How Long Does It Take To Get A Certificate Of Eligibility

The COE is not something you want to leave until the last minute, as it might put a major hitch in your giddy-up if youre trying to buy a house in a timely fashion.

The amount of time it takes to receive a COE varies, but it can take up to 6 weeks to receive the document, especially if you are requesting the document by mail.

Mortgage Lender requests do tend to be the quickest way to receive the COE back from the VA, but even that can be delayed given your length of time in service and mitigating factors like understaffing on the VA end.

How Do I Prepare Before Starting My Application

-

Veteran:- If you are a Veteran, youll need to show a copy of your discharge or separation papers .

-

Service member:- If youre an active-duty service member, youll need a statement of service showing the information mentioned below:

-

Full name of Servicemember

-

Social Security number of member

-

The actual date of birth

-

The date you Joined the duty

-

The duration of any lost time

-

The name of the command that confirms the information

-

National Guard or Reserve member:- If youre a current or former member of an activated National Guard or Reserve force, you will need to submit a copy of your discharge, or separation papers .

How Do You Get Coe On Ebenefits

The system will generate a COE based on the information saved in the profile. Click on View your COE to open the document. The COE will show entitlement available, exempt status and, if exempt, the amount of compensation being paid monthly, if any. NOTE: In most situations this will be the final step.

You May Like: Chfa Loan Colorado

Surviving Spouse And The Coe

If you are a surviving spouse of a service member you can still apply and be approved for a COE. To do this, fill out the VA Form 26-1817 and either bring it to your loan officer or mail it to:

VA Loan Eligibility CenterPO Box 100034Decatur, GA 30031

If you can not print and mail the document, you can call this number: follow the prompts, and they will mail you your COE.

If you have additional questions, contact a loan officer today.

Print Out And Mail In The Coe Form

Service members that prefer a paper trail can still print out and mail in the Certificate of Eligibility Form to the Department of Veterans Affairs for processing.

The COE Form is VA Form 26-1880, and it can be printed directly from the VA site and mailed to the address listed on the form.

This method will take longer as service members are at the mercy of the postal service, but the VA still offers the paper option for those more comfortable doing business that way.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Va Credit History Requirements

The VA does not set a minimum credit score for eligibility. Instead, the VA requires lenders to review your entire loan profile to make a lending.

Nevertheless, VA lenders set minimum score requirements. You’ll find that most lenders require a minimum FICO credit score of 640, although some others set the bar at 620

This credit score requirement is called a lender overlay, which is a guideline on top of the VA minimum standard. In other words, if your scores are low and the VA lender declines your loan, you may benefit by applying at another lender. The other lender may be willing to take on your VA loan request because it sets a more relaxed or different loan requirement, such as a lower minimum credit score.

If, on the other hand, you repeatedly encounter trouble finding a VA lender willing to take on your loan, you might want to take a closer look at your credit score by reviewing the details of your credit report. Examine your report for false information, identity theft or anything else that could lower your score. Correcting any discrepancies or inaccuracies in your report could immediately raise your credit score and increase your probability of finding a VA lender to process your loan request.

Contractors Tradespersons Or Seasonal Employees

If you run your own business, your lender will look at your most recent federal income tax returns to confirm your earnings and overall net income. Here again the two-year benchmark surfaces. Your lender will look for a minimum two-year history with a sustained amount. An income showing a year-to-year gain works in your favor. Income from interest, dividends, disability, retirement or pension might count, too, but only if you can demonstrate you’ve received these payments for the past two years and are more than likely to continue receiving them for three additional years.

If you are an independent contractor, your VA lender will look to your 1099 instead of a W-2 to verify yearly income. If you work with only one company, your lender will require verification of employment, the same requirement for salaried employees. If you work for multiple companies, your lender will require a letter from a Certified Public Accountant as verification of employment. If you don’t use a CPA, you’ll need two or more reference letters from companies you worked for.

If you are a seasonal employee who is not currently employed, your lender will look at the amount you’ve received in unemployment compensation. Your employer also will confirm that it’s probable that you’ll be rehired for the next season.

Recommended Reading: How To Get A Loan Officer License In California

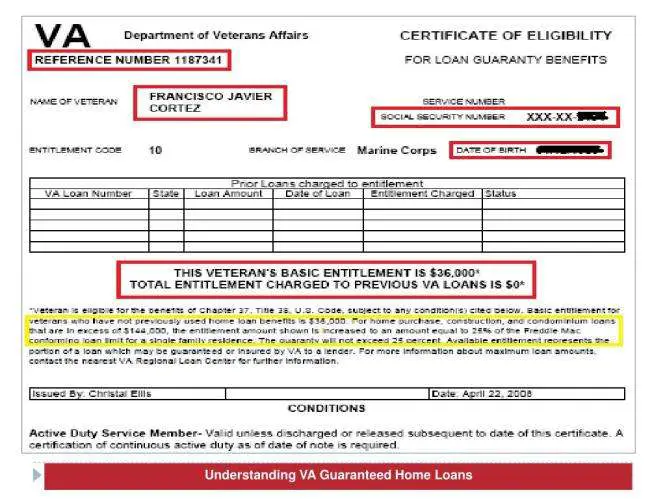

My Va Coe Says My Basic Entitlement Is Only $36000 What Does This Mean

Awe yes, no need to freak out!

This line on your VA COE is for your private lender.

It shows whether you have full VA loan entitlement.

The $36,000 isnt the total amount you can borrow.

Rather, it means that if you default on a loan thats under $144,000, the VA guarantees to pay your lender up to $36,000.

For loans over $144,000, the VA guarantees to pay your lender up to 25% of the total loan amount.

What You Need To Get A Va Coe

If you are currently active, youll need a statement of service signed by your commander, adjutant or personnel office that includes your name, your Social Security number and date of birth. Itll also need to document the day you started your service, any lost time and the name of the command providing the information.

If you are a veteran, youll need your discharge or separation papers .

If you are a discharged member of the National Guard or Reserves and were never activated, youll need to meet a few other requirements in order to document your eligibility. Check the VAs complete list of what you need for your application.

Surviving spouses also have some additional paperwork. Youll need to complete the VAs Request for Determination of Loan Guaranty EligibilityUnmarried Surviving Spouses form. Then, youll need to track down your spouses military records, which you can do via the National Archives a copy of your marriage license and a copy of your spouses death certificate.

You May Like: Ussa Auto Loan

Do I Need To Meet A Minimum Credit Score For A Va Home Loan

No, the VA does NOT have a minimum credit score requirement to secure a VA home loan.

However, private lenders absolutely DO have minimum credit score requirements.

Thus, youll still need to meet your private lenders credit score and income requirements to receive financing, especially if you want more favorable VA home loan terms and conditions.

Generally, the higher your credit score, the better the interest rate and loan terms youll receive from a private lender.

In 2021, most private VA lenders require a minimum credit score of 620.

Note that you may still qualify for a VA home loan with a credit score below 620, however, your options will be limited.

Your Path To Buying A Home With A Va Loan:

Navy Federal makes the process easy for you. Were here to explore whether you meet VA home loan requirements and answer any questions along the way.

You May Like: How To Refinance An Avant Loan

Show You Will Occupy Or Intend To Occupy The Property

The VA wants borrowers to use the home as their residence. Put another way, the VA does not want veterans to use their mortgage benefit to buy investment properties. Accordingly, the VA requires the borrower to either live in the property or “use it as his or her home within a reasonable time,” according to the VA Lenders Handbook. The exception to this rule are IRRRL loans.

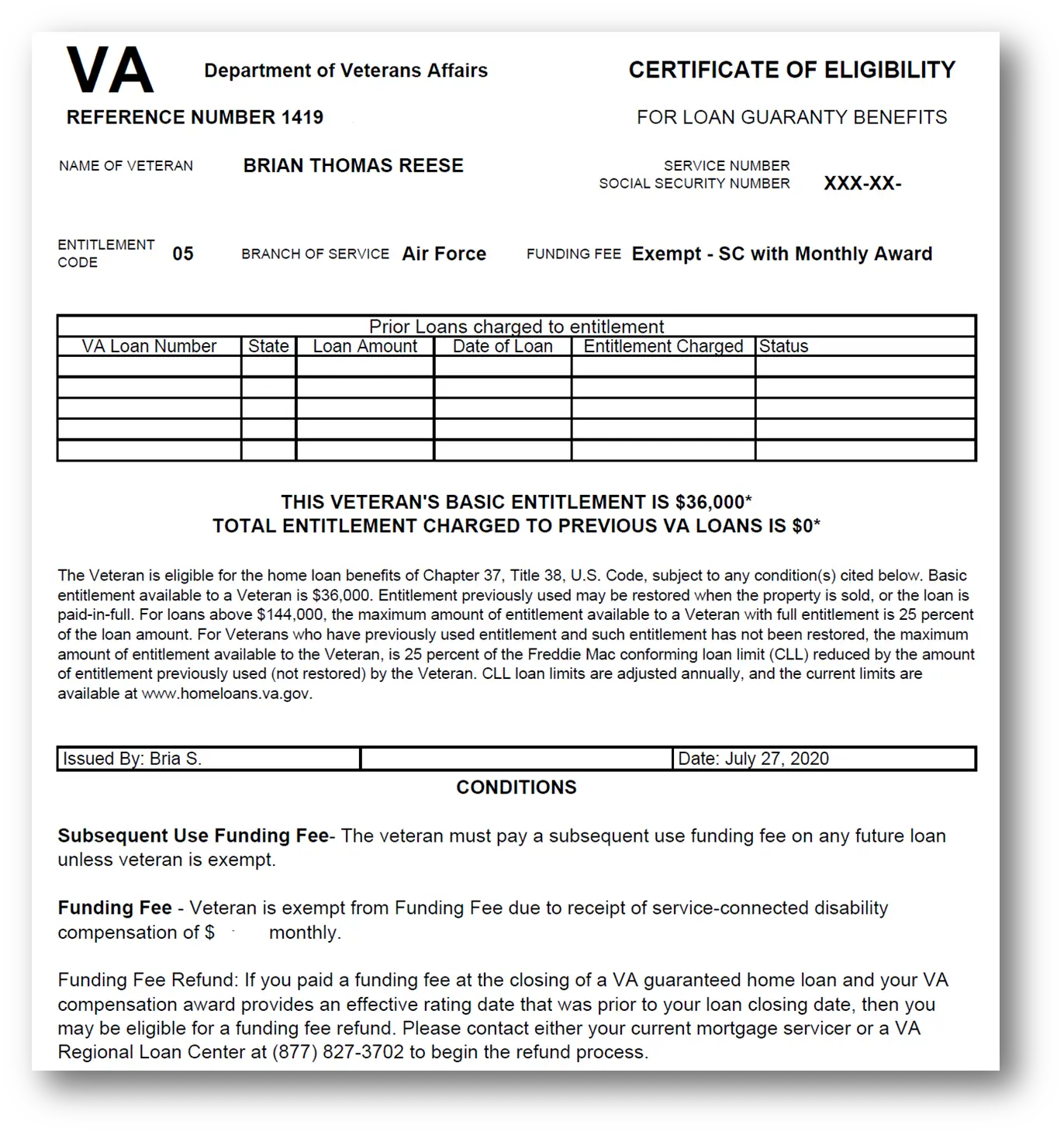

Restoration Of Entitlement Of The Coe

Our customer Michelle bought her home with a VA Loan in December. I included a copy of her COE to point out one more item that could limit your eligibility. The VA calls it restoration of entitlement.

Take a look at a copy of Michelles COE. I numbered three items 6-8. Below the COE Ill explain each.

- 6. Entitlement Code 05

- 7. VA Funding Fee Exempt

- 8. One Time Restoration of Entitlement

Also Check: What Is The Maximum Fha Loan Amount In Texas

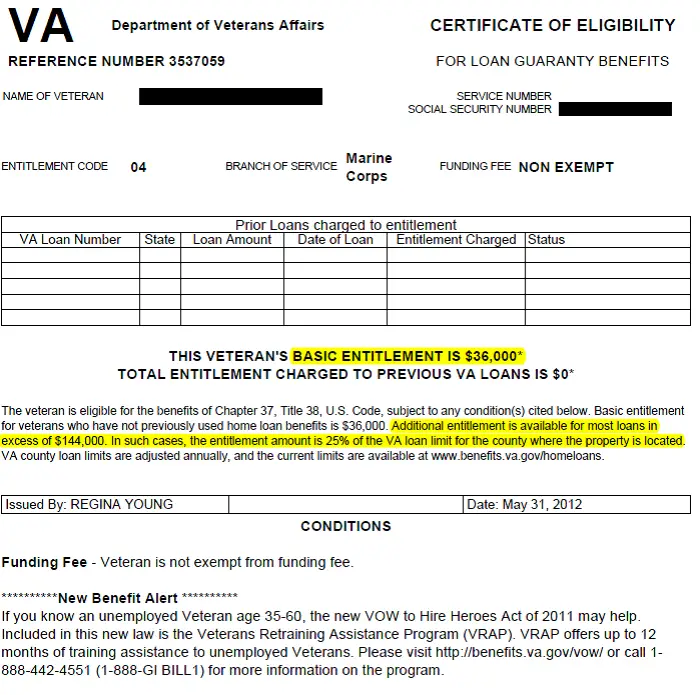

How To Calculate Your Entitlement

To figure out how much entitlement is available, follow the VAs instructions that I highlighted on the COE. …the entitlement amount is 25% of the VA loan limit for the county where the property is located.

The national VA loan limit for 2019 is $484,350. So multiply $484,350 by 25% to get your entitlement amount of $121,087.

Mason already used $75,000 of his $121,087 entitlement. To figure out how much he has left over for his next home purchase, subtract $75,000 from $121,087 to get $46,087.

For a thorough explanation and examples of VA entitlement, see How to use VA entitlement for one or more VA Loan.

Can I Request My Va Coe Form By Mail

Yes, you can request your VA COE by mail.

To apply by mail, youll need to fill out a Request for a VA Certificate of Eligibility and mail it to the addresses listed on the form, depending upon your state of residence.

Keep in mind that this will take longer than applying online or having your VA lender obtain it through the VAs LGY HUB.

You Served You Deserve!

And weve got your six! Become an Elite Member and talk with one of our Veteran Coaches to begin your journey to a higher rating!

You May Like: Usaa Car Loan Refinance Rates

How To Get The Best Va Loans Rates

Buying your dream home is one of the most exciting steps your family will take. As a veteran, you and your spouse have sacrificed everything for your country, even risked your life. We believe your kids deserve to grow up in a home they will remember for the rest of their lives. You and your spouse can relax on the spacious property you all can grow old on together.

VA Loans are the best loan for obtaining your dream home if you have served in the military or are active-duty. Like any large purchase, you should conduct extensive research and understand your options, which we will help with. Our team has the information you need to understand how to get your lowest rate before signing the dotted line.

Confirm You’re Eligible For A Va Loan

The easiest way to get a copy of your COE is to ask your lender to do it for you. Most lenders have access to the VAs online system. They can get your COE in a couple of minutes. You can call me for help at 855-610-1112.

If you prefer to do it yourself, the VA tells you How to Apply for a VA Home Loan Certificate of Eligibility . Alternatively, call the VAs eBenefits Help Desk at 1-800-983-0937, Monday-Friday, 8 am to 8 pm EST.

You May Like: Becu Auto Loan Phone Number

How To Read A Certificate Of Eligibility

Once you obtain your Certificate of Eligibility, you’ll notice an array of information, including your name, Social Security number, branch of service and even the name of the VA employee who issued your COE.

Most of it is clear and straightforward, but some items you may not recognize. The one part that often leads to questions from prospective VA borrowers is what’s known as an entitlement code.

This two-digit number gives VA lenders more information about your military service history and whether you may be exempt from paying the VA Funding Fee, an upfront cost that goes directly to the Department of Veterans Affairs.

Borrowers receiving compensation for a service-connected disability, Purple Heart recipients on active duty, and eligible surviving spouses do not have to pay this fee.

There are 11 possible VA entitlement codes, which you can learn about here. Most of the entitlement codes relate to a period of military service. But an important one for Veterans who’ve used their VA loan benefit in the past is Entitlement Code 05.

This entitlement code notes that a borrower has previously obtained a VA loan, repaid the loan in full and restored the entitlement used on the property. Borrowers who’ve used a VA loan before are subject to paying a higher funding fee on future VA purchases unless their Certificate of Eligibility indicates they are exempt from the fee.

Va Loan Certificate Of Eligibility

Do you know what it means to have a VA Loan Certificate of Eligibility ? This important document is necessary in the lending process when using your VA Home Loan benefit to buy, build, or refinance a home.

Eligible veterans who have met the minimum time-in-service requirements to be eligible for a VA loan can apply online via the VA for their COE, or ask the lender to help.

The COE contains important information for you and the lender including how much VA loan entitlement you have , whether or not you are exempt from paying the VA Loan Funding Fee, and much more.

The VA Home Loan offers $0 Down with no PMI. Find out if youre eligible for this powerful home buying benefit. Prequalify today!

The VA Loan Process: COE First

The VA loan process begins with establishing that you, the borrower, are eligible to apply. This is what applying for your COE is all abouttelling the participating VA lender that you are allowed to apply for consideration to get a VA mortgage.

You are not automatically approved for a VA mortgage once you are awarded your COE. All applicants must financially qualify for a VA mortgage loan the same as with any other major line of credit. The COE merely establishes you as an eligible applicant for the loan.

Read Also: Can You Refinance An Fha Loan

Secure A Certificate Of Eligibility

A Certificate of Eligibility is a document showing your lender you have the required active duty service or service history to qualify for a VA loan. You can apply for a COE online or by mail. In most cases, the online application process is much faster. Your lender can also assist you with this process.

Who Qualifies For A Va Loan Certificate Of Eligibility

Not every single person who wore a uniform qualifies for a VA Loan Certificate of Eligibility.

Service-members must have 181 days of service during peacetime, or 90 days of service during wartime, 6 years of service in the National Guard or Reserves or are the surviving spouse of a service member who has died in the line of duty or from a service-connected disability.

The service member must have received an honorable discharge, as well.

You May Like: How Do I Find Out My Auto Loan Account Number

Va Funding Fee Exemption

Michelle is exempt. She didnt pay a funding fee for her VA Loan.

Veterans who receive compensation, retirement, or active duty pay from the VA for a service-connected disability dont pay the fee. A surviving spouse of a veteran who died in service or from a service-connected disability is also exempt.

How To Apply For A Va Loan

Alright, youve met the eligibility requirements and youready to apply for a VA loan but you might be wondering where to even start.

First, you will need to have a VA Home Loan Certificate of Eligibility . The VA will require some information and documents from you to apply for a COE so it is best to prepare your documents beforehand so that you can get through the application process smoothly.

Read Also: What Credit Score Is Needed For Usaa Auto Loan