How Scammers Typically Find Their Victims

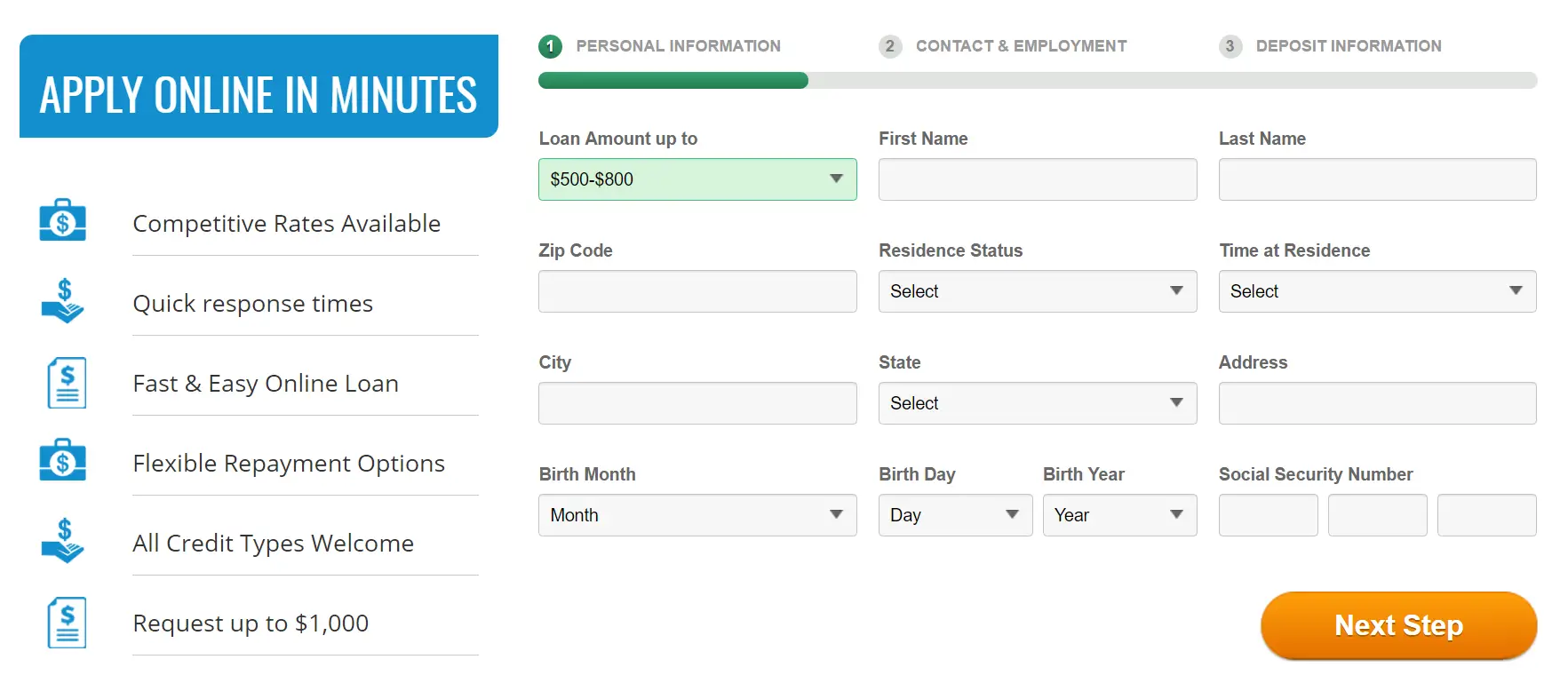

You may be on their list. If you have applied for loans lately, you can be assured that your need for financial assistance has been made known to others besides the company to which you have applied. Often, such consumer information is sold by the credit reporting agencies, passing into hands far and wide. This practice makes it easy for unscrupulous companies to find potential victims for scams like advance fee loans. Be wary of unsolicited offers promising guaranteed loan approval made by mail, phone, or email, especially if personal information is requested. Never give out any personal information, such as your social security or bank account numbers, unless it is to a trusted company with which you have initiated contact.

Worried You’re Being Scammed

I hope this helps you navigate the world of student loans a little better and avoid getting played. If you want to know more, don’t forget to check out my Definitive Guide to Student Loan Debt.

Are you worried that you could be dealing with a scammer? Stop by our new Student Loan Forum and post about it in the Student Loan Scams section. Protect yourself and protect others as well!

Readers, have you ever been the victim of a student loan scam?

Robert Farrington is Americas Millennial Money Expert® and Americas Student Loan Debt Expert, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications including the New York Times, Washington Post, Fox, ABC, NBC, and more. He is also a regular contributor to Forbes.

Is A Personal Line Of Credit Right For Me

We want you to be sure that you are making the right decision for your personal situation. Visit our help section to learn more about LendDirect personal lines of credit.

Interest rates range from 19.99% to 46.93% Annual Interest Rate.Subject to eligibility, credit check, underwriting and approval. Terms and conditions apply.Credit limit and interest rate are based on creditworthiness at time of application.Generally, applicants who are most creditworthy qualify for the lowest rates. All loans are open-ended with no minimum or maximum payback term.15-minute funding available only when using Interac e-Transfer®from 9:00am ET to 10:00pm ET Monday – Saturday subject to system limitations.e-Transfers submitted after 10:00pm ET will receive their transfer the next day .Interac e-Transfer® can be used to transfer funds up to $10,000.Interac® and the Interac design are registered trademarks of Interac Inc.

Cash advances only available up to approved credit limit some restrictions may apply.

Loan Protection: Must be 18 years of age or older, and under 70 years of age to be eligible.Policy sold and administered by Premium Services Group Inc.Underwritten by Canadian Premier Life Insurance Company.

Read Also: How Much Do I Pay For Student Loan

Are Bad Credit Loans Legitimate

There are several legitimate business lenders who specialize in working with borrowers with bad credit. In most cases, those lenders will base their decision on your verifiable business revenues and will require at least a year in business. Take your time when comparing bad credit business lenders to make sure you not only avoid scams but also improve your chances of getting favorable terms on your loan.

Restore Your Financial Freedom Apply For An Instant Loan Approval With Us Now And Wellimmediately Connect You To A Top Canadian Lender That Is Most Likely To Approve Your Loan Todaywe Help Many Customers Each Day To Get Their Loans Approved And We Can Help You Too No Matterwhat Your Credit Status Is

Getting Your Loan

A super easy, straightforward process

-

Complete a short application online

It takes just a few minutes to complete our no-obligation online application for easy approval loans

-

Instantly access over 20+ reputable Canadian lenders

Get the best chance of approval. Your application will instantly be seen by over 20+ lenders

-

Receive best loan offers from lenders who approve your loan

Compare approval offers and select the best loan option

-

Get connected to your chosen lender and receive your cash loan

Finalise process with lender and receive payment into your account today*

Read Also: Where To Get Fast Loan Online

What To Do If You Think Youve Been Scammed

While no one wants to think that theyve been a victim of fraud, it can and does happen. The good news is that there are several steps you can take if youve been targeted, beginning with cutting off all communication with the company in question.

Here are some additional steps to consider taking:

- Provide documentation of what happened. If you have emails, screenshots or other documentation that will help your case, gather them to present to authorities.

- Contact your local law enforcement. By filling out a police report, youll have an official record.

- Contact agencies specializing in oversight. After calling law enforcement, consider contacting your state attorney generals office, the FBI, the FTC and the Better Business Bureau. With this information, these agencies can better serve and protect Americas consumers.

- Talk about it with family and friends. As scammers evolve their tactics, its important to help others stay informed.

- Place a fraud alert with one of the major credit bureaus. If you place an alert with Equifax, Experian or TransUnion, the alert will be posted with all three. A fraud alert isnt a credit freeze instead, it lets creditors know you may be a victim of fraud and that they should contact you to verify your identity before issuing new credit.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: How To Get Personal Loan With Low Interest

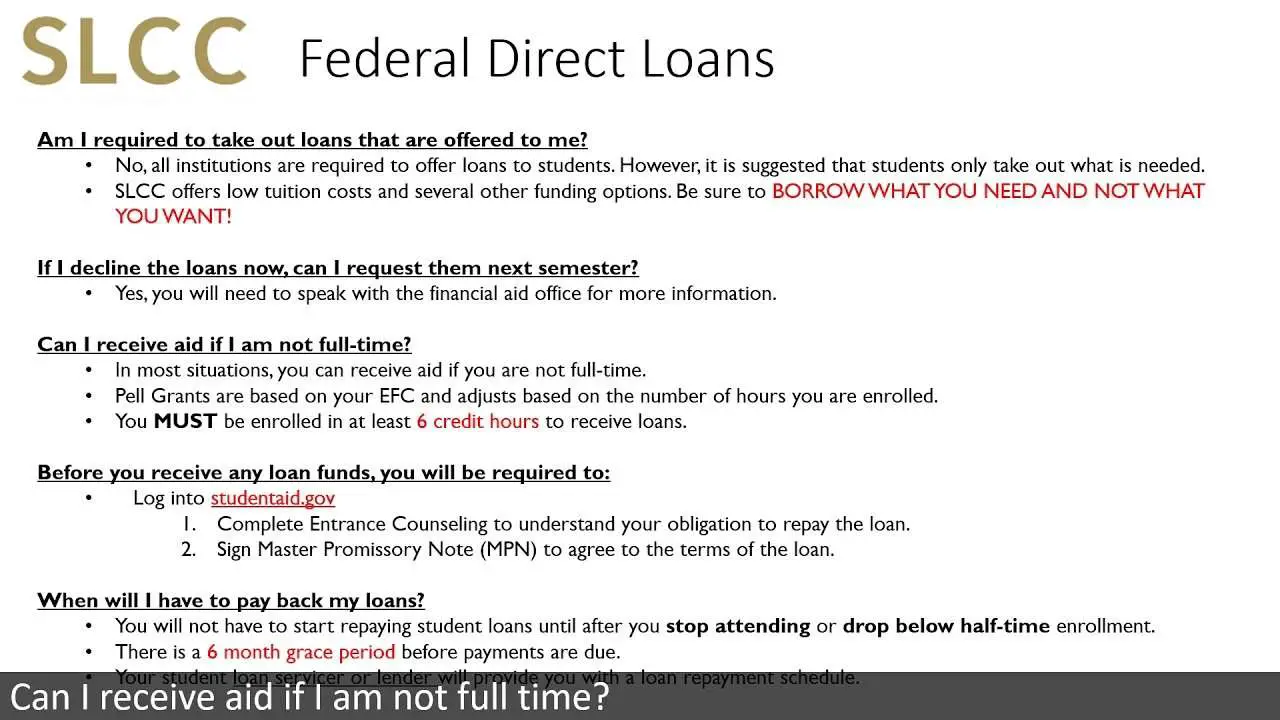

Danger : You Can Easily Borrow More Than You Need

When you apply for a Direct PLUS Loan for your child, the government will check your , but not your income or debt-to-income ratio. In fact, it does not even consider what other debts you have. The only negative thing it looks for is an adverse . Once you’re approved for the loan, the school sets the loan amount based on its cost of attendance. However, a schools cost of attendance is usually more than most students actually pay. This can lead to parents borrowing more than their child needs for college.

If you have other outstanding debt, such as a mortgage, you may find yourself in over your head when it comes time to repay the PLUS loan.

The Nuts And Bolts Of A $200 Payday Loan

How this works is as follows: payday loans companies are non-traditional financial institutions. You will most commonly contact them through a website they’ve paid loans online since the 2000s. Their most important feature is that you’re supposed to settle up on a payday loan when you receive your next paycheck .

The fact that customers’ ability to repay payday loans is backed by their earnings instead of their credit history has two important consequences. Firstly, almost anyone who meets some basic requirements is almost certain to get a $200 payday loan just by asking. Though most lenders will at least check your credit score, bad credit usually isn’t an issue: since this is a quick loan you’re expected to pay off by payday, they’re willing to trust nearly anyone with a $200 loan for a few weeks.

Read Also: How Do I Access My Student Loan Account Number

Are Payday Loans My Best Choice What Other Kinds Of Loans Are There

Though the phrase “payday loans” is the most popular, there are a lot of other names for them: deferred deposit loans, payday cash advances, salary loans, and small-dollar loans are all more or less the same thing. This can get confusing, but there’s more: many payday lenders specialize in particular types of loan or customer:

Types Of Loans To Avoid

Here are some loans that are financial traps:

Car Title Loan By using your car title as collateral, you can receive a loan amount worth up to 50% of the cars value. But the interest rate on a car title loan is usually 25% per month and must be paid back in 30 days. On a $500 loan, that means you must repay $625 in 30 days or your car gets repossessed.

On some occasions, the loan might be rolled over into another month meaning an even larger cash outlay somewhere close to $800 to pay off interest and fees.

Because these loans are especially popular among military members, the Military Lending Act of 2006 protects service members and their families against predatory lending.

The law caps interest rates at 36% on loans with a term of 181 days or less to repay. It also requires lenders to alert service members of their rights and prohibits lenders from requiring borrowers to submit to arbitration in a dispute.

Two reasons to bypass this loan: a) You might lose your car b) Washington enacted a law that limited this loan. As members of law enforcement would say, Theres your clue.

Overdraft Protection Loan Most banks offer overdraft protection on checking accounts. That allows you to draw money from the bank even if your account balance is zero. The average bank fee for overdraft protection is $30-$35 each time it occurs. Lets think about this: If you are out of money already, how are you helping your future self by adding a $30 service fee?

Also Check: How To Use Va Loan For Investment Property

Single Family Housing Direct Home Loans

What does this program do? Also known as the Section 502 Direct Loan Program, this program assists low- and very-low-income applicants obtain decent, safe and sanitary housing in eligible rural areas by providing payment assistance to increase an applicants repayment ability. Payment assistance is a type of subsidy that reduces the mortgage payment for a short time. The amount of assistance is determined by the adjusted family income.

For existing Section 502 direct and 504 borrowers who have received a payment moratorium related to COVID-19. The American Rescue Plan Act of 2021 appropriated additional funds for Section 502 direct and 504 loans, to remain available until September 30, 2023. The focus will be to refinance existing Section 502 direct and Section 504 borrowers who have received a payment moratorium related to COVID-19. Beginning May 17, 2021, the Agency will accept applications from existing Section 502 direct and Section 504 loan borrowers, to refinance outstanding loans which have been in an approved COVID-19 moratorium. Details are available in the ARP Program Fact Sheet. Additional information for these borrowers, including a standardized application package, is available at .

Applicants must:

Properties financed with direct loan funds must:

Applicants must meet income eligibility for a direct loan. Please select your state from the dropdown menu above.

How much may I borrow?

What governs this program?

You Feel Pressured Into A Loan

When shopping for a personal loan, you should also keep an eye out for offers set to expire within a short period of time or loans with otherwise urgent application requirements. Reputable lenders generally have consistent loan offerings that are based on factors like creditworthiness and current personal loan rates. And, while some lenders can offer limited time fee waivers, these temporary deals often are limited to fees and wont affect your interest rate or other loan terms.

Therefore, if a lender tries to pressure you into a loan by offering a low interest rateand then claiming its only available for a short timeits likely a scam.

Also Check: Can I Refinance My Sofi Loan

How To Qualify For A Lendingclub Personal Loan

LendingClub requires that all borrowers be at least 18 years old, have a verifiable bank account, and are either a U.S. citizen, a permanent resident, or living in the U.S. on a valid, long-term visa. LendingClub loans are not available to residents of Iowa or the U.S. territories.

Although LendingClub doesnt list any credit score requirements on their website, a PR representative confirmed that the minimum credit score required to qualify for a personal loan is 600. Keep in mind that even if you qualify for a loan, having a lower credit score will likely mean getting higher interest rates or qualifying for a lower loan amount.

LendingClub doesnt have any minimum income requirements, although they do require proof of income. Your debt-to-income ratio, along with your credit history and credit score, may affect your loan approval and interest rate.

If you have trouble qualifying for a loan due to a poor credit score, LendingClub allows you to add a co-borrower, which may help you qualify. Adding a co-borrower to a personal loan has its risks and benefits, so be sure to consider the pros and cons before starting a joint loan application.

LendingClub allows members to have up to two active personal loans through LendingClub at the same time. However, the combined minimum outstanding amount must be less than $40,000, and youll need a history of on-time payments on your first loan in order to qualify for a second one.

You’ve Got Options If You Were Denied Pslf

If your application for Public Service Loan Forgiveness was denied, you may be able to receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness opportunity.

As part of this opportunity, the Department of Education reconsiders your eligibility using an expanded list of qualifying repayment plans.

This TEPSLF opportunity is temporary, has limited funding, and will be provided on a first come, first served basis. Once all of the funds are used, the TEPSLF opportunity will end.

Visit StudentAid.gov for detailed information on how to be reconsidered for loan forgiveness.

Also Check: How To Get Better Interest Rate On Car Loan

Who Is Upgrade Best For

Upgrade personal loans are available from just $1,000 to $50,000, making it best for borrowers who need access to smaller loans. And, while Upgrade may help borrowers with fair credit get approved, applicants with higher scores are more likely to avoid the companys highest APRs. Upgrade personal loans are generally unsecured, but the company may offer eligible applicants a secured loan to make it easier to qualify or access a lower rate.

When considering Upgrade, keep in mind that the company does not offer loans in Iowa, West Virginia or Washington, D.C.

How A Simple Loan Works

- Apply anytime within online and mobile banking, with a real-time decision1 and quick access to loan funds.

- Borrow up to $1,000, in $100 increments.

- Loan funds are deposited directly into your U.S. Bank consumer checking account.

- Repay the loan in three monthly payments.

- No late fees or prepayment fees.

Recommended Reading: What Is The Housing Loan Interest Rate

Small Payday Loans Overview

Most short-term loans available online get approved the next business day regardless of your credit score. However, lenders have rights reserved to reject borrowers who defaulted on payday loans before or have fallen into bankruptcy. Below, youll learn about the most common short-term and small loans available on the direct lenders market.

Netcredit Reviews & Transparency

Category Rating: 4.5/5

- Better Business Bureau: NetCredit , receives a score of A+ but is not accredited. Their parent company, Enova International, Inc., has an A rating and is not accredited.

- Consumer Financial Protection Bureau: Enova International, Inc., the parent company of NetCredit, has 25 personal loan complaints with the CFPB. Many have to do with NetCredits extremely high interest rates and high payment amounts. Enova International has always responded in a timely fashion.

- WalletHub: NetCredit has a user score of 4.1/5 from more than 320 reviews.

- Transparency: NetCredits website does list their rates and fees, but you must check them on a state-by-state basis. NetCredit could be clearer about the overall ranges. Its helpful that NetCredit has a pre-qualification tool, but the fact that theyre vague about overall minimum requirements isnt great.

Read Also: How Many Type Of Mortgage Loan

Research The Business Location

Look under the website contact information for a physical address, then look that address up on google maps. You may be surprised how many of these searches result in a residential home address or a business that has nothing to do with lending! If the only address is a P.O Box, make sure you do additional research to verify the company is legitimate. You can also do a reverse search on the phone number calling you.