Business Line Of Credit

A Business line of credit is an open revolving line of credit. This type of financing allows business owners to draw funds when needed on-demand or make purchasesa business line of credit charges a principal & interest. Business lines of credit do have a credit limit that cannot be exceeded without approval. They are not open-ended forever and require renewal either semi-annually or annually to be extended. Lines of credit may be used for small purchases and expenses. Interest rates vary due to risk and higher interest rates may apply to qualify. Loans and lines are different products with different features.

Product Overview

Fixed Rates: 5.50% or treasury index plus 1% to 2.5%. Typically not variable interest rates.

Terms: Open revolving line

Fee: Origination fees ranging from 0% to 3%

Payment: Monthly, bi-Weekly or weekly

What Factors Impact Business Loan Rates

No matter what type of interest rate a lender assigns, there are general factors that could impact whether its high or low.

Lenders assess both personal and business credit when reviewing loan applications. If you have a newer business that has yet to build up business credit, a lender may heavily weigh your personal credit when making a decision.

A higher credit score generally leads to a lower interest rate. Most lenders require a minimum credit score to qualify for financing. Banks may look for scores of 680 or higher, while alternative lenders may accept scores in the 500s.

Business finances

Your businesss financial standing indicates your likelihood of repaying a loan, which would impact your interest rate. If a lender perceives you as a high-risk borrower, you would likely receive a higher rate. Be prepared to share information illustrating items like your revenue, cash flow and profitability.

Lenders may have certain revenue requirements, similar to credit scores. You may also be required to explain how you plan to spend loan funds, should you be approved.

Time in business

The amount of time youve been in business also indicates how risky you may be as a borrower. Businesses or startups that have been open less than two years are often considered risky because they typically lack capital, collateral or business credit.

Typical Business Loan Fees

Because your APR includes interest rate and fees, its important to look for lenders that charge fewer fees that dont inflate your rate. While its not always possible to get a loan without any fees at all, here are some you should know about:

- Application fee:Some lenders charge this just for processing your application including running a credit check and rendering a decision.

- Origination fee: This fee comes into play when the lender originates and disburses the loan funds. In most cases, the lender will deduct the expense from your loan disbursement instead of requiring you to fork over cash.

- Processing fee: In addition to an application fee, some lenders may charge a processing fee for the time it takes to review your loan application.

- Guarantee fee: If youre getting an SBA loan, youll be required to pay a guarantee fee. Depending on the type of SBA loan you get and the amount, this fee can range from 0.25% to 3.75%.

- Prepayment fee: This fee is a penalty a lender may assess if you pay off your loan before the end of the repayment term.

- Late payment fee: Most lenders charge a fee if you miss a payment. In some cases, you may get a grace period, but theres no guarantee.

- Check fee: If you choose to make your monthly payments by check instead of via bank transfer, the lender may charge you a fee for the service.

Also Check: What Is Loan Interest Rate

Business Loan Interest Rates In 2020 By Loan Type

As you search for a business loan for your company, youll likely come across several different types of lenders and loans.

Loans that come from traditional lenders or are insured by the U.S. Small Business Administration typically charge the lowest interest rates, but they also tend to have stricter criteria for approval. On the flip side, online business loans and other types of loans charge more in interest but are easier to get.

Here are some interest rates you may come across as you compare various business loan options.

What Is The Average Interest Rate

According to many reports from different sources, the average interest rate it typically between 4% and 5%.

Of course, this can vary depending on the type of lender that you choose to get your loan from, but for a handy guide see the table below in the interest rate comparison section where you can find out more.

For instance, Shawbrook Bank can offer APR between 0% and 19.9%, whereas Funding Circle which is a peer-to-peer lending platform can usually offer their customers 4.5%.

Also Check: How Do I Know If My Ppp Loan Is Approved

Cdc/504 Loan Eligibility & Terms

In addition to showing that you have the ability to repay the loan, to qualify for a CDC/504 loan, youll have to show that you have management experience and that the project will create jobs. If you meet these requirements, you have a good chance of qualifying:

- Must be a for-profit business

- Must do business in the US

- Must not have funds available elsewhere

- Must have demonstrated the ability to repay the loan

- Must have relevant management expertise and a business plan

- Must have a tangible net worth less than $15 million, and an average net income less than $5 million after taxes for the preceding two years

Businesses that qualify will be able to borrow a loan with these terms:

How Sba Disaster Loan Rates Are Determined

Disaster loan rates are determined by these factors:

- If you have the ability to access funds from other, non-federal, sources, the SBA will assign you higher interest rates.

- Type of business or organization: Disaster loans are granted to businesses, private non-profit organizations, small agricultural co-ops, and homeowners. Your interest rate will be dependent on the category you fit into. In general, businesses have the highest interest rates, whereas homeowners have the lowest.

- Type and location of disaster: Interest rates differ based on the disaster and area. To see the rates available in your area, take a look at the fact sheet via the SBAs disaster loan portal.

You May Like: What Is Jumbo Loan Limit In Georgia

How To Choose The Ideal Repayment Tenor For Business Loans

- Loan amount A shorter tenor is better for a small loan amount and vice-versa.

- Rate of interest If interest rates are comparatively lower, consider going for a shorter tenor. Longer repayment tenor increases the total cost of loan.

- Financial plans If there are large expenditures planned in the future, go for a shorter tenor and clear off your debts early.

- Monthly liabilities In case of high monthly expenses, a longer tenor is ideal for convenient repayment.

S You Can Take To Improve The Interest Rates Youre Offered

As well as shopping around, business owners can take positive steps to ensure that they pay the lowest possible interest rate on any business loans:

-

Improve your personal credit, particularly if the business is relatively new and/or small

-

Compare lenders

-

Seek out secured loans

-

Pay over the shortest term possible and affordable

-

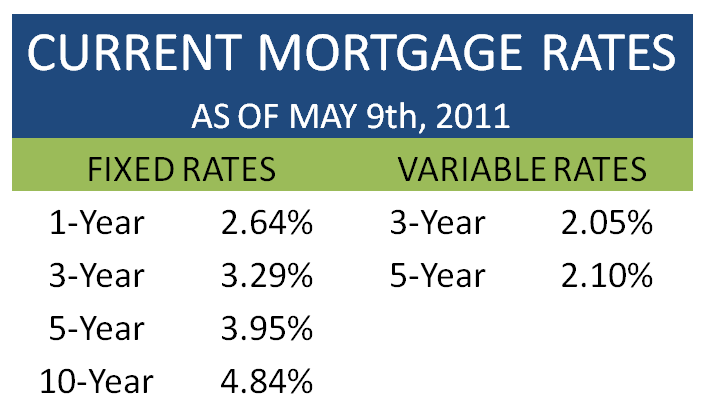

A variable interest rate will be lower than a fixed rate, but comes with the risk it could rise in the future

We can help

Borrowing money to finance your business is often the first step toward growth and innovation, but it only makes sense if you can keep the cash flowing in. Partnering with a payment platform like GoCardless makes this as simple as possible, and this includes the more complex aspects such as dealing with ad hoc payments or recurring payments.

GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today.

You May Like: Can Closing Costs Be Included In Refinance Loan

What Determines An Interest Rate For A Small Business

There are many determinants when it comes to small business interest rates. The more you can demonstrate that the loan will be repaid, the lower your rate will be. The higher your chances of failing to make the repayment, the higher the interest rate will be. This is natural the banks and lending marketplaces need to offset the increased risk with a higher interest rate. Three of the main interest rate determinants include:

This is not a definitive list. Your cash reserves, industry, loan type, and term length will also play a role. It is a complex field with many moving parts. There are plenty of tools that you can use to calculate the interest rate on a loan.

Best Way To Compare Business Loans

Before making the final decision on your business loan provider, make sure the various factors are compared with other banks and NBFCs. The factors that should be considered are interest rate, processing fee and other charges, EMI, which type of interest rate method is used, what are eligibility criteria, is there a need for collateral or not. How reliable the bank is, what minimum requirement criteria are and so on.

Also Check: How To Apply For Home Equity Loan With Bad Credit

Sba 7 Loan Eligibility & Terms

If you run a for-profit business, you are likely eligible for a 7 business loan in the eyes of the SBA. However, the partner lenders are ultimately responsible for borrower eligibility. In general, to qualify for a loan, you will need to meet these requirements:

- Own a business that is at least two years old

- Have fair credit

- Have strong cash flow and debt-to-income ratio

If eligible, borrowers benefit from long-term, low-interest loans that can be used for most general business purposes.

- Most loans have a maximum borrowing amount of $5 million, but SBA Express loans max out at $350,000. The amount you are eligible for will depend on the use of proceeds, your cash flow, and other factors.

- The maximum term length is 10 years for most loans, including inventory, working capital, and equipment. For real estate, the maximum term length is 25 years.

- The SBA will guarantee a portion of your loan. For loans of $150,000 or less, the SBA will guarantee 85% of the loan. If your loan is above $150,000, the SBA will guarantee 75% of the loan. Express loans carry a maximum guarantee of 50%.

- The SBA charges a guarantee fee of 0% to 3.75% and a possible prepayment penalty. SBA partners might also charge fees, such as closing costs, referral fees, packaging fees, or others.

A Canada Small Business Financing Loan Is Commonly Used For:

- New businesses looking for financial support to start or grow a company

- Established businesses experiencing issues with cash flow as a result of a large investment

Not sure if this product is right for your business?

85% of the loan is guaranteed by the Federal government.

Previous Purchases Are Eligible

Purchases made within the past six months are eligible for financing.

Repayment Options That Work for You

- Floating rate principal plus interest

- Floating rate principal including interest

- Fixed rate principal plus interest rate

- Fixed rate principal including interest

Terms That Meet Your Needs

- Equipment loans up to a 10-year amortization

- Leasehold improvements up to a 7-year amortization

- Real property loans/ immovable up to 15-year amortization

Read Also: What Does Fixed Rate Loan Mean

Things To Consider When Applying For A Business Loan

Listed below are a few points that you should consider before availing a business loan:

The above-mentioned points are a few things that you should take into consideration when applying for a business loan. Also, it is in your best interest to compare at least a few business loans that are offered by different lenders and opt for one that suits your requirements.

When Would I Need A Business Loan

A business loan could be instrumental to keeping your business afloat when there are unexpected delays in receiving the payment invoices, or a tax suddenly creeps up on you.

Short-term loans could be the quick injection of cash that you need, but you should always keep an eye on what kinds of interest rates you need to expect.

Plus, y should always compare your options, so to find out what kinds of loans you could secure today.

Recommended Reading: Which Is The Best Student Loan Lender

How To Get Your Best Business Loan Rates

The business loan rate you receive is often tied to the type of financing you choose to borrow. But there are a few ways to improve your chances of getting your best business loan rates.

Offer collateral

Some types of funding may require collateral, such as equipment financing or invoice factoring. Offering collateral when its not required could help you receive more favorable rates. When you provide collateral, you give the lender the ability to seize the assets you offered if you default on the loan. This reduces risk for the lender, and may reduce the amount of interest the lender charges. Loans secured with collateral generally come with lower rates than unsecured business loans.

Boost your personal credit

The higher your credit score, the less risky you may seem to a business lender, which could result in low-interest financing. Depending on your credit score, you may want to improve your credit profile before applying for financing. Some quick ways to build up your credit include:

- Paying down any existing debt, including credit card balances.

- Making on-time or early bill payments.

- Disputing any errors that currently appear on your credit report. You may be able to remove those errors as well.

Boost your business credit

Establish a relationship with a lender

Current Sba 7 Interest Rates

The maximum rate for SBA 7 loans varies based on your term length, the borrowing amount, and the base rate . Below are the current rates for most SBA 7 business loans :

| Loan Amount |

|---|

SBA Express and SBA Export Express loans have slightly different rates. Currently, the maximum rate for Express loans of $50,000 or less is 9.75% the rate for loans above $50,000 is 7.75%.

You May Like: Do I Have To Have Pmi With Fha Loan

What Is A Business Loan

Business loans can take different forms, including installment loans, lines of credit, equipment loans and commercial real estate loans. They can work like personal loans that are used for business expenses such as office leases and employee pay. But there are also types of business loans that work a bit differently, such as accounts receivable financing, which is when a business uses the money it’s owed as collateral to get a loan.

Since business loans are borrowed by businesses and not people, the business’s finances and credit are what’s scrutinized by a lender. These factors help determine if the business qualifies for a loan, how much it can borrow and the rates and terms it’s offered.

A business loan’s interest rate can be impacted by:

The Bottom Line: Advice And Tips About Applying For A Business Loan

Whether its a Business Loan Broker, Direct Lender, or a Business Finance Marketplace Platform, its important to ask questions and do your research about the loan originator you are choosing.

As a business owner, always ask yourself the key questions when getting a loan for your business. What types of financing products are offered? Does the Loan Originator have the experience and knowledge to assist me in finding the best product for my needs? Does the loan originator not only have great customer service on the origination of my loan but also on the processing, financing, and servicing of my loan on the back end?

Always start by asking, Why do I need the money? How am I going to put it to good use for the business? Is it going to improve how the business operates? Have I been given all financing options in the marketplace? Am I getting competitive rates, costs, and terms for my situation and profile? Have I done my cost verse benefit analysis for borrowing money for the business?

Always check your proposals and agreements for terms and conditions, which most lenders will include the cost of money , all closing or financing fees, term duration, payment frequency, personal or business guarantees, and any collateral requirements. If you ask the tough questions of yourself, you will be better armed to make great decisions.

You May Like: How Much Do You Need Down For Fha Loan

What Is An Interest Rate Anyway

As a current or potential small business owner, you need to break down the interest rate and understand everything about the loan process. This is because interest rates can be misleading and there can be numerous fees and charges that are not openly advertised.

For example, the interest rate is different from the Annual Percentage Rate , and it does not include origination fees or closing charges. Understanding how the interest rate is calculated will help you to figure out if the loan is affordable or not.

Every loan will have a principal figure, along with a rate of interest. The interest rate is expressed as a percentage of the principle. For instance, if you were looking to borrow $500,000 from a bank to get a mortgage, you might get an interest rate of 5%. In total, you would repay $525,000, $500,000 in principle and $25,000 in interest.

However, this is only for a one-year term. For a 20 year mortgage, the total amount would be $1,000,000. Some lenders will use a compound interest rate, though this is not typically used for small business loans.

Business loans are frequently calculated using a base/prime rate, along with the spread charged by the lender. This makes up the total interest rate, but there will often be other charges along with this.