Best For Refinancing: Openroad Lending

OpenRoad Lending

OpenRoad Lending specializes in auto refinancing saving customers an average of more than $100 per month, making it our choice as the best for refinancing.

-

No option to prequalify and check rates with a soft pull

-

Vehicle age and mileage restrictions

While getting a new set of wheels is exciting, theres something to be said for sticking with a reliable ride. However, if your credit improved, you paid off debt, or you got a raise since you first financed your auto loan, you may be paying too much.

OpenRoad Lending allows eligible applicants to refinance existing loans and save an average of $100 per month on their car payments. The application process is simple and entirely online. Within as little as a few minutes of applying, you can receive your decision with complete details about the loan.

If you run into any trouble with your application, OpenRoad Lending’s customer service team can help. Perhaps that’s why 98% of customers say that they are satisfied with their loans. Before applying, you should know that there is only the option to apply with hard credit pull and it is not possible to prequalify or check rates with a soft pull, so this service is only for people who are serious about refinancing. The higher your credit score the lower your rate will be.

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

BEST OF

Recommended Reading: When Can I Apply For Grad Plus Loan

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Providers With The Best Auto Loan Rates

In the table below are five top providers with the best auto loan rates in 2021. Based on our research, PenFed Credit Union currently offers the lowest annual percentage rate at 1.04%, and Bank of America and myAutoloan.com also offer some of the best rates and financing terms.

Be aware that the lowest rates are available for borrowers with the best credit. In other words, the minimum credit score is the minimum needed to qualify for auto financing from the particular lender, not to get the lowest interest rate. Also, interest rates change frequently. The information presented here is current as of the time of publication.

| Lender With Best Auto Loan Rates | Lowest APR |

|---|---|

| Good |

Recommended Reading: What Do Mortgage Loan Officers Do

Lenders With The Best Auto Loan Rates

- PenFed Credit Union tops the list with annual percentage ratings starting at 1.04%.

- Shorter financing terms of 24 to 36 months generally come with the lowest interest rates.

- Shop around and get quotes from multiple lenders to find the best auto loan rates for you.

Affiliate disclosure: Automoblog and its partners may be compensated when you purchase the products below.

Lenders compete with one another by offering low interest rates to what they consider dependable borrowers. Currently, the best auto loan rates for new vehicles are about 2.5% and under. Many providers offer rates like this, including credit unions, banks, and online lenders.

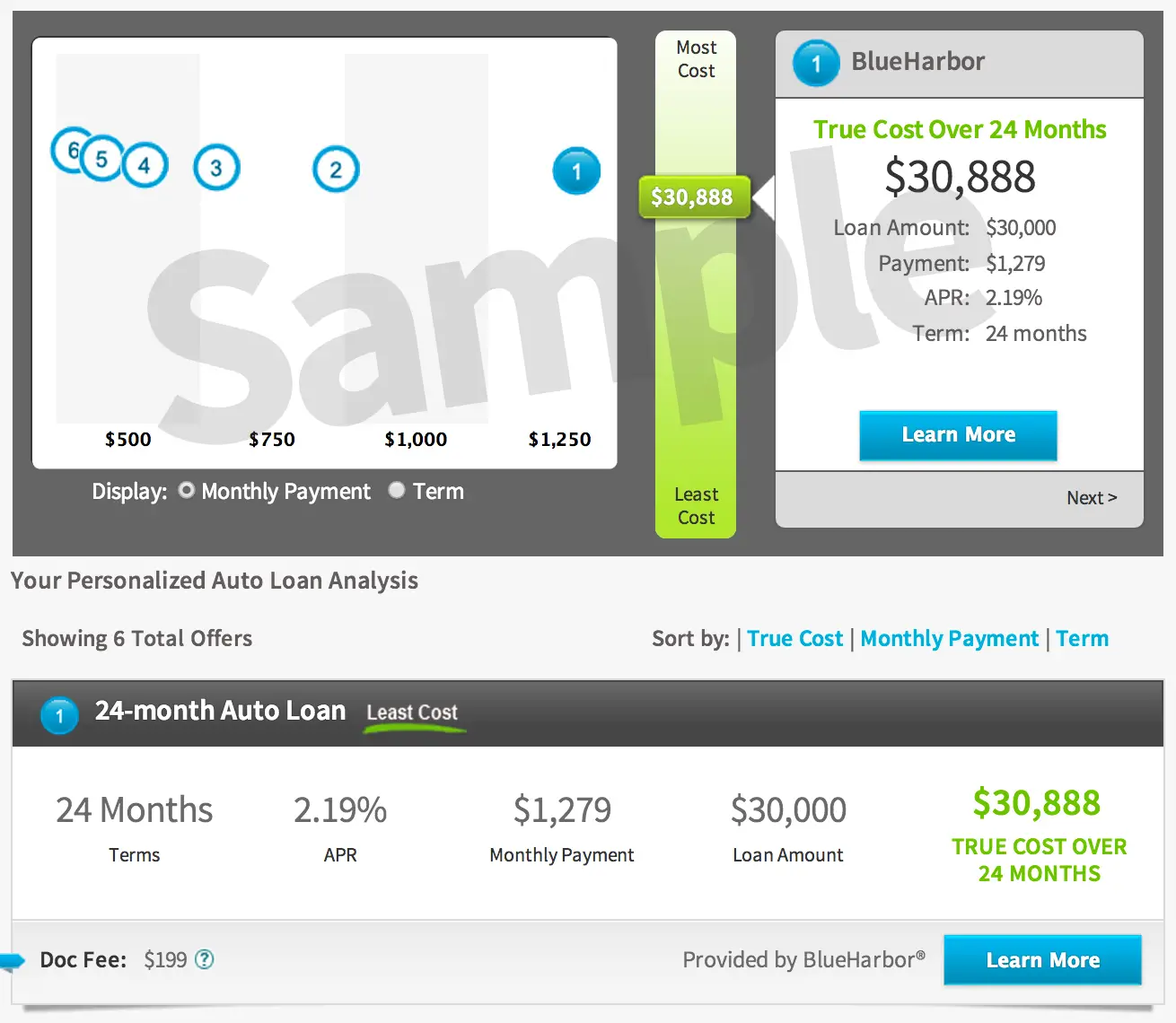

In this article, well talk about the five best providers for low auto loan rates and go over how you can find good financing terms. When shopping around for auto loans, its a good idea to compare pre-qualification offers from several top lenders.

Best Bank For Auto Loans: Bank Of America

Bank of America

- As low as 2.39%

- Minimum loan amount: $7,500

Bank of America auto loans come with the backing of a major financial institution. Low rates and a big selection of loan options make it a major competitor in the auto loan landscape. In J.D. Power’s 2020 Consumer Financing Satisfaction Study, which deals with auto loans, Bank of America ranked seventh out of 12 in its segment and scored equal to the average.

-

Offers new, used, and refinance auto loans

-

Transparent rates and terms online

-

Well-known financial institution

-

Restrictions on which vehicles it will finance

-

High minimum loan amount

Bank of America is a large financial institution offering a number of auto loan options, including new, used, refinance, lease buyout, and private party loans.

For the most creditworthy borrowers, APRs start at 2.39% for new vehicles. Used vehicle loans start at 2.59% APR, while refinances start at 3.39% APR. Customers of the bank who are Preferred Rewards members can get up to a 0.5% discount on their rate.

BofA provides a no-fee online application that it claims can offer a decision within 60 seconds. You can choose from a 48-, 60-, or 72-month term online, but there are additional options ranging from 12 to 75 months if you complete the application process at a branch or over the phone.

You May Like: How Do I Find Out My Auto Loan Account Number

Get Current Auto Loan Rates And Choose A Loan Thats Right For You

Car loan interest rates change frequently, so its important to keep track of them. Your loans interest rate influences how much youre going to pay for month to month. And a lower interest rate can mean thousands of dollars in savings. Our rate table can help you know the best time to buy a new or a used car.

Current auto loan interest rates| 4.43% |

Find The Best Auto Loan Or Refinancing Provider For Your Credit Score

Finding the best auto loans can be tricky. There is a sea of providers out there, and getting stuck with a bad car loan can mean years of debt. The difference between a good interest rate and a bad interest rate can add up to thousands of dollars after all is said and done.

When making any major financial decision, its important to compare options. This list will point you to a number of reputable auto loan providers to help you decide where to apply. Well also explain the application process as well as tips for how to get the lowest auto loan interest rates.

If you want to start comparing auto loan rates, visit AutoApprove.com.

Recommended Reading: How To Transfer Car Loan To Another Person

Navy Federal Credit Union: Best Auto Loan Rates For Those With Military Affiliation

*Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Rates without AutoPay are 0.50% higher. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Payment example: Monthly payments for a $10,000 loan at 3.49% APR with a term of 3 years would result in 36 monthly payments of $292.98.

LightStream auto loans are unsecured, meaning there are no restrictions based on the vehicles age, mileage, make or model. The 2.49% APR applies to any auto loan: new, used or refinance. This rate could possibly go lower LightStream promises to beat any qualified offer from another lender by 0.10 percentage points.

How To Calculate Car Loan Emi

The Equated Monthly Installments that you will pay will depend on a few key factors.

- The size of the loan

- The interest rate that is applicable to the loan

- The tenure of the loan

- The processing fees

The higher the loan amount, the higher your EMI will be. Similarly, the shorter the loan tenure the higher the EMI. To find the best compromise between an affordable EMI and duration you should check out our car loan EMI calculator.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

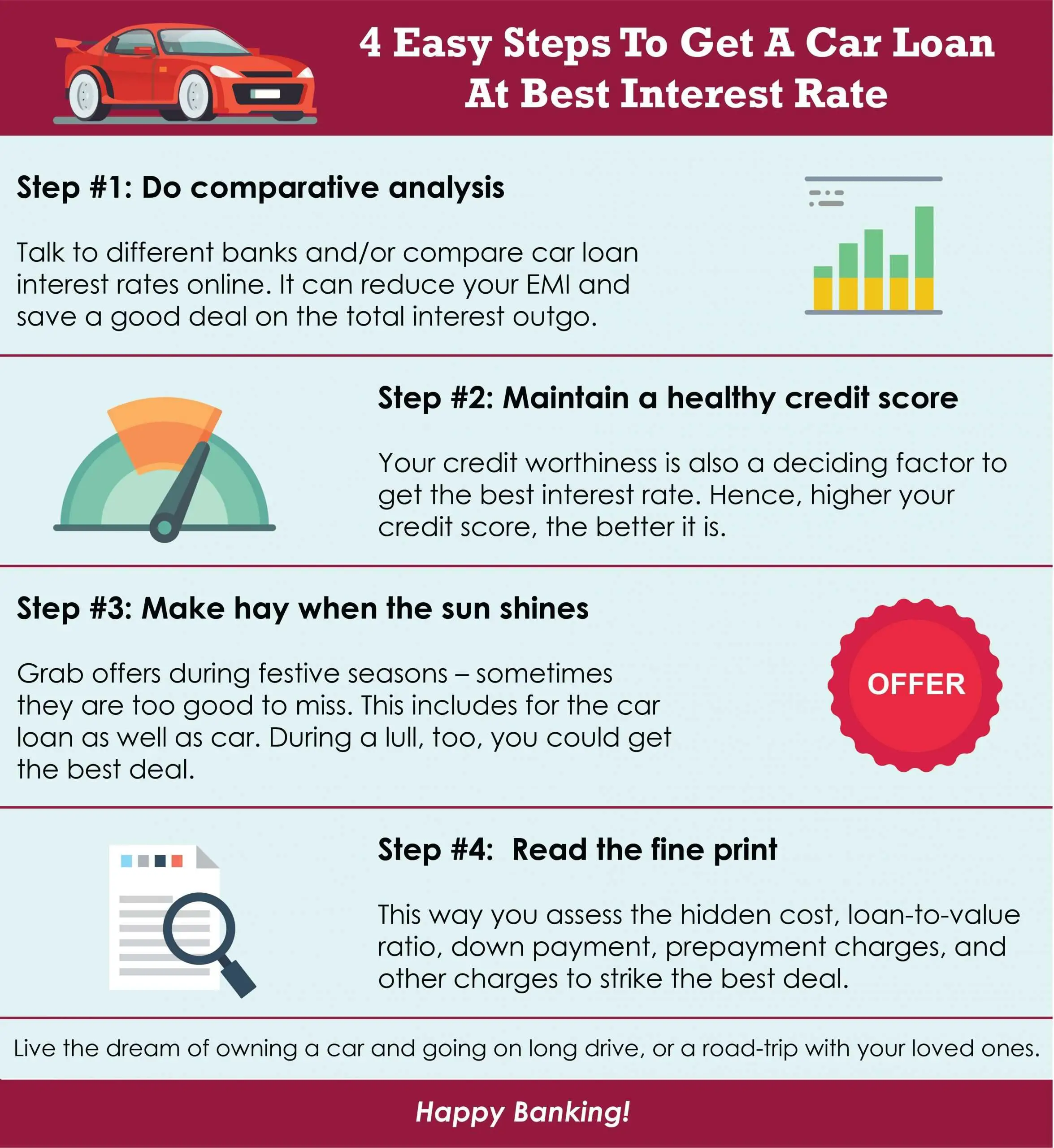

Tips For Getting The Best Auto Loan Rates

In order to get the lowest rates from a financial institution, youll want to check your credit report, which contains your credit score. This can be done for free through banks, credit card companies or online sites such as Credit Sesame.

If your credit score is not as high as youd hoped, you can improve it by improving your debt-to-income ratio, aka how much you make vs. how much you spend. Paying down any debt helps improve this ratio and raise your credit score in the eyes of financial institutions. Similarly, you can ask your credit card companies for credit limit increases, which lowers the percentage of your available credit that youre using, thus raising your credit score. Finally, make sure there arent any errors on your credit report. If there are, have them fixed as quickly as possible.

Saving up for a down payment can make a difference as well. A larger down payment reduces your loan amount, which shortens your loan term, lowers your APR and, in turn, reduces your monthly car payment. If you have bad credit, consider having a co-signer with a high credit score, which also reduces your cost of borrowing, as it gives your lender more confidence that the loan will be paid back.

Youll also get a better rate by taking out a used auto loan instead of one for a new car. Less expensive than the same model purchased new, a used car will save you money, as your car loan will be smaller.

Finally, be sure to shop around for the best auto loan rates.

Best For Shopping Around For Refinancing: Lendingclub

LendingClub

- 2.99% to 24.99%

- Minimum loan amount: $4,000

Using a soft pull on your credit, LendingClub allows borrowers to instantly compare refinancing options

-

Easily compare refinance rates online

-

Pre-qualify with a soft credit check

-

No origination fees or prepayment penalties

-

Not available in all states

-

Some vehicle restrictions

Although LendingClub made a name for itself with peer-to-peer personal loans, the online lender now offers auto loan refinancing. If youre looking for ways to lower your monthly bills, LendingClub can help by showing you your refinancing options.

First, complete the initial application and get instant offers. This step is a soft pull on your credit that won’t change your score. Then you can compare the details of each proposal to see which best fits your needs. Whether you need to lower your interest rate, increase the length of your loan, or both, you can find the right lender.

Once you decide on an offer, you can finish the official application. The process is entirely online and easy. Although LendingClub is a broker, you won’t pay an origination fee for your loan. Finally, sit back and enjoy a smaller monthly payment. Rates start at 2.99%. Whether you’re sure you want to refinance or just seeing what’s out there, LendingClub is a great option.

Also Check: What Happens If You Default On Sba Loan

Am I Likely To Qualify For Refinancing At A Lower Interest Rate

Your credit history will have a direct impact on the interest rate youre offered. If youve made six to 12 months of steady, on-time payments on your current loan, its likely that your credit score has improved. With a better credit score, you will probably qualify for a lower interest rate when you refinance.

» MORE:Get car insurance quotes

How Were These Winners Determined

These lenders were chosen based on interest rate for various credit scores, whether you’re buying new or used, and loans for a specific need like refinancing or lease buyouts. Insider gathered data from NerdWallet, MagnifyMoney, and , and from the lenders themselves. This list only considers loans that were available in most of the US, and does not include captive lenders lenders owned by auto companies.

You May Like: Does Va Loan Work For Manufactured Homes

Which Lender Is The Most Trustworthy

We’ve reviewed each institution’s Better Business Bureau score to help you make the best decision possible when choosing an auto loan. The BBB measures businesses’ trustworthiness based on factors like truthfulness in advertising, honesty about business practices, and responsiveness to consumer complaints. Here is each company’s score:

| Lender | |

| Clearlane by Ally | D- |

A majority of our top picks are rated A or higher by the BBB, with the exception of Clearlane by Ally. Keep in mind that a high BBB score does not guarantee a good relationship with a lender, and that you should keep doing research and talking to others who have used the company to get the most helpful information you can.

The BBB currently rates Clearlane by Ally a D- in trustworthiness because of 53 complaints filed against the business, including one unresolved complaint. Due to the lenders’ BBB scores, you might prefer to use a different auto loan company on our list.

Us Bank Auto Loans: Best Auto Loans Company For Used Car Rates

U.S. Bank is ideal if youre undecided between a new and used car, as it will offer the same auto loan rates for both. The caveat is that youll need a strong credit history to qualify for the lowest APRs, while you should make use of the 0.5% discount available to U.S. Bank check and saving account customers too.

Applying for an auto loan is relatively fast and straightforward, while you can pop into your local branch if you prefer managing your finances face-to-face. However, be aware that it might take you a while to find the extra snippets of auto loan information that most borrowers like to know – U.S. Bank has a website that would definitely benefit from some clearer FAQ direction.

Don’t Miss: Do Loan Officers Make Commission

Capital One: Best Auto Loan Rates For Prime And Subprime Credit

on LendingTrees secure website

Capital One offers prequalification through its Auto Navigator feature, which allows you to shop for a vehicle and then get an estimate of your auto loan with only a soft credit pull. Unlike other lenders that specialize in working with those with excellent or poor credit, Capital One offers competitive rates for both types of borrowers.

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make monthly payments on the principal of the car with no interest for a set number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

You May Like: How To Transfer Car Loan To Another Person

What Happens If I Extend My Loan Term

Extending the length of your loan when you refinance will lower your monthly payments. However, you likely wont save money because youll pay more in interest over the life of your loan.

Extending your term could also put you at risk of becoming upside-down on your loan, meaning you owe more than your car is worth. This is a risky situation to be in. If you get in an accident, and your car is totaled, your insurance might not cover what you owe. Also, if you have to sell your car, youd still owe money on the loan.

To recap our selections…