Get Information From A Source You Trust

It’s natural to have questions. Besides the basics such as the interest rate and term, it’s a good idea to ask about other things like prepayment charges if you plan to sell your property or pay down your mortgage loan faster. To ensure that you get accurate, actionable information we recommend seeking answers from a trusted source. TD Mortgage Advisors are well versed in every aspect of the mortgage process and can be an easily accessible source of information.

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

How Do You Apply For Pre

The rules and processes for applying for pre-approval will depend on the particular lender.

When you apply for pre-approval with ANZ, we will complete a credit check. Be aware, this may impact your credit history.

We will also ask you for things like proof of your identity, expenses, employment and income. You’ll also need to let us know the price range of the property you want and how much you have saved for a deposit.

Please note, however, that pre-approval gives you an indication of how much you may be able to borrow from ANZ, not a guarantee that we’ll lend you the funds. Once you’ve found the right property, please speak to us about progressing to making an application for full approval of your loan.

The rules and processes for applying for pre-approval will depend on the particular lender.

When you apply for pre-approval with ANZ, we will ask you to provide evidence of:

- your income, expenses, and employment

- your savings record

- the amount you have saved for a deposit

- any debts that you currently owe

- your identity

You’ll also need to let us know the price range of the property you want.

Heres a handy home loan document checklist to help you prepare for applying for pre-approval.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Shop For Homes During The Preapproval Period

When you receive your preapproval letter, itll probably say its good for 30 to 90 days. Since thats a relatively short period, youll probably want to wait to get preapproval letters until youre ready to start seriously shopping for a home. And remember, a preapproval is only a conditional approval. If you rack up more debt, change jobs or reduce your savings, you could get denied when you go to get final mortgage approval.

Ready To Take The Next Step

REX Home Loans offers a quick pre-approval process to help jump-start your home search. By removing the high cost of commissions for our loan advisors, we offer competitive rates from some of the industrys top lenders. Because our mortgage advisors dont work on commission, there is never any pressure to go with one lender over another. Our goal is to help you find the best option for your mortgage, while bringing greater ease and transparency to the borrowing process.

If youre curious about your financing options, get in touch with REX. With brokerage, mortgage, title and escrow, insurance, and home services all under one roof, well be with you every step of the way toward finding, financing, and closing on your next home.

Here are some other articles you may enjoy:

Read Also: Usaa Auto Refi Rates

Consider Other Associated Costs

As you go through the mortgage process, it’s important to think about the true cost of owning a home. Besides the costs required at closing and regular mortgage payments, there are other recurring costs such as property tax, home insurance, heating costs, condo fees and more. Even though pre-approval specifies an amount you may be approved for, consider a lower principal amount to reduce regular expenses while leaving money for other unforeseen expenses.

Close On Your Home Faster

If you already have a pre-approval, you wont have to worry as much about going through the whole mortgage shopping process once youve made an offer. You wont have to wait for lenders to run your financial details and determine if you are approved youve already done this step!

This can expedite the process, getting you from offer to owner faster. This is also attractive to sellers.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Consider Working With Multiple Lenders

Just as you want to get the best deal on the house you buy, you also want to get the best deal on your home loan. Every lender has different guidelines and interest rate options, which can have a big effect on your monthly payments. If you only get preapproved with one lender, youre stuck with what it has to offer. When you get preapproved with multiple lenders, you can choose the offer thats best for you.

Your lender will pull your credit reports during the preapproval process. This is known as a hard inquiry and will usually lower your credit scores by a few points.

If youre shopping for a mortgage, you have a window of time where multiple inquiries are counted as a single inquiry for your credit scores. The window is typically 14 days though it could be longer.

Since its difficult to know which credit-scoring model a lender will use, youll likely want to get all those rate quotes within 14 days.

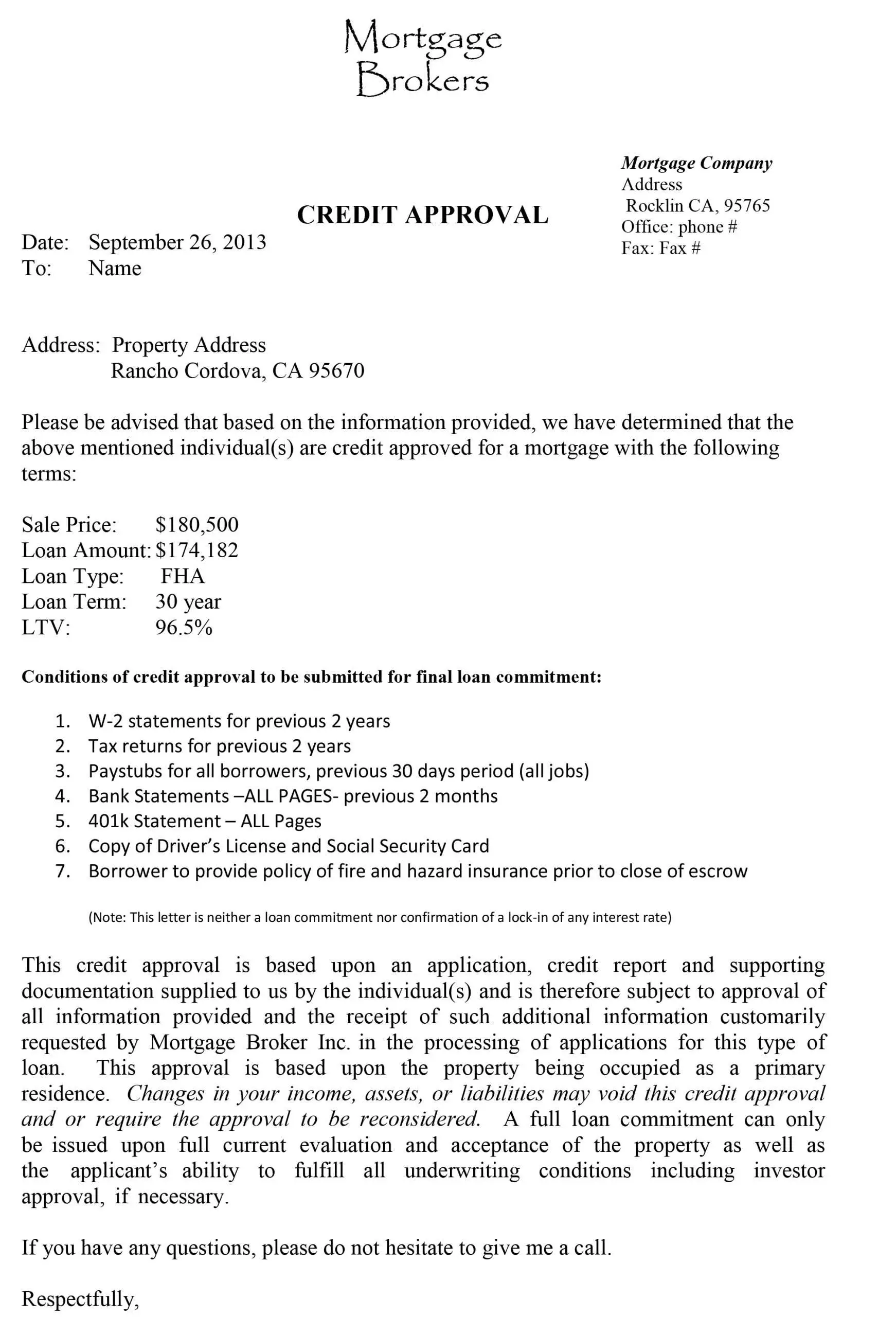

Important Features Of A Pre

-

It is not tantamount to a guaranteed home loan sanction, which ultimately depends on complete verification of all relevant documents, among others

-

These usually carry a lower interest rate but other processing charges may be attached such fees are non-refundable

-

It stands valid for a definite time frame

-

Borrowers credit limit gets affected to the tune of the pre-approved amount meaning your ability to repay a personal or an education loan will be arrived at basis the loan you want to pre-approve

-

Most lenders will allow a concession on the interest rate levied on a pre-approved loan

-

Processing is relatively faster, considering the bank already has most of the relevant papers

Home Loan EMI Calculator

Recommended Reading: Pre Approved Auto Loan Usaa

Question: What Is A Mortgage Loan Pre Approval

What is mortgage preapproval? Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. Theyll also perform a credit check.

Contents

Changes In Your Credit Score

Lenders consider your credit score when they give you a mortgage pre-approval. If your credit score has dropped below the minimum credit score requirements since you got pre-approved, your home loan application may still be denied.

Your score may have dropped recently for a number of reasons, such as taking on new debt, making late, or missing payments. You should monitor your credit standing carefully from the time you got pre-approved and until you file a complete home loan application. Practice good borrowing habits and make sure there are no errors in your credit report. For tips on how to improve your credit score you can read this article.

Recommended Reading: Usaa Used Car Loan Interest Rates

Know Your Budget And Stick To It

If you have a pre-approval in hand when you are shopping for a home, there will be little room for guessing how much you can afford. Youll know how much money you can get approved for, but also have a chance to talk with your mortgage lender about budgeting.

This allows you to stick to your budget and ensure youre buying a home you can afford. Its easy to get swept away when you fall in love with a home, but if youve taken the time to think about your budget and apply for pre-approval, youll be more likely to stay within your means.

Do Mortgage Lenders Look At Your Spending

How you spend your money each month can have an immediate affect on your mortgage approval. Banks check your credit report for outstanding debts, including loans and credit cards and tally up the monthly payments. Bank underwriters check these monthly expenses and draw conclusions about your spending habits.

Recommended Reading: Can I Refinance My Sofi Personal Loan

Why Would I Need Pre

One of the biggest advantages of home loan pre-approval is that it provides a clear amount that you can afford to spend on your future property. This can help you narrow down your search and avoid wasting time on homes that are beyond your budget.

When you do find a place youd like to buy, having finance pre-approved leaves you free to focus on price negotiations rather than juggling the stress of arranging a home loan at the same time .

Benefits Of A Fully Underwritten Pre

Securing an underwritten pre-approval can be a secret weapon for homebuyers to win their dream home in highly competitive real estate markets. When buyer demand outpaces for sale listing inventory, this is commonly called a sellers market.

In this type of competitive market, there are multiple well-qualified buyers competing for the same homes resulting in bidding wars. Some of these buyers make all-cash offers without financing contingencies and sellers prefer non-contingent deals.

One of the top reasons to get a fully underwritten pre-approval is having the option to waive a mortgage financing contingency in order to be considered alongside all-cash and other non-contingent offers.

Don’t Miss: Va Manufactured Home Guidelines

Understand The Difference Between Pre

A mortgage pre-qualification is often a basic financial evaluation. A TD mortgage pre-approval on the other hand, is in-depth. It includes a more thorough assessment of your finances. It also offers a rate hold of up to 120 days , while a pre-qualification does not. Plus, if you apply for a TD mortgage pre-approval online, it has no impact on your credit score. These benefits make a pre-approval an important part of the mortgage process.

How To Get A Mortgage Pre

A mortgage pre-approval gives you some peace of mind and a competitive edge, helping you secure the home of your dreams.

Edited byChris JenningsUpdated October 12, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

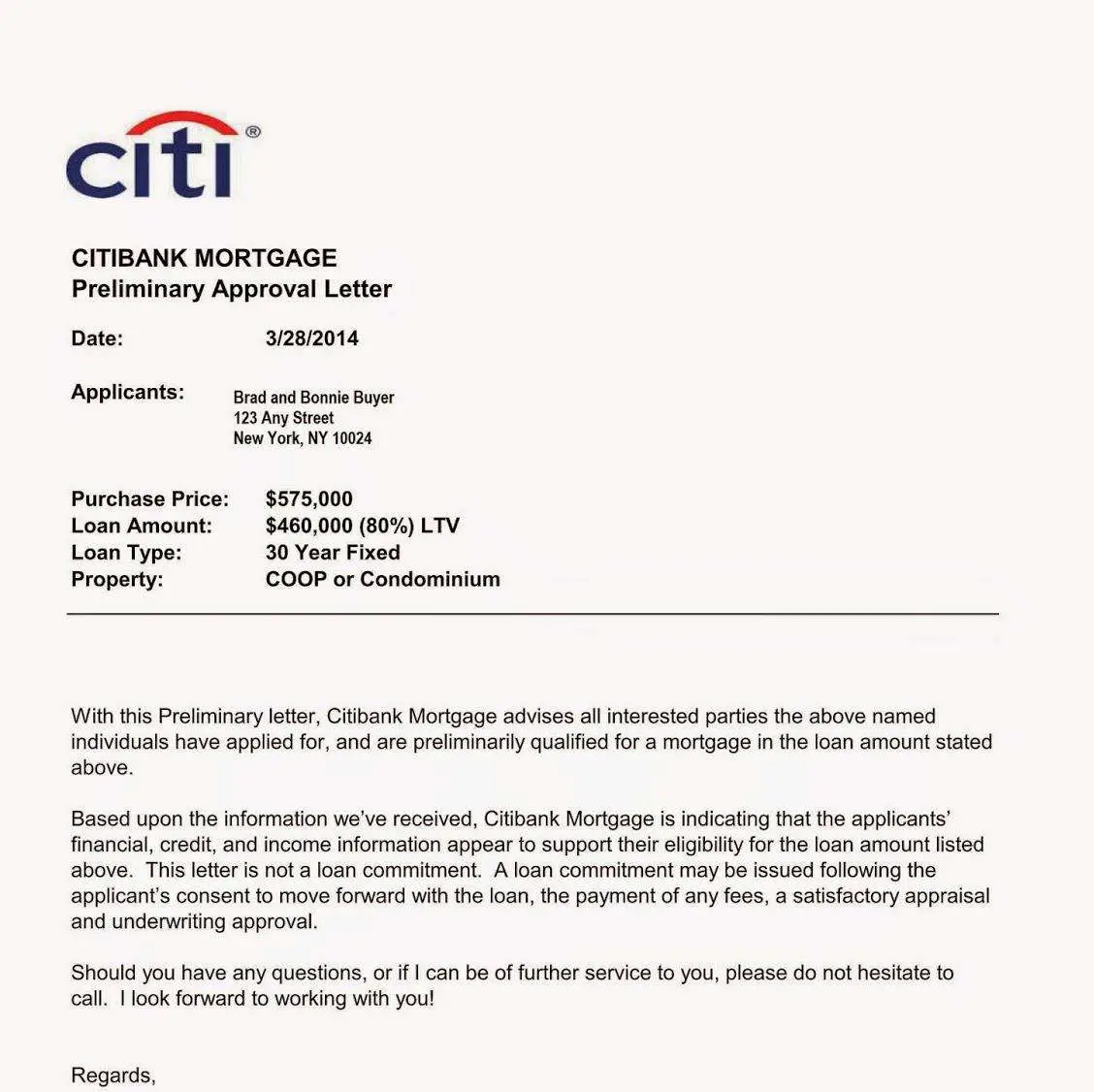

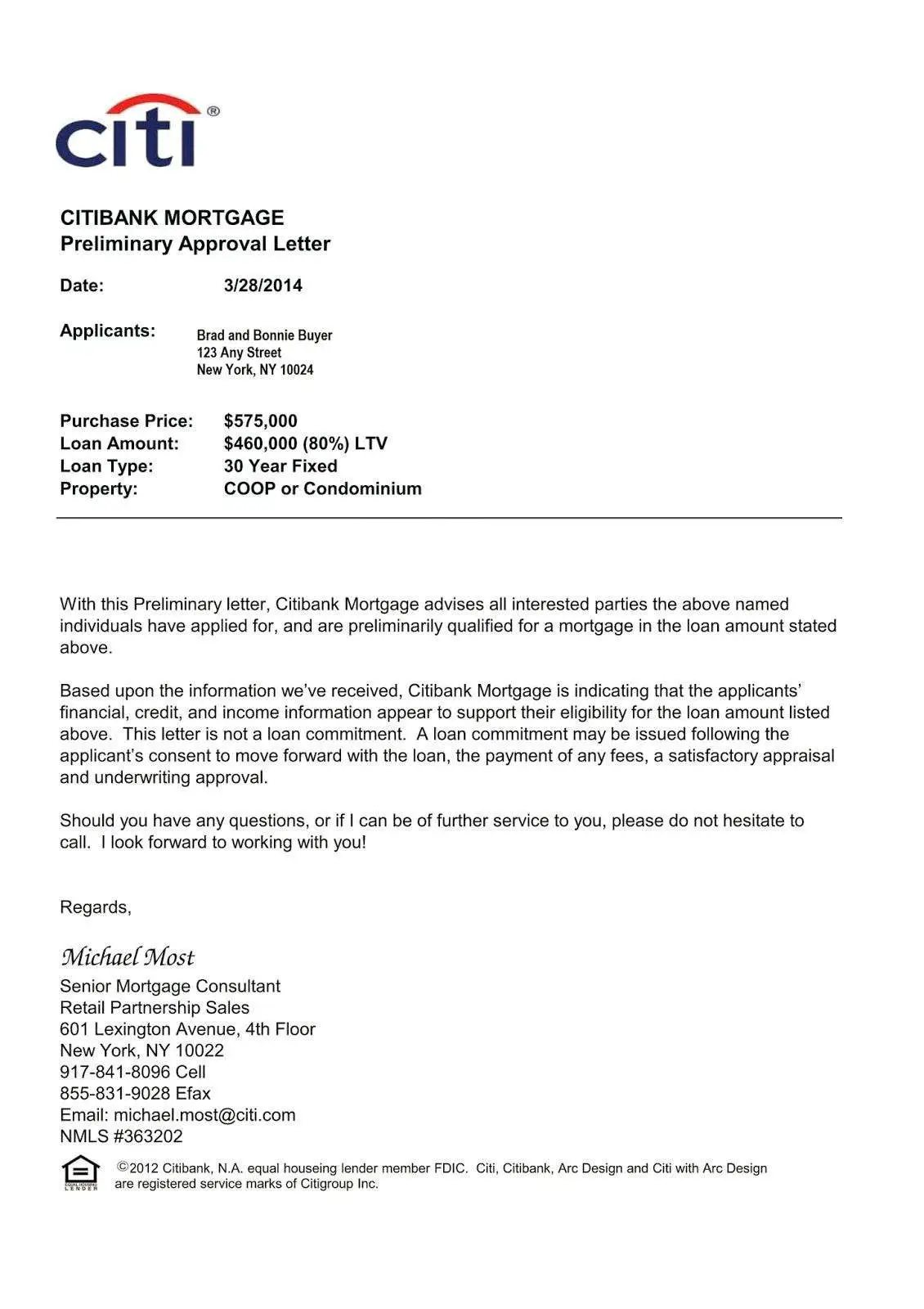

Getting pre-approved is a key step in the homebuying process. Once youre pre-approved by a lender, youll receive a mortgage pre-approval letter, which shows how much youre qualified to borrow. It also demonstrates to the seller that youre a serious buyer.

If you want to get pre-approved for a mortgage, make sure to follow these five steps:

Read Also: What Kind Of Loan Do I Need To Buy Land

What Is A Pre

Essentially a sanction by the lender, pre-approval is the process whereby a bank determines a borrowers eligibility for a home loan, based on the individuals financial standing, credit history, net worth, age and repayment record.

Such a loan has its own advantages such as a relatively low interest rate, easy documentation and quick processing.Unlike a home loan, this does not involve scrutiny in to the technical and legal validation of the property you wish to buy. After having probed all the parameters and variables at play, the bank will assess whether you are eligible and accordingly license a loan, attach a specific rate of interest, payable over a definite period of time.

The borrower can avail of the pre-approved loan, only after submitting all relevant property related documents the bank needs for subsequent due diligence. However, a pre-approval doesnt add up to a guarantee by the lender. It is only an eligibility check and the lender retains the final right to approve of the loan once you have shortlisted the property and collated important paperwork. Generally, the pre-approval stands valid for about three months however, it is up to the specific lenders discretion.

Additional Read:Get your Home Loan Approved Instantly

How Is Your Experience With The Entire Pre

Let us know about your experience in the comments section below.

So if you want to know more about the step by step process of how to get a mortgage approval, check out this video series here, as well as additional videos on home financing, which you can find here. Don’t forget to subscribe to keep learning from the experts, and I’ll see you in the next video.

You May Like: Jp Morgan Chase Lien Release Department

What If You Get Declined By A Mortgage Insurance Provider

Clients will ask me, “We got declined for one. Is there a good chance we get declined from the other one?”

And I would say, “Not necessarily.”

Every insurance provider, even though they have certain guidelines to look at, their underwriting practice is a little bit different.

So it’s always worth trying it with all three insurance to see where it fits.

Now, if all three of them don’t want to get approved, then unfortunately, you’re out of options at that time, and then maybe we just have to wait a little bit.

We can do some low credit coaching at that time, maybe a little more saving down payment, and then get you back into the whole buying process again.

It might be very disheartening to didn’t get the approval that you were looking for, but the second time around, the chances are a lot higher of you getting approved, because now, we’ve mitigated any of the risks that your file has.

The approval process, it’s different, and it varies per circumstances, and per clients, and insurance companies.

Karl Yeh:

And if you want to know more about mortgage insurance, I’m going to leave a video up here and in the description below as well.

How Long Preapproval Lasts

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

The right home is out there.

Find it online at RocketHomes.com.

Read Also: How Long For Sba Loan Approval

Be Competitive For The Home You Want

The home-buying market is competitive these days. When you make an offer on a home, you are likely going to be up against several other buyers. A mortgage pre-approval can give you a leg up by showing the seller that you are serious.

Sometimes, sellers even want to see pre-approvals before they accept your offer. This lets them know that not only can you afford the offer youre making, but the closing process will move quickly.

You Know How Much You Can Afford

You need to consider several factors and make many decisions when youre looking to buy a new home. But before anything else, you need to know how much you can work with.

Purchasing a house is one of the biggest investments youll make in your life. If youre like most people, you probably wont be paying all the costs upfront. By getting pre-approved, youll know how much your budget would be, allowing you to look for a property thats within your budget.

Read Also: What To Do If Lender Rejects Your Loan Application

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

What Is Mortgage Prequalification

Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, youre getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals.

You May Like: Does Va Loan Work For Manufactured Homes

What Is Conditional Approval

Home loan pre-approval means that a lender has agreed, in principle, to lend you money towards the purchase of your home but hasnât proceeded to full or final approval. Getting pre-approved for your home loan allows you to look â and enquire â with confidence. Here are eight commonly asked questions about conditional approval, that important first step in the home buying journey.

What About Placing An Offer On A Property ‘subject To Finance’

Even if you have pre-approval for a home loan, you may want to make your offer subject to finance. That way, if your lender declines your home loan application, then you may be able to withdraw your offer.

Whether you choose to make an offer subject to finance or not is up to you. You should seek advice from your solicitor or conveyancer before making an offer so that you are fully aware of your rights and responsibilities, including the risks of making an offer.

If you are buying at auction, ‘subject to finance’ conditions are generally not allowed, so you should seek advice from your conveyancer or solicitor before you start bidding.

Don’t Miss: How Much To Loan Officers Make