When Is The Right Time To Get A Mortgage

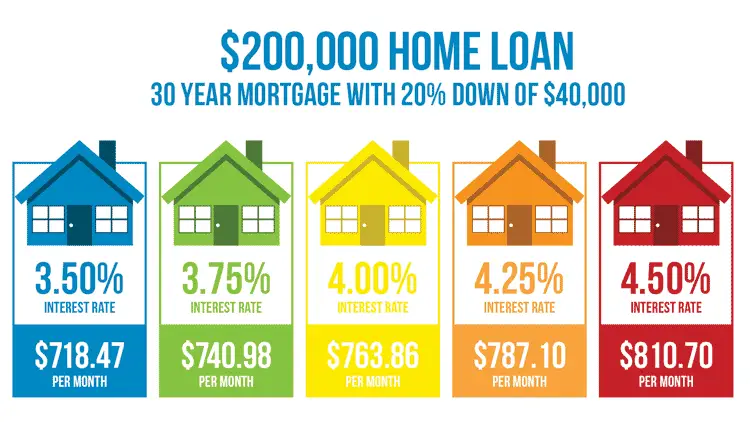

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and qualify for better interest rates.

The best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Because home sales slow down during the winter, you may be able to get a better price in the spring. However, general nationwide trends dont always apply to every real estate market. Talk with local experts in your home shopping area to get a better sense of the market.

What Is Interest Rate

Interest rate is the amount charged by lenders to borrowers for the use of money, expressed as a percentage of the principal, or original amount borrowed it can also be described alternatively as the cost to borrow money. For instance, an 8% interest rate for borrowing $100 a year will obligate a person to pay $108 at year-end. As can be seen in this brief example, the interest rate directly affects the total interest paid on any loan. Generally, borrowers want the lowest possible interest rates because it will cost less to borrow conversely, lenders seek high interest rates for larger profits. Interest rates are usually expressed annually, but rates can also be expressed as monthly, daily, or any other period.

Interest rates are involved in almost all formal lending and borrowing transactions. Examples of real-world applications of interest rates include mortgage rates, the charge on a person’s outstanding debt on a credit card, business loans to fund capital projects, the growth of retirement funds, amortization of long-term assets, the discount offered by a supplier to a buyer for paying off an invoice earlier, and much, much more.

Simple vs. Compound Interest

Fixed vs. Variable Interest Rates

Fha 30 Year Fixed Mortgage Rates

With an FHA 30 year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines or streamline refinance with less documentation than a traditional loan.

FHA loans are backed by the Federal Housing Administration, that is, the federal government insures them. Rather than issuing mortgages, the FHA offers insurance on mortgage payments so that more people can get the financing they need to buy a house or refinance. However, borrowers are required to pay Upfront Mortgage Insurance and monthly mortgage insurance when obtaining an FHA loan.

Do I qualify for an FHA loan?

For FHA 30 year fixed rate loans, there are low down payment options, gifts are allowed, Streamline Refinances are permitted and there are no penalties for repayment.

Don’t Miss: Do Loan Originators Make Commission

How To Calculate Interest On Home Loan

In general, home loans are long-term loans and it is important to figure out your overall interest liability towards the loan at the first place. You can calculate the same using one of the two methods listed below:

How Much Is 3 Down Payment On A House

For example, if a mortgage lender requires a 3 percent down payment on a $ 250,000 home, the home buyer must pay at least $ 7,500 in foreclosure. A down payment reduces the amount the buyer needs to borrow to buy the home.

Can I buy a house for 3 installments? It is now possible to buy a home at least 3% down, and you may even be able to buy a home without money if you qualify for a VA or USDA loan. If you have less than 20% down payment, you may have to buy private mortgage insurance, pay a higher interest rate, or face more competition in the housing market.

You May Like: Usaa Car Refinance Calculator

Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, your annual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thats because with bi-weekly payments, youll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2% mortgage rate.

Recommended Reading: Specialized Loan Servicing Lawsuit

Choosing A Mortgage Term

There are other considerations to your mortgage term length besides just the mortgage rate. Breaking your mortgage, which happens when you sell your home and move or renegotiate your mortgage before the end of the term, will come with significantmortgage prepayment penalties. You will be able to avoid mortgage penalties if you wait until your term expires. A short mortgage term would be more suitable if youre thinking of selling your home soon or refinancing your mortgage.

Theres also a chance that mortgage rates might not move in the direction that youre predicting it will, or it might not move as much as you thought it would. For example, a 10-year fixed mortgage rate might be at 5% while a 5-year fixed mortgage rate might be at 3%.

If interest rates stay the same for the next ten years, youll be paying a mortgage rate of 5% while you could have had a mortgage rate of 3% for two 5-year terms.

If interest rates increase by 2%, where the first 5-year mortgage term has a rate of 3% and the second 5-year mortgage term has a rate of 5%, youll still be worse-off with a 10-year mortgage as youre paying the 5% rate for the first five years rather than 3%.

Mortgage rates will need to increase significantly for a 10-year mortgage term to break-even over shorter-term options.

Average 5/1 Arm Rates

Average 5/1 ARMs tend to feature lower rates than comparable 30-year and 15-year home loans, at least during the initial 5 year promotional period.

Rates will adjust to market rates, plus a spread, following the expiration of the initial 5 year period.

Here are the current average 5/1 adjustable rates mortgage rates for each state.

Average 5/1-ARM Rates by State

| State |

|---|

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%.

While ARMs do offer lower monthly payments in the short run, the variable interest rates on 5/1 ARMs means that your monthly payments adjust to market rates upon expiration of the temporary promotional rate period.

This means that your monthly payments may increase significantly on an annual basis, especially if interest rates are on the rise.

This makes them a risky proposition unless you’re committed to selling or refinancing the property within a few years.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Read Also: Used Car Loan Rates Usaa

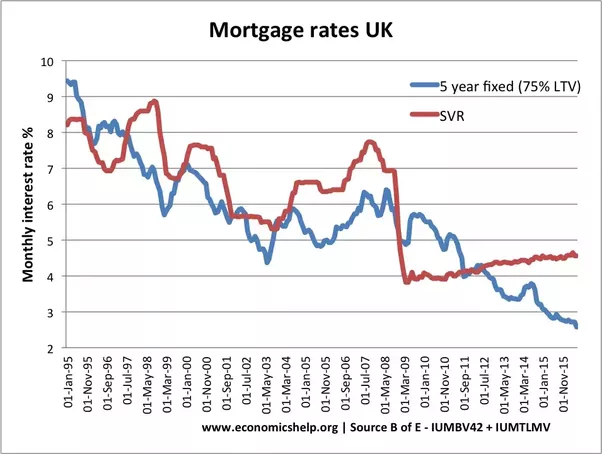

Overview Of 2022 Mortgage Rates Forecast

We interviewed eight mortgage, housing, and finance professionals to get their mortgage rate forecasts for 2022.

Average interest rate predictions put 30-year fixed rates at 3.88% and 15-year fixed rates at 3.27% in 2022.

| Industry Expert | |

| Al Lord | 3.75% |

| Stephen Adamo | 4% |

| Lyle Solomon | 4% |

| 3.88% | 3.27% |

Put in perspective, its important to remember that mortgage interest rates have remained relatively affordable. And for the foreseeable future, they shouldnt stray too far from alltime lows.

Ponder that, 40 years ago, mortgage interest rates were close to 17%. With that in mind, an increase to even 4% by the end of 2022 doesnt seem too scary.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Read Also: Usaa Pre Approval Auto Loan

Citibank’s Lowest Home Loan Interest Rate Offers At 675%

Citibank is now offering home loan to its customers starting at 6.75% p.a. The interest rate charged by Citibank is lower than interest rates offered by some of the leading lenders and finance houses in India. The bank has also decided to waive off the processing fee on home loans till 31 December 2020.

Citibank has linked its interest rate to its 91-day treasury bill which is unlike the other lenders who have linked their interest rate to the Reserve Bank of Indias repo rate. So far, linking of interest to an external benchmark which is treasury bill for Citi has been effective for them since the RBIs repo has fallen 115 basis points.

19 November 2020

Calculate Your Mortgage Payment

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford.

To estimate your monthly mortgage payment, you can use a mortgage calculator. It will provide you with an estimate of your monthly principal and interest payment based on your interest rate, down payment, purchase price and other factors.

Gather these data points to calculate your monthly mortgage payment:

- Home price

Don’t Miss: Flex Modification Calculator

Open Vs Closed Mortgages

You may often notice a significant difference in mortgage rates betweenopen and closed mortgages. Open mortgages allow you to make principal prepayments at any time without any charges or penalties, which makes it very flexible. This flexibility is counterbalanced by open mortgage rates being higher than closed mortgage rates.

Choosing a closed mortgage can let you access much lower mortgage rates at the risk of prepayment penalties if you go over your lenders annual prepayment limit. Things like selling your home or a mortgage refinance can cause you to have to pay significant prepayment penalties. This could be avoided with an open mortgage, but youll have to pay a higher mortgage rate.

Find A Mortgage Loan Officer In California

Our local mortgage loan officers understand the specifics of the California market. Let us help you navigate the mortgage process so you can focus on finding your dream home.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rate and program terms are subject to change without notice. Mortgage, Home Equity and Credit products are offered through U.S. Bank National Association. Deposit products are offered through U.S. Bank National Association. Member FDIC. Equal Housing Lender

Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after consummation for ARM loans.

The rates shown above are the current rates for the purchase of a single-family primary residence based on a 60-day lock period. These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend. Your guaranteed rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors.

FHA Loans – Annual Percentage Rate calculation assumes a $255,290 loan with a 3.5% down payment, monthly mortgage insurance premium of $176.30, and borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable.

You May Like: Refinance Auto Loan Usaa

Dcb Bank Cuts Down The One

DCB Bank has cut down the marginal cost of fun based lending rates or MCLRs recently by 0.18%. previously, the one-year rate of MCLR was 9.85%. However, now it has been reduced to 9.671%.

The bank has cut down the rates by the said percentage across different tenures of the MCLR. The new rates will be effective from the 8th of December 2020.

9 December 2020

Mortgage Rates: What The Experts Are Saying

With mortgage rates so low, most experts agree the only direction to go is up. The question now: how fast will it happen?

Experts have been saying all year that mortgage rates will continue ticking upwards through the end of 2021. News of the Omicron COVID-19 variant has created fresh economic uncertainty and is putting upward pressure on rates. At the same time, rates are getting downward pressure due to the highest inflation in nearly 40 years. The result is volatility. For example, since November 10th, rates have followed this up and down pattern each week: 3.15% 3.22% 3.24% 3.2% 3.24% and most recently 3.28%.

While experts still expect rates to increase as the economy recovers, the recent volatility could continue through the end of the year and into 2022. Most experts believe increases would be incremental. Were not expecting an overnight shoot up where all of a sudden mortgage rates are at 3.5% or 4%, says Ali Wolf, chief economist at Zonda, a California-based housing data and consultancy firm.

Despite the ups and downs, todays mortgage rates are still close to 1% lower than pre-pandemic levels. So, if you are in the market to refinance or purchase a home, now is a good time to take action. Here is everything you need to know about scoring the best rate and how much it can save you.

You May Like: How Much Of A Loan Can I Get For A Car

Lyle Solomon Principal Attorney Oak View Law Group

30year mortgage rates forecast: 4%

15year mortgage rates forecast: 3.25%

For Lyle Solomon, attorney at Oak View Law Group, the equation is simple: When consumers can spend more, which is true today, they can afford to buy homes. That increases the demand for mortgages, which is likely to happen in 2022, he says.

Expected stronger economic growth, which may lead to higher treasury yields, is the biggest reason why Solomon anticipates a 4% average rate for a 30year mortgage next year.

On the other hand, if inflation gets under control, mortgage rates will go down, he adds.

How Coronavirus Affects Mortgage Rates

The COVID-19 pandemic has done a number on the economy job loss and other hardships have caused financial instability for a lot of people. Coronavirus has also had a drastic effect on mortgage rates across the country. Unlike the toll the pandemic has taken on the economy, though, the pandemic has affected interest rates in a positive way for consumers. As of early July, national mortgage rates hit a new record low, with economists speculating that 30-year rates could drop below 3% later this year.

As of , multiple key mortgage rates had dropped, and the average rate for 30-year fixed mortgages was at 3.07%, down six basis points from the week prior. As rates have decreased, though, some lenders have increased credit score requirements in efforts to reduce their risk, which may make things a bit tougher for borrowers with less than excellent credit.

Read Also: Bayview Mortgage Reviews