How To Calculate Ppp Loan Amount If You Are Self Employed

Here we are focusing on those who are self-employed and who file a Form 1040, Schedule C. As a reminder, the SBA states you may be eligible for a PPP loan if:

- You were in operation on February 15, 2020

- You are an individual with self-employment income

- Your principal place of residence is in the United States and

- You filed or will file a Form 1040 Schedule C for 2019 or 2020.

For those who are self-employed and file a Form 1040, Schedule C, the SBA provides separate calculations based on whether or not you have employees. You will find those below.

Update: On March 3, 2021 the SBA released a new Interim Final Rule that applies to PPP applicants who are self-employed. Prior to this change, self-employed borrowers who file Schedule C used line 31 of their Schedule C to calculate the owners compensation portion of their loan amount. The new calculation provides more flexibility, allowing borrowers to use net profit or gross income.

Note: Do not include payments you make to 1099 contractors in your payroll. They can apply for PPP themselves.

Can I Request More Money If I Used Net Profit

If you applied for PPP as a self-employed individual using net profit, you may discover you could get a larger loan by using gross income. The change in calculation methods is not retroactive. The IFR states that it applies to loans approved after the effective date.

However, it appears that whether you can get a larger loan amount depends on the status of your loan. Information provided by SBA to lenders states that a lender may cancel a PPP loan application and submit a new application on behalf of the borrower all the way up to the point where the loan funds have been disbursed to the borrower but a Form 1502 has not been submitted by the lender to the SBA.

Once the loan has been disbursed and the lender has filed Form 1502 with the SBA, there is no option to reapply for a larger amount.

Contact your lender if you have already submitted a loan application based on Schedule C net profits and have questions about the new calculations.

Keep in mind that if you already qualified based on the maximum owners compensation of $20,833 based on net profit on your Schedule C there is no need to do anything. .

If You File A Schedule C Take Note: Sba Offers Guidance For Self

From April 3 through April 14, 2020, the Small Business Administration has guaranteed over one million loans under the Paycheck Protection Program . Over 4,600 lenders throughout the U.S. have been tasked with serving as conduits for distributing $349 billion in federal loan funds made available for the PPP, with approximately $296 billion dollars having already been approved for distribution in eleven days. The average PPP loan amount so far has been $239,000, though the vast majority of approved loans have been for $150,000 or less.

Lenders have felt the urgency in which business applicants wish to obtain loan funds to maintain payroll and business operations during the COVID-19 crisis, while understanding that gaps in loan guidance are creating hesitancy amidst applicants and lenders who want to understand how these loans can ultimately be forgiven. With each loan application comes a unique set of facts, issues, and needs, and the SBA’s guidelines to borrowers and their lenders are constantly catching up to the pace of loan issuance.

You May Like: Loan License In California

Im Still Confused And Need Help Where Can I Get It

If you are still confused about the PPP forgiveness application process, here are a few suggestions that may help:

This article was originally written on May 19, 2020 and updated on July 28, 2021.

Does Ppp Verify With Irs

IRS summonsing bank records where back payroll taxes are owed and PPP loans were received. Although IRS is not indicating why they are investigating companies with payroll tax balances to confirm if those companies received PPP funds, this may be an indicator that IRS wants to confirm how the PPP funds were used.

Recommended Reading: Usaa Auto Loan Pre Approval

How Do I Document Forgiveness

If you are applying for forgiveness just based on owners compensation replacement the SBA states that the 2019 or 2020 Form 1040 Schedule C that the borrower provided at the time of the PPP loan application must be used to determine the amount of net profit allocated to the owner for the covered period.

If you include nonpayroll expenses you must include cancelled checks, payment receipts, transcripts of accounts, purchase orders, orders, invoices, or other documents verifying payments on nonpayroll costs.

What Is The Benefit Of The Paycheck Protection Program

This program is designed to help Americans stay employed and retain their salaries. As the name implies, this is a payroll-focused program. The payout you receive will be based on your average monthly payroll expense multiplied by 2.5. Under the PPP, your payroll expense can include your salary expenses and health insurance premiums.

The biggest perk of this program is that it can be almost entirely forgiven. If you keep your payroll expenses consistent to what they were before the COVID-19 pandemic, including the salary paid and the number of employees paid, you could be eligible to have those expenses forgiven from your loan amount, as well as certain other expenses such as rent and utilities.

The good news is that if you are self-employed , this should be easy to achieve!

However, it is important to note that you cannot receive both Unemployment Benefits and a PPP loan at the same time. You can use the PPP funds to pay yourself through whatâs called owner compensation share or proprietor costs. This is to compensate you for a loss of business income. To take the full amount of owner compensation share, you will have to use a covered period of at least 11 weeks weeks. By doing so, you are making yourself ineligible for unemployment benefits for the full 11 weeks.

You should consider the payout of each program to determine which is the best fit for you.

Further reading:PPP Loans vs. Unemployment Benefits

Recommended Reading: Credit Score For Usaa Auto Loan

Major Changes To Ppp For Schedule C Filers

by Thomas Maddrey | Mar 4, 2021 | COVID-19, Current News, Strictly Business Blog

Less than 24 hours ago, late Wednesday, March 3, 2021, the Small Business Administration posted the latest revision to the Paycheck Protection Program and these revisions have MAJOR effects on how sole proprietors, independent contractors, and others who file taxes using IRS Form 1040 Schedule C.

Bottom line? New applicants can now use Gross Income as a basis for their PPP amounts. This means that if you had a negative or low amount and could not get a PPP loan, or the loan amount was not worth getting previously, you may now be eligible.

The devil is in the details, however, so lets dive into the new rules, how this is different, and how this will affect many visual creators and the self-employed. Stay tuned to ASMP.org, and our weekly newsletter to see when I will be doing more classes and webinars on this.

Note that as before, you will apply for a PPP loan through your bank or financial company, and they will not be ready for these changes today. But if you havent applied, and this rule might apply to you, PLEASE WAIT UNTIL YOU CAN APPLY UNDER THESE NEW RULES! This change is NOT retroactive to previously approved and funded loans.

As always, remember that I am not a tax attorney or account, and it is critical that you seek out specific advice for your situation. This is not tax or legal advice.

Complete 1040 Schedule C Part Iiexpenses Section And Part Vother Expenses Section

The expenses incurred by your business reduce its profit, and this translates to a lower tax liability. Most of the fields in Part II are self-explanatory, and you can pull this information from your income statement. However, there may be some expenses that dont tie directly to any of lines 8 through 27a. Youll use Part V of Schedule C to reflect these expenses.

Below you will find a brief description of what information you need to report in the expenses section of 1040 Schedule C. For a complete description of deductible expenses, see our guide to IRS Business Expense Categories.

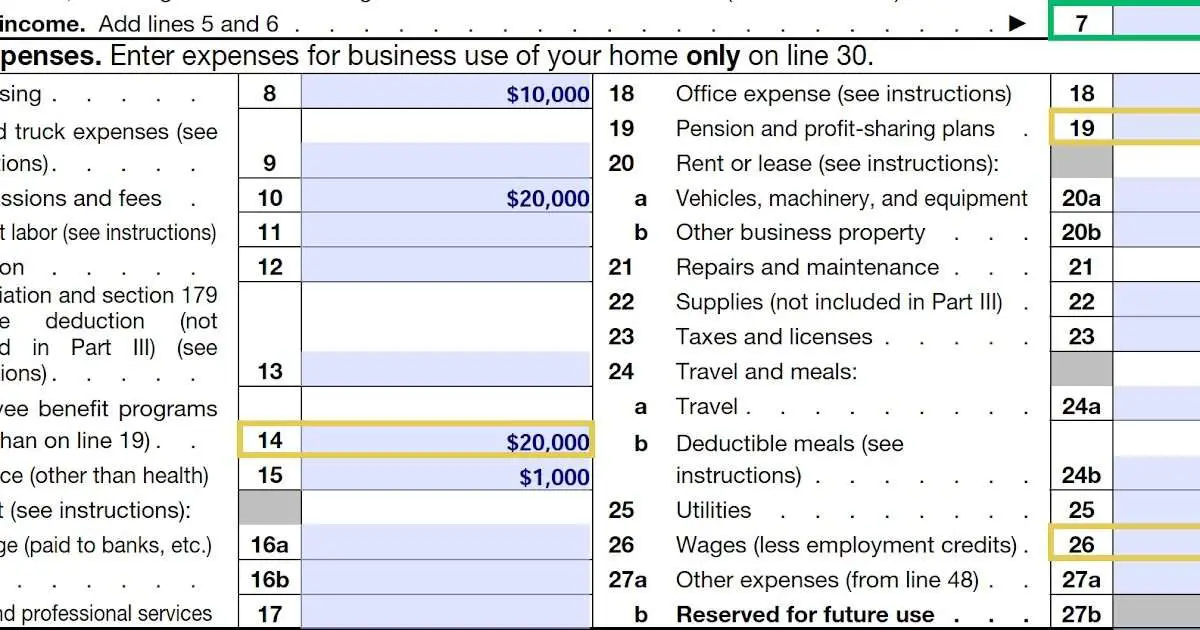

Below is an example of Part II:

Schedule C Part II

Line 9: Car and truck expensesYou have the option to deduct the actual expenses of using your vehicle for business or taking a standard mileage deduction.

Line 11: Contract LaborEnter payments made to independent contractors for services provided. Dont include any wages paid to employees reported on Form W-2.

Line 12: DepletionDepletion is only reported by companies that own and use natural resources, such as mining, timber, and petroleum businesses.

Line 13: Depreciation and section 179Include the annual deduction allowed to recover the cost of business equipment or investment property used in your business that has a useful life beyond the tax year. To learn more about how to calculate this deduction, check out IRS Publication 946.

Line 32If line 31 is negative, you need to check one of the following boxes:

Schedule C Part V

Don’t Miss: Can You Refinance Fha Loan

Schedule C Filers Now Eligible For Larger Ppp Loans

Kate Serpe

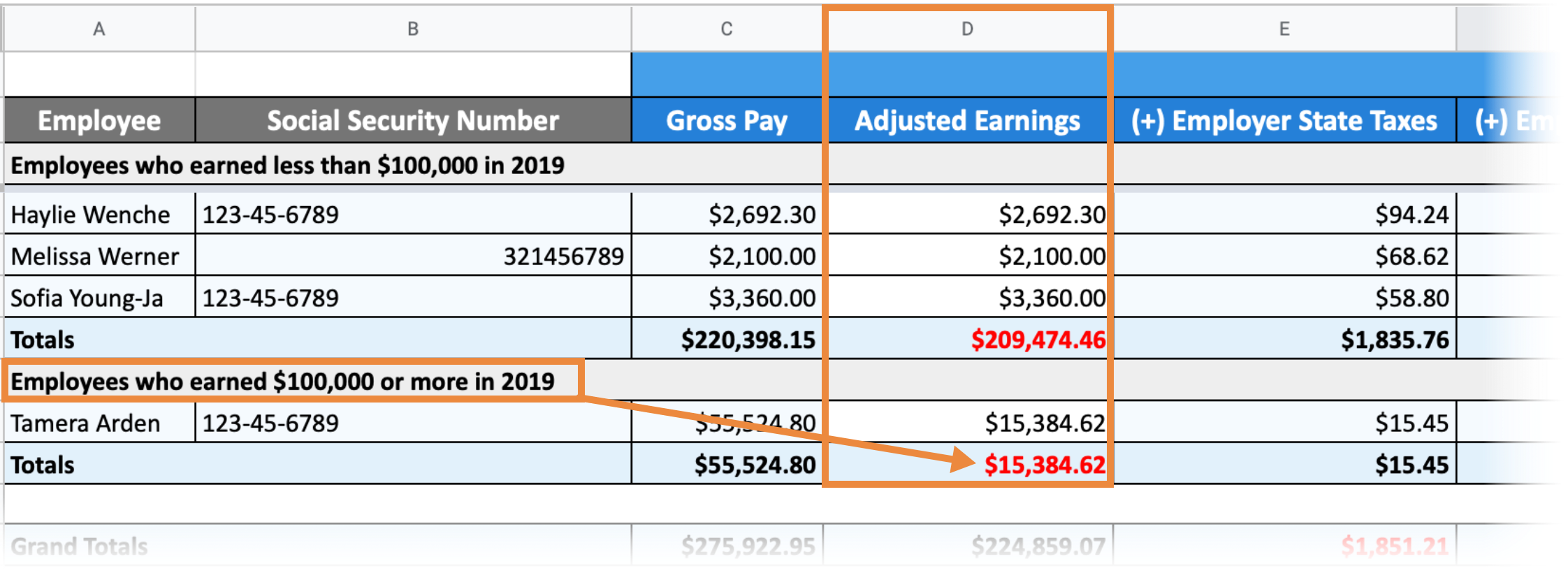

On Wednesday, March 3rd, the SBA and Treasury released a new Interim Final Ruling that details previous guidance announced by the Biden administration related to Schedule C filers and the calculation of their maximum PPP2 first draw or second draw loan. The new guidance allows Schedule C filers to use either gross income or net profit when calculating an amount for owner compensation replacement, in addition to payroll costs for employees. New Borrower Application Forms are now available for Schedule C filers applying for a PPP2 first draw or second draw loan.

Gross income is the amount the borrower reports on line 7 of Schedule C. If there are no employees, the borrower may elect to calculate its loan amount based on either net profit or gross income. If there are employees, the borrower may elect to calculate the owner compensation replacement based on either Schedule C net profit or Schedule C gross income less employee benefit program expense , pension and profit-sharing plans expense , and wages expense less employment credits . The owner compensation replacement payroll costs are now referred to as proprietor expenses.

Schedule C Filers Can Use Gross Income To Calculate New Ppp Loans

Note: This post has been updated to include new guidance and forms published March 12 and March 18 at the bottom.

On March 3, the Small Business Administration published an interim final rule implementing a new policy President Biden announced several weeks ago: allowing Schedule C filers to receive more financial assistance by revising the Paycheck Protection Program loan calculation formula for these applicants. In support of this change, the SBA explains that it is acting within its discretionary authority to reduce barriers to accessing the PPP and expand funding among the smallest businesses.

The new rule, which applies to first draw and second draw loan calculations, is summarized below. It should be noted that unless Congress changes the law, the PPP is set to expire March 31.

Don’t Miss: What Car Can I Afford With My Salary

Go Through A Series Of Questions Related To Your Tax Documents

In order to qualify for the PPP loan, you will need your tax documents. The information from your tax return will help determine how much you qualify for.

This is where Womply has customized it for us : youll choose what kind of gig worker you are here. If you drive for multiple platforms, choose the description that best describes the platform you drive for the most:

How Have The Calculations Changed

Previously, PPP rules defined payroll costs for individuals who file Form 1040 Schedule C as net earnings from self-employment. Many Schedule C filers without employees had net profits less than $100,000 and were ineligible to receive the maximum PPP amount, and those with $0 net earnings were ineligible to receive a PPP loan.

To reduce barriers to accessing PPP funding, the revised SBA guidance changes the calculation for sole proprietors and independent contractors by allowing them to use gross income as the basis to size their loan.

Read Also: Auto Loan Self Employed

What If I Want To Use My Ppp Loan For Other Expenses

To qualify for full forgiveness, payroll related expenses must account for 60% of the forgiven amount in this case, that refers to owners compensation replacement. Eligible non-payroll costs cannot exceed 40 percent of the loan forgiveness amount. You may choose this method if you want to use the 8-week covered period or you want to use other expenses to qualify. Eligible non-payroll expenses include:

- Business mortgage interest payments

- Business rent or lease payments

- Business utility payments

- Covered supplier costs

- Covered worker protection expenditures.

There are some specific requirements when it comes to forgiveness eligibility for these expenses, so if you are thinking of using them to qualify make sure you read the details in the latest forgiveness guidance.

How To Fill Out A Schedule C For A Sole Proprietor Or Single

Schedule C is a tax form for small business owners. Here is how to fill out a Schedule C for a sole proprietor or single-member LLC.

Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. Schedule C is a form attached to your personal tax return that you use to report the income of your business as well as business expenses, which can qualify as tax deductions. As you will see by reading this article, Schedule C can be complicated, overwhelming, or confusing. We highly recommend you consult a tax professional for help, or at the very least, use tax software to complete the calculations in the form, rather than trying to fill it out by hand. Regardless of how you choose to do it, its helpful to familiarize yourself with the form so you can gather and prepare all of the information you will need. Here is how to fill out a Schedule C for a sole proprietor or single-member LLC.

Also Check: Usaa Auto Loan Refinance

Does Sba Report Ppp To Irs

Forgiven PPP loans are not taxable

It’s been in the internal revenue code forever, Hall says. Paycheck Protection Program loans break from that code. Congress specified, and the IRS clarified, that forgiven PPP loans will not count as income. This applies whether your entire loan is forgiven or just a portion.

Important Note About This Report

This report runs based on data in OnPay. If you did not run payroll with OnPay in 2019, we may not be able to run calculations for both lookback periods. If this is the case for you, we recommend consulting an accountant or financial advisor when applying for loan forgiveness.

The information from the Schedule A is used to fill out the PPP Loan Forgiveness Calculation Form on page 1 of SBA Form 3508. This guide will walk you through filling out the PPP Loan Forgiveness Calculation Form using information from your OnPay PPP Loan Forgiveness Report. Learn

Don’t Miss: How To Get Leads As A Loan Officer

Can I Use Ppp To Refinance My Eidl Loan

Some borrowers have received both a PPP loan and an Economic Injury Disaster Loan . There are some very specific but limited circumstances where you can refinance an EIDL loan with PPP. Pay careful attention to the dates here!

- You must use PPP to refinance your EIDL if you received EIDL loan funds from January 31, 2020 through April 3, 2020 and used the EIDL loan funds to pay payroll costs.

- You may use PPP to refinance EIDL loan funds received from January 31, 2020 through April 3, 2020 and you used the EIDL loan for purposes other than payroll costs.

- You cannot use PPP to refinance an EIDL loan if you received EIDL loan funds before January 31, 2020 or after April 3, 2020. This is the majority of borrowers.

What If I Dont Use A Payroll Service

If you own a business and do not give yourself a salary through a payroll service, you are likely still eligible for the Paycheck Protection Programâwith one exception. Businesses that are structured as C corporations or S corporations must be using payroll to pay their owners, because the corporation is taxed separately from the individual. If you own a corporation and have not been paying yourself a salary through payroll, you will not have a salary covered through the PPP. This is because distributions or dividends from a corporation are not considered to be a salary or self-employment income.

Further reading:Do Owner Draws Count as Salary for the Paycheck Protection Program?

Recommended Reading: Car Loan Interest Rate With 600 Credit Score

What Is The Covered Period

The clock for spending your PPP money starts the day your PPP loan funds are disbursed, or deposited into your bank account. When the CARES Act first passed, the covered period was 8 weeks. When the PPP Flexibility Act passed in June 2020, the covered period was changed to 8 or 24 weeks. And now with the Economic Aid Act it is any period between 8 and 24 weeks your choice. That applies to anyone whose PPP loan has not yet been forgiven.

Many self-employed individuals will want to choose a covered period that allows them to get full forgiveness based on money they pay themselves, and that ties into the next question: