Usaa Offers The Following Types Of Mortgages:

- VA mortgage. You could pay zero down for a home without private mortgage insurance .

- Fixed-rate mortgage. Firm interest rate for the duration of the loan, which is usually 15 or 30 years.

- Adjustable-rate mortgage . Interest rate set for the first few years and then it can change according to the market.

- Conventional 97 or first-time homebuyer loan. You may be able to borrow 97 percent of your home price and pay as little as a 3 percent down payment.

- Jumbo mortgage. For borrowing a larger amount than the limits on the other types of mortgages.

Get prequalified, which you can do on the USAA website, to see what you can reasonably afford. This will give you some bargaining power when you find your ideal home.

Compare rates with other lenders and if you choose USAA, fill out your mortgage application by making a phone call to 800-531-0341. Gather the documents youll need to submit with your application like proof of income , bank statements, and anything else you think might be requested.

Home Equity Loans Vs Helocs

Home equity loans and home equity lines of credit, or HELOCs, are two types of loans that use the value of your house as collateral. Theyre both considered second mortgages.

The main difference between them is that with home equity loans you get one lump sum of money whereas HELOCs are lines of credit which you can draw from as needed.

Refinancing A Home With Usaa

If youd like to lower your monthly mortgage payments or shorten the time you have left to pay on your home, USAAs Streamline Interest Rate Reduction Refinance Loan should do the trick. Its considered one of the best products on the market today because USAA doesnt charge an origination fee, and they pay your appraisal, title, and VA funding fees. In 2019 borrowers avoided an average of $2,800 in closing costs with this type of refinance from USAA.

However, remember that we said USAA has higher rates than average? This is probably why. Lenders typically raise their rates slightly to pay for fees and closing costs. This can be a good deal for most, though, as refinancing homeowners rarely want to come up with cash to refinance or roll costs into their loan via a higher balance.

With an IRRRL, you can refinance your entire existing loan balance, no matter what your home is worth now. Plus, theres very little documentation involved. You dont need an appraisal, proof of income, or employment verification. That speeds up the process and makes it less costly.

If the mortgage loan on the home youre refinancing was from a lender other than USAA, you may still have to get an appraisal.

Besides VA mortgage loans and refinancing, USAA provides a host of other advantages to its members.

You May Like: What’s The Minimum Credit Score For An Fha Loan

Alternatives To A Home Equity Loan

A home equity loan is not the right choice for every borrower. Depending on what you need the money for, one of these options may be a better fit:

- Home equity line of credit : Like a home equity loan, a HELOC allows you to borrow from your home’s equity. However, you’ll borrow from a credit line. Additionally, HELOCs have variable rates.

- Cash-out refinance: If you can qualify for a lower interest rate than what you’re currently paying on your mortgage, you may want to refinance your mortgage. If you refinance for an amount that’s more than your current mortgage balance, you can pocket the difference in cash.

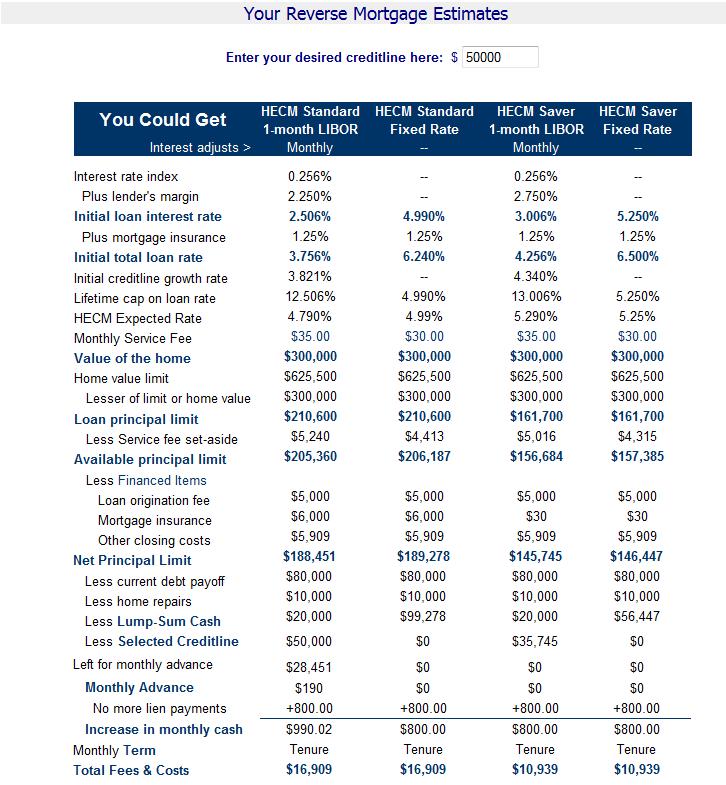

- Reverse mortgage: With a reverse mortgage, you receive an advance on your home equity that you don’t have to repay until you leave the home. However, these often come with many fees, and variable interest accrues continuously on the money you receive. These are also only available to older homeowners .

- Personal loan: Personal loans may have higher interest rates than home equity loans, but they don’t use your home as collateral. Like home equity loans, they have fixed interest rates and disburse money in a lump sum.

Payments On Home Equity Loans Vs Helocs

A home equity loan is a lump sum of money with a fixed interest rate, so your monthly payments stay the same for the loans lifetime. Its best if you need a large sum with predictable payments.

A HELOC is a line of credit you can draw from as needed, so your monthly payment fluctuates based on how much you borrow. Its best if you want the option to borrow small amounts over time.

With most HELOCs, you make interest-only payments during the draw period, but you are free to add to that as you are able. Once the repayment period starts, your loan amount is amortized to include interest and principal so that you can pay it off within the term.

Don’t Miss: What Would Be The Interest Rate For Car Loan

Discover: Best Home Equity Loan For Low Rates

Overview: Discover is well known for its rewards credit cards, but this national bank also offers a full lineup of banking services, such as checking and savings accounts, personal loans and student loans. We chose this bank as the best for low rates because of its national reach and low rates.

Why Discover is the best home equity loan for low rates: Its APRs start at 6.99 percent.

Perks: Discovers home equity loans allow you to borrow up to $300,000 against your home equity. You can choose a loan term of 10, 15, 20 or 30 years. Plus, borrowers wont pay origination fees, application fees, home valuation fees or cash at closing. Its a solid option thats available to most borrowers across the country.

What to watch out for: The best rates go to customers with excellent credit, so if your credit score needs work, you may want to look elsewhere. Also, borrowers who pay their loans off within 36 months may have to repay closing costs covered by Discover .

- LENDER:

How Home Equity Loan Payments Are Calculated

This calculator tells you how much you may be able to borrow in total, but not what your monthly payments would be.

A home equity loan has equal payments every month. The monthly payments depend on three factors:

-

Loan term. The term is the number of years it will take to pay off the loan. For a given amount and interest rate, a longer term will have lower monthly payments, but will charge more total interest over the life of the loan.

-

Interest rate. Usually, a longer loan term has a higher interest rate.

You May Like: Bad Credit Online Loans Guaranteed Approval

How To Get The Best Heloc Rate

There are several factors you should consider when searching for a HELOC, to ensure you get the best rate:

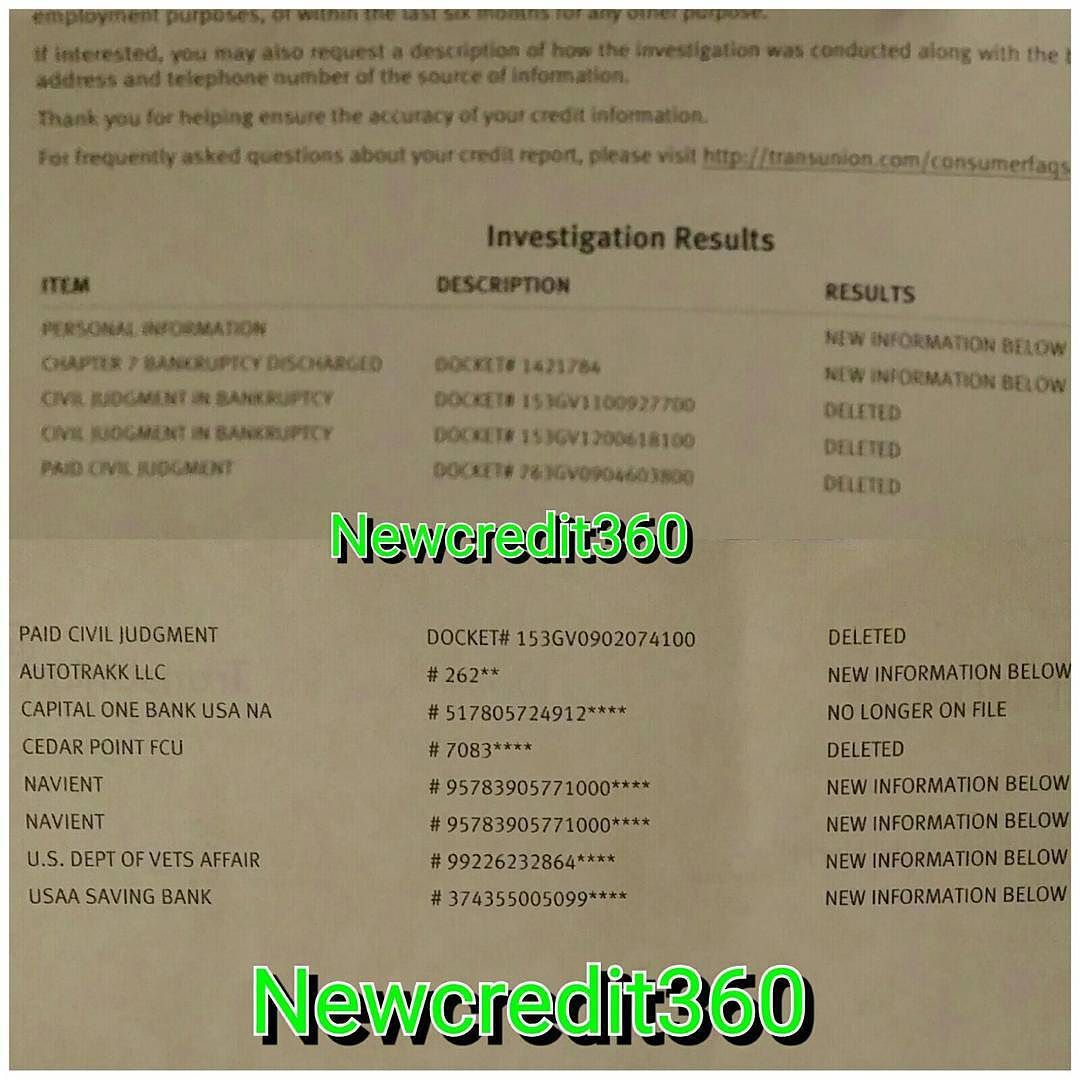

- Your credit score and history: Lenders will pull your credit score to determine your creditworthiness, just as they would for any other type of credit application. Having good credit, or improving your credit before you apply, can increase your chances of getting a more favorable rate.

- Your home equity: The more home equity you have, the more it will positively affect your loan-to-value ratio . LTV is a metric used to measure the relationship between how much you owe on your mortgage and the market value of your home. The more equity you have, the lower your LTV will be and the better youll look to lenders.

- The lender: Different lenders offer different rates. Make sure to shop around and consider all of the options for HELOC rates, and dont discount local credit unions or banks.

Basic Uses For Home Equity Loans

Debt consolidation and home improvements are the most common reasons homeowners borrow from their equity, says Greg McBride, CFA, chief financial analyst for Bankrate. There are other reasons borrowers may tap home equity, such as education costs, vacations or other big ticket purchases.

Under the Tax Cuts and Jobs Act of 2017, borrowers can deduct the interest paid on HELOCs and home equity loans if they use the funds to buy, build or improve the home that acts as collateral for the loan.

Home equity loan rates can vary depending on the lender and home equity product you choose. For example, home equity loan rates ranged from 5.1 percent to 5.89 percent in 2020, while HELOC rates ranged from 4.52 percent to 6.2 percent.

One drawback is that home equity loans and lines of credit have closing costs and fees similar to a standard mortgage. Closing costs vary but can run into the thousands of dollars based on the value of a property.

You May Like: How To Get Instant Loan Online

How Is A Va Loan Calculated

Calculating monthly payments for a VA loan is similar to other mortgage options. However, it’s not exactly the same. VA loans come with unique calculations, including the VA funding fee, which can vary based on the Veteran and loan type. Veterans United’s VA loan calculator considers these factors to accurately estimate your purchasing power.

What Is A Home Equity Loan

A home equity loan is an installment loan based on the equity of the borrower’s home. Most home equity lenders allow you to borrow a certain percentage of your home equity, typically up to 85 percent. Unlike with a HELOC, you receive all of the money upfront and then make equal monthly payments of principal and interest for the life of the loan .

Recommended Reading: Why Are Home Equity Loan Rates So High

Usaa Alternatives To Home Equity Loans Or Helocs

Though USAA does not currently offer home equity loans, it does offer personal loans of up to $100,000. This may be a viable alternative to a home equity loan or home equity line of credit if the borrower has a strong credit history.

Cash-out refinancing means refinancing the remaining balance of a mortgage with a larger loan and taking the difference in cash. This can be helpful when the homeowner can refinance to a lower interest rate. However, borrowers should compare the total cost of a cash-out refinance with the cost of refinancing the loan and adding a home equity loan to get the cash.

Most cash-out refinances have surcharges that apply to the entire loan balance, not just the extra cash. So if a borrower refinances a $300,000 loan and adds $20,000 of cash-out, and the surcharge is 2% and applies to the entire balance, the upfront cost to get that money is $6,400 . But suppose the borrower has a $100,000 mortgage balance and borrows an extra $100,000, and the surcharge is .5%. The cost to borrow is more reasonable at $1,000 . For many homeowners, cash-out refinancing is not the cheapest way to borrow.

Other Options & Print Your Results

You can also edit any of the other variables in the calculator. For sections that are minimized by default, please click on the dropper in the upper right section to expand them. Once you are done with your calculations you can click on the button to bring up a detailed report about your loan. Once you are in the active report view you can click the button to create a printer friendly version of your results.

Also Check: How Much Student Loan Do You Pay Back

Would You Qualify For A Mortgage From Usaa

While you dont need a super high FICO score to qualify for a USAA home loan, you generally do need at least a 620 FICO score. This lender does not offer FHA loans, which can have lower credit score requirements. That means if youre below the 620 benchmark, you should probably wait to apply until after you increase your credit score.

In addition to credit score, your loan agent will consider the home price, your income, down payment savings and debt-to-income ratio. If youre applying for a VA loan, you dont need a down payment, and if youre applying for the Conventional 97 loan that requires just 3% down, your savings wont need to be as significant as a conventional borrower. However, you still need to prove you have enough money to cover closing costs, mortgage payments and other household expenses. That said, if youre applying for a jumbo home loan, youll need a 20% down payment for a conventional mortgage and 25% saved for a VA jumbo loan.

Another qualification consideration is cash flow. Your agent will look at your income and debt and calculate a percentage known as the debt-to-income ratio . Your DTI one of the ways your mortgage lender determines whether youll have enough money to pay your monthly loan bill. In general, most lenders look for a DTI of 36% or less for the most favorable loan terms. When you have a higher percentage, you dont have enough free cash to afford a mortgage.

What We Love About Usaa Auto Loans

USAA is a popular financial company that has a reputation for great customer service. That reputation holds true with its auto loans. Customers can expect an easy application and strong customer service throughout the borrowing process.

Loans are flexible, with terms as long as 84 months, and have highly competitive rates and fees so borrowers can feel confident that theyre getting a good deal.

Additionally, because USAA was founded by members of the military and is dedicated to serving the military, its also well-equipped for handling the unique circumstances servicemembers face.

One great perk of USAAs auto loans is that if you buy from a USAA certified dealer and find a better deal on a car right after you make your purchase, USAA will refund the difference, acting as a form of purchase protection.

Recommended Reading: How To Get My Student Loan Number

Refinancing Your Heloc Into A Home Equity Loan

HELOC payments tend to get more expensive over time. There are two reasons for this: adjustable rates and entering the repayment phase of the loan.

HELOCs are variable rate loans, which means your interest rate will adjust periodically. In a rising-rate environment, this could mean larger monthly payments.

Additionally, once the draw period ends borrowers are responsible for both the principal and interest. This steep rise in the monthly HELOC payment can be a shock to borrowers who were making interest-only payments for the first 10 or 15 years. Sometimes the new HELOC payment can double or even triple what the borrower was paying for the last decade.

To save money, borrowers can refinance their HELOC. Here well take a look at two options and how they work.

Helocs Vs Home Equity Loans: How Do I Decide

Home equity products each come with their own pros and cons.

A HELOC may be more advantageous if youre doing an ongoing home improvement project and want to ensure that you have funds available for extras that pop up during the project. This way, you wont have to withdraw funds until you actually need them. It also allows you to make a smaller monthly payment during the draw period, which can help you save money upfront while postponing the major payments until later.

We have used multiple HELOCs on our rental real estate properties and have been very happy with their ease of use and relatively low rates and fees compared to having to do a cash-out refi every time we needed to tap money from our real estate, said Scott, a long-time real estate investor and the blogger behind the popular blog Costa Rica Fire. We picked a HELOC over a home equity loan because we wanted the flexibility to borrow as much or as little as we needed at various times, as opposed to needing a specific amount of money at any one time.

Scott from Costa Rica Fire

With a home equity loan, youll have a fixed, predictable payment that you can budget for while getting one lump sum of funds for your needs right away. This is advantageous if youre using the funds for a one-time expense.

Don’t Miss: What Are Commercial Loan Rates Now

Heloc & Home Equity Loan Qualification

The three primary things banks look at when assessing qualification for a home equity loan are:

- Available equity in the home: as mentioned above, banks typically allow a max LTV of 70% to 85%

- People with an excellent credit score of above 760 will get the best rates. Those with good credit of 700 to 759 will still be able to access credit, though typically not at the best rate. People with a fair credit score of 621 to 699 will typically be able to obtain credit, though at higher rates. People with poor credit scores may not be able to obtain credit.

- Debt to income ratio: lenders generally like borrowers to spend less than 36% of their pre-tax income on monthly mortgage & debt payments, though some banks may allow borrowers to obtain funding with DTI ratios as high as 43%

Are Home Equity Loan Rates Higher Than Mortgage Rates

Home equity loan rates are typically higher than mortgage rates because home equity loans are considered second mortgages. In the event of a foreclosure, the lender of a second mortgage will be paid only after the lender of the first mortgage has been paid in full. To make up for this risk, lenders offering second mortgages will charge higher interest rates.

Also Check: How To Get 500k Business Loan

How Does A Heloc Work

A home equity line of credit lets you borrow against the available equity in your home just like a home equity loan. Your home is used as collateral, meaning if you default on your payments, the lender can seize your home.

A HELOC is a type of revolving credit, similar to a credit card. This means youll be able to access funds from your HELOC as you need them, instead of taking out a set amount at the onset like an installment loan. Theres usually a minimum withdrawal amount based on the total amount of your credit line.

HELOCs typically are divided into two periods: a draw period and a repayment period. During the draw period, you may take funds from your HELOC up to the amount of your credit line. On interest-only HELOCs, youre only required to make monthly payments toward the accrued interest, not the principal, during the draw period.

Once the draw period is over, you can no longer withdraw money and you enter the repayment period, where you begin paying back both principal and interest. While terms may vary by lender, the draw period typically lasts five to 10 years, while the repayment period usually lasts 10 to 20 years.

HELOCs traditionally have variable-rate APRs, meaning your interest rate adjusts over time based on the benchmark U.S. prime rate. The prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest U.S. banks, according to the Wall Street Journal.