Chase Auto Loans Preferred Credit Criteria

As mentioned above, Chase Auto Finance has a great full spectrum lending program and they loan to A+, A, B, C and upper level D tier credit customers.

Customers that fit within one of those credit tiers will need a minimum credit score of 540.

Chase Auto Finance has six prime credit tier levels and four non prime credit tier levels. Unlike most other auto lenders, they do not use credit score to determine what tier a customer will fit into.

They base their decisions on:

- Monthly debt ratio.

- Monthly payment to income ratio.

Because Chase Auto Finance does not use credit scores to define their tiers it can be a little difficult to accurately explain their auto loan program.

They have a computer scoring system that rates each customers application, based on the above criteria, and that determines what tier a customer will fit into.

Typically, to get an approval, a customer would have to have at least three lines of well paid credit with at least three years of credit history.

Sometimes just credit cards and a decent pay history will do it, but often times it seems they like to see installment loan credit, like previous auto loans and/or home loans.

This is especially true if you have some accounts that have been paid poorly, sent to collections or even charged off.

They will approve deals with prior collection accounts, chargeoffs, bankruptcies, etc., but you’ll want to show them that you have the overall desire to pay and that you have paid in the past.

How Does Chase Car Loans Work

Chase Car loans work the same as most banks, today. You will have the option of speaking with your local banks loan officer, or you can apply for an auto loan online.

Based on hours of reading customer reviews, we would strongly suggest that you consider a Chase Bank Car Loans only if you are going to work with your local banks loan officer.

Chase Auto Loan Reviews reveal glaring deficiencies with Chases online loan processes when anything out of the norm is necessary.

How To Get A Car Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

» MORE: Learn the basics of how car loans work

Also Check: Usaa Car Buying Rates

Get Preapproved For An Auto Loan

Once youve narrowed your search to a few lenders, its time to request interest rate quotes and compare offers. Getting lenders to compete for your business helps you get the best rate. Also, because lenders weigh factors in your credit report differently, car loan interest rate offers can differ widely.

When applying to lenders, you can be pre-qualified or preapproved for a loan. These are different, and it’s important to know what each one means.

Pre-qualification provides an estimate of the rate and loan amount you might expect to qualify for, based on a limited amount of information the lender has about your credit history. Pre-qualification requires only a soft credit pull, so it will not lower your credit score. However, the estimated rate you are given could change considerably once a full credit check is done.

Preapproval is a step up from pre-qualification. It requires a hard credit pull, temporarily lowering your credit score. Because the lender has more information about your credit history, and personal information you provide, the estimated rate should be closer to the final rate you receive upon loan approval.

If youre really ready to buy your car, getting preapproved for an auto loan offers several advantages, such as giving you more negotiating power at the dealership and protecting you from marked up rates.

Chase Auto Loan Perks

There are a few benefits that come with using a large national bank for auto financing. For example, you can take advantage of the Chase mobile app to manage your auto account from your phone.

Chase.com also offers an online auto account resource center that includes instructions for setting up automatic payments from a Chase checking account or external account, starting paperless statements, or setting alerts for paying your bill.

Read Also: Usaa Mortgage Credit Score Requirements

Determine The Car You Want To Buy And Where You Want To Buy It From

Before applying, you will need to know the car you want to buy. While the exact amount you need to borrow may vary based on different trims or add-ons, the more accurate you can be, the better.

Keeping your budget in mind, you need to decide what kind of car and features are important to you. Some things youll want to consider are the size youre looking for and what you need to use it for. If youre commuting in a big city, a sedan may best suit your needs. If you live somewhere that often gets inclement weather, a car with four-wheel drive may be something you want to consider.

Dont be afraid to go try out your car of interest. Remember you dont have to buy the car just because you took it for a test-drive.

After youve figured out the car you want, its time to gather your documents and actually apply for the loan.

Other Products & Services:

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, member FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. . JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

“Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

You May Like: Usaa Vehicle Refinance

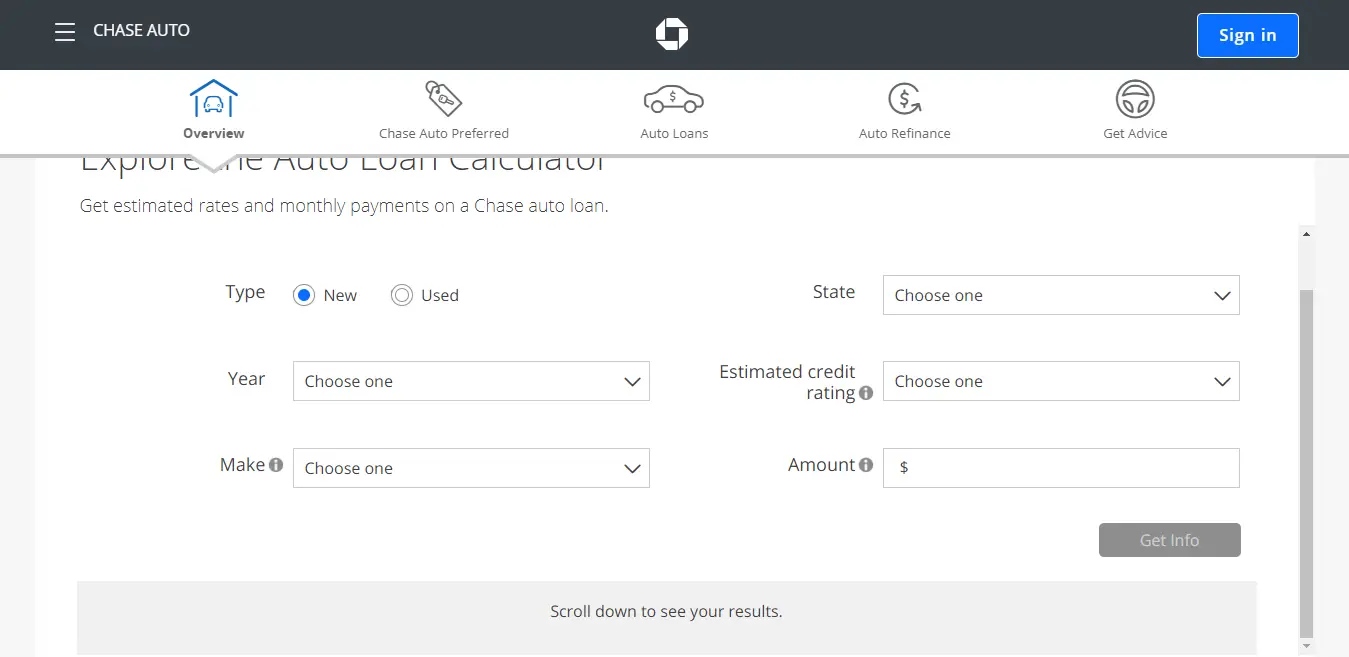

What Can The Chase Auto Loan Offer

When looking at getting an auto loan, you have to consider the rate offered, loan term and the amount youre financing. While you must determine the amount you can afford to borrow, the rate and term options are offered by the bank, which is why its important you shop around to find the best deal.

As one of the main players in the auto loan industry, its not surprising that Chase is competitive in all these areas. When it comes to auto financing, Chase not only offers competitive rates but in certain cases, special financing relationships with certain car brands, as well as rate discounts. Additionally, Chase offers a car buying service through TrueCar that can help you find the right car at a fair price.

Where And How Can I Use My Prequalification

Your prequalification is an estimate based on your self-reported income, an estimated Annual Percentage Rate based on your credit, and a term of 72 months. Now that you have an idea of how much you may be able to borrow you can start shopping for a car at a dealer in our network. You may submit your application online or apply directly at the dealership when you are ready to finance your car.

You May Like: Usaa Refinance Auto Loan

How To Accelerate The Financing Process:

- Proof of identity: A photo ID with your signature on it. Government identification or a passport are typically acceptable documents. Check with your lender or dealership to see which they prefer.

- Proof of insurance: Dealers may ask you for proof of insurance before you purchase and take out a loan on your new or used vehicle. You can contact insurance companies from the dealership when you buy your car, or get details lined up with the insurance provider before purchasing the vehicle.

- In some cases, you’ll need proof of residence: A driver’s license is typically acceptable.

- If you’re trading in another vehicle as part of your financing, you should probably have your registration papers for your current vehicle.

- In some cases you’ll need to prove that you have a steady source of income, usually through several months of pay stubs or W-2 forms. Some lenders may also call your employer for verification.

Taking Action On A Car Loan

Hopefully, you found this Chase Auto Loan Review helpful because getting an auto loan can be complicated and a time-suck if done incorrectly.

Now that you know there are dealerships ready and willing to work with you there is no reason to go without a car.

Want to learn more about Chase Bank?

Getting a car loan is also part of establishing a different type of tradeline which overtime, will help increase your credit score.

Editorial Note: The editorial content on this page is not provided or commissioned by any financial institution. Any opinions, analyses, reviews, statements or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by any of these entities prior to publication.

You May Like: Fha Title 1 Loan Rates

Summary Of Chase Auto Loans

All in all, Chase Auto Finance offers some excellent rates and terms for new and used vehicles. You can feel confident in knowing that you are getting a very competitive rate, especially if you are able to get rates in the mid 4% to low 5% range.

You can access the Chase website here. Don’t forget to bookmark this site so that after you get your approval you can learn some very valuable time and money saving car buying tips.

If you fit into their top credit tier, Chase auto loans offer pretty competitive rates for used vehicles, but if you are a little short, then it may be best to look elsewhere, because you may be able to do better.

As for Chase auto loans for private party and lease buyout rates, they seem to also be pretty good, but you may want to shop their rates to be sure.

Our Take On Chase Auto Loans: 35 Stars

While Chase auto loans do not have the lowest interest rates we have seen, the company does offer competitive rates. Plus, the Chase Auto Preferred program can make Chase your one-stop shop for finding an auto loan and purchasing a vehicle.

Chase is an established bank with many resources that may be useful for Chase loan customers. While some drivers have reported issues with their Chase auto loans, these represent a small fraction of overall customers.

| Our Rating |

|---|

Also Check: Usaa Auto Refinance Calculator

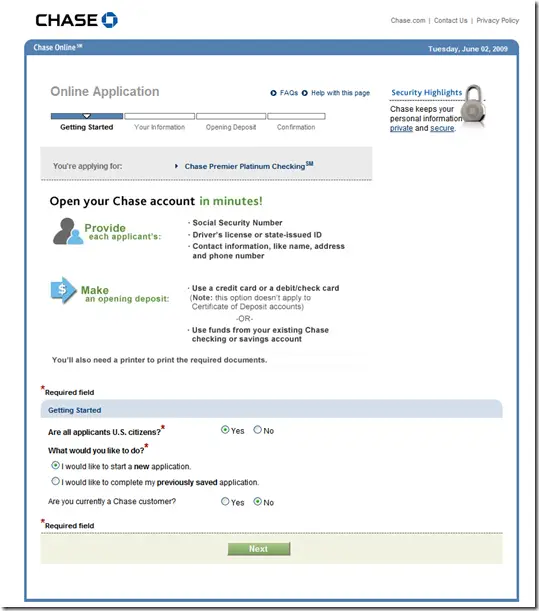

Apply Online Or At A Local Branch

Once youve gathered all your information, you can apply online or at a local branch. A loan decision may take just a few hours or up to three business days. When you apply online, you ll be able to check the status of your application using the application ID that is emailed to you at the time of your application.

You can also use the application ID to complete your application if you were unable to finish it in one sitting. Once approved, the decision and the rate offered are good for 30 days. It will also inform you of what documents you will need to take to the dealer.

How To Get A Chase Auto Loan

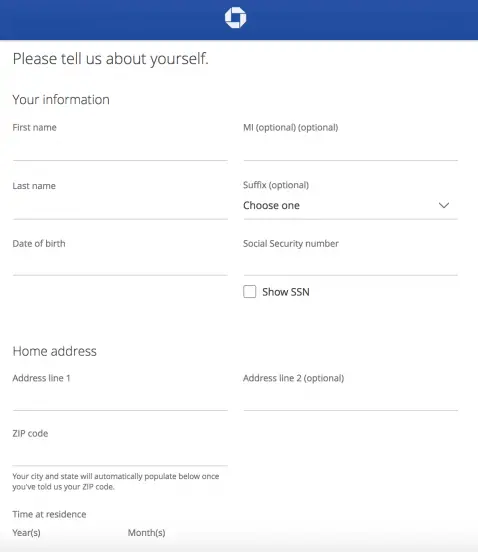

Applying for a Chase Auto Direct loan is a bit different from applying for a Chase mortgage. Heres how to apply for a Chase auto loan:

You May Like: How To Transfer Car Loan To Another Bank

Things To Consider Before Refinancing

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Recommended Reading: How Long Does Sba Take To Approve

What Do Other Borrowers Have To Say About Chase

Chases online reputation isnt great. Remember the subprime mortgage crisis? JP Morgan Chase & Co. was involved. In 2013, it reached a $13 billion settlement over its mortgage practices. That settlement doesnt have much to do with loans it directly offers, but its reputation as a financial institution hasnt totally recovered.

That might explain why its not accredited with the Better Business Bureau alarming for such a large bank and gets an F rating based on over 200 customer reviews. And as of January 2019, it only has a 2.5 out of 10 on Trustpilot. Only one-third of borrowers rate it Excellent, while over half rate it as Bad.

Many reviewers complained about issues making repayments and didnt like its frustratingly archaic way of dealing with problems. Its customer service got lukewarm reviews at best. Many reviewers felt Chase didnt care enough about them and stated theyd be taking their business elsewhere.

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

Recommended Reading: What Car Can I Afford With My Salary

Chase Auto Loans Offer Rates As Low As 349 Percent For Qualified Borrowers

JPMorgan Chase & Co. is a multinational bank that offers a wide variety of financial services, including Chase auto loans for purchasing new and used vehicles. In this review, well take a close look at this company and explore loan details, the application process, and Chase auto loan reviews from customers.

If youre trying to purchase a vehicle, finding the right auto loan can save you thousands of dollars in the long run. Read our review of the best auto loans to learn more about all your vehicle financing options.

Chase Auto Loan Details

Chase auto loans are available for purchases of new and used cars. Compared to the best loan providers, Chase auto loans come with slightly higher annual percentage rates , but one nice feature is that there are no fees for application, prepayment, or origination. A summary of key loan details is outlined in the chart below.

| Chase Auto Loan Details |

|---|

| None |

| Prepayment Penalty |

| None |

Chase does not require a down payment when taking out an auto loan, but making a larger down payment can result in a lower interest rate and ultimately decrease the final cost of your Chase auto loan.

You May Like: Usaa Car Loan Refinance Rates

Best Online Auto Loan: Lightstream

LightStream

- 2.49% to 10.99%

- Minimum loan amount: $5,000

LightStream offers a fully online process for its extensive list of vehicle loan options. It’s very transparent about its rates and terms, and it has few restrictions on what kind of car it will finance. It’s also strong on customer service, receiving the top score in the J.D. Power 2020 U.S. Consumer Lending Satisfaction Study for personal loans.

-

No restrictions on make, model, or mileage

-

Offers unsecured loans to borrowers with excellent credit

-

Prefers borrowers with good credit

LightStream is the online lending arm of SunTrust Bank. It stands out for its online lending process. Borrowers can apply online, e-sign the loan agreement, and receive funds via direct deposit as soon as the same day.

LightStream also offers a remarkably wide range of auto loan options, including new and used dealer purchases, refinancing, lease buyouts, and classic cars. It even offers unsecured loans for those with excellent credit.

Rates from the lender start as low as 2.49%, which includes a 0.5%-point discount for autopay. The maximum APR on an auto loan is 10.99%.