How To Calculate Auto Loan Payments

This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.There are 11 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 416,343 times.

Buying a new or used car, for most people, is not a purchase made by writing a check or handing over cash for the full amount. At least part of the amount is typically financed. If you do finance a car, it’s important that you understand exactly how much you’ll be paying every month, otherwise you could end up going over budget.

A Few Additional Tips About Using The Car Loan Calculator

In addition to;looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the calculator’s total amount paid result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

The car loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates;and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

How Does The Car Loan Payoff Calculator Work

Our calculator helps you work out the costs associated with purchasing a car on credit. Once you have entered the amount, the interest rate and the period of the loan, the calculator will return the total repayment amount, the total interest and the monthly payment figure, as well as full amortization.

Don’t Miss: What Is The Lowest Car Loan Rate

What To Do With Your Trade

Although it’s convenient to trade in your old vehicle to the dealer at the time of purchasing another, it’s not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice; from the Arizona Attorney General to the FTC. Don’t underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, it’s extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put a “for sale” sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

You May Like: How Much Can I Borrow Personal Loan Calculator

How To Calculate Auto Loan Interest For First Payment

When figuring out how to calculate auto loan interest for the initial payment, the steps below can help:

The number you get is the amount of interest you pay in month one.

Divide Total Interest By Time

Once you have the total amount of interest you will pay off over the life of the loan, divide this number by the number of years you will be paying on the loan to determine the yearly interest payments. You can then divide this number by twelve to determine the amount of your monthly payment that will be applied to interest. An auto loan calculator available on the Internet can aid in this process, which can help you customize your payment options to fit your budget and financial schedule.

Before you take out a loan for a new or used car, you should calculate the auto loan interest that youll end up paying on the loan. Auto loan terms can be hard to understand sometimes, if not misleading.

Recommended Reading: Can I Roll Closing Costs Into Loan

There’s More To A Loan Than A Monthly Payment

That same wise shopper will look not only at the interest rate but also the length of the loan. The longer you stretch out the payments, the more expensive the loan will be. Let’s take that same $20,000 loan above at 5% at 5 years and see how much we can save by paying it off in 3 years. So, $20,000 at 5% for 36 months will cost $21,579.05 saving you $1,066.43. Using the calculator above you will see that the monthly payment for the 5 year loan is $377.42 and the monthly payment for the 3 year loan is $599.42. If you can easily handle the higher payment the savings are well worth it.

If your credit drastically improves & your initial loan was at a higher interest rate, it may be worth looking into refinancing at a lower rate.

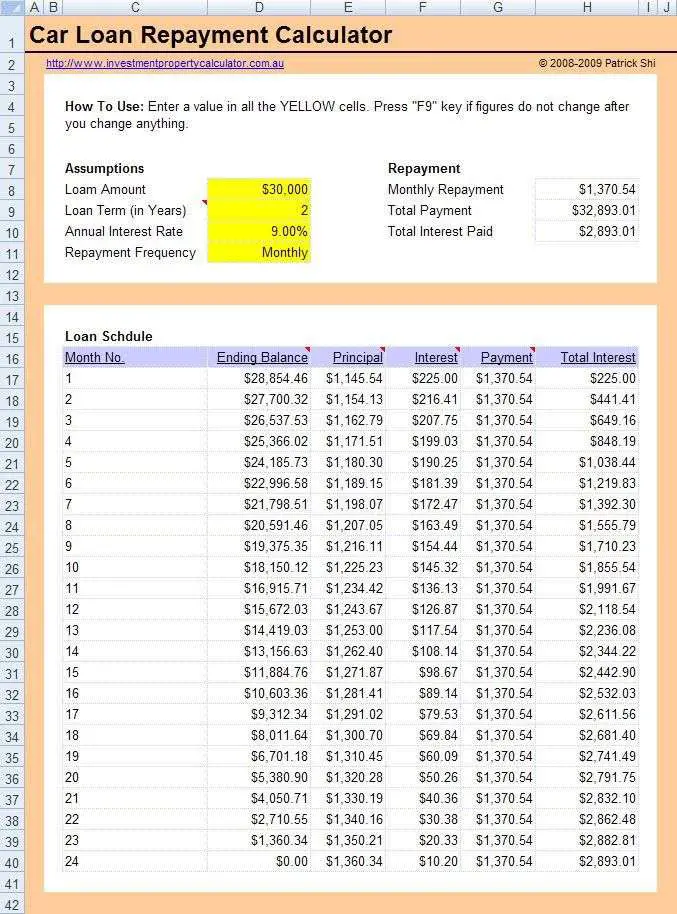

How To Calculate A Car Loan In Excel

wikiHow is a wiki, similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 9 people, some anonymous, worked to edit and improve it over time. This article has been viewed 193,709 times.Learn more…

Microsoft’s Excel spreadsheet program can be used for many different types of business and personal applications. For instance, you can use Excel to calculate car loan transactions and payment amounts as well as the total interest paid over the life of a loan. In addition, you can use Excel to compare multiple scenarios in order to make sound financial decisions. Here’s how to calculate a car loan in Excel before you make a commitment.

Read Also: Can You Add Onto An Existing Loan

What You Need To Know

Before you can calculate your exact payments, you’ll need to collect some information about your car and finances. The Consumer Financial Protection Bureau has a handy worksheet you can use to gather this information, just fill in your details next to the example scenario.

First, figure out the overall value of the car and registration. This figure includes the sticker price of your car, along with any taxes, titling fees, warranties, and prior car loan amounts being rolled over into your new car loan. Once you’ve calculated this cost, you can subtract your down payment, along with any applicable rebates and the trade-in value of your previous vehicle.

Next, take a close look at the terms of the loan. To determine the car payment amount, you will need to know the length of the loan and the interest rate you will pay. The period of vehicle loans is generally stated in months, even if it lasts for years.

The CFPB has documented a steady rise in the length of car loans. Term lengths of six years or more made up just 26% of car loans issued in 2009. By 2017, these long-term loans made up 42% of car loans.

Save Time And Interest

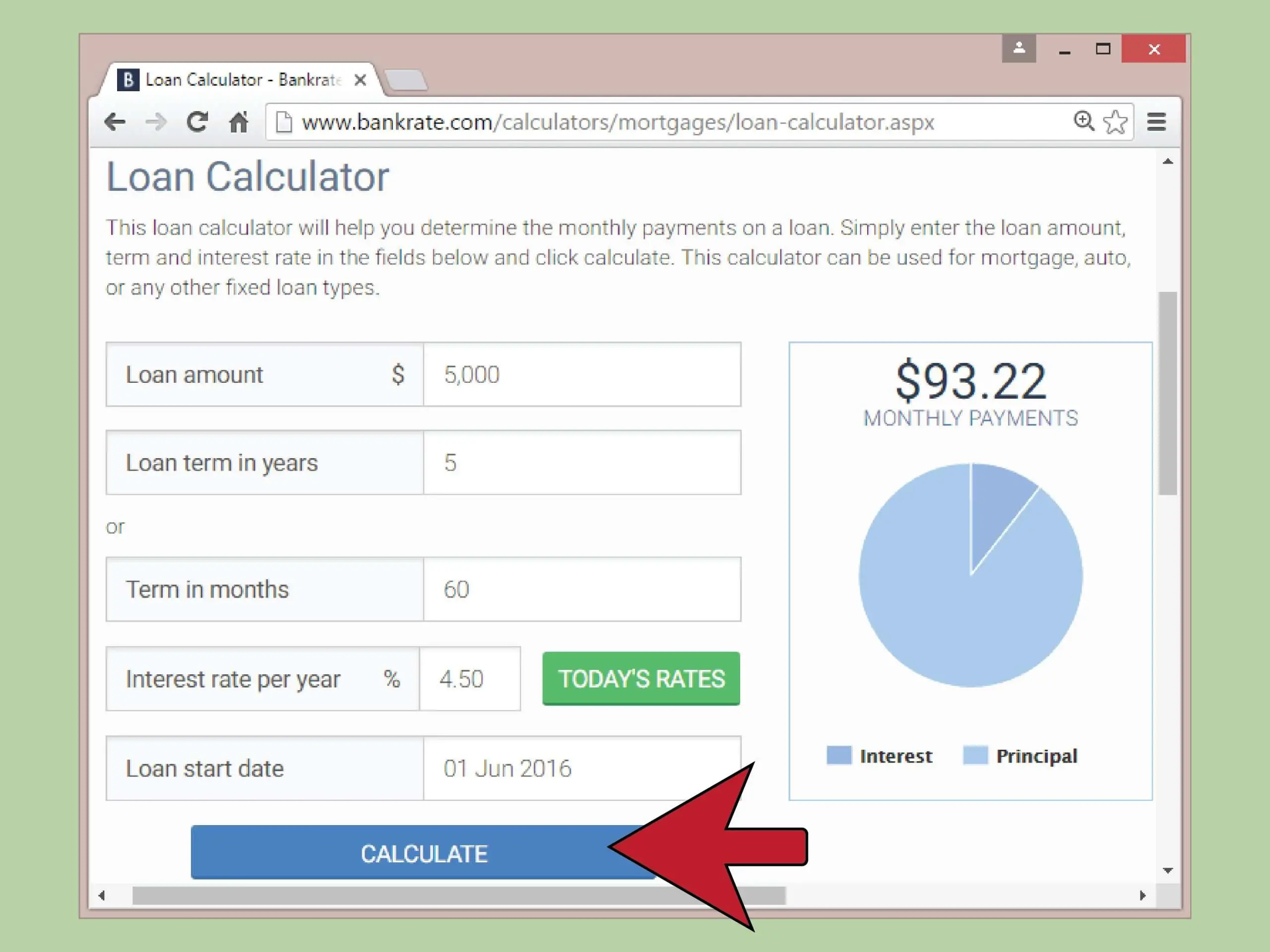

Wondering how to pay off your car loan faster while saving interest? Increasing your monthly payment could be a smart way to save yourself money in the long run. The Bankrate Auto Loan Early Payoff Calculator will help you create the best strategy to shorten the term of your car loan..

Enter your information into the early loan payoff calculator below, including your additional monthly payment, and click Calculate to see your total savings. Click “view the report” to see a complete amortization payment schedule.

You May Like: How To Qualify For Loan Modification

What If The Math Still Doesn’t Add Up

If these two steps made you break out in stress sweats, allow us to introduce to you our third and final step: use an online loanpayment calculator. You just need to make sure you’re plugging the right numbers into the right spots. The Balance offers for calculating amortized loans. This loan calculator from Calculator.net can do the heavy lifting for you or your calculator, but knowing how the math breaks down throughout your loan term makes you a more informed consumer.

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

Also Check: Can You Include Closing Costs In Loan

Early Auto Loan Payoff Calculator Faqs

What is a pay-off car loan early calculator?

A pay-off car loan early calculator is a calculator that helps you know how much time you can shave-off from your car payment and the interest you can save by increasing your monthly car payments.

How will an auto loan calculator help me with extra payments?

Auto loans that span for a long period are great, but they accrue a lot of interest to be paid over time. Our auto loan calculator will show you just how much you can save on these interests by making extra monthly payments.

How To Use The Car Loan Calculator

Heres a guide for the information you will need to input into the car loan payment calculator.

Car price:;In this field, put in the price you think youll pay for the car. To estimate new car prices,;you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars,;estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate:;There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment:;Enter;the total amount of cash youre putting toward the new car, plus;the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

Don’t Miss: How Do I Access My Student Loan Account Number

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

Using Microsoft Excel To Calculate Auto Loan Payments

You May Like: How Much Loan Can I Get With 800 Credit Score

How To Get The Best Deal

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.