How To Apply For Ppp Loan Forgiveness As A Self

Youll work with your lender on your PPP loan forgiveness application. They should have sent you follow-up information on how to submit your forms and paperwork. Youll need to submit this application within 10 months of the end of your covered periodif not, your loan payment deferment will end, and youll have to start making monthly payments on your PPP loan.

After you submit your application, your lender will review your documentation and get back to you within 60 days. Once approved, the SBA will refund the portion of your loan that was deemed forgivable.

FAQs

Ppp Loan Forgiveness Process

A PPP borrower can apply for loan forgiveness any time on or before the maturity date of the loan, assuming the borrower used all of the loan funds for the specified purposes.

A borrower that does not apply for forgiveness within 10 months after the end of the maximum covered period or some or all of the loan amount is not forgiven must begin paying principal and interest.

Borrowers that apply for forgiveness within the 10-month period, will not be required to make payments and will not accrue interest while a decision is pending, assuming the loan is fully forgiven. Interest continues to accrue on any portion of the loan that is not forgiven.

Any amount not forgiven is due by the loans maturity date.

Forgiveness Process for PPP Loans of $150,000 or Less

The SBA offers an optional, streamlined PPP loan forgiveness process for smaller loans, representing more than 90 percent of all PPP borrowers.

This process is available via a PPP direct forgiveness portal that simplifies PPP loan forgiveness for borrowers with loans of $150,000 or less. Using the portal, qualifying businesses and not-for-profits can register and apply for loan forgiveness directly through the SBA. Importantly, the borrowers lender must also opt in.

Payroll Costs for Employees Residing in the U.S.

Payroll Costs for Independent Contractors and Employees Outside of the U.S.

Utilities

After Receiving Your Ppp Loan

Once your loan hits your back account, youâll need to spend all of your proceeds during the âcovered periodâ to receive forgiveness.

There are a few ways that you can reduce your total PPP loan forgiveness. Forgiveness is not binaryâyou can reduce your forgiveness dollar by dollar depending on how you spend your funds and whether you maintain your payroll .

Regardless of whether or not you plan to apply for full or partial loan forgiveness, youâll want to track the following things during your covered period. Doing this will help you understand how much money the SBA will convert into a grant, and how much youâll need to repay over the next two years.

You May Like: Upstart Loan Calculator

What To Do If You Suspect Fraud

The Department of Justice allocated at least $850 million to investigate and prosecute PPP fraud. They are taking any suspected fraud very seriously and have even created a fraud hotline to report suspected fraud.

If you suspect that your employer has abused their PPP loan, you will want to document any suspicious activity in a file that you keep at home. For instance, if your employer notified everyone that they took out a PPP loan and you have noticed them making several large purchases while also laying off employees chances are they may be misusing the PPP funds. You dont need to worry about conducting a thorough investigation just jot down any facts that you think may be important. The federal government has appointed investigators in each state who will be able to look into the matter.

Once you have collected any relevant information, you should contact the U.S. Attorneys Office fraud hotline . You may also be interested in consulting with an attorney, particularly if you have been laid off from a company that received PPP funds. It may be possible that your former employer is both committing fraud and violating your rights as an employee.

Key Takeaways For Applying Through Womply

The process is very simple and there is significant money that drivers can get for payroll! Also, Womply makes it very easy for you to apply.

In Jays case, he did hear from Womply, and they needed to confirm some more information, but again, the whole process was simple. Hes currently waiting to hear back about his application we will update when he does!

Ready to get started on your own PPP application? Get started using Womply here.

Readers, have you taken a PPP loan? What questions do you have about the PPP loan process?

Don’t Miss: Usaa Bad Credit Auto Loans

What Is The Meaning Of Public Utility Service

Public utilities are those business undertakings which provide necessary services to the society. The undertakings dealing with the supply of electricity, gas, power, water and transport etc. are all covered under public utility services. It is expected that the services should be provided at reasonable rates.

How Should I Spend Self

Posted on – Last updated: May 3, 2021

As an Amazon associate and affiliate for other products and services, I earn from qualifying purchases.

You’re self employed. Youreceived your Paycheck Protection Program funding. Now what?

You hear that you can get in trouble for using your money wrong. People are being thrown in jail for PPP loan fraud.

Did you bite off more than you can chew? How do you stay out of trouble?

More importantly, how do you spend that PPP money in a way that you make sure you get your loan forgiven?

It’s not as bad as a lot of people are making it out to be. Let’s wade through the confusion, hysteria and bad information and find the good information about how you need to use your money as an independent contracotr, a self-employed individual, or gig worker with apps like Doordash, Uber Eats, Grubhub, Instacart, Lyft and others.

Disclaimer: This is my analysis based on research. This article is intended for educational purposes. Do not take it as personal, legal, or tax advice. If you need specific advice relative to your personal situation you should seek out your own professional advice.

You May Like: How Does Usaa Auto Loan Work

Who Qualifies For A Ppp Loan

Any small business with 500 or fewer employees may be eligible. This includes small businesses, S corporations, C corporations, LLCs, private nonprofits, faith-based organizations, tribal groups and veteran groups. Self-employed individuals who file an IRS Schedule C with their Form 1040, such as independent contractors and sole proprietors, are also eligible.

Throughout the term of the Paycheck Protection Program, there have been complaints about larger companies getting more loans than smaller firms who may really need them. To address this, the Biden administration is proposing a two-week period where only firms with 20 or fewer employees can get the loans. This restriction is scheduled to start on Wednesday, February 24.

Bidens administration is also planning on setting aside $1 billion for businesses with no employees located in low-income areas.

Another change instituted once Joe Biden took office is a plan changing the calculation for self-employed people. Essentially, loans will no longer be based on the profit reported on a businesses taxes. Instead, for sole proprietors, the loan calculation for sole proprietors will be based on the firms gross income, which is expected to expand the pool of eligible businesses and allow some firms to get a bigger loan.

Restaurants and hospitality businesses may qualify if they have 500 or fewer employees per location. Details on the size standards and exceptions are on the SBA website.

Will This Second Ppp Loan Be Forgiven In Whole Or Partially

The loans for the second round of PPP forgiveness are up to $2 million , and during the forgiveness process, you may choose a covered period between eight to 24 weeks.

If a loan is less than $150,000, the loan amount shall be forgiven if the recipient completes a one page form and submits certain certifications to the lender. The certifications include:

-

The number of eligible employees the business was able to retain

-

The amount of the loan spent on payroll costs

-

The total loan amount

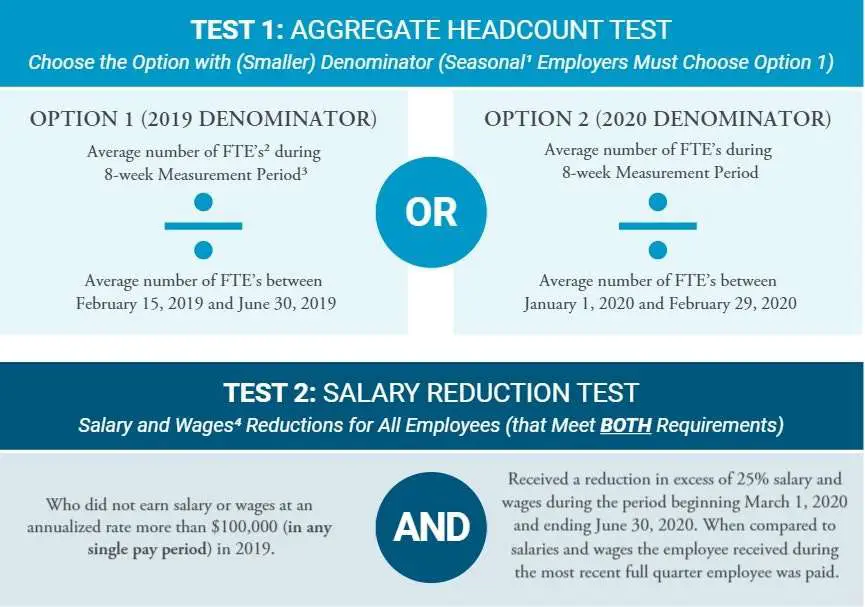

If your loan is greater than $50,000, your loan forgiveness could be reduced based on the number of employees and salaries that fell more than 25%. Note that borrowers must retain relevant records related to employment for four years and other records for three years. For loans above $150,000, records will need to be retained for six years. In all cases, any PPP loan records may be reviewed and audited for fraud by the SBA later.

At least 60% of the PPP loan must be used for payroll costs to be eligible for full forgiveness, just like the first round of PPP. If borrowers do not apply for forgiveness within 10 months after the last day of the covered period, PPP loan payments are no longer deferred. Be sure to contact your lender for the correct form.

Read Also: Credit Needed To Refinance Home

Ppp Round 3 General Terms And Conditions

As a refresher, both first- and second-draw PPP loans were subject to the same general terms and conditions as original PPP loans under the CARES Act, including:

- Loans are 100% guaranteed by the government.

- No collateral is required.

- No personal guarantees are required.

- The interest rate for all loans is 1% and maturity is five years.

Can I Use The Ppp On Retirement Plans

Yes, the employerâs contributions to employee retirement plans are allowed.

Contributions to a personal IRA or other retirement account would be considered to be a use of your personal owner compensation. The guidelines related to owner compensation apply as normal.

Further reading:401K and IRA Changes During COVID-19

You May Like: Usaa Auto Refinance Calculator

Do I Need Any Documentation To Prove My Expenses For Forgiveness

You will need to prove your expenses for payroll costs and other covered expenses. However, for the owner compensation share, you just need to provide your 2019 or 2020 Schedule C to be able to claim the amount for forgiveness.

If you are applying for PPP forgiveness for a second PPP loan, you will need to provide documentation to prove a 25% decrease in gross receipts between a quarter in 2019 and a quarter in 2020 .

Keep in mind that your lender and the SBA have the right to request and audit your businessâs financial documents and records, as outlined in your loan agreement. Continue with your ongoing bookkeeping and recordkeeping habits.

Good bookkeeping ensures you stay on top of how you spend your PPP and helps you master your business. Benchâs monthly reports equip you with what you need for relief applications and beyond. Learn more about how we can help you stay informed on your business.

Utilize Accounting Software And/or Payroll Services

Manually managing your spending, particularly payroll, is not only a headache, but makes it easier for you to mismanage your PPP loan.

Third-party payroll services such as Gusto, Zenefits, or Paychex can automatically debit your new bank account holding your PPP funds, and many providers have rolled out PPP-specific reports that will make applying for loan forgiveness a breeze.

Additionally, accounting software such as QuickBooksâa helpful tool in any moment, not just in dealing with PPPâcan help you earmark and track spending specific to your loan.

Have these tools and documents ready to go before you receive your loan for peak effectiveness.

You May Like: Are Auto Loans Amortized

Talk With Your Lender

Keep the communication lines strong with your lender throughout the process. From the day you apply to the day you request forgiveness, talk with your lender about your loan forgiveness responsibilities.

When applying for a PPP loan, ask your lender about loan forgiveness requirements. And, ask them what documents you need to bring when applying for loan forgiveness.

Ppp Loan Accounting Tip #: Document Every Disbursement

A final tip? Document the dollar amount, timing and deductibility of every disbursement.

So, like youre being audited by the Internal Revenue Service. And by a really suspicious auditor.

For example, for payroll costs? Document the dollar amount and the payment date with actual copies of the payroll checks or electronic payment receipts. And be sure you have any other appropriate documentation too: Timecards? W-4s? Payroll reports from the payroll service company? You see the pattern.

For employee health insurance which also counts as payroll? Same sort of stuff. Use checks and electronic payment receipts to prove the dollar amounts and payment dates. Use the monthly insurance company statement to document the deductibility.

Retirement plan contributions? Yeah, treat those like employee health insurance.

For any rent, mortgage interest, and utilities services? Again, use the actual checks or electronic payment receipts to document the amounts and dates of payments. Then collect copies of the actual rental lease, the mortgage or bank loan agreement, and the utility service contract.

This note about non-payroll costs: The legal agreement for the rent, the mortgage or the utility services needs to have been in entered into before February 15, 2020.

One other point: Only the interest on the mortgage or business loan qualifies for forgiveness. So, you want to have a monthly statement or bill from the lender that breaks the payment into interest and principal.

Read Also: Refinancing Through Usaa

How To Apply For Ppp Loan Forgiveness

To apply for loan forgiveness, businesses need to contact their PPP lender and complete the correct form.

- SBA Form 3508. This is the standard PPP Loan Forgiveness Calculation Form. All borrowers can use this form, and borrowers who do not qualify to use Form 3508EZ or 3508S must use it.

- SBA Form 3508EZ. This version requires fewer calculations. Its for borrowers who are self-employed and have no employees or have employees but did not reduce employee levels, wages, or hours.

- SBA Form 3508S. This version of the forgiveness application requires almost no calculations. Its for borrowers who took out loans of $150,000 or less.

Regardless of which form you use, you must have supporting documentation to support your application. That documentation may include:

- Bank account statements

- Receipts, canceled checks, or account statements documenting employer contributions to employee health insurance and retirement plans

- Mortgage amortization schedules or lender account statements

- Copies of current lease agreements and receipts or canceled checks verifying rent and lease payments

- Receipts, canceled checks, or account statements documenting utility payments

Borrowers who apply for forgiveness using SBA Form 3508S do not have to submit supporting documentation with their application. However, they should maintain all relevant records in case the SBA requests documentation as part of its loan review and audit process.

Am I Eligible For The New Round Of Ppp

Companies with 300 or fewer employees who suffered a 25% drop in any quarters revenue from 2019 to 2020 are eligible for the second round of PPP. This means a 25% or more reduction in gross income from any quarter in 2020 relative to that same quarter in 2019 or during the year of 2020 as compared to the year of 2019.

Its important to note that in the first round of PPP, companies with 500 or fewer employees were eligible.

Unlike the first round, new entity types are now eligible, including:

- Trade organizations

- Chambers of commerce

- Non-profits or government instrumentalities that engage in destination or tourism marketing with 300 or fewer employees

- Owners with non-fraud related felony convictions

- Owners who are delinquent on student loans

- Non-citizens who are U.S. residents, like Green Card or visa holders

As with the previous round, this round also includes:

- Non-profit organizations

- Independent contractors

- Seasonal businesses

This additional round of PPP also more clearly defines seasonal businesses for purposes of calculating the PPP loan amount. Seasonal businesses that operate for no more than seven months out of the year or earned less than a third of its receipts in any six months of the previous year can have their PPP loan calculated on any 12-week period during 2019 or 2020.

Ask our team about the PPP Process

Square has a dedicated community board for PPP updates.

You May Like: Stilt Personal Loans

What Is The Paycheck Protection Program

Issued as part of the CARES Act in March 2020, the PPP gave small businesses and independent contractors loans to cover payroll costs for a period of up to eight weeks.

The program which ran from April to August 2020 initially allotted $349 billion in funding to small businesses, then injected another $320 billion to help satisfy the high demand of applicants. Unlike other SBA loans, PPP loans are designed to be partially or fully forgivable, meaning you wont have to pay them back as long as you follow certain rules.

Here are a few key facts about the first round of PPP loans:

- Qualified businesses could receive 2.5 times their average monthly payroll costs up to $10 million

- Business owners could get their loans forgiven if they used at least 60% of the money to cover payroll costs.

- The loans required no collateral or personal guarantees

- The interest rate was just 1%

Though the program helped countless small businesses stay afloat amid COVID-19 shutdowns and restrictions, the Paycheck Protection Program wasnt a cure-all for the small business economy. Many small businesses were ignored by bank lenders, while others didnt receive a loan before the PPP closed in August 2020.

Now, to offset these losses and help a greater number of small businesses recover, Congress is amending a handful of terms and requirements around PPP loans.

Who Qualifies For The Paycheck Protection Program

Associations and organizations that fulfil the guidelines set by the SBA may qualify for the loan.

First, you may qualify for the PPP loan if you have been affected by COVID-19 and own a private business, as characterized by the SBA. Second, the tax structure of your association to a limited extent decides eligibility. You should be a business, a nonprofit association, a 501 association, a 501 veterans association, or tribal business. Third, you need to utilize under 300 full-time employees or meet the SBA employee size limit.

In case you are in the food administration or hospitality industries, have in excess of 300 employees, however have less than 300 employees in every area, you also might be eligible for a paycheck protection program loan.

You may be eligible for a loan if you are a sole ownership, a self employed entity, or an eligible independently employed person.

To be eligible your business or association should have also had a decrease in net receipts in excess of 25% over two equivalent time spans.

Don’t Miss: Usaa Car Loans Credit Score