What Do I Need To Get Started

Once youâre pre-qualified, youâll need to upload some documents to verify income and help us pay off your old loans.

- CheckYour Most Recent Student Loan or Payoff Verification StatementIf you have multiple student loans, no problem â just send us one for each.

- CheckProof of IncomeIf youâre employed, two recent pay stubs work best. If you have other income, weâll instruct you on the proper documentation.

Ready to Start Saving?

You Put In The Work Now Reap The Rewards

- Variable Rates between 1.95% – 5.63% APR1

- Fixed Rates between 2.55% – 5.59% APR1

- Flexible repayment terms including 5, 10, 15, 20 and 25 year loans.

- No application or prepayment fees

- Cosigner release with 24 consecutive on-time payments2

- Show more info »

1Interest Rates

Fixed interest rates range from 2.55% APR to 5.59% APR . Your interest rate will depend on your credit qualifications. The fixed interest rate will remain the same for the life of the loan.

Variable interest rates range from 1.95% APR to 5.63% APR . Your interest rate will depend on your credit qualifications. Variable rates may increase after consummation. The variable interest rate is equal to the One-Month London Interbank Offered Rate plus a margin. The One-Month LIBOR in effect for each monthly period will be the highest One-Month LIBOR published in The Wall Street Journal Money Rates table on the twenty-fifth day of the month immediately preceding such calendar month. The Annual Percentage Rate for a variable interest rate loan will change monthly on the first day of each month if the One-Month LIBOR index changes. This may result in higher monthly payments. The current One-Month LIBOR index is 0.10% as of August 1, 2021.

2Cosigner Release. A request for the cosigner to be released can be made by either the borrower or cosigner when each of the following conditions has been met:

Refinance Loan Limits:

Laurel Road Student Loan Refinance

Min. Credit Score

Fixed APR

Variable APR

View details;

Best for borrowers who want to refinance during their medical or dental residency.

Pros

-

You can refinance parent PLUS loans in your name.

-

Refinancing available for medical and dental residents.

-

You can see if youll qualify and what rate youll get without a hard credit check.

Cons

-

Payment postponement isnt available if borrowers return to school.

Qualifications

-

Typical credit score of approved borrowers or co-signers: Did not disclose.

-

Loan amounts: $5,000 up to your total outstanding loan balance.

-

Must have a degree: At least an associate degree for select professions. Borrowers in their last year of undergrad can refinance. For parent PLUS loans, the child does not need to have graduated to refinance.

Available Term Lengths

5, 7, 10, 15 or 20 years

Disclaimer

Recommended Reading: Who Can Loan Me Money

Consolidating Your Parent Plus Loans

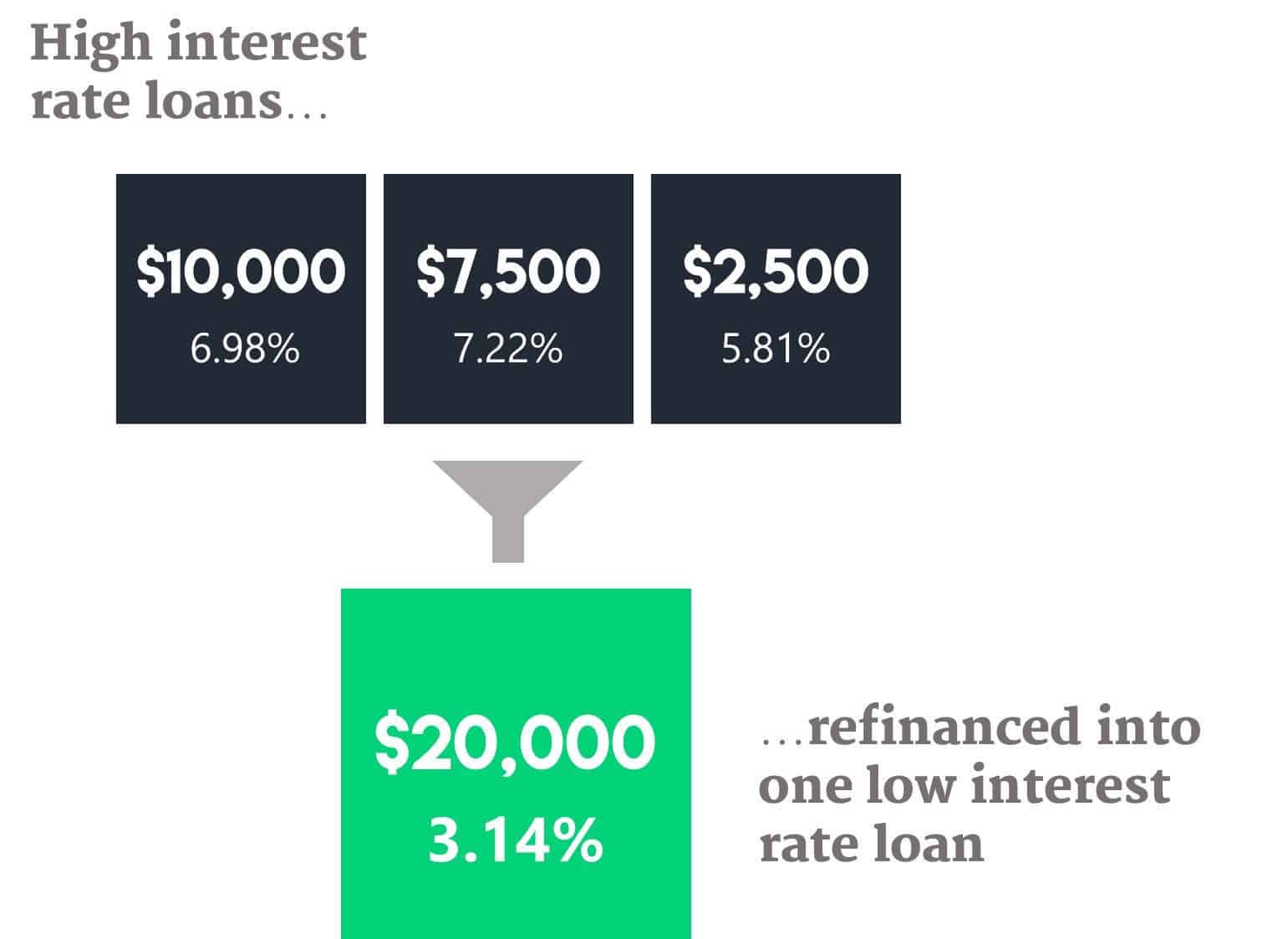

Another big reason parents might consider refinancing their Parent PLUS loans is to simplify their finances entirely. Whether due to preference or necessity, you may have taken out several different loans in order to help pay for your childs college education. If this is the case, you likely know what a headache it can be to juggle multiple monthly payments to multiple lenders. Not only can this eat away at your income, but also your time. The ability to streamline your student loan payments and consolidate under one lender is a major reason why so many parents turn to refinancing. And while many parents enjoy the fresh start refinancing can afford them, its the peace of mind that comes with one single monthly loan payment that entices many to take the plunge. If you find yourself often overwhelmed by the sheer amount of payments you are responsible for paying each month, consolidating your loans through refinancing may very well ease some of that burden.

Refinancing To Consolidate Parent Plus And Private Student Loans

Refinancing Parent PLUS Loans may also offer you the opportunity to consolidate other debt associated with financing your childs education. If you have Parent PLUS Loans and have also cosigned private student loans for your child, your Parent PLUS Loans and their private student loans that you cosigned can be consolidated together by refinancing with a private lender like ELFI.

The federal government does not allow Parent PLUS Loans to be refinanced, but only consolidated through a Direct Consolidation Loan, and private loans can not be included. Refinancing and consolidating Parent PLUS Loans and private student loans can provide you with one simple monthly payment and potentially a lower interest rate, allowing you to pay off your loans faster and save money over your loan term.

Recommended Reading: Is My Loan Fannie Mae

Refinance Your Parent Plus Loans With Earnest

Similar to student loan refinancing, parents are able to bring their loan to a private lender and refinance the total amount for a lower rate.

At Earnest, we also offer the ability to customize your new;loan terms and repayment options based on a budget that works for you. Earnests;Precision Pricing feature allows you to customize your new refinanced loan with a lower rate to fit your budget and needs.

What To Do Before You Take A Plus Loan

Many times, a school will present the student’s financial aid package with a Direct PLUS Loan added in. The school might say that it wants to make families aware of all of their available funding options, but including the Direct PLUS Loan in the package can make the true cost of college confusing. When considering the costs of college, ask for a financial aid package breakdown without the PLUS loan.

Instead of a Direct PLUS Loan, you might have your child opt for a private student loan for any leftover costs that grants, work-study, federal student loans, scholarships, and other aid do not cover. If you want to help your child financially, you can make payments on the private loan while they are still in school. This allows you to subsidize your childs college costs but doesn’t hold you solely accountable for the debt.

You may be able to refinance your PLUS loan to lower your interest rate or spread payments over a longer period.

Don’t Miss: How To See My Loan Balance

How To Refinance A Parent Plus Loan

A Parent PLUS loan is money a parent borrows from the federal government for a childs college education. These loans are all part of the myth that you need to take on back-breaking levels of debt just to get an education. But this is a lie! Anyone can get a debt-free degree.

When it comes to refinancing your Parent PLUS loan, there are basically two options: 1) keep it in your name or 2) transfer it to your child.

Option 1 is just like any other refi. The benefits are:

- A lower interest rate. Because Parent PLUS rates can climb to 7 or 8%, a lower rate gives some relief and allows for faster progress on the overall loan.

- A more manageable budget. Combining multiple loans can make budgeting easier and give you more time and energy to focus on actually paying them off.

Refinancing does come with some warnings. Here are some other things to be aware of:

If you do qualify for a refi, and youre not concerned about the federal program benefits, you should definitely consider refinancing your loan, but only if you can find one that checks all our boxes:

What You Should Consider Before Refinancing Parent Plus Student Loans

Refinancing your federal PLUS Loans into a private loan means losing all federal loan benefits including the income-based repayment plans, loan forgiveness programs, forbearance options and other perks they come with. Because of this, it may be smart to consider a federal Direct Consolidation Loan first, as these can also lower your payment, while still retaining the valuable benefits of a federal loan.

You should also take into account your credit profile or that of your childs before moving forward with a refinance. Private student loan lenders based their rates and terms on credit score, debt-to-income ratios and other elements of your financial picture, so if you or your child is not in a strong place credit-wise, it might not be beneficial to refinance just yet.

When this is the case, Dvorkin suggests a creative alternative. Parents can pursue an informal arrangement with their child to have them start paying off the loan, if both parent and child agree to the details of repayment. In this case, a child would become the borrower and a parent would set interest rates and other terms similar to an official refinanced arraignment.”

You May Like: How To Calculate Amortization Schedule For Car Loan

Student Debt Relief Loan Refinancing Advertiser Disclosure

Student loan offers that appear on this site are from companies or affiliates from which Student Debt Relief may receive compensation. This compensation may impact how and where products appear on this site . Student Debt Relief does not include all student loan companies or all types of offers available in the marketplace. Student Debt Relief tries to keep all rates offered by lenders up to date.; There may be instances where rates have been changed, but Student Debt Relief has not been made aware of those changes, and/or has not yet had a chance to update its website.; We make no guarantees as to the rates being offered. For more information see our privacy policy.

Best Companies For Parent Student Loan Refinance

1Rates and offers current as of April 1, 2021. Annual Percentage Rate is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Fixed Rates range from 2.99% APR to 5.15% APR and Variable Rates range from 2.15% APR to 4.45% APR. Both Fixed and Variable Rates will vary based on application terms, level of degree and presence of a co-signer. These rates are subject to additional terms and conditions and rates are subject to change at any time without notice. For Variable Rate student loans, the rate will never exceed 9.00% for 5 year and 8 year loans and 10.00% for 12 and 15 years loans . Minimum variable rate will be 2.00%.

Don’t Miss: What Is An Ellie Mae Loan

Risk Of Using A Home Equity Loan For Parent Plus Loan Refinancing

The downside to using a home equity loan is the fact that you could lose your home if you dont make payments. With a Parent PLUS loan, there are credit consequences, and non-payment could mean wage garnishment or tax refund garnishment. However, you dont have to worry about losing your home.

Parent PLUS loans are unsecured debt, while a home equity loan is a secured debt. Its important to be very careful and understand the risks before you use secured debt to pay off an unsecured loan.

Should You Refinance Or Consolidate Your Parent Plus Loans

If your credit score is good enough to qualify for low rates, refinancing your Parent PLUS loans is typically a better option than consolidating them. As long as you won’t have any trouble making your loan payments, you could save a lot of money.

Parent PLUS loans have a fixed interest rate of 7.6% as of 2019, and that interest rate goes up when you consolidate. The top student loan providers, on the other hand, have fixed rates under 4% and variable rates under 3%.

Consolidation is a better option if you think you could need an income-based repayment plan in the future. It’s also a way to get a lower monthly loan payment if you don’t have good credit.

Also Check: How To Pay Down Student Loan Debt

You Wont Be Eligible For Alternative Payment Plans

If you have federal Parent PLUS Loans and cant afford your payments under a standard 10-year repayment plan, you have three options available to you:

- You can sign up for a Graduated Repayment Plan: With this approach, your payments start out low and increase every two years. Youll still pay off your debt within 10 years, but youll have lower payments early on.;

- You can sign up for an Extended Repayment Plan: Under an Extended Repayment Plan, your repayment term is extended to 25 years. Youll pay more in interest than you would with a 10-year plan, but you could have a much lower payment.;

- You can take out a Direct Consolidation Loan: You can consolidate your debt with a Direct Consolidation Loan. When you do so, your loan will be eligible for an income-contingent repayment plan, which extends your repayment term and caps your monthly payment at a percentage of your discretionary income.;

If you decide to refinance your student loans, your loan becomes private instead of federal.;Private student loans arent eligible for federal benefits, so youll lose out on the ability to sign up for an alternative payment plan.;

How To Refinance Your Parent Plus Loans

Congratulations, parentsthat bundle of joy you brought home more than two decades ago has now graduated from college or earned their professional degree.

If you borrowed federal student loans with the Parent PLUS loan;program for your childs education, you are not alone.;Millions of families have used federal loans aimed at parents to help pay for their childrens bachelors degrees, according to the federal government.

However, these are among the most expensive education loans for borrowers with good credit. If you borrowed federal Parent PLUS loans over the last four years, your loans likely have interest rates that range from 6.41% to 7.90%, plus the origination fees.

The good news is that you are eligible to;refinance your federal loans for a lower interest rate.

Parent PLUS loans accrue interest from origination, and payments typically start right after the loan amount has been disbursed. If you decided on deferment when you took the loans, keep in mind that your repayment term for Parent PLUS loans starts six months after your student has been out of school .

Check our student loan calculator to compare your rates.

You May Like: When To Apply For Ppp Loan Forgiveness

A Note About Student Loan Refinancing

Understand and evaluate the various features and benefits of your current loans, and any potential benefits that may be lost by refinancing federal and private education loans, such as the loss of any remaining grace periods. Learn more about what to take into consideration when refinancing federal student loans with private education loans.

Parent Plus Loan Consolidation

An alternative to refinancing your parent PLUS loans with a private lender is to consolidate them through the Direct Consolidation Loan program. This is the federal student loan consolidation program, and is only available for federally held loans, meaning if you want to combine federal and private student loans together, you would not be able to do so with a Direct Consolidation Loan. You do not have to include all of your federal student loans in your consolidation loan.

Lets look at the pros and cons of Direct Consolidation Loans.

Also Check: How To Lower Car Loan Payments

Use A Home Equity Loan

Another way to pay off your Parent PLUS loans is to refinance using a home equity loan. If you have enough equity in your house, you could get a loan and then pay off the PLUS loan.

In many cases, because a home equity loan represents secured debt, you can get a lower interest rate. You might be able to save money and lower your payments each month. Depending on your credit, you might be able to get better terms with a home equity loan than you would from using a private Parent PLUS refinancing company.

Options For Refinancing Parent Plus Loans

Even though your child/dependent may not have graduated from college yet, you can lower your debt burden by taking advantage of refinancing your Parent PLUS loans . Refinancing can potentially save money by either lowering your interest rates and/or extending the term of your payment.;

The good news about refinancing Parent PLUS loans is that you can refinance student loans more than once, assuming you qualify. So you can refinance your Parent PLUS Loans at any time with a private lender even before your dependents/children graduate! If you have multiple Parent PLUS loans, you can combine them all, if economic, when your dependents/children graduate as well!

Although Parent PLUS Loans originate through the U.S. Department of Education, they can only be refinanced through private lenders. Refinancing your Parent PLUS Loans with ELFI1 could mean:

- Lower Interest Rates

- Choose a New Repayment Term Length

You May Like: How To Check If Loan Is Fannie Or Freddie

Can A Parent Plus Loan Be Transferred To The Student

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

As each student puts together their unique strategy to finance college, plans often include scholarships and grants, along with savings and student loans taken out by the student.

Sometimes, though, thats not enough, so maybe youre considering taking out a Parent PLUS loan to help your child finance collegeor maybe youve already taken out one of these loans. In either case, its never too soon to think about the most effective way to repay this debt.

The U.S. Department of Education provides these Direct PLUS Loans, and they can be taken out by a parent to fund their childs education. Before applying, the student and parent must fill out the Free Application for Federal Student Aid , then the parent can apply for a Direct PLUS Loan for Parents.

Read on to learn more about:

;;Further information on Parent PLUS loans

;;Questions parents often want answers to, including, Can you transfer a Parent PLUS loan to the student?

;;Pros and cons of that process