property every homeowner receives whether he used a loan or bought the property outright.

Mortgage Payments Vs Rent

Paying a mortgage on time can make a big difference in your credit score and paying the same amount in rent on time typically does not.

Rent payments are considered in some scoring models if they are reported .

But mortgage payments are typically reported without any special effort on your part and are routinely factored into credit scores.

About the authors:Teddy Nykiel is a former personal finance and student loans writer for NerdWallet. Her work has been featured by The Associated Press, USA Today and Reuters.Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Don’t Miss: Defaulting On Sba Disaster Loan

How Does Home Equity Affect Student Financial Aid

Youâre getting ready for one of your children to leave the nest and embark on the next big adventure: a college education! When it comes time to pay for higher education, what happens if you donât get the financial aid you expect? Can home equity affect your financial aid, and can it be one solution to paying for college? These questions can be daunting, especially during a time when COVID-19 is affecting education plans. Weâve got the details you need to know on how to use a home equity loan to pay off student loans.

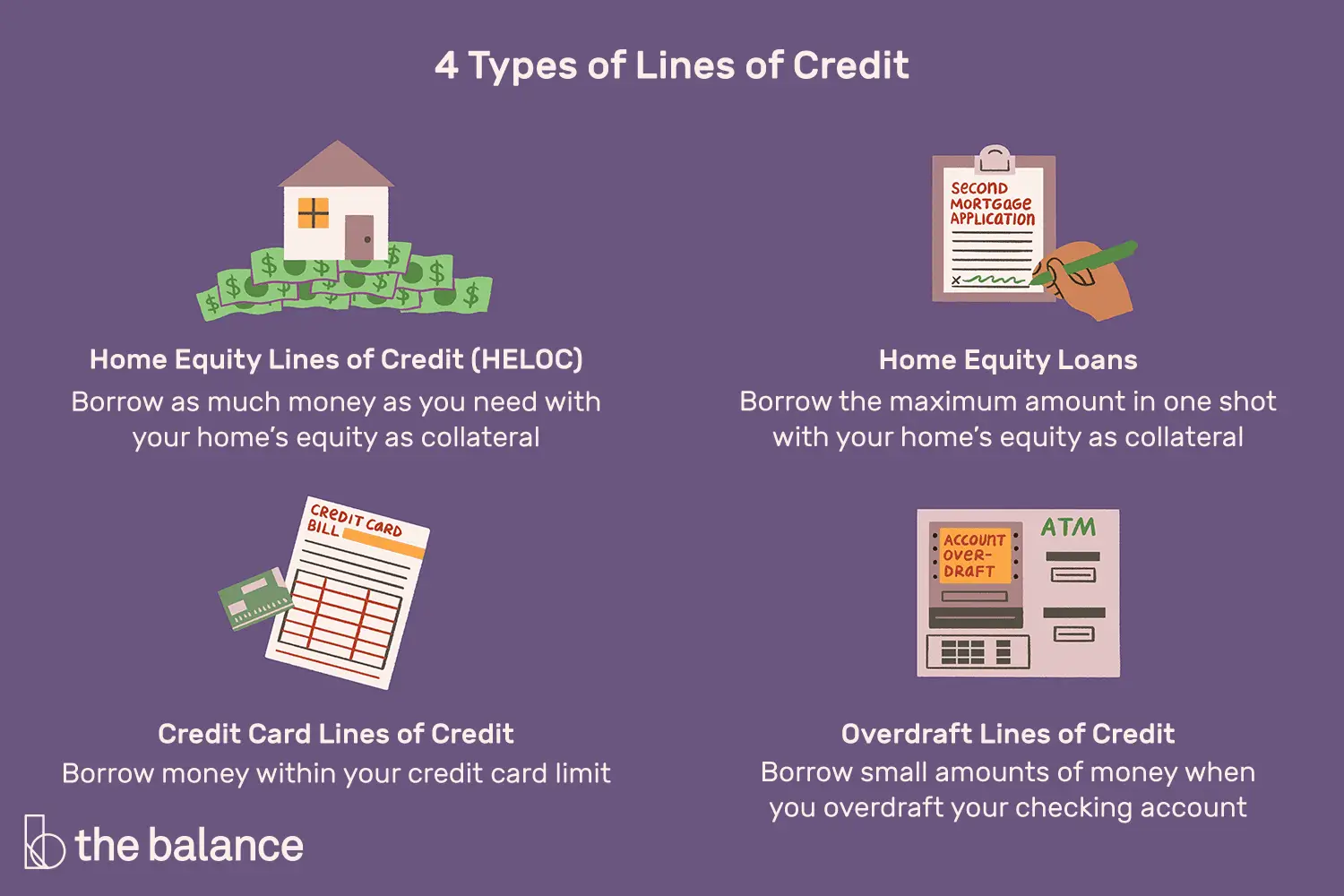

Which Is Better: A Heloc Or A Home Equity Loan

Choosing between a HELOC and a home equity loan comes down to your financial situation, needs and priorities.

A HELOC usually has a longer repayment period and allows you to take only the money you need, when you need it, so its best for people who have ongoing expenses or those who prefer to pay back debt at their own pace.

A home equity loan, on the other hand, offers more predictability in terms of monthly payments, since youll receive a large sum of money upfront and pay it back in monthly installments with a fixed interest rate. Home equity loans are usually best for people who need a lump sum right away and want a predictable monthly payment.

Read Also: Usaa Credit Score Range

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Read Also: How To Calculate Amortization Schedule For Car Loan

Can I Have A Heloc And A Mortgage At The Same Time

Absolutely. Many homeowners are still paying on their original mortgage when they open a HELOC to access some of the equity theyve built up in their home. The only noticeable impact for you is that there will now be multiple monthly payments due, so it is crucial to understand your budget and what you can afford to spend.

Additionally, when you have both a mortgage and a HELOC, it could mean there are multiple lenders with a lien on your home. However, providing you make your payments and pay off the mortgage and line of credit, there is no downside to having both open simultaneously.

Risks Of Relying On Helocs

HELOCs can be closed with little or no notice by lenders. This can create a sudden problem for those who rely on HELOCs for ongoing financing. Many lenders will close lines if they feel that the home the line is based on has dropped enough in equity to make the line an unsupportable risk in default.

References

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How To Apply For A Heloc

With most HELOC lenders, you can generally get the application process started in just a few minutes online. Youll simply enter some personal and financial information, such as your name, address, salary, desired loan amount and estimated credit score.

To apply for a HELOC, start with these steps:

What To Look For In Your Heloc To Help Protect Your Credit Score

So, with all these pros and cons to consider, how can you best protect your credit score if you decide to open a HELOC?

- Know your terms. Ensure you understand when youre expected to make payments, especially if those expectations change over time. For example, interest-only periods may look easy to pay off at first, but when the lump sum or balloon payment is due at the end of your loan, you may be faced with a challenge.

- Keep your maximum possible interest rate in mind. Your HELOC agreement should state the maximum interest rate youll be expected to pay. If the rate spikes and you have to pay the maximum, can you still afford it?

- Use financial calculators. If youre using your HELOC for debt consolidation or financing a significant expense, use financial calculators to plan and make informed decisions. For example, a debt consolidation calculator can help you figure out if extended repayment terms will actually make you pay more in the long term.

Your Liberty Bay experts understand how important it is for you to have flexible financing options for your life plans and daily needs. Let us help you decide if a HELOC is right for you or work with you to ensure opening a HELOC will help, not hurt, your financial health.

Recommended Reading: Is Bayview Loan Servicing Legitimate

Make A Plan To Use Your Home Equity Line Of Credit

Establish a clear plan for how you’ll use a home equity line of credit. Consider a repayment schedule that includes more than just minimum monthly interest. Make a realistic budget for any projects you may want to do.

You may be able to borrow up to 65% of your homes purchase price or market value on a home equity line of credit. This doesnt mean you have to borrow the entire amount. You may find it easier to manage your debt if you borrow less money.

The Pros And Cons Of Helocs

You might use a home equity line of credit to make improvements to your home.

- Print icon

- Resize icon

Yes, home equity lines of credit can have an impact on your credit score. Whether that impact to your credit score is negative or positive depends on how you manage your HELOC. It also depends on your overall financial situation and ability to make timely payments on any amount you borrow via your home equity line of credit. Find out more about how a HELOC affects a credit score.

What is a HELOC?

HELOC stands for home equity line of credit. If you have equity in your home, you can use it to take out a line of credit up to that value. Whether or not youre approved for a HELOC depends on your credit history. However, a HELOC is not a second mortgage.

Unlike a mortgage, you can take out money from your HELOC as you need itusing only the amount you needand paying your loan back in a revolving manner or in monthly payments. It works a lot like a credit card but with a larger available credit limit. For example, if you have $40,000 in equity and get approved for a HELOC for the total amount, you can take out up to that much in funds.

How is a HELOC different from a home-equity loan?

Is a home equity line of credit a good idea?

How does a HELOC affect a credit score?

Do unused credit lines hurt your credit score?

Don’t Miss: How Do I Find Out My Auto Loan Account Number

Common Uses Of A Heloc

Some of the most popular ways homeowners use HELOC funds include:

- Home improvements. Using your home equity to pay for home improvement projects that increase the value of your home is a smart move.

- Medical expenses. A HELOC may be a good option if you have large or ongoing medical expenses and want to take advantage of low interest rates.

- Large purchases. Because HELOCs have longer repayment periods than many loans, they may be an attractive choice for making large purchases.

- Tuition or education costs. HELOCs often have lower interest rates than student loans, though some lenders may place restrictions on how you can use the funds.

- Debt consolidation. A HELOC may be a good choice for consolidating credit card debt. However, be careful not to rack up even more debt during the HELOCs draw period.