Pay Off In 6 Years And 2 Months

The remaining term of the loan is 9 years and 10 months. By paying an extra $150.00 per month, the loan will be paid off in 6 years and 2 months. It is 3 years and 8 months earlier. This results in savings of $4,421.28 in interest payments.

If Pay Extra $150.00 per month

| Remaining Term | 6 years and 2 months |

| Total Payments |

| 9 years and 10 months |

| Total Payments |

| $11,188.54 |

Understand Your Grace Period

Grace periods vary depending on the type of loan. A grace period is the amount of time you have after graduating from high school before making your first payment.

Federal Stafford loans have a six-month grace period, whereas federal Perkins loans have a nine-month grace period. Therefore, you may be eligible for a six-month delay on federal PLUS loans.

Private student loan grace periods vary, so check your papers or contact your lender to learn more. Dont forget to make your first payment!

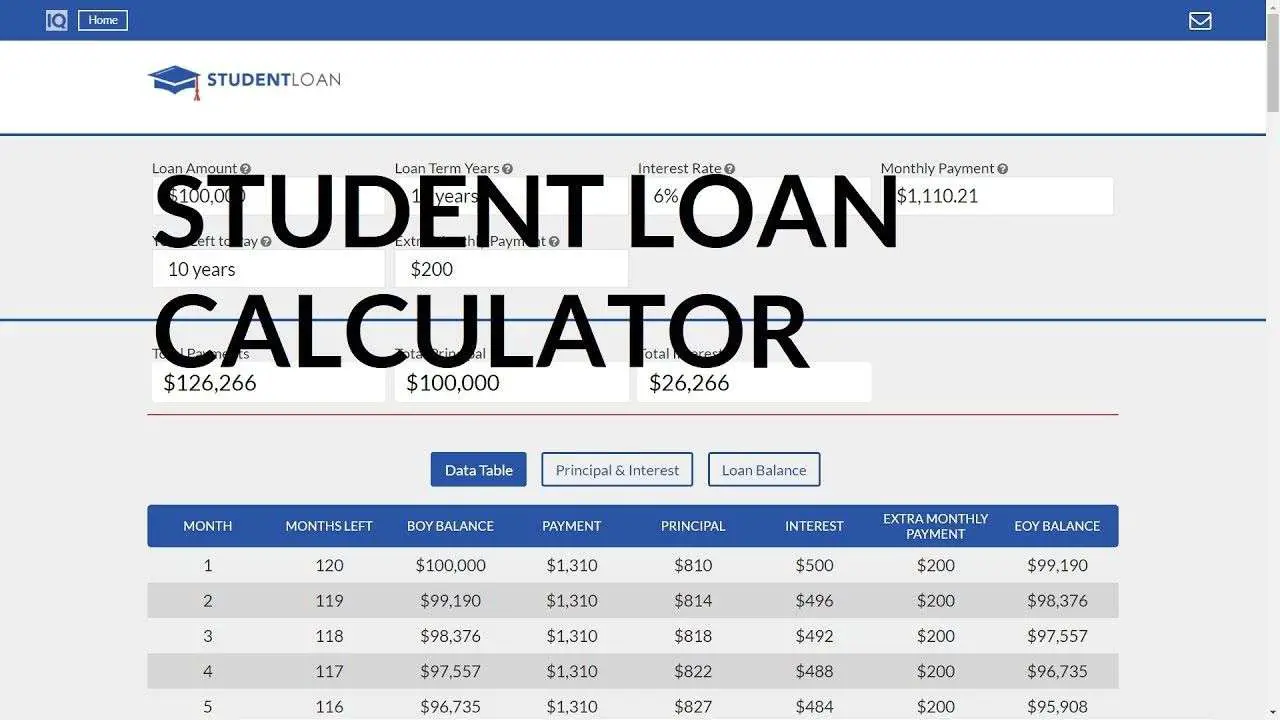

The First Step: Amortization Schedules

The first step toward calculating what your student loan payments will be is figuring out an amortization schedule. That might sound complicated, but the idea behind it is simple. If the lender knows the size of the loan, the interest rate on the loan, and the time over which it wants to get repaid, then it can come up with a schedule of monthly payments that will zero out the loan balance at the desired maturity date.

You can calculate an amortization schedule manually, but it’s much easier to use a calculator to do so. This loan calculator can give you your monthly payment, along with a schedule that lists how much interest you’ll pay each month throughout the course of the loan.

Recommended Reading: Usaa Auto Interest Rates

Use Your Results To Save Money

If you have unsubsidized or private student loans, you can lower your total to repay by making monthly interest payments while youre going to school. Or, you may opt to make a lump sum payment of the total interest that accrues before repayment begins. Either method will prevent the interest that accrues from being capitalized. The result: a lower monthly bill amount.

You can submit more than your monthly minimum to pay off your loan faster. The quicker you finish paying your loans, the more youll save in interest. Learn how to pay off your student loans fast.

If youre having trouble making payments on your federal loans, you can extend the term to 20 or 25 years with an income-driven repayment plan. Income-driven plans lower your monthly loan payments, but increase the total interest youll pay throughout the life of your loan.

Private lenders may allow you to lower monthly payment temporarily. To permanently lower monthly payments youll need to refinance student loans. By doing so, you replace your current loan or loans with a new, private loan at a lower interest rate. To qualify youll need a credit score in the high 600s and steady income, or a co-signer who does.

Can I Get My Loans Forgiven

In some circumstances, your student loans may be discharged before your repayment term ends. For example, for federal loan borrowers, if you make 120 on-time loan payments while working full-time for the government or a qualifying nonprofit, you could get your loans forgiven through the Public Service Loan ForgivenessProgram.

Also Check: Parent Plus Loan Interest Deduction

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

What Is A Traditional Student Loan Repayment Plan

Traditional repayment plans are based on the loans principal balance. Your principal balance is just the amount of money that you borrowed to fund your education.

Traditional repayment options dont factor in things like your personal income or family size when working out how much you will be paying on a monthly basis.

Both traditional and income-driven repayment plans come with their own set of pros and cons including different repayment terms.

Traditional repayment plans include:

Also Check: Www Upstart Com Myoffer

Capitalization Increases Interest Costs

In most cases, youll pay off all of the accrued interest each month. But there are a few scenarios in which unpaid interest builds up and is capitalized, or added to your principal loan balance. Capitalization causes you to pay interest on top of interest, increasing the total cost of the loan.

For federal student loans, capitalization of unpaid interest occurs:

-

When the grace period ends on an unsubsidized loan.

-

After a period of forbearance.

-

After a period of deferment, for unsubsidized loans.

-

If you leave the Revised Pay as You Earn , Pay as You Earn or Income-Based-Repayment plan.

-

If you dont recertify your income annually for the REPAYE, PAYE and IBR plans.

-

If you no longer qualify to make payments based on your income under PAYE or IBR.

-

Annually, if youre on the Income-Contingent Repayment plan.

For private student loans, interest capitalization typically happens in the following situations, but check with your lender to confirm.

-

At the end of the grace period.

-

After a period of deferment.

-

After a period of forbearance.

To avoid interest capitalization, make interest-only student loan payments while youre in school before you enter repayment and avoid entering deferment or forbearance. If youre on an income-driven repayment plan for federal student loans, remember to certify your income annually.

Use Various Combinations In The Loan Amortization Calculator

The examples above change just one variable for the sake of clarity. Of course, your loan calculations may not be that straightforward, which is why you can change multiple variables in getting the information you need. For example, you may want to refinance at a lower rate but for a shorter term. You can compare the variables of the loan you have now to a loan with a lower rate and a shorter term in order to figure out your monthly payments.

Also Check: Can You Use A Va Loan For Land

Education Department To Forgive $415 Million In Student Debt

The Department of Education has approved $415 million in borrower defense claims for nearly 16,000 former students after new evidence showed that their schools may have misled them into loans. The latest round of loan forgiveness brings the total amount approved by the department to approximately $2 billion for more than 107,000 borrowers.

“When colleges and career schools put their own interests ahead of students, we will not look the other way,” Federal Student Aid COO Richard Cordray said in a statement Wednesday.

Getting And Keeping Your Job

Its routine for employers to run background checks on potential employees, but they might go deeper and take a look at your credit report and calculate your DTI. Why? Especially if your job entails money management or access to sensitive information, an employer may want to know that you can effectively manage your own finances. There are so many factors out of your control that would raise your DTI, but may not compromise your ability to perform well at a particular job, even if it does require money management.

While we dont recommend bringing up your DTI unless asked about it , it is good to have a narrative in place that doesnt sound like a bunch of excuses, but frames you as a proactive manager of your situation, as opposed to a passive recipient. Especially if your student loans are a significant contributor to your DTI, you should prep a few answers about your education and how it may have helped you, how you are managing your debt, and your plans for repayment.

And realize that your student loan debt could get you fired from your job.

Read Also: Loan Options Is Strongly Recommended For First-time Buyers

What Happens If You Default On Your Student Loan

The consequences of defaulting on your student loan can be bad for your financial health.

Heres what happens when you default on your student loan.

- Your loan and its interest becomes due and payable

- You will not be able to become eligible for programs like student loan forgiveness, forbearance, deferment, and changing repayment plans

- You will not be eligible for additional financial aid

- Your loan will be reported to the 3 credit bureaus as a delinquent

- Defaulting on loans can hurt your credit score

- Your wages can be garnished to repay the debt

- Your lender can send the loans to the collection agencies for collection.

- You could have your tax return, social security and federal payments garnished.

When Do I Have To Start Paying Off My Student Loan

With most lenders, you can usually begin making payments as soon as you want to. You can even pay your loan off completely without penalty. But the good news is, you typically dont need to make monthly payments while in school. You usually have until 6 months after you graduate though there are a couple of lenders that dont give you this grace period.

If youre going to grad school, youre usually able to defer your undergraduate loans, as well. Just keep in mind that interest will still accrue, so making payments even if interest-only is still a good idea if you can.

Most private lenders offer flexible repayment options, too, that include interest-only repayment options, deferral options, and more. Just make sure you ask your lender about the different loan repayment plans before you take out the loan.

You May Like: Usaa Refinance Auto Loan Rates

Make Multiple Payments A Month

You know the saying about more being merrier? Channel it when it comes to the frequency of student loan payments the more you make, the easier it will be to shrink your balance .

Paying even an extra $50 a month on our hypothetical $40,000 debt will help you pay it off four months earlier. The easiest way to do this is to plan your payments to coincide with the days you get paid, so you can direct money to your debt before youre tempted to spend it elsewhere. Rooker recommends automating this through your checking account or payroll provider.

You just have to make the decision once and then let technology work for you,” he says.

Quick tip: Be sure to tell your loan servicer you want your extra payments to go toward the principal balance, not to count as a prepayment for the next month.

Use Tools To Research Potential College Financial Aid Awards

The mission behind Edmits college search tools is to help families see beyond school advertisements. In the free version of our tool, you can enter one college. Well give you borrowing guidelines and an estimate of potential financial aid in the form of federal student loans, grants and merit scholarships. The estimates are based on information you input about family income and the students GPA and test scores. Well also show you five alternate schools that may offer better financial aid packages.

When you are accepted, review your financial aid letter look at the student loan area as a gap that could also be filled by private scholarships, student employment, or changes that reduce the costs of attending college. For instance, you can save several hundreds of dollars by changing meal plans or using a good strategy for saving on textbooks. The cost of attendance that the school provides estimates textbook costs based on the school bookstore prices, and not one based on using smart strategies to save money.

Don’t Miss: Usaa Auto Loan Refinance Calculator

Find Out How Much This Totals Each Month

Take this figure and multiply it by the number of days since your last payment. If you are making monthly payments, this should be 30 days.

For example: $1.60 x 30 = $48.00

The typical monthly payments for a person who owes $20,000 with 3% interest using a 10-year fixed-interest repayment plan is about $193. This means that $48 of this payment would be going towards interest while the remaining $145 would go towards repaying the principal.

This math shows just how significantly interest can impact your monthly student loan payments and millions know just how much those payments impact their finances. Even before the pandemic hit and unemployment spiked, more than 20% of student loan borrowers were behind on their payments.

Don’t miss:

Why Is It Important To Know The Interest Rate And Terms On My Student Loans

Its important to know your interest rate and terms on the student loans you borrow, so you can understand how much youll owe. If you take out $15,000 in student loans, youre not just going to owe $15,000. Youre going to owe $15,000 plus interest over the life of your loan .

Like the example above, if you borrowed $15,000 at a rate of 5% over the standard 10-year repayment plan, you would end up paying back $19,091 total.

Check Out: Todays Student Loan Interest Rates

Read Also: Fha Mortgage Refi

Choose The Right Repayment Plan

If you dont choose a different payback plan when your federal loans mature, your payments will be based on a standard 10-year repayment plan. However, there are alternative options if the basic payment is too much for you to handle, and you can change plans at any time if you want or need to.

Extending your repayment duration beyond 10 years will cut your monthly payments, but youll pay more interest frequently a lot more throughout the loans life.

Income-driven repayment plans , such as the IBR plan and REPAYE, are essential options for student loan borrowers. And thats because they limit your monthly payments to a reasonable percentage of your annual income

Then, forgive any remaining debt after no more than 25 years of affordable payments. Borrowers in the public and nonprofit sectors may be eligible for forgiveness after just ten years of payments.

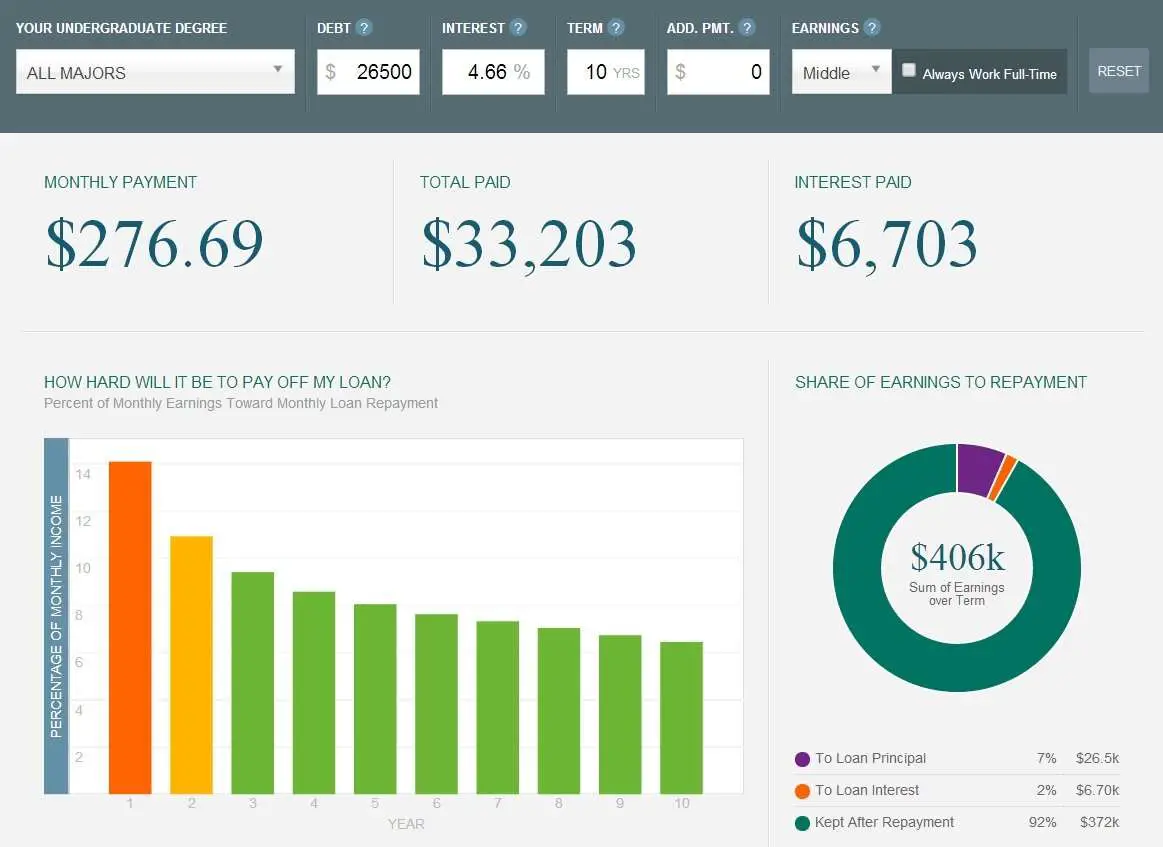

Student Loan Projection Calculator

Use the calculator below to estimate the loan balance and repayment obligation after graduation. This calculator is mainly for those still in college or who haven’t started. Before estimating, it may be helpful to first consult our College Cost Calculator to get a rough idea of how much college may cost.

| To Graduate In |

| Do you pay interest during school years?Yes |

| Total Interest: | $23,234.95 |

You need to make $45,790 per year or more to repay the loan with less stress.

In the U.S., there are several types of student loan providers: government and private. Federal and state governments provide the lion’s share of student loans in the country and offer the considerable advantage of being subsidized. This means that students are not required to pay interest on their student loans while they are still considered students. Therefore, the cost of public, subsidized loans is lower than those offered by the private sector. As a matter of fact, federal student loans have some of the lowest interest rates around and do not require cosignatories, simply proof of acceptance to an educational institution. For these reasons, more than 90% of student debt today is in the form of federal loans.

Don’t Miss: Should I Get A Fixed Or Variable Student Loan

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Nslds.ed.gov Legit

Change Your College Budget When Needed

Beyond applying for new scholarships, an excessive amount of student loan debt can be a signal to rebudget.

Textbooks are a highly flexible expense.

A member of our told us she spent a total of $500 on books for two masters degrees because she was able to buy and then resll them on Amazon.

In comparison, school bookstores rarely pay a good buy-back price. Plus, your school could have retired that edition of the book while another school hasnt. Thus, the resale value could be better in a different locale.

Students can get budgeting help for all aspects of their budget from the student money management department or a credit union financial counselor on campus.

They may help them find ways to save on food, entertainment, or housing.

For instance, a change in meal plans can save several hundred dollars per semester.