Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Pay More Than The Minimum

Any time you owe a debt, if you can afford to pay more than the minimum it will help you chip away at the actual loan balance. By paying only the minimum, you are merely covering the interest on the loan and so your total debt doesnt shrink. Additionally, paying more than the minimum helps to improve your and minimize interest charges, too.

Va And Lender Dti Benchmarks

Lenders can set their own benchmarks for the maximum allowable DTI ratio. Those caps can vary based on a host of factors, including the presence of compensating factors and whether the loan file needs to be underwritten manually.

Some lenders might allow a DTI ratio above 50 percent, even well above it, in some cases, depending on the strength of the borrower’s overall credit and lending profile.

In these cases, borrowers will get an up-close look at the link between DTI ratio and the VA’s guideline for discretionary income, known as residual income.

Don’t Miss: Ussa Car Loans

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

How Can I Lower My Dti

Lowering your DTI may be necessary in order to qualify for the loan amount you want. Fortunately, there are ways to do so. The easiest method to lower your DTI is by reducing your debt. Since DTI is based on monthly expense, it makes the most sense to pay down the debt with the combination of the lowest balance and highest monthly payment.

Other means of lowering your DTI include, increasing income, avoiding major purchases or in extreme cases, getting help from a financial adviser.

For individuals with an already high DTI, Increasing your income is the most beneficial thing you can do to improve the ratio. This can be done by asking for a salary increase, working overtime, taking on a part-time job, or even making extra money from a hobby. The more you can increase your income without raising your debt payments, the lower your DTI ratio will be.

Don’t Miss: Fha Maximum Loan Amount Texas

This Weeks Question: I Have The Ability To Pay For My Debts And Im Wondering If A Zero Dti Is Good Im Looking At Buying A House Next July

A 0% debt-to-income ratio means that you dont have any debts or expenses, which does not necessarily mean that you are financially ready to apply for a mortgage. In addition to your DTI, lenders will review your credit score to assess the risk of lending you money. The specific requirements vary from lender to lender. But, most lenders look for a 35% or lower DTI and a minimum credit score above 620 to qualify for a conventional loan. On the other hand, FHA loans have more flexible requirements.

How to calculate your DTI

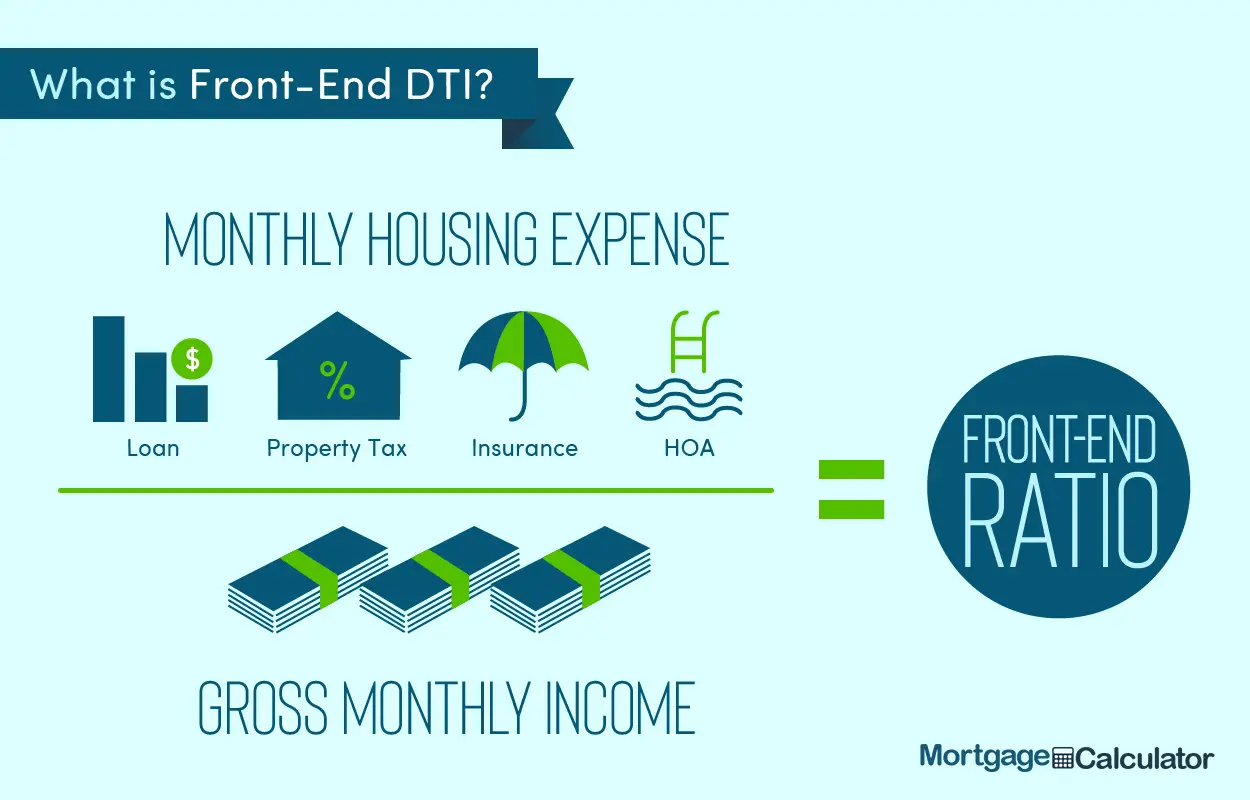

Your DTI determines the percentage of your gross income used to pay for your debts and certain recurring expenses. There are two types of ratios, the front-end and the back-end DTI, which is what lenders focus on the most when applying for a mortgage. To calculate your front-end DTI, add your home-related expenses such as mortgage payments, property taxes, insurance, and homeowners association fees. Then, divide them by your monthly gross income, and multiply it by 100. Most lenders look for a 28% front-end DTI.

Monitor your credit score

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Read Also: Usaa Auto Loan Credit Score Requirements

Recommended Reading: Should I Pick Variable Or Fixed Rate Student Loan

Why Is Dti Important

Your DTI is important to both you and lenders because it demonstrates that you have a good balance of debt and incoming funds. It proves to lenders that you are responsible with your money and that you can handle additional debt.

The Consumer Financial Protection Bureau requires that mortgage lenders examine your financial health before you take out a loan to assure that you can afford to repay the money. Calculating your DTI is one of a few ways they go about doing this. If your DTI percentage is low enough, you may qualify for a better loan than you would if you were responsible for more debt. On the other hand, if your DTI is too high, lenders may be unwilling to grant you a mortgage loan, so its important to make sure your DTI is within an acceptable range.

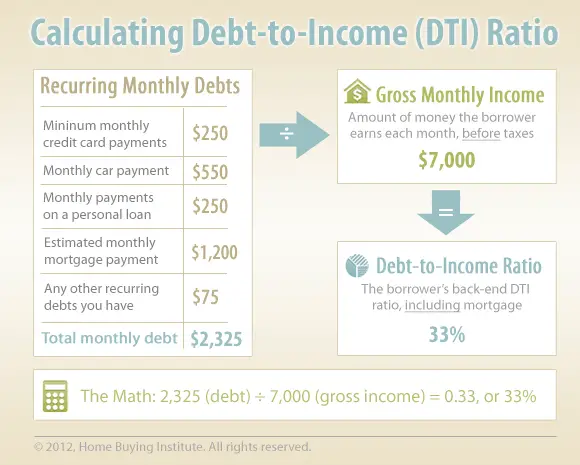

How To Calculate Debt

To calculate your debt-to-income ratio, first add up your monthly bills, such as rent or mortgage, student loan payments, car payments, minimum credit card payments, and other regular payments. Then, divide the total by your gross monthly income. This includes wages, salaries, freelance income, overtime pay, commissions, tips and other allowances, etc.

Read Also: Fha Illinois

Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

Personal Loans And Auto Loans

With personal loans and car loans, you might be able to qualify for financing with a DTI ratio higher than the typical 43% cap for a qualified mortgage. But you should pay close attention to your interest rate and monthly payment to make sure its affordable for you.

Wells Fargo, for example, says that if you have a DTI of 35% or less, youre probably in pretty good shape.

Read Also: Va Second Tier Entitlement Calculator 2020

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Recommended Reading: How Much Commission Does A Mortgage Loan Officer Make

Will All Lenders Remove The 1% Rule

We get this question a lot. Do all lenders require the 1% rule?

The answer is that the lender chooses whether or not to follow the underwriting guidelines for the type of mortgage you are applying for.

Fannie Mae, Freddie Mac, FHA, VA & USDA offer guidelines, which are minimum requirements to qualify for the loan program.

Individual lenders have the freedom to add overlays or restrictions to these guidelines. Many lenders do this.

Between lender overlays and inexperienced loan officers, you will often get 5 different answers if you call 5 different lenders.

What these lenders and inexperienced loan officers are failing to tell you is that THEY do not follow the guidelines and that another lender that does follow the guidelines could help you.

Also Check: Defaulting On Sba Disaster Loan

How Can I Improve My Debt

There are a number of ways you can try to improve your debt-to-income ratio. The basic idea is lowering your debt or increasing your income. Here are some ideas.

- Pay down debt early. If you have room in your finances, make more than the minimum payments on your debts each month so that you pay them down faster. For example, pay more than your minimum credit card payment every month.

- Cut monthly expenses to pay off more debt. Look at your budget and consider ways you can adjust your spending so that you have more money to use toward debt repayment.

- Consider a debt-consolidation loan. If you cant make extra payments on your debt or trim your budget, a debt-consolidation loan could be a good option. This may help you reduce the amount of interest you pay while you work to pay down your debts.

- Get a side hustle or ask for a raise. Extra income from side jobs can count toward your income when you calculate your debt-to-income ratio. The boost in salary youd get from a raise could also help to lower your DTI.

Read Also: Bayview Loan Servicing Foreclosure Process

Cut Back On Credit Card Purchases

Scaling back on unnecessary expenses is always a fiscally responsible move, but reducing your dependence on credit card purchases, in particular, will help you meet your DTI goals. Its way too easy to spend beyond your means by relying on credit cards and racking up more debt in the process. Credit card interest payments are another cost you simply dont want to deal with if youre trying to lower your debt-to-income ratio.

Excessive unpaid credit card balances also impact your , which is another important factor that lenders will weigh when considering your mortgage application. So, for the sake of your homebuying aspirations, put the credit card back in your wallet whenever possible.

Whats Included In Your Dti Ratio

Our tool calculates your back-end DTI ratio using potential mortgage payments and the following recurring debts:

-

Auto loans

-

Child support and alimony

-

Personal loan or other monthly debts

Of course, these probably arent your only monthly expenses. Your back-end DTI ratio can also include what you spend on food, utilities, gas, insurance or entertainment, in addition to proposed mortgage payments. Although lenders may not inspect your back-end ratio to this detail, its important to look carefully at these costs so your true monthly financial obligations are represented.

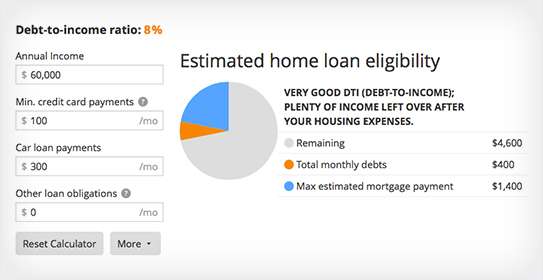

Ideally, your total DTI ratio should be under 36%. Keep this in mind when deciding what affordable means for you.

Also Check: How To Get A Loan Officer License In California

Divide That Total By Your Gross Monthly Income

Once you have an idea of what your monthly debt total is, divide it by your gross monthly income to determine your DTI ratio. Your gross monthly income is the amount of money you make each month before taxes. You can usually find your gross income on your paystubs or you can calculate it.

If you are a salaried employee, you can divide your yearly salary by 12 to find your gross monthly income. If you are paid hourly, multiply your hourly rate by the number of hours you work in a week and then multiply that number by 52 to get your yearly income, which you can divide by 12 to get your monthly gross income.

Once you know your monthly gross income, you should be able to use it to find your DTI. If you make $4,000 a month as your gross income and your total debts amount to $1,200, the formula to calculate your DTI would look like this:

= 0.3, or 30%

Fha Minimum Credit Score: 500

FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

However, its important to bear in mind that while the FHA sets out guidelines for credit score minimums, FHA lenders may require higher minimum scores. FHA loans dont come directly from the government the FHA insures them on behalf of the lender. Despite having that as backup, lenders often choose to minimize their risk by mandating higher credit minimums. This is one of the reasons why its smart to shop and compare FHA lenders. Not only might they have different qualifications, but you can also weigh different lenders rates and fees.

Its worth noting that even with a lender whos following FHA guidelines to the letter, youll get better terms if you have a higher credit score. A stronger credit score should also help you get a better FHA mortgage rate.

Read Also: Fha Refinance Mortgage Insurance

Lender Standards For Debt

Lenders want to know how well youre making ends meet and how much home you can actually afford. The lower your DTI, the less debt you owe and the more able you are to make monthly loan payments.

Lenders consider both your front-end ratio, which is the percentage of mortgage you pay relative to your income, and your back-end ratio, which measures your total debts, including mortgage expenses, against your income. It can be helpful to know how your spending and savings can impact your future homeowning goals, too.

| Mortgage Industry Term |

|---|

How Does Dti Ratio Differ From Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Don’t Miss: How Long Does Sba Take To Approve

Get Clarity On Your Dti With A Pre

At Better, we want you to be as prepared for buying a home and the mortgage process as possible.

Applying for a pre-approval takes as little as 3 minutes and will provide you with a clear picture of how much you can afford. Youll undergo a soft credit check that allows our underwriters to look at your debts, income, and credit in detail to obtain a more accurate picture of your DTI.

Although your DTI ratio is just one important factor to consider when buying a home, carrying less debt relative to your income will make it easier to get a mortgage and help ensure youll be able to afford your home for years to come.

Better Mortgage can help you understand your DTI and the financing options available to you. Start your pre-approval process today.

What Is A Debttoincome Ratio

Debttoincome is a lending term that describes a persons monthly debt load as compared to their monthly gross income. Mortgage lenders use debttoincome to determine whether a mortgage applicant will be able to make payments on a given property. In other words, DTI measures the economic burden a mortgage would have on a household.

Also Check: Upstart Prequalify