Loans Against Insurance Policies

Yes, you can also avail of loans against your insurance policy. However, note that all insurance policies don’t qualify for this. Only policies, such as endowment and money-back policies, which have a maturity value, can avail loans.

Thus, you can’t avail of a loan against a term insurance plan as it doesn’t have any maturity benefits. Also, loans can’t be availed against unit-linked plans as the returns aren’t fixed and depend on the market’s performance. It’s essential to note that you can opt for a loan against endowment and money-back policies only after they’ve acquired a surrender value. These policies gain a surrender value only after paying regular premiums continuously for three years.

How Much Do Personal Loans Cost

Some lenders charge origination, or sign-up, fees, but none of the loans on this list do. All personal loans charge interest, which you pay over the lifetime of the loan. The lenders on our list do not charge borrowers for paying off loans early, so you can save money on interest by making bigger payments and paying your loan off faster.

How Do Lenders Set Interest Rates On Loans

-

Funding and operating costs, risk premium, target profit margin determine loans interest rate

-

Competition between banks affects interest rates

-

Most difficult part of loan pricing is calculating risk premium

For many borrowers, the factors that determine a bank’s interest rate are a mystery. How does a bank decide what rate of interest to charge? Why does it charge different interest rates to different customers? And why does the bank charge higher rates for some types of loans, like credit card loans, than for car loans or home mortgage loans?

Following is a discussion of the concepts lenders use to determine interest rates. It is important to note that many banks charge fees as well as interest to raise revenue, but for the purpose of our discussion, we will focus solely on interest and assume that the principles of pricing remain the same if the bank also charges fees.

You May Like: Apply Capital One Auto Loan

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

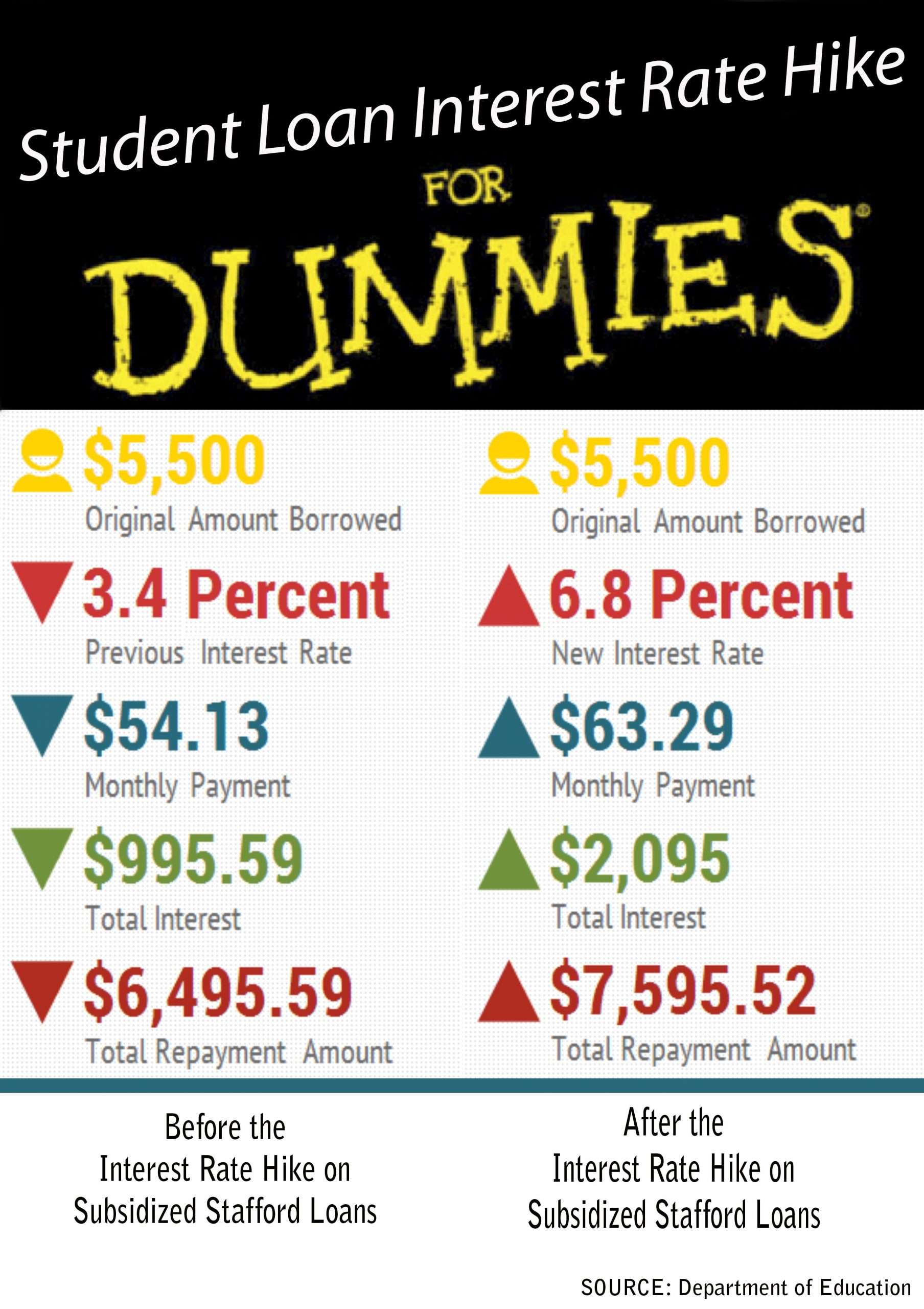

Video Answer: Student Loan Interest: How Does It Work

Rates will rise to 3.73% for the 2021-22 academic year after the historic low of 2.75% for the past year. Federal student loans will be more expensive for 2021-22 school year. As a result, federal student loan interest rates fell to a historic low in 2020

Private and federal student loan interest rates tend to be a bit higher than other kinds of good debt, such as mortgages or car loans Current average interest rates for private student loans are as follows: 3.64% to 13.63% for fixed rate loans and 2.72% to 11.88% for variable rate loans.

Most borrowers like the certainty of a fixed interest rate, but a variable rate could save you money All federal student loans have fixed interest rates, but when you work with a private lender, you’ll usually have a choice of a fixed or variable student loan.

There are a few arguments made by people who argue a student loan is not haram: Student loans charge interest rates that track inflation. Student loans are a necessity A student loan is not really a loan in the shari sense used to be true but no longer is as the student loan company in England & Wales now charges above-inflation interest rates.

Read Also: Usaa Auto Pre Approval

Savings Accounts To Earn More On Interest: All You Need To Know

If you are new to the world of bank accounts, you might feel overwhelmed and confused. Lets take a look at the different types of savings accounts weve mentioned above in more detail in the next section.

- Regular and High-Yield Savings Accounts – When choosing a savings account, the first important decision you will have to make is choosing the right bank. The second is finding the right savings account type. Regular savings accounts are by far the most popular ones, and they allow account holders to safely store their money, quickly access funds and earn minimal interest. Basic savings accounts rates go from 0.01% to 0.06%. However, you might also be able to find high-yield regular savings accounts that offer rates as high as 0.5%.

- Money Market Accounts are a great alternative because they offer a high level of flexibility and versatility. Account-holders can write checks, withdraw money, and are federally insured. And, money market accounts offer higher rates, which equals higher earnings. At the same time, it isnt uncommon for money market accounts to charge a fee and have strict minimum balance requirements. That is why this is usually a better alternative only for a bank account with a lot of money! In some cases, you can also find free money market accounts that dont require any minimum balance – these are the best ones!

Further Reading

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

Read Also: Advantage Auto Loans Legit

Choosing The Right Loan Type

Each loan type is designed for different situations. Sometimes, only one loan type will fit your situation. If multiple options fit your situation, try out scenarios and ask lenders to provide several quotes so you can see which type offers the best deal overall.

Conventional

- VA: For veterans, servicemembers, or surviving spouses

- USDA: For low- to middle-income borrowers in rural areas

- Local: For low- to middle-income borrowers, first-time homebuyers, or public service employees

Loans are subject to basic government regulation.

Generally, your lender must document and verify your income, employment, assets, debts, and credit history to determine whether you can afford to repay the loan.

Ask lenders if the loan they are offering you meets the governments Qualified Mortgage standard.

Qualified Mortgages are those that are safest for you, the borrower.

What Credit Score Is Needed For A Personal Loan

Youll generally need a good to excellent credit score to qualify for a personal loan a good credit score is usually considered to be 700 or higher. Your credit score also plays a major role in determining what interest rates you qualify for. In general, the better your credit score, the lower the interest rates youll likely get.

Here are the credit score ranges you can typically expect to see as well as how they can affect the interest rates youre offered:

Poor :

Fair :

While there are several lenders that offer fair credit personal loans, you can generally expect to pay a higher interest rate. Having a cosigner might get you a better rate, even if you dont need one to qualify.

Good :

A good score greatly increases your chances of qualifying with several personal loan lenders. Youre also more likely to receive more favorable rates. While you likely wont need a cosigner to get approved for a loan, having one might help you get the best interest rates.

Fair :

Scores above 750 will qualify you for the vast majority of personal loans as well as help you get the lowest interest rates advertised by lenders.

Donât Miss: Usaa Auto Financing

Read Also: How Much Car Can I Afford Based On Income

Faqs On Personal Loan Interest Rates

The interest rate that applies on your personal loan is an important factor. In this page, weve put together some of the questions borrowers usually ask regarding their personal loan interest rates.

PNB offer personal loans at attractive rates starting from 6.90% p.a. However, the interest rate may vary from customer to customer depending on certain factors, customers including credit profile and relationship with the bank, to name a few.

Your income denotes your capacity to repay a loan. A higher income shows that you have a better financial bandwidth to repay the loan on time. This means that your risk level is low. Lenders prefer individuals with low risk profiles and may hence offer you a lower interest rate.

Working with reputed companies means that you are more likely to have a stable job and income. Your work experience shows work stability as well. This reflects on your loan rate.

A good credit score indicates that you are responsible in handling your finances. This keeps your risk rating low. If your credit score is 750 and above, most likely you will be offered preferential rates.

How Payday Loan Finance Charges Are Calculated

The average payday loan in 2021 was $375. The average interest or finance charge as payday lenders refer to it for a $375 loan would be between $56.25 and $75, depending on the terms.

That interest/finance charge typically is somewhere between 15% and 20%, depending on the lender, but could be higher. State laws regulate the maximum interest a payday lender may charge.

The amount of interest paid is calculated by multiplying the amount borrowed by the interest charge.

From a mathematical standpoint, it looks like this for a 15% loan: 375 x .15 = 56.25. If you accepted terms of $20 per $100 borrowed , it would look like this: 375 x .20 = 75.

That means you must pay $56.25 to borrow $375. That is an interest rate of 391% APR. If you pay $20 per $100 borrowed, you pay a finance charge of $75 and an interest rate of 521% APR.

Read Also: Marcus Goldman Sachs Loan Reviews

When Should I Lock My Mortgage Rate

Right now, mortgage rates are historically low, so its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Best For Small Loan Amounts With No Credit Check

The average pawn shop loan was around $150 in 2017, according to the National Pawnbrokers Association. If you dont think youll qualify for a traditional personal loan, you may want to consider a pawn shop loan. You wont need a credit check to get one and they may be less risky than a payday loan or title loan.

Don’t Miss: Unsubsidized Loan Definition

Which Bank Has The Highest Rate On A Savings Account

The leading savings account rate in the country can fluctuate at any time, as banks and credit unions are free to adjust their rates on savings accounts whenever it suits their purposes. However, what you can see from our rankings of the top rates is that many of the best APYs come from Internet-only banks. Rounding out the top contenders are some online arms of traditional banks and a few credit unions that offer broad, nationwide membership eligibility.

What you also may notice is the absence of the biggest bank names you know. Chase Bank, Bank of America, and Wells Fargoâthree of the country’s four largest banks by assetsâoffer savings account rates far below the national average. Competing heavily for deposit funds is something they simply don’t do, as their business model and size enable them to secure sufficient capital from other sources.

Among the big-four banks, only Citibank offers a savings account product with a competitive interest rate. But even Citibank doesn’t make the cut because plenty of smaller and lesser-known banks and credit unions offer higher rates.

What you can count on from our rankings is that these are the definitively highest savings account rates offered in the country from institutions that are open to customers nationwide. We do not rank them according to advertising or sponsorship relationships, or any criteria other than APY, nationwide availability, and a minimum deposit of $25,000 or less.

Interest Rate Calculator Terms & Definitions

- Principal â Denoting an original sum invested or lent.

- Interest Rate â The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the loan outstanding.

- Annual Interest Rate â The annual rate that is charged for borrowing, usually expressed as a single percentage number that represents the actual yearly cost of funds over the term of a loan.

- Term â A fixed or limited period for which something lasts. In this case, a loan.

- Monthly Payment â The amount paid each month towards the principal and interest amount of a loan. The monthly payment may or may not include taxes and insurance. In this case, it’s best not to include taxes and insurance.

- Loan â A thing that is borrowed, especially a sum of money that is expected to be paid back with interest.

- Principal â Denoting an original sum invested or lent.

- Lender â An organization or person that lends money.

- Borrower â An organization or person that borrows money.

- Amortization â The spreading of payments over multiple periods.

Recommended Reading: Prosper Loan Approval Time

Borrowing From Retirement & Life Insurance

Those with retirement funds or life insurance plans may be eligible to borrow from their accounts. This option has the benefit that you are borrowing from yourself, making repayment much easier and less stressful. However, in some cases, failing to repay such a loan can result in severe tax consequences.

Learn more about retirement accounts.

What Type Of Loan Is The Cheapest

Whatâs your cheapest option when you need a loan? The answer isnât always the method with the lowest interest rate. Costs involved in any loan can vary widely, so add up all the fees and interestand understand the fine print. Availability and credit requirements are also critical factors. That said, some loans are decidedly less costly than others. Here are some of the cheapest options and how to find them.

Also Check: Is It Better To Get A Fixed Or Variable Student Loan

Different Types Of Loans You Should Know

Loans can help you achieve major life goals you couldn’t otherwise afford, like attending college or buying a home. There are loans for all sorts of actions, and even ones you can use to pay off existing debt. Before borrowing any money, however, it’s important to know the type of loan that’s best suited for your needs. Here are the most common types of loans and their key features.

Good Interest Rate On A Personal Loan By Credit Level

- For excellent credit: You may be able to get interest rates as low as 4% – 7%. Thats where the majority of lenders set their minimums.

- For good/fair credit: Youre unlikely to get the lowest interest rates available, nor should you have to pay lenders maximums. Look at lenders credit score requirements the higher your score is above their minimum, the better your chances of getting a lower rate.

- For bad credit: You probably wont find rates lower than 25% to 36% from a bank or online lender. But personal loans from federal credit unions are capped at 18%.

If youre planning on consolidating debt, a good interest rate on a personal loan is one thats significantly lower than the rates on your existing debt. But as you compare personal loan interest rates, dont neglect other terms.

A low interest rate might not be as great as it seems if you also have to pay costly fees to go along with it. For example, many lenders charge origination fees of 1% to 6% of the loan amount as an extra cost for opening the loan.

How do you lower the interest rate on a personal loan?

How to Get a Lower Interest Rate on a Personal Loan:

Tips for Negotiating a Lower Interest Rate on a Personal Loan

The keys to negotiating with your lender are to be clear about what you want to accomplish, truthful about your situation, and polite to the representative. Ask for copy of any new terms you agree to in writing. And if youre unable to get a good deal, refinance instead.

Don’t Miss: Usaa Graduate Student Loans