Federal Perkins Loan Cancellation For Teachers

You may qualify for up to 100% cancellation on your federal Perkins student loans through Perkins Loan Cancellation if you are a full-time teacher at a low-income school. You may confirm whether your school classifies as low-income through the U.S. Department of Educationâs online database.

You may also qualify for this student loan forgiveness program if you teach a specific subject. Some state education agencies will determine what subjects qualify based on shortages of qualified teachers for a particular subject.

This program cancels student loans over five years incrementally. Only teachers with existing Perkins loans may seek this forgiveness option because no new Perkins loans are available.

What Is Public Service Loan Forgiveness How Did It Originate

The Public Service Loan Forgiveness is a program that was launched in 2007 in an effort to steer more college graduates into public service. As long as they made 10 years of payments on their federal student loans, the program promised to erase the remainder.

The program, however, has proved anything but forgiving. Before Wednesdays announcement, only 16,000 borrowers had seen their debt forgiven via the program, according to the Education Department. About 1.3 million people are trying to have their debts discharged through the program.

One of the most problematic pieces of Public Service Loan Forgiveness: Many borrowers had the wrong type of loan and didn’t realize they weren’t eligible for relief.

When the loan forgiveness program was first introduced, many of the loans offered from the federal government were Family Federal Education Loans , or loans made through private entities but insured by the federal government.

The government stopped offering those loans in 2010 and now relies on direct loans the kind eligible for forgiveness. The Education Department said about 60% of borrowers with an approved employer hold FFEL loans.

You Dont Know What Kind Of Federal Loans You Have

Its very common for borrowers to not know what kind of federal loans they have. You can see what loans you have by logging into your account on StudentAid.gov, going to the My Aid page , and scrolling down to the Loan Breakdown section.

There, youll see a list of each loan you have borrowed, even if you have paid the loan off or consolidated it into a new loan. Direct Loans begin with the word Direct. Federal Family Education Loans start with FFEL, and Perkins Loans include the word Perkins in the name.

Don’t Miss: Conventional 97 Loan Vs Fha

What Are My Responsibilities

Once you have been approved for the B.C. Loan Forgiveness Program, there are things you must do to maintain eligibility:

- One year after your program registration date , you must submit via StudentAid BC online account, mail or courier a signed letter from your employer documenting your hours of in-person service in an eligible occupation at a publicly-funded facility in British Columbia either in an eligible under served community or working with children. The letter must include the following:

- Letterhead and name of the facility where you are employed

- Your name, occupation and community

- Dated within 30 days of your 12 month anniversary date

- Signature of your employer and,

- The number of in-person service hours provided during the 12-month period prior to the anniversary date.

- Maintain your current mailing and email address information with StudentAid BC.

Note: If your verified in-person hours of service is less than 400 and greater than 99 hours, your benefits under the program for that year will be prorated as indicated below.

| Total Annual Hours of In-Person Service | Annual Percentage of BC Student Loan Debt Forgiveness |

|---|---|

| 0 to 99 |

Consider Student Loan Refinancing

Refinancing gives you the chance to adjust your monthly payments and choose new repayment terms, often between five and 20 years.

You could qualify for a lower interest rate than you have now, thereby saving money on your loans. And if you refinance multiple loans, you can combine them into one single loan to simplify repayment.

Before you shop for student loan refinancing options, note that refinancing federal loans turns them private. As a result, youll lose access to federal forgiveness programs and repayment plans, which proved especially helpful while the coronavirus pandemic squeezed the economy in 2020 and 2021. If youre comfortable with this sacrifice, however, consider refinancing as a way to restructure your debt and potentially save money on interest.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

What Are The Choice To Non

If youre on the lookout for forgiveness for a personal Student Loan, its seemingly that you justre combating funds after paying for faculty. Heres what you are able to do

- Defer your student loans

- Look into refinancing

- Bankruptcy

Though non-public student loan forgiveness doesnt exist within the conventional sense, there may be non-public student loan assist there. The secrets to speak to your lender if you happen tore struggling to see what choices can be found and to behave quick.

You dont wish to fall into delinquency or deferment, which might damage your credit. So if you happen tore dealing with difficulties along with your student loan fee.

Are There Disadvantages Of Getting Your Loan Forgiven

Knowing the cons of student loan forgiveness applications is as necessary as understanding the professionals. Understanding the cons helps you really make an knowledgeable resolution as as to if to use for loan forgiveness program and likewise which one is finest on your circumstances.

Some disadvantages of Student Loan forgiveness embody:

- The qualifying standards are very stringent.

- It limits job prospects.

- It would require you to make a long-term job dedication. To qualify,

- Commit at the least 5 to 10 years within the chosen discipline of labor. This will be cumbersome in case you are not considering working in related jobs.

Weighing the benefits of student loan in opposition to its disadvantages offers you sufficient info to make your resolution.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

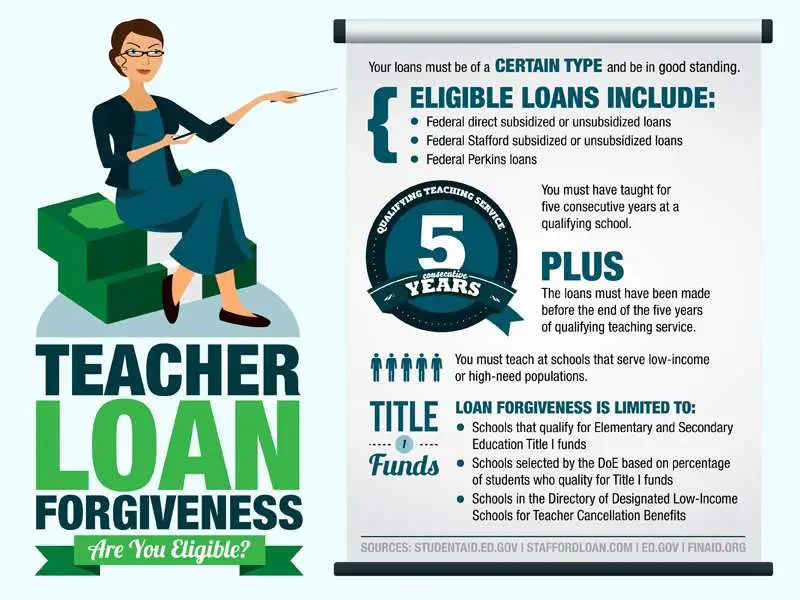

How Does Student Loan Forgiveness Work For Teachers

Teachers with student loans have four options for student loan forgiveness. These various programs may depend on where you work and the types of student loans that you have.

Generally, you may apply for student loan forgiveness if you work in approved educational institutions and have federal student loans. Here is a closer look into your forgiveness program options as a teacher with student loans.

How Do You Apply For Public Service Loan Forgiveness

Fill out and submit the Employment Certification Form each year, or as you change jobs.

FedLoan Servicing will review your information and let you know if you qualify. They might ask for more information, like pay stubs, W-2s or other documentation.

FedLoan Servicing will let you know how many qualified payments you have made, and how many payments you will need to make until you qualify for forgiveness.

Currently, there is no limit on the amount forgiven under PSLF. The full amount of your federal student loans is eligible for forgiveness.

You May Like: Usaa Car Loan Interest Rates

If I Qualify What Steps Do I Need To Take

Changes to the loan forgiveness program will take place in two parts.

The agency will first loosen some of the rules that had prevented eligible borrowers from discharging their loans, via a limited waiver. The government, for example, will allow payments on any of a person’s loans to count toward the total number required for forgiveness.

The Public Service Loan Forgiveness waiver will be available to borrowers who have direct loans, Federal Family Education Loans and Perkins Loans.

Parent PLUS loans are not eligible under the limited waiver.

The department said it would automatically credit borrowers who already have direct loans and have proved they work in an eligible field. Others who haven’t enrolled in the program or have ineligible federal loans will have to apply for forgiveness, which may require them to consolidate their loans. Borrowers will have until October 2022 to apply.

To find out more about loan consolidation, visit StudentAid.gov/Manage-Loans/Consolidation.

The Education Department also plans to review all Public Service Loan Forgiveness applications that had been denied and to give federal employees automatic credit toward forgiveness.

Other changes will come about more slowly via regulations made by “rule-making,” a lengthy and complicated bureaucratic back-and-forth between the government and other stakeholders.

For more information, visit StudentAid.gov/PSLFWaiver.

Teacher Loan Forgiveness Vs Pslf

Any teacher with student loans would love an easy way to wipe out that debt and create more financial freedom. Debt elimination would not only remove a giant stress in your life but also free up money for other life goals like buying a home, starting a family and saving for retirement.

Federal teacher loan forgiveness has strict requirements to be eligible for the full $17,500 in loan forgiveness. The alternative $5,000 option is helpful. But if you have over $25,000 in student loan debt, youll still have a hefty remaining balance to pay off.

Another potential issue is not picking the right program and sabotaging your chances for more funds. Technically, you can receive loan forgiveness through the Teacher Loan Forgiveness Program as well as PSLF. But there is a catch.

According to the Federal Student Aid website, you can potentially receive forgiveness under both the Teacher Loan Forgiveness Program and the Public Service Loan Forgiveness Program, but not for the same period of teaching service.

In other words, if you work for five qualifying years to receive Teacher Loan Forgiveness, you cant count any of the payments made during that time period toward your required 120 qualifying payments for PSLF. This rule adds five more years of payments to your financial strategy if you wanted to pursue both programs.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Student Loan Repayment Assistance Programs For Other Careers

Most state LRAPs award loan assistance to professionals in exchange for two years of service. The most common occupations are doctors, nurses, teachers and lawyers, but some other career paths qualify, too.

Several LRAPs for doctors, for instance, help out pharmacists and veterinarians. Other programs, like the Alfond Leaders Program in Maine, award people in STEM careers.

Even if youre not a doctor, nurse, teacher and lawyer, check your states offerings to find out if it has a loan repayment assistance program for you.

Fact Sheet: Public Service Loan Forgiveness Program Overhaul

Contact:

The Public Service Loan Forgiveness Program is an importantbut largely unmetpromise to provide debt relief to support the teachers, nurses, firefighters, and others serving their communities through hard work that is essential to our countrys success. By cancelling loans after 10 years of public service, PSLF removes the burden of student debt on public servants, makes it possible for many borrowers to stay in their jobs, and entices others to work in high-need fields.

Today, the Department of Education is announcing a set of actions that, over the coming months, will restore the promise of PSLF. We will offer a time-limited waiver so that student borrowers can count payments from all federal loan programs or repayment plans toward forgiveness. This includes loan types and payment plans that were not previously eligible. We will pursue opportunities to automate PSLF eligibility, give borrowers a way to get errors corrected, and make it easier for members of the military to get credit toward forgiveness while they serve. We will pair these changes with an expanded communications campaign to make sure affected borrowers learn about these opportunities and encourage them to apply.

Today the Department is announcing it will:

To further strengthen oversight of PSLF, the Department will improve its reporting on PSLF, including information on timelines for processing applications and results of servicer audits.

Recommended Reading: How Do I Refinance An Auto Loan

Difficulties To Earning Loan Forgiveness

Teacher loan forgiveness and cancellation plans can be complicated, and successfully obtaining debt relief through one of them requires planning and avoiding mistakes regarding repayment. This table describes a few of the potential challenges to earning loan forgiveness and what can be done to avoid them:

Federal Teacher Cancellation For Perkins Loans

The Federal Perkins Loan program expired in September 2017. However, if you borrowed money through the program before its expiration date, you might still qualify for Federal Teacher Cancellation for Perkins Loans.

How much its worth : Up to $27,500.

Requirements: You must teach for at least one year and meet one of the below requirements:

- Teach at a low-income school

- Teach special education

- Teach in mathematics, science, foreign languages or bilingual education

- Teach in a field that has a shortage of qualified teachers in your state

How long it takes: Minimum one full year of teaching, and 100% Perkins Loan debt cancellation after five years.

The details: After just one year of teaching, you can have 15% of your outstanding Perkins Loans canceled. This continues in varying amounts until you have all Perkins Loan debt canceled after five years. To apply, contact the school that holds your Perkins Loans. To learn more about requirements, check out the Federal Student Aid website.

You May Like: Usaa Rv Rates

Student Loan Discharge For Special Circumstances

While student loan discharge isnt the same as forgiveness, it could leave you debt-free. In rare circumstances, borrowers can get their student loans completely canceled.

There are several situations when you could qualify for student loan discharge, including:

- Closed school

If you think you could qualify or want to learn more, speak with your loan servicer.

Qualifying For Student Loan Forgiveness

Of course, anything that sounds as good as not having to repay your student loans is bound to come with some strings attached.

Loan forgiveness for teachers requires you to meet qualifying criteria. Those criteria can vary depending on the type of loan you have, whos forgiving it and where you work.

You May Like: Car Refinance Rates Usaa

Potential Pitfalls Of Forgiveness

The IRS likes to tax things, and forgiven debt is no exception. Public service loan forgiveness is not taxable. But any balance wiped out through an income-driven repayment plan can be counted as income and taxed. It’s important to prepare for this eventual tax bill. Consider setting aside money in a dedicated savings account.

Note that the American Rescue Plan , passed by Congress and signed by President Biden in March 2021, includes a provision that student loan forgiveness issued between Jan. 1, 2021, and Dec. 31, 2025, will not be taxable to the recipient.

Who Is Eligible For Student Loan Forgiveness

The government previously restricted eligibility for the Public Service Loan Forgiveness program to only certain types of federal student loans and specific repayment plans.

However, through October 2022, borrowers who have made 10 years worth of payments while in a qualifying job such as positions in federal, state or local governments, a nonprofit organization or the U.S. military will now be eligible for loan relief no matter what kind of federal loan or repayment plan they have.

Past loan payments that were previously ineligible will now count, moving some borrowers closer to forgiveness. That is expected to especially help those borrowers with Federal Family Education Loans.

Among other changes, the department will allow military members to count time on active duty toward the 10 years, even if they put a pause on making their payments during that time.

Recommended Reading: How Much To Loan Officers Make

Do Your Loans Qualify

To qualify, you must have Direct Loans or Federal Stafford Loans , or a Direct or Federal Consolidation Loan that was used to repay one of these types of loans. And if youre in default on a loan, you cant take advantage of Teacher Loan Forgiveness until youve made repayment arrangements for that loan.

Unfortunately, PLUS Loans and Federal Perkins Loans are not eligible for the Teacher Loan Forgiveness Program, although Perkins loans may potentially be eligible for other forms of cancellation.

Who May Need To Consolidate Their Loans

If you have Federal Family Education Loan Program loans, Federal Perkins Loans or other types of federal student loans that arent direct loans, you must consolidate them into the direct loan program by Oct. 31, 2022, according to Federal Student Aid.

This is important for borrowers because you can’t receive credit for payments if you consolidate after that date. Once the consolidation process is complete, you must then submit a PSLF form to your loan servicer.

The help tool on the Federal Student Aid website will be updated in the coming months to process applications for borrowers in the Federal Family Education Loan Program and those with Perkins loans.

Right now, employment can still be verified for them in Step 1 of the help tool, and loan consolidation can still be requested, Federal Student Aid said on its website. But an application for the Public Service Loan Forgiveness program through the tool may not be available in the near term for those borrowers.

Also Check: How Much Car Can I Afford For 500 A Month

Student Loan Forgiveness For Borrowers Defrauded By Their School

The Biden administration expanded relief under Borrower Defense to Repayment, a program that cancels federal student loan debt for borrowers who have been defrauded by their college, university, or trade school.

The $1.5 billion in new student loan cancellation announced by the Biden administration will be provided automatically, and it only applies to certain borrowers who already have approved Borrower Defense claims. The administration reversed a Trump-era policy that had permitted the Department of Education to provide only partial relief for approved Borrower Defense claims. With the new changes, the Department will be canceling any remaining federal student loan balance for borrowers whose loans are covered by the new, expanded relief. No action is required, and the Department has already started notifying impacted borrowers.

Student loan borrowers who do not benefit from the automatic relief can, of course, submit a Borrower Defense application and potentially still benefit from the reversal of the prior partial relief policy. But a new application would still be subject to Department review and approval.