So Does Mip Make Fha Loans Undesirable

For most borrowers of FHA loans, mortgage insurance is a pain worth enduring. If home prices are shooting up where you want to buy and you are having trouble qualifying for other mortgage loans, then putting up with MIP until you can refinance is likely worthwhile. This is because, in many real estate markets, you stand to make way more by being a homeowner than mortgage insurance costs you.

Peter Warden

MyMortgageInsider.com Contributor

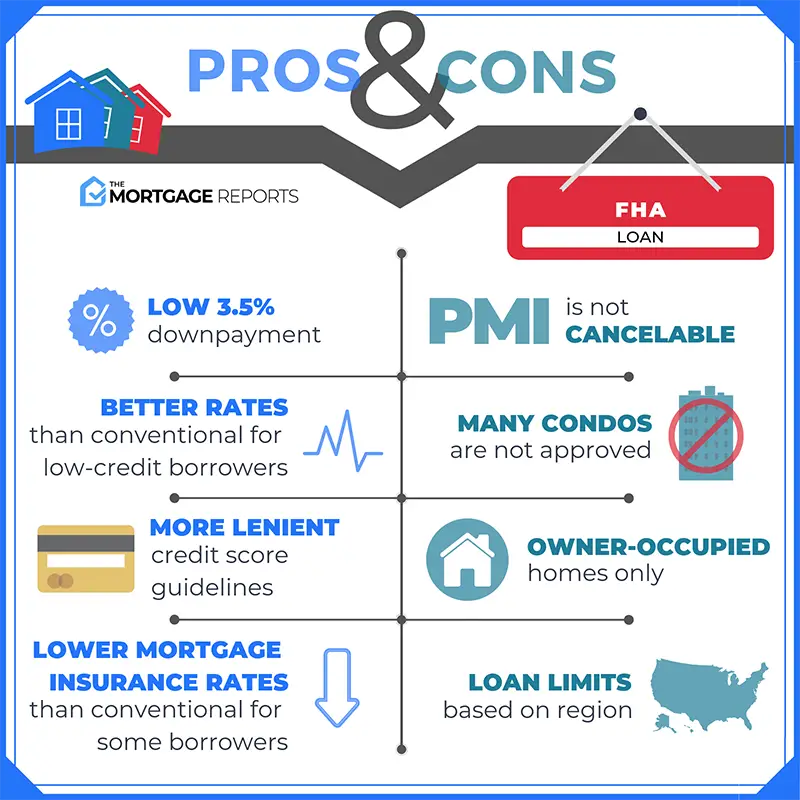

Disadvantages Of Fha Mortgages

FHA loans aren’t the perfect mortgage for everyone. There are certain limitations and conditions that may affect whether they’ll be the right choice for you.

For starters, there are limits on how much you can borrow with an FHA mortgage. FHA county loan limits for single-family homes range from $271,050 in most of the country to as much as $625,500 in counties with high real-estate values. .

FHA mortgage insurance is required on all FHA loans. There’s an upfront premium of 1.75 percent, plus an annual premium paid as part of your monthly mortgage payments. This may make an FHA mortgage more costly than other loan options, particularly if you have good credit. If you put less than 10 percent down, you need to carry FHA mortgage insurance for the life of the loan. Most mortgages allow you to cancel mortgage insurance once you reach 20 percent equity.

FHA home loans have stricter property eligibility requirements. Homes must pass an inspection to ensure there are no structural problems or hazards.

FHA mortgage guidelines generally do not allow them to be used to buy a second home or investment property. They can only be used to buy a property for use as your primary residence.

More information: FHA mortgage pros and cons

How Does An Fha Loan Work

FHA loans are a home buying program backed by the Federal Housing Administration.

This agency which is an arm of the Department of Housing and Urban Development uses its FHA mortgage program to make homeownership more accessible to disadvantaged home buyers.

FHA does this by lowering the upfront barrier to home buying.

Reduced down payments and lower credit score requirements make homeownership more accessible to buyers who might not otherwise qualify for a mortgage.

Although FHA loans are backed by the federal government, theyre originated by private lenders. Most major lenders are FHA-approved, so its relatively easy to shop around and find your best deal on an FHA mortgage.

If you have a sub-par credit score, low savings, or high levels of debt, an FHA mortgage could help you get into a new home sooner rather than later.

You May Like: How To Get Loan Originator License

Fha Minimum Down Payment: 35%

With an FHA loan, the minimum down payment depends on your credit score. If you have a credit score that’s 580 or higher, the minimum down payment is 3.5%.

If your score falls between 500 to 579, the minimum down payment required is 10%. FHA guidelines sometimes refer to this as the Minimum Required Investment it just means the down payment.

Fha 203k Loan Requirements For 2021

A 203k is a subtype of the popular FHA loan, which is meant to help those who might not otherwise qualify for a mortgage.

FHAs flexibility makes203k qualification drastically easier than for a typical construction loan.

203k credit scorerequirements

FHA allows credit scores down to 580, although some lenders might require a score of 620-640 to qualify for a 203k loan.

Still, thats much lower than the 720 or higher you would probably need for a conventional construction loan.

Minimum downpayment

FHA requires just a 3.5 percent down payment, based on the purchase price and total project cost. For instance:

- Home price: $200,000

- Total project cost: $25,000

- Down payment: $7,875

You can receive 100 percent of your down payment requirement via a gift from family or an approved non-profit organization.

Income anddebt requirements

Lenders will examine your debt-to-income ratio, too. This is the comparison of your monthly income and debt payments.

Typically, less than 43percent of your income should go toward your proposed mortgage payment plus all otherdebts.

Thats $430 in payments per$1,000 of before-tax income.

For example, if your incomeis $5,000 per month, your future house payment plus auto loan payments, studentloan payments, and credit card bills shouldnt exceed $2,150 per month.

Loanamount

Using an FHA 203k loan, you can borrow up to 110% of the propertys proposedfuture value, or the home price plus renovation costs, whichever is less.

Occupancy

Citizenship

Recommended Reading: Defaulting On Sba Loan

Can You Put At Least 35% Down

The big advantage of an FHA loan is that you can get away with putting as little as 3.5% down, assuming your credit score is up to snuff. Another bonus of an FHA loan? Up to 100% of your FHA down payment can come from a gift. If you cant scrape together that 3.5%, though, youll have to wait and save up more down payment funds before getting an FHA loan.

Understanding Federal Housing Administration Loans

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lender, like a bank or another financial institution. However, the FHA guarantees the loan. Some people refer to it as an FHA-insured loan, for that reason.

In order to secure the guarantee of the FHA, borrowers that qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan.

While Federal Federal Housing Administration Loans require lower down payments and credit scores than conventional loans, they do carry other stringent requirements.

| How Long You Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

Is An FHA Mortgage Still A Bargain?

Also Check: Oneaz Auto Loan

Types Of Conventional Loans

Lets outline these two types of conventional loans: conforming and non-conforming.

Conforming loans have terms and conditions that comply with guidelines dictated by Fannie Mae and Freddie Mac, . These two companies purchase mortgage loans from lenders then package them into securities and sell them to investors.

Fannie Mae and Freddie Mac guidelines establish certain criteria such as:

- The maximum loan amount

- The down payment necessary to get a home loan

Loans that are above the maximum loan amount set forth by Fannie Mae and Freddie Mac guidelines are called non-conforming loans, and are also known as Jumbo loans. These loans are distributed on a smaller scale and have higher interest rates than regular conforming loans.

How To Qualify For An Fha 203k

Working with the right mortgage lender is essential when it comes to the 203k loan. For one, the Federal Housing Administration will only approve 203k home loans from an FHA-approved mortgage lender. Second, financing a fixer-upper with an FHA 203k loan is different from other types of home loans. There is a fair amount of paperwork required to meet application requirements. Youll need to work with approved contractors and verify all estimates for repairs and materials. In addition, you will often work with a HUD consultant.

Talk to your mortgage advisor about home renovation loans to find out which loan is the best fit. Buying a fixer-upper in 2021 can put you on the fast track to financial freedom, and getting approved for an FHA 203k loan might be the best next step.

Once your 203k loan is approved, you can rest assured youve got the financing you need to finish the work on your new home. Its a helpful safety net, especially if this is your first fixer-upper.

Recommended Reading: Can I Refinance My Sofi Personal Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can I Meet The Down Payment Requirement

Itâs true, mortgage lenders love borrowers who are able to make 20% down payments. But think about how long it would take for small families living on $70,000 per year to save $40,000 to buy a modest $200,000 home with conventional mortgages. FHA was created to solve this very problem and help those families that aren’t a good fit for a conventional loan. Wages have not accelerated with the pace of home prices. FHA’s 3.5% minimum down payment is vital to the health of America’s residential real estate market.

Expect your lender to verify you have your down payment saved and ready to go. You’ll be asked for bank statements confirming the funds are yours. If the money is a result of a large deposit, expect to identify where it came from. The minimum amount you’ll need is 3.5% of the purchase price. Remember, you’ll have closing costs if the seller hasn’t agreed to pay them , so your actual cash out of pocket will likely exceed your 3.5% down payment.

What if I don’t have 3.5% for my down payment?

Many first-time homebuyers who are new to the process struggle to come up with 3.5%. Fortunately, one of FHA’s greatest features is the allowance of a financial gift to cover your down payment.

An FHA down payment gift can be a fast-track to homeownership. It’s worth exploring if you do not yet have your down payment saved.

Don’t Miss: Va Manufactured Home 1976

Benefits Of Fha Loans

Once youve seen the FHA down payment requirements, you may wonder what the benefits of FHA loans are versus conventional loans. The biggest difference is accessibility. With conventional loans, youll often be shut out unless your credit score is 620 or greater. FHA is much more forgiving, typically allowing it to drop as low as 580.

Although FHA loans generally have lower down payments, there are instances where you can find conventional loans with down payments that are lower than the typical 5 to 20 percent. Its rare, though, and much more likely youll find a 3.5 percent FHA loan than a 3.5 percent conventional one. One benefit of conventional, though, is that you can get away from mortgage insurance once your loan-to-value ratio hits 80 percent. With an FHA loan, youll usually pay insurance premiums throughout the life of the loan.

What Down Payment Do You Need

While most homebuyers make a down payment below 20 percent, its best to put at least a 20 percent down payment when ready to buy your home. The less you borrow, the less money youll pay in interest. The more your down payment, the safer it is for mortgage lenders to offer you a favorable interest rate.

If you can afford to pay a 20 percent down payment, lenders will see you as a much safer investment. You will avoid paying private mortgage insurance, also known as PMI. If you put down less than 20 percent, the mortgage lender may require you to pay private mortgage insurance, which would be included in your monthly payment.

Recommended Reading: How Do I Find Out My Auto Loan Account Number

Fico Scores And Down Payment Requirements

First-time buyers want to know how much they’re expected to save for their FHA loan down payments. For those who qualify financially as new borrowers or return borrowers, the minimum FHA mortgage down payment is 3.5%. However, that low down payment option is not available for everyone.

Those who have marginal FICO scores are required to make a 10% down payment. According to FHA home loan minimum standards, those with FICO scores between 500 and 579 are required to come up with this higher down payment. Those with FICO scores at 580 or higher technically qualify for the lowest down payment offered.

It’s best to start saving early for your down payment and to anticipate how much that payment might be. You’ll need to estimate the price range for the home you want to buy and calculate either the 3.5% or 10% down payment using that potential sales price as your guide.

What Is Covered Under Fha 203k

Homebuyers can use a standard FHA 203 mortgage to do almost any type of renovation except for luxury amenities . Also, all updates and repairs must be considered permanent for the home. A few popular renovations that are covered:

- Upgrades to remove health and safety hazards

- Improve accessibility for a disabled person

- Update plumbing and sewer systems

- Structural changes such as adding bedrooms

- Remodel bathrooms and kitchens

- Install or replace flooring, windows, roofing

- Major landscaping projects

Its a good idea to meet with contractors early to make sure your project can get started as soon as the loan closes. Make sure to find a contractor with experience working on projects financed with an FHA 203k loan.

All renovations financed with a 203k loan must be finished within six months.

Recommended Reading: Usaa Auto Refinance Phone Number

Gathering A Down Payment

Although there are various ways to satisfy the FHA down payment requirements, drawing the money from your own savings account is usually the easiest. Setting money aside for a down payment can be challenging if youre already struggling to pay your bills. There are small things you can do on a daily basis to make it easier, though.

The first step in any savings plan is to set a goal. Determine how much youll need for a house in your target range and pinpoint how much youll need to save each month to make it happen. Look for small things you can cut in your budget that will add up over time, even if its taking your lunch to work or dropping cable TV. A side hustle can get you even further toward that goal, whether its dog-walking, tutoring or driving for a ride-sharing service.

Saving For A Home Down Payment But Not Quite There Yet

If your progress is slow, I have bad news. Its no longer a marathon, its a race.

Utah is one of the fastest growing states in the country. Ive had borrowers from all over relocate and purchase homes here. Especially from high-cost states like California and Oregon, where home prices are so out of reach, that many simply cant afford to buy anything.

This is only one small piece of the housing puzzle.

Increased demand has pushed home prices up, which are pushing the cost of property taxes up. Add rising mortgage interest rates in the mix, and you effectively qualify for less home the more you wait.

If you think youre safe paying rent, think again.

Rent prices are moving up as well. More and more landlords are selling their investment properties and using the cash for other projects. Some were only renting out because their previous home value couldnt justify a sale. When was the last time you talked to your landlord about the future of your lease?

But I dont have a down payment saved or I have some credit issues. Stop that.

If you are determined to build better prospects for yourself, you will find a way. And it starts by researching, asking questions, and taking action.

Youre staring at the start line right now, reading this.

Read Also: Does Va Loan Work For Manufactured Homes

Qualifying For An Fha Loan

Qualifying for an FHA loan is much easier than trying to qualify for a conventional mortgage loan. No matter your income level, you can gain access to an FHA loan. You can check with several different lenders to see what their requirements are and there is no minimum income level required to qualify.

However, you should still have a reasonable debt-to-income ratio, so you can show you can afford the monthly payments. Borrowers with lower credit scores or less-than-perfect credit are also likely to get approved for the 3.5% down payment. However, if you can pay a bit more toward the down payment of the home, your score can even be between the 500 and 580 mark, and you could still qualify.

How Much Do You Have To Put Down On A 203k Loan

The minimum down payment is 3.5% for applicants with a credit score above 580. For homebuyers with a credit score between 500-580, the typical down payment required is 10%. Gifted funds are allowed from friends and family, and there are also down payment assistant programs that might be available. Connect with a mortgage advisor to decide which mortgage program will save you the most money.

If your credit score is wavering, learn how to improve your credit score in less than 60 days which we blogged about here.

You May Like: Rv Loan 600 Credit Score

Is 10000 Dollars Enough To Buy A House

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If youre buying a home for $200,000, in this case, youll need $10,000 to secure a home loan. FHA Mortgage. For a government-backed mortgage like an FHA mortgage, the minimum down payment is 3.5%.

The Upfront Mortgage Insurance Premium:

FHA loans have a hefty upfront mortgage insurance premium equal to 1.75% of the loan amount. This is typically bundled into the loan amount and paid off throughout the life of the loan.

For example, if you were to purchase a $100,000 property and put down the minimum 3.5%, youd be subject to an upfront MIP of $1,688.75, which would be added to the $96,500 base loan amount, creating a total loan amount of $98,188.75.

And no, the upfront MIP is not rounded up to the nearest dollar. Use a mortgage calculator to figure out the premium and final loan amount.

However, your LTV would still be considered 96.5%, despite the addition of the upfront MIP.

Don’t Miss: How Much Car Can I Afford For 500 A Month