How And When To Consolidate Parent Plus Loans

- Kat Tretina

Federal student loan

Get Purefys free 20-page Ultimate Guide with just one click.

Get Purefys free 20-page Ultimate Guide with just one click.

If you were worried about your child taking on too much debt or they exhausted their own student loan options, you may have decided to take out Parent PLUS Loans to help them pay for their education. Its a common decision: as of the end of 2020, 3.6 million borrowers owed $100.8 billion in Parent PLUS Loans.

Unfortunately, Parent PLUS Loans can be a significant burden. They have the highest interest rates of any federal loan, and they arent eligible for most alternative payment plans, like other loan types are.

If youre struggling with Parent PLUS Loans, loan consolidation or parent loan refinancing can be useful strategies. Continue reading to learn how to consolidate Parent PLUS Loans and make your debt more manageable.

How Will I Receive My Parent Plus Loan Funds

The Parent PLUS Loan is disbursed to the borrower or student depending on the refund preference selected on the Parent PLUS Loan Application. If the loan is a full year loan, the loan will be disbursed half in the Fall and the other half in the Spring semester. If the loan is for one-semester, the loan will be disbursed in one disbursement. If the student owes money to San Francisco State University, the university deducts all financial obligations and forwards the balance. A check is sent to the parent if the borrower is the refund preference. Otherwise, if the student is the refund preference, a check is sent to the student or direct deposit is initiated. We encourage students to sign up for direct deposit on the Student Center under the option to Enroll In Direct Deposit.

Can You Get A Better Interest Rate With Private Lenders

The current interest rate for Direct PLUS Loans is a fixed rate of 6.28 percent . If you have a good credit score, you may be able to qualify for a better interest rate with a private lender. Look into private loan options and determine where you can get the best rates before deciding to apply for a parent PLUS loan.

Recommended Reading: Bayview Loan Servicing Tucson Az

Heres How Parents Are Ditching High

Parent PLUS Loans are no fun.

Paying them off can frustrate your financial plans and the interest they accumulate can be quite nauseating.

But there are better and smarter ways to repay Parent PLUS Loans so you can wave goodbye to that annoying debt forever.

Here are the top tried-and-tried strategies to get rid of Parent PLUS Loans quickly.

Sign A Master Promissory Note And Receive Loan Funds

Finally, youll sign a Master Promissory Note through the schools financial aid officethe loan agreement that outlines the terms of your parent PLUS loan.

Loan funds are then disbursed to your childs school and applied to outstanding charges for room, board, tuition, and fees. The school pays out remaining funds to you or the student, per your selection on the loan application.

Read Also: Fha Loan Limits In Texas

Can I Or My Lenders Make A Child Pay For A Parent Plus Loan

One concern that many parents have is that because Parent PLUS Loans pay for a childs education, their child will have to pay the debts if the parents arent able to do so.

Only parents are liable for repaying parent PLUS loans. The student does not have to sign the master promissory note for the loan before the government disburses the funds and doesnt have to take any responsibility for repaying the debt.

Only the parents and their endorser, if they have one, have to repay the loans. Parents also cannot transfer their debt to their children. The child can agree to help make payments but is not required to. However, these kinds of side agreements might be an alternative way for students to access more funds to pay for college depending on your situation.

Whom Are Parent Plus Loans Best For

Youre probably suited for one if youre a parent who:

- Has a student whos borrowed up to the maximum undergrad loan limits and is able and willing to help

- Wants to be responsible for this student debt rather than having it burden their child

- Has compared parent PLUS loans with private student loans, and has found that the federal option offers lower interest rates and total costs

- Cant qualify for private student loans

- Wants access to federal student loan benefits, such as deferment and forbearance, federal repayment plans, or even forgiveness.

Also Check: Usaa Car Loan Calculator

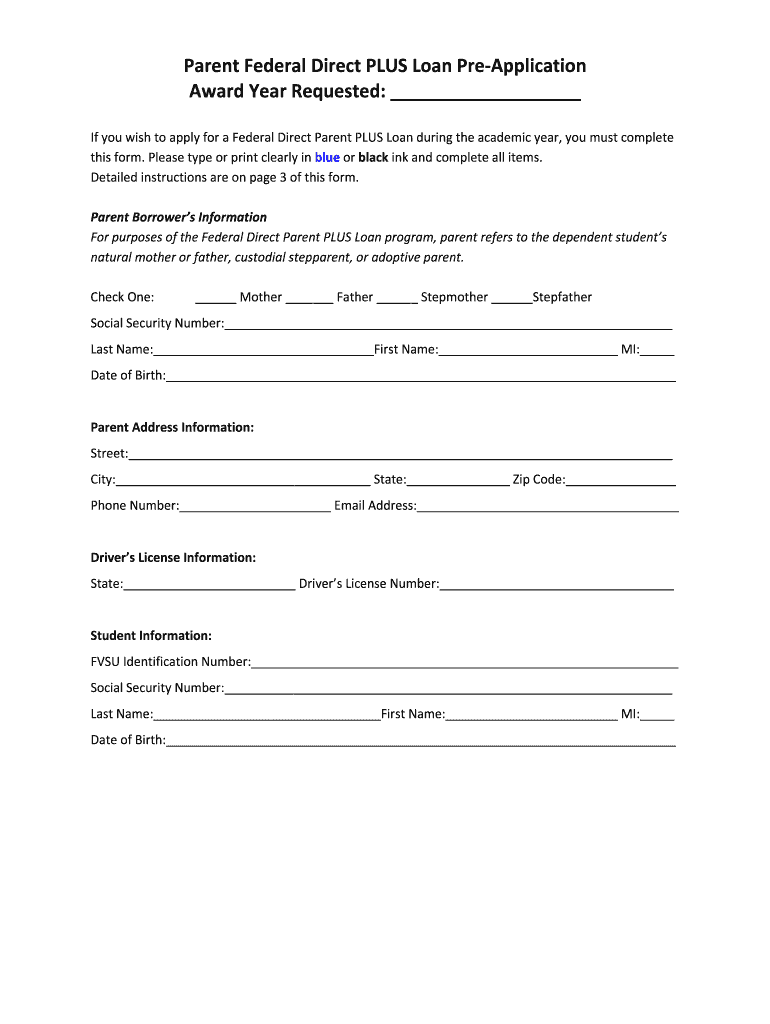

Apply For The Loan Through The Department Of Education Website

Applications for parent PLUS loans can be completed online at the Department of Educations website. The information you enter will be sent to your childs school, and the school will determine if you qualify for a parent PLUS loan. The application process typically takes about 20 minutes to complete.

Before you begin the online parent PLUS application process, have this information available:

- Your verified FSA ID.

- Your employers information.

How To Apply For Federal Plus Loans

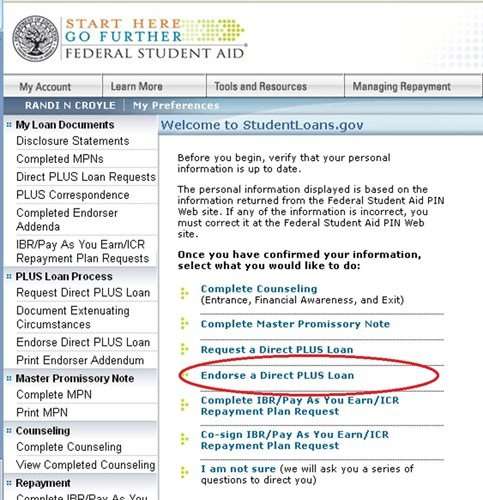

To obtain a Federal PLUS Loan, talk to the colleges financial aid office. The Federal PLUS Loan is disbursed through the college financial aid office, so they administer the application process and determine the maximum amount you can borrow. They will ask you to complete a PLUS loan application at the Studentaid.gov web site. You may be required to complete entrance counseling.

PLUS Loan borrowers will also have to sign a Master Promissory Note at Studentaid.gov to obtain a Federal PLUS Loan. The Master Promissory Note is good for a continuous period of enrollment at a specific college for a period of up to 10 years.

Also Check: Bayview Loan Servicing Foreclosure Listings

Parent Plus Loan Rates And Terms

Parent PLUS loan interest rates are currently fixed at 7%. They are tied to the rate of the ten-year Treasury note, with a cap of 10.5%.

The PLUS loan is given for one academic year at a time. As a result, parents must qualify for the loan each year. In other words, the credit check at year one does not make parents eligible for four years worth of Parent PLUS Loans. The loan enters repayment once it is fully disbursed, and there are a variety of repayment options available to parents, including deferment.

Problem #: Parent Plus Loans Have No Limit

So far, we have discussed the problems surrounding Parent PLUS Loan denials. But, there is actually a big problem facing parents who qualify for the loan:

The Parent PLUS Loan has no limit.

This loan is designed to cover the difference between the total cost of attendance and the amount of aid that has been awarded to the student. If the student has chosen to go to an expensive school that offers very little financial aid, the Parent PLUS Loan will be for a larger amount, burdening the parents with more debt.

Essentially, this is a matter of financial literacyAre parents and students evaluating colleges based on finances?

Students and parents should carefully review financial aid offers from different schools. They should consider grant amounts and look for low-interest rate loans in their package. Any remaining amount, which can be covered by the PLUS loan, should be considered carefully. Students and parents should want this amount to be as low as possible. Why? Because this amount will be covered by either a PLUS loan or private loans with more dangerous terms.

Lets take a closer look. Here, we assume a student is considering two public schools, one is in-state and one is out-of-state. The out-of-state school will require that the parents take out a larger PLUS Loan:

| Public In-State | ||

|---|---|---|

| Total PLUS Loan Repayment Amount | $32,556 | $65,111 |

Don’t Miss: Upstart Second Loan

What Happens If I Dont Pay Back My Loan

Not paying back your student loan can have serious consequences. If you go into default your lender can require you to repay the entire amount immediately, including all interest plus collection and late payment charges. The lender can sue you and can ask the federal government for help in collecting from you. The Internal Revenue Service may withhold your income tax refund and apply it toward your loan. You cannot receive any additional federal student aid until you make satisfactory arrangements to repay your loan. Your grades and official transcripts will be held until you resolve the default status. Also, the lender may notify credit bureaus of your default. This may affect your credit rating which will make it difficult to obtain credit cards and car loans in the future.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

You May Like: Usaa Used Car Loan Calculator

What To Do If You Don’t Qualify For Parent Plus Loans

If you’re denied a parent PLUS loan because of the credit requirements, you could become eligible if you get an endorser which works similarly to having a co-signer for private student loans or if you can prove extenuating circumstances related to your adverse credit history.

If you qualify for a parent PLUS loan through either of these methods, you’re also required to complete credit counseling on the federal student loan website.

You can also consider borrowing or co-signing a private student loan if you cant meet the non-credit parent PLUS loan requirements for example, if you’re a grandparent. Borrowing privately may not be a solution if your credit is a problem if you can qualify with a private lender, your interest rate might be higher than it would be for a parent PLUS loan.

Your Child Can Afford To Take Over The Debt

When you take out Parent PLUS Loans, you are legally responsible for the loans repayment your child has no legal obligation to repay the loan.

However, there are some cases where your child may be willing and financially able to take over the debt. If thats the case for you, you and your child can refinance the loans and transfer them into their name. By doing so, your child will be responsible for the loans, and you will no longer have to make payments.

Having your child take over the loans can be especially helpful if you are planning on applying for other types of credit, such as a car loan or mortgage. Without the student loans on your credit report, you are more likely to qualify for a loan and secure a lower interest rate.

Recommended Reading: Can You Refinance With An Fha Loan

How To Get Parent Plus Forgiveness Through Public Service Loan Forgiveness

The Public Service Loan Forgiveness program is a federal program that offers student loan forgiveness to employees who work for the government or a non-profit and make 120 monthly payments. To get Parent PLUS Loan forgiveness, the parent borrowers employment is what matters not your childs employment.

It is important to understand all the requirements of the Public Service Loan Forgiveness program. To qualify for public service loan forgiveness, you must first consolidate your Parent PLUS Loans into a Direct Consolidation Loan. Then, you must make a majority of your loan payments while enrolled in an income-driven repayment plan such as Income-Contingent Repayment .

Each year or whenever you change employers, you must submit an Employment Certification Form to the U.S. Department of Education. After you complete all 120 monthly payments, you can submit an application for public service loan forgiveness. If you are approved, you will receive student loan forgiveness on your remaining balance. The amount of forgiven is not taxable.

Danger : You Can Easily Borrow More Than You Need

When you apply for a Direct PLUS Loan for your child, the government will check your , but not your income or debt-to-income ratio. In fact, it does not even consider what other debts you have. The only negative thing it looks for is an adverse . Once youre approved for the loan, the school sets the loan amount based on its cost of attendance. However, a schools cost of attendance is usually more than most students actually pay. This can lead to parents borrowing more than their child needs for college.

If you have other outstanding debt, such as a mortgage, you may find yourself in over your head when it comes time to repay the PLUS loan.

You May Like: Usaa Car Loans Credit Score

Discharge Options For Parent Plus Loans

The terms forgiveness and discharge have the same essential meaning, but theyre used to refer to different conditions for loan cancellation.

When your loans are erased because you work in a certain type of job, the government refers to that as forgiveness, while the situations below are considered circumstances for discharge. In both cases, youre no longer required to make loan payments and your repayment is considered complete. Here are the cases when parent PLUS loans are eligible for discharge.

- Discharge due to death. If the parent PLUS borrower or the child for whom they took out a loan dies, the loan is forgiven. To receive the discharge, documentation verifying the death must be provided to the student loan servicer.

- Total and permanent disability discharge . If the parent borrower becomes totally and permanently disabled, their loans may be discharged. The government reaches out to eligible Social Security recipients with student loans to let them know TPD is available to them, but others can apply proactively through the federal website DisabilityDischarge.com.

- Closed school discharge. Parents may also be eligible for discharge if their childs school closed before the child could complete their degree program. Contact your student loan servicer to identify whether youre a candidate.

Parent Plus Loan Interest Rates And Fees

While interest rates on federal student loans tend to be low, Parent PLUS Loans are the exception. Loans disbursed between July 1, 2020, and June 30, 2021 have an interest rate of 5.30%. However, loans disbursed in prior years had much higher rates. For example, if you took out a Parent PLUS Loan in 2019, the rate was a staggering 7.6%

In addition, Parent PLUS Loans charge disbursement fees. Loans disbursed between October 1, 2020, and September 30, 2021 have a 4.228% fee that is deducted from the loan amount.

With its high rates and fees, Parent PLUS Loans can be an expensive form of debt. Your loan balance can quickly balloon out of control thanks to accrued interest, causing you to owe far more than you initially borrowed.

Also Check: Usaa Bad Credit Auto Loans

When Do Student Loans Get Disbursed

Category: Loans 1. Receiving Financial Aid Federal Student Aid Grants and Student Loans Generally, your school will give you your grant or loan money in at least two payments called disbursements. In most cases, your The anticipated disbursement date is the date that the school will expect to disburse

What Is A Mortgage Broker Job Description

Category: Loans 1. Learn About Being a Mortgage Broker | Indeed.com Mortgage broker job description example · Acting as the intermediary between potential lenders and borrowers · Analyzing and comparing multiple loans for Primary Responsibilities · Work with various lenders to find the best deal for a homebuyer. · Originate

Recommended Reading: Usaa Prequalify

To Receive A Plus Loan You Must:

- Request the loan from the financial aid office

- File a FAFSA

- Parents must be able to pass a credit check

- Parents and students must meet general eligibility requirements for federal student aid

- Must not be in default of any loan or owe a refund to any Federal Student Assistance program

- Must complete an Annual Student Loan Acknowledgement Form. Click here for more details.

What Happens To My Parent Plus Loan When I Retire

Your retirement has no effect on your parent PLUS loan and youll be expected to make payments as usual. However, if youre enrolled in income-contingent repayment, the amount you owe each month is determined by your income. Once you retire, your earnings may go downin that case, your loan payment would decrease as well.

Read Also: Usaa Car Loan Rates

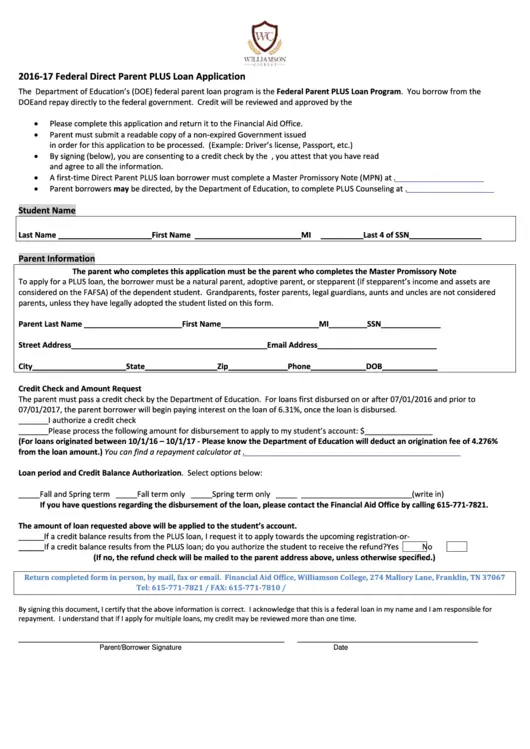

Federal Direct Parent Plus Loan Borrower Instructions

- Please be sure to complete the Master Promissory Note for the PLUS loan which is part of the application process.

- All PLUS Loan funds will be processed as a Fall/Spring loan with two equal disbursements unless specified during the loan application process. If you choose “Maximum Loan Amount,” “Unknown” or “School Credit Balance Options”, on the application, please be aware your loan amount will be calculated by subtracting your student’s aid package from the overall cost of attendance. Please have your student visit “YOUR CONNECTION” for exact cost of attendance figures.

- It will take approximately 2-3 weeks for the Financial Aid Office to process your Federal PLUS loan.

How To Get A Parent Plus Loan With Bad Credit

If your appeal is unsuccessful or you have bad credit, you can still get a parent PLUS loan by adding an endorser to your application.

The endorser also cannot have adverse credit history and, like a co-signer, will be legally responsible to repay the loan if you cant. The child benefitting from the parent PLUS loan cannot be your endorser.

An endorser will need an FSA ID, then they must complete an addendum online. If your endorser is approved, you’re expected to complete credit counseling on the federal student loan website.

You May Like: Capital One Pre Approval Auto