Fannie Mae’s And Freddie Mac’s Business Models

This section uses Fannie Mae’s and Freddie Mac’s business models to provide a basis for understanding their roles in the housing finance system and their problems. Fannie Mae’s and Freddie Mac’s business models have evolved similarly. They both

- sell bonds to purchase mortgages

- purchase single-family mortgages that other companies have originated 18

- guarantee investors that the mortgages will be paid and pool the mortgages to create MBS

- charge sellers a fee to guarantee these mortgages

- sell the MBS to institutional investors, or keep them in their own investment portfolios. If the GSE decides to keep the MBS, it uses the money raised by selling the bonds to finance these MBS. Otherwise it uses the proceeds from selling the MBS to purchase more mortgages.

How Common Is Home Foreclosure

Foreclosure is quite uncommon. In the wake of the 2008-2009 global recession which was driven in large part by a housing crash much of the damage was concentrated on the states of Arizona, California, Florida & Nevada.

The above spike was driven by the combination of a housing price crash, a global recession, and many consumers levering up by refinancing during the housing boom.

In states like California with high real estate prices homeowners carry a higher debt load against their homes.

The number of bankruptcy filings vastly exceeds the number of foreclosures.

Homeowners are far more likely to fall behind on credit card or student loan payments than they are to fall behind on car or home loans.

From 1931 to 1935 in the Great Depression the foreclosure rate exceeded 1%. Between 2007 & 2016 over 7.7 million homes were foreclosed upon. Over 1.1 million foreclosures occured across California, while Florida had 960,000 foreclosures. Foreclosures were more prevanent in housing boom cities like Miami & Las Vegas.

Over 3.4 million homeowners lowered foreclosure risk by modifying their loans under the HARP program.

There are over 134 million housing units across the United States. In the decade following the Great Recession about 5.8% of homes were foreclosed upon.

Prior to the crisis period about 1,000,000 homes were foreclosed upon each year according to the Mortgage Bankers Association.

Reform Proposals And Implications

The housing GSEs generally have been successful in achieving their dual housing mandates-increasing liquidity in the secondary mortgage market and encouraging home ownership, especially among low- and middle-income households. Reform proposals, therefore, are typically focused on the risk of GSEs’ operations.

A radical approach to reform of the housing GSEs is “true” or “complete” privatization. All of the special privileges and exemptions currently enjoyed by the GSEs, including the lines of credit they have with the Treasury, would be eliminated. The former GSEs and all government representatives would state clearly, publicly and repeatedly that the firms’ debts are not guaranteed by the government in full or in part. Provisions for declaring a GSE insolvent and for winding it down would be put into place. Sallie Mae, the Student Loan Marketing Association, provides a roadmap for GSE privatization. Its special status was dismantled piece by piece over several years. It will become the fully privatized SLM Corp. in the near future.

Privatization may address some of the aforementioned moral-hazard issues, and it could eliminate the government subsidy that the housing GSEs currently are failing to pass through to mortgage borrowers in full. Yet, privatization does nothing directly to eliminate the systemic importance of the housing GSEs. That is, a fully privatized Fannie Mae still might be considered too big to fail by the Federal Reserve and by the Treasury.

Also Check: Mortgage Commitment Fee

Gses And The Average Homebuyer

GSEs, with the exception of Farm Credit Banks, do not lend money directly to individuals. However, if you purchase a home with a Federal Housing Administration loan, you are indirectly benefiting from a GSE. Since they were created by the Roosevelt administration in the 1930s, Freddie Mac, Fannie Mae and other GSEs have helped millions of people purchase homes, leading to home ownership as an integral and affordable part of the American Dream.

References

Options Maintaining Gse Status

Option: Return Control to Stockholders

Congress could decide to make little or no change to the GSEs’ charters. The GSEs would continue to be stockholder-owned companies with special charters and special obligations to support the housing market.

If this option were adopted, common stockholders would regain their right to elect the boards of directors, which in turn would appoint senior management. Dividends to preferred stockholders could resume. Dividends on the senior preferred stock owned by the federal government would continue. The GSEs would decide whether to retire the senior preferred stock held by the federal government. The boards of directors could resume common dividends. Bond payments would continue. As required by the contract with Treasury, the GSEs would shrink their portfolios by 15% annually until their portfolios were less than $250 billion.

Arguments in Favor

The main point in favor of the no change option is that by some measures the GSEs have been successes some argue that since the GSEs became stockholder owned , only the recent exceptional housing markets have required government intervention.26 Arguably, the GSEs have led to many changes in the nation’s mortgage markets that have improved efficiency and consumer choice, including

Some might debate whether these innovations have been improvements, and others might claim to have invented them before the GSEs.

Arguments Against

Option: Retain GSE Status with Additional Regulation

You May Like: What Happens If You Default On Sba Loan

Why Refinance Second Mortgages

There are a number of reasons to refinance a second mortgage. Many times, they may be different than the reason used to refinance the first time.

Some borrowers may refinance for lower interest rates, especially if those rates are significantly lower than when they took out of their second mortgage, or if their financial situation has improved. This is a common step taken by people with improved credit scores.

The types of second mortgages people may want to refinance for lower interest rates include:

- Piggyback Loan: This is a home equity loan or line of credit that is made at the same time as your main mortgage. It allows borrowers with low down-payment savings to acquire loans for more funds to lower their loan-to-value ratio and to qualify for a mortgage without paying private mortgage insurance .

- Home equity line of credit : This is essentially a revolving source of funds that you can access as you choose. HELOCs usually include a withdrawal period, where you can access as little or as much of your available funds as you want, followed by a repayment period that requires you to pay back the principal, plus interest.

- Home equity loan: This is a loan in which you use your home equity as collateral. It comes as a lump sum of cash.

Us Mortgage Market Statistics: 2019

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

While interest rates have fallen considerably over the past year, homeownership rates are still lower than they were in the 10-year period before the Great Recession of 2007 to 2009. This is due, in large part, to home prices continuing to stay hot throughout 2019.

Fortunately, there are still many ways to make your mortgage more affordable. For example, homebuyers can lessen the blow of rising home prices by shopping around for a mortgage to find their best rate offer before they buy. Those who already own a home can also save by refinancing their current mortgage to a lower rate.

Read on to find a variety of housing metrics to understand the current state of the housing market, who gets home financing, how mortgages are structured and how Americans are managing debt.

Read Also: Do Pawn Shops Loan Money

How Much Can I Take Out With An Fha Loan

To figure out how much you can take out with an FHA cash-out refinance, you must be aware of your maximum loan-to-value ratio for an FHA cash-out loan, which is 80% for most homeowners.

This means that you can borrow as much as 80% of what your home is worth as long as you have at least 20% equity remaining.

Therefore, the amount of cash that you can take out depends on your equity. To get an estimate of how much you can take out, determine your equity, then subtract 20%. Factor in closing costs to get the best estimate.

Below is an example of an FHA cash-out refinance calculation:

Current Home Value: $400,000

Paying off Current Loan: -$250,000

Max FHA Cash Out: $70,000

In this example, the homeowners maximum FHA cash out is $70,000, minus closing costs.

This is the maximum in an ideal scenario, not factoring in credit scores or debt-to-income ratio, which could greatly affect the maximum amount you qualify to borrow.

Current Mortgage Refinance Rates On A $260000 Fixed

The following table highlights locally available current mortgage rates. By default the table lists refinancing rates, though you can click on the Purchase heading to see purchase money mortgages. The Products drop down menu lets you select various loan terms & other lending options like hybrid ARM loans.

Recommended Reading: How Long For Sba Loan Approval

Stress Testing The Gses

Under the Dodd-Frank Act, the GSEs are subject to annual stress tests by the FHFA. Those stress tests differ from the stress test imposed by the Federal Reserve. As described below:

- The FHFA stress tests contain significantly less severe assumptions

- The stress tests administered by the FHFA do not capture some of the unique risks faced by the GSEs, including potential losses associated with the failure of nonbanks that service GSE-guaranteed loans.

Stress severity. The basic framework used in the Federal Reserve and FHFA stress tests is similar and uses the same macroeconomic stress scenario and global market shock. However, the FHFA stress tests are considerably less stringent than the Feds stress tests for four primary reasons.

One clear cause of the difference in loss rates is the treatment of private insurance. The FHFA notes that it expects the GSEs to have lower loss rates than banks because the GSEs employ loss mitigation strategies namely, private mortgage insurance. In contrast, the Federal Reserve does not allow banks to incorporate private mortgage insurance in the calculation of loss given default because such insurance was unreliable during the financial crisis.

| 7.63 |

How Mortgage Rate Predictions Work

Almost nobody knows where mortgage rates will go in the future as the economy is inherently unpredictible. Black swans like the COVID-19 crisis are not easy to predict, though even more normal market conditions can be hard to predict. Many predictions are nothing more than a linear projection of the recent past onto the future.

The Federal Reserve raised rates 4 times in 2018 at their meetings in March, June, September and December. On October 3, 2018 Federal Reserve Chairman Jerome Powell stated the central bank was “a long way” from neutral, hinting many more rate hikes would be coming.

With that trend and guidance in place, many mortgage industry veterans predicted mortgage rate would rise in 2019. Rates actually fell as the Federal Reserve delivered no more rate hikes and instead began loosening monetary policy.

You May Like: How Much Do Mortgage Officers Make

Fannie Mae And Freddie Mac Are Government Sponsored Enterprises

Fannie and Freddie are private corporations that were chartered by Congressthe formal term for this kind of company is a Government Sponsored Enterprise . There are several other GSEs, like the Farm Credit System. While GSEs are publicly traded companies, they all serve a very public mission of supporting the nations financial system. Because of the large role they play in the economy and their governmental affiliation, some investors assume they are implicitly guaranteed by the federal government. This means they believe the government would bail out Fannie and Freddie if they couldnt pay back their debts.

Even though Freddie Mac and Fannie Mae are technically shareholder-owned, they have been under government conservatorship since the Great Recession. Many investors who hold stock in the two companies are eagerly waiting for them to emerge from government control so their stock can trade on public exchanges again.

Pros And Cons Of Refinancing Second Mortgages

here are a number of pros and cons to consider when it comes to refinancing second mortgages.

Pros:

- Change your existing loan rate and term: If interest rates have dropped, you may want to consider refinancing to take advantage of new rates.

- Lower monthly payments: Lower interest rates may also mean lower monthly payments on your house.

- Allow you to switch to a fixed interest rate: This is good for those who are at a variable rate and would want a fixed rate due to rising interest rates.

- Consolidate debt: Refinancing your second mortgage will give you access to more funds, depending on your homes equity, that you can then use to consolidate high-interest debt, such as credit card debt or student loans.

Cons:

- Consider the extended life of the loan: If you refinance a second loan, you will usually be prolonging the life of the loan and, therefore, be making payments longer.

- Cost: Refinancing can be costly, as you will need to pay, at minimum, an appraisal fee, as well as closing costs.

Summary

Refinancing a second mortgage may be the right option for you if you are seeking a more favorable interest rate or lower monthly mortgage payments. Refinancing a second mortgage is similar to refinancing a first mortgage you will want to have a good credit score, employment history, and debt-to-income ratio to qualify for the best interest rates.

Talk to an expert before pursuing a refinancing of a second mortgage to ensure that it is the best choice for you.

Also Check: How To Get An Aer Loan

First Lien Information By Ethnicity & Income

| Borrower race & ethnicity, borrower income & neighborhood income | 2004 |

|---|

| 3.71% | 6,114,421 |

When interest rates rise much of the demand to refinance dissipates, as homeowners prefer to maintain their existing loans with lower rates. In 2017 there were over a million fewer refinances than during 2016 as interest rates rose. In 2018 there will once again be fewer refinancing loans as interest rates continue rising.

Home equity loans & home equity lines of credit allow homeowners to borrow against a portion of their home equity while maintaining their first mortgage at its existing low rate. TransUnion published a study in 2017 which suggested there will be an average of 2 million HELOCs per year between 2018 and 2022.

Here is a breakdown of refinancing activity by ethnicity & income.

| Borrower race & ethnicity, borrower income & neighborhood income | 2004 |

|---|

| $166 |

What Is A Government

A government-sponsored enterprise is a quasi-governmental entity established to enhance the flow of credit to specific sectors of the American economy. Created by acts of Congress, these agenciesalthough they are privately-heldprovide public financial services. GSEs help to facilitate borrowing for a variety of individuals, including students, farmers, and homeowners.

Don’t Miss: Paypal Business Loan Reviews

Fannie Mae And Freddie Mac Help Inflate The Housing Bubble

Fannie Mae and Freddie Mac pumped more and more money into the U.S. home finance system in the years leading up to the financial crisis, buying an outsized number of mortgages on the secondary market. This helped support the bubble in home prices that emerged in 2005 through 2007.

Together with lax oversight and financial engineering at big investment banks, unsustainable mortgages took off, with many people getting mortgage loans who might not have qualified for home loan financing in more normal times. Both homebuyers and the financial system as a whole became overleveraged and unbalanced, driven by financing from Freddie Mac and Fannie Mae.

The unwinding of the housing bubble in 2007 and the financial crisis that followed in 2008 hit Fannie and Freddie hard. To avoid a complete collapse, the FHFA seized the companies and put them into conservatorship on September 6, 2008just days before Lehman Brothers filed for bankruptcy and sent the financial markets into a tailspin.

Options Eliminating Gse Status

Fannie Mae and Freddie Mac are GSEs because of their charters, which were created by enactment of legislation, and legislative action could repeal the charters. In some circumstances, repeal might raise legal and other concerns about financial compensation for current common and preferred stockholders, assumption of responsibility for paying off existing bondholders, guarantees of timely payment of mortgages, and other liabilities. On the other hand, Treasury has warrants to purchase nearly 80% of each GSE’s common stock at nominal cost making stockholder approval of a government proposal a certainty.

The GSEs could continue with state charters like other financial intermediaries including commercial banks. In the early 1990s, the Student Loan Marketing Association sought to relinquish its GSE status because of the financial burdens that came with its being a GSE and to make loans that it could not as a GSE.33 In 1996, Congress agreed to allow Sallie Mae to relinquish its congressional charter and give up its GSE status.34 Sallie Mae became a stockholder-owned company with no special privileges in 2004.

If the GSE charters were repealed, Congress might wish to consider whether the GSEs’ securitization of mortgages should be continued by a government agency. The GSEs have been able to compete against the government programs by creating a broader product than some government programs, and by competing on price.

Option: Government Agency

Option: Privatization

Read Also: Aer Loan Requirements

Regulatory Drivers Of Mortgage Trends

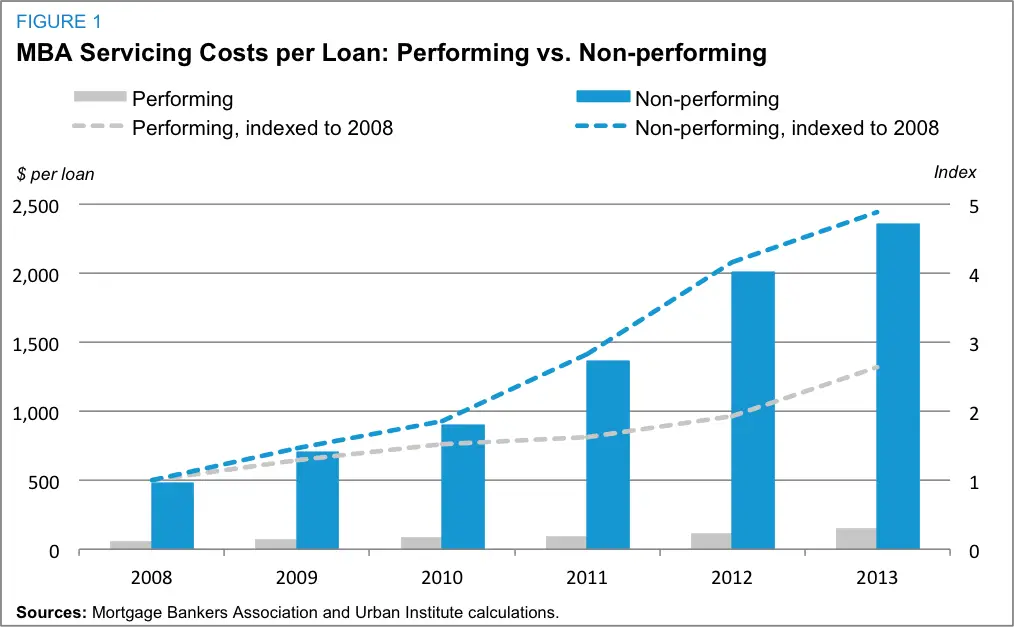

Regulatory changes have substantially increased the absolute and relative cost to a bank of originating a mortgage. Specifically, risk-weights for first-lien residential mortgage loans are 50 percent under the standardized approach, and about 80 percent under stressed conditions . These numbers are multiples higher than the 20 percent risk weights produced under the so-called advanced-internal ratings-based approach , which accounts for the risk of a mortgage loan with greater specificity and risk sensitivity. Thus, capital requirements under the Basel III standardized approach or under the Feds stress tests require a bank to hold more capital relative to the underlying risk of the asset.

With respect to servicing, the Basel III Accord increased significantly the risk-weight of MSAs. Specifically, the risk-weight on MSAs is equal to 250 percent if its share relative to common equity tier 1 does not exceed 10 percent. MSAs above the 10 percent limit are directly deducted from CET1 an effective risk weight of 1250 percent. The chart below plots the share of MSAs relative to capital at banks since 2001. Up until the 2007-2009 crisis, MSAs as a share of bank capital hovered around 10 percent. After the implementation of Basel III, MSAs declined significantly and are close to 3 percent according to the most recent regulatory reports. Thus, the increase in risk-weights reduced the incentives for banks to service the loans they originate and sell to the GSEs or Ginnie Mae.