How Do Lenders Decide What Interest Rate To Charge You

When it comes to deciding the interest rate for a car loan, lenders will consider many different factors, including:;

Car Loan Terms;

When buying a new car, lenders often offer longer loan terms to accommodate new buyers. However, the longer loan term will certainly be accounted for in the interest rate. Generally, a longer loan term equates to a higher interest rate and a higher overall price.;

Vehicle Status

If you opt for a secured personal loan, your car will act as security or collateral in the event that you cannot pay the lender back. Cars are quickly depreciating assets; so, lenders will account for that throughout the term of the loan. If you cannot pay your loan and your car has depreciated or malfunctioned, the lender takes a risk. They may increase the interest rate after some time has passed. Furthermore, old cars tend to encourage higher interest rates. New cars may encourage lenders to offer lower interest rates.;

Experts recommend knowing your before you apply for a car loan. Your credit score is important to a lender, as it lets them look at your history of debt repayment. If you have a lot of debt and expenses, lenders will see you as a higher risk borrower, resulting in a higher interest rate. If you have a great credit score, you have a higher chance of securing a lower interest rate.;;

Down Payment;

Debt-to-Income Ratio

Employment Stability

The Economy

Best For Used Cars: Lightstream

;LightStream

- 2.49% to 9.49%

- Minimum loan amount: $5,000

LightStream offers several auto loans, including unsecured loans for borrowers with excellent credit that dont use the car as collateral, securing our spot as the best for used cars.

-

Offers secured and unsecured auto loans

-

No restrictions on make, model, or mileage

-

0.5% autopay discount

-

No pre-approval process

The online lending arm of SunTrust Bank, LightStream makes it easy to apply for a loan and get funding the very same day, helping buyers negotiate a better purchase price with their cash in hand. It will also beat other lenders offers by 0.10% and offers a 0.5% discount for setting up monthly auto payments.

Borrowers with excellent credit even have the option to take out unsecured loans that dont use your vehicle as collateral. If you cant make payments, your car wont be repossessed, though it can still have a serious impact on your credit. Since LightStream doesnt use a car as collateral, it has no restrictions on the age, mileage, make, or model of a vehicle.

LightStream also offers no pre-approval process, which means applying for a loan requires a hard credit check. As a result, its a better option for borrowers with high credit scores who can afford to lose a few points from the credit inquiry.;;;;;;

Best Car Loan Rates Of September 2021 Investopedia

As with most lenders, youll need excellent credit to get the lowest rates. Best Online Auto Loan : LightStream;How Do Car Loans Work?What Should You Consider When Choosing an Auto Loan?

Apr 20, 2020 How to Qualify for 0% Financing · Always pay your bills on time. · Pay down your credit card balances. · Avoid closing old credit cards. · Apply for;

Mar 25, 2020 How to Lower Auto Loan Interest Rates After Getting a Loan · Check your credit report. · Dispute inaccurate or fraudulent information. · Pay on;

You May Like: Can I Transfer My Mortgage Loan To Another Bank

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Here’s How To Pay A Car Payment With A Credit Card:

- Mobile payment services: One way to pay your car loan or lease with a credit card is to use a mobile payment app such as Venmo or PayPal as a middleman. These applications allow you to transfer money from user to user, and you can fund them with a credit card.

So, for example, you could use your credit card to pay a friend or family member through the app, and they can then make your car payment for you or give you the money to do it yourself. Just make sure you really trust the person, and be careful because payments may count as purchases or cash advances, depending on the service and the credit card issuer. But either way, there are fees involved. Venmo, for example, charges 3% of the transaction amount.

- Money transfer services: Companies like MoneyGram and Western Union allow you to directly pay a collection of participating billers, and you can fund the transaction with a credit card. However, this may be treated as a cash advance, which would mean expensive fees and interest charges would apply, in addition to the fees charged by the service. You can learn more about how this works from our explanation of how to transfer money from a credit card to a bank account.

The bottom line is that these options are far from ideal and should only be considered if you’re in a real bind, or if you do the math and somehow find an opportunity to save. That could be the case if you’re able to transfer part of an auto loan to a 0% balance transfer credit card, for example. ;

|

Category |

Don’t Miss: How To Get Loan Originator License

Lightstream: Best Auto Loan Rates For Unsecured Car Loans

- New and used auto loan APRs start at 2.49% with the autopay option

- Terms range from 2484 months

- Amounts range from $5,000$100,000

The online lender LightStream offers no restrictions based on vehicle age, mileage, make or model and the starting rate for new, used and refinance car loans are the same, because these loans are unsecured. While most people shy away from unsecured car loans, thinking their APR will be high, LightStream was the most popular choice on LendingTree in Q1 2021, offering one of the lowest average rates across all credit scores.

WHAT WE LIKE

LightStream says it will beat any qualified rate by 0.10 percentage points and it has a $100 customer satisfaction guarantee, though terms apply.

WHERE IT MAY FALL SHORT

LightStream heavily prefers borrowers with credit scores above FICO 660 and low debt-to-income.

HOW TO APPLY

The only way to apply directly is through the LightStream website.

Is It Better To Get An Auto Loan From A Bank Or Dealer

Dealerships typically have a network of partner lenders, including banks, credit unions and financing companies. But dealers can and often do mark up that rate for their own profit.

The only way for you to know what rate you deserve is to get your own preapproved offers. Apply to lenders directly, or fill out a single form at LendingTree, and receive up to five auto loan offers from lenders, depending on your creditworthiness.

You May Like: Can You Refinance An Fha Loan

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

Average Car Loan Interest Rates In Canada

Statistics Canada reported the average car loan rate for Canadians to be 4.38%. However, its important to remember that this average number does not necessarily mean you will have this rate. Depending on someones financial situation, car loan interest rates can be significantly higher.;

Here are the average interest rates per month as shown on Statistics Canadas website:

| $900 | $3,909.35 |

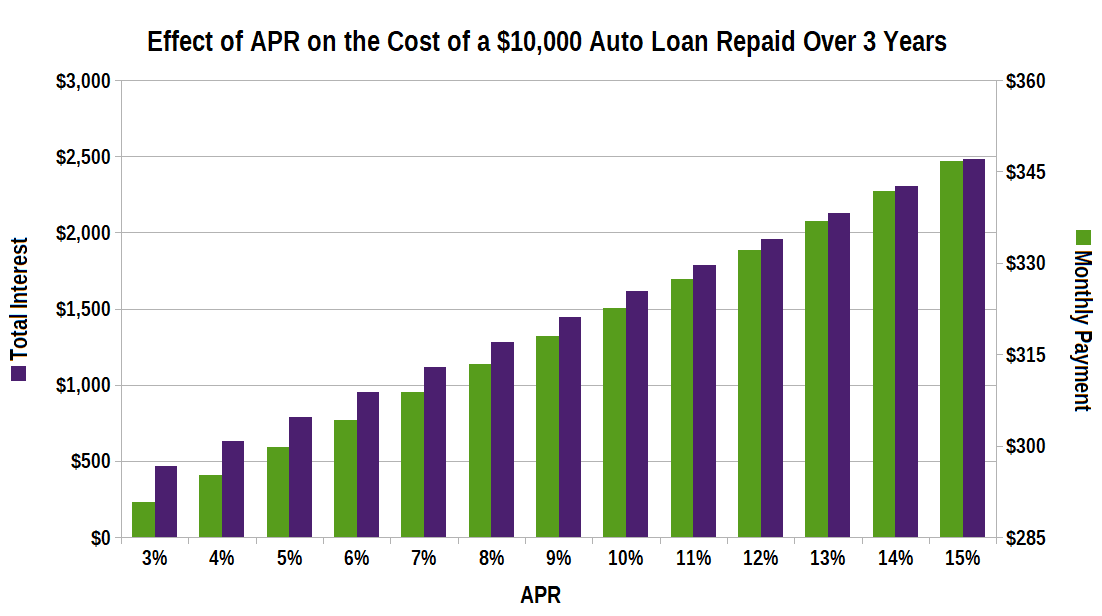

As you can see, interest rates have a strong effect on the total amount of money you pay for your car loan. The 19.5% interest rate translates to roughly an additional $3,100 on your total price when compared to the 4.5% interest rate. If you have low credit, a small down payment or no down payment, or problematic employment history, you are more likely to have a car loan resembling the last column, with a high-interest rate. Your goal is to have something closer to the first column, which shows a lower interest rate.;

Read Also: What Is The Maximum Va Loan Entitlement

What Is A Car Loan And How Does It Work

A car loan is a personal loan that is used to purchase a vehicle preowned or new. Over time, you will pay back the amount you borrowed from the lender, plus interest.

The car serves as collateral for the loan, and if you are unable to make payments on time, the lender can seize the vehicle.

You can get a car loan from a bank, dealership, online lender, or credit union.

An online lender is convenient and you can easily compare rates without leaving your home. Online lenders like Canada Drives and Car Loans Canada have partnerships with dealerships which accelerates the process from applying for a loan to getting your new car.

The various terms you should understand when applying for a car loan include:

Principal: This is the amount you borrow to purchase a vehicle.

Interest rate: This refers to the effective interest rate you pay on your loan. The car loan rate you qualify for varies with your , vehicle age, down payment, and the lenders prime rate.

The interest rate can be fixed or variable. For most car loans, your monthly payments stay the same . When you make a payment, a portion goes to offset the principal amount owed and the remainder goes to interest.

Loan Term: This is the length of time you have to pay back the car loan. It can range from 1-8 years .

The combination of a lower interest rate and a shorter loan term can help you save money on your car loan. Use the car loan calculator below to test various scenarios.

How Average Interest Rates Vary For Loans For New And Used Vehicles

The average interest rates on auto loans for used cars are generally higher than for loans on new models. Higher rates for used cars reflect the higher risk of lending money for an older, potentially less reliable vehicle. Many banks wont finance loans for used cars over a certain age, like 8 or 10 years, and loans for the older models that are allowed often carry much higher APRs. One leading bank offers customers with good credit interest rates as low as 2.99% for purchasing a new model, but the minimum interest rate for the same loan on an older model from a private seller rises to 5.99%.

The typical auto loan drawn for a used car is substantially less than for a new model, with consumers borrowing an average of $20,446 for used cars and $32,480 for new. However, terms longer than 48 or 60 months are generally not allowed for older model used cars, as the potential risk for car failure grows with age.

You May Like: What’s Better Refinance Or Home Equity Loan

Pentagon Federal Credit Union: Best Auto Loan Rates For A Car

- 0.99% APR for vehicles purchased through PendFeds car-buying service

- Terms range from 3684 months

- Amounts range from $500$100,000

If you would like some help finding your next car, a PenFed auto loan might be the best option for you. Pentagon Federal Credit Union teams up with AAAs no-haggle car-buying service to help you find and get the best price on the car you want. Using the service gets you a great rate discount. And if you find a vehicle on your own, PenFeds starting APR of 1.79% for vehicles purchased independently is not bad, either.

WHAT WE LIKE

With the rate reduction from using the car-buying service, PenFed has the lowest advertised auto loan rate we saw from a lender that is not affiliated with an automaker. Plus, membership requirements for the credit union are lax and you can request to join even if you have no ties to the military.

WHERE IT MAY FALL SHORT

The eye-catching, low APR only applies if you use the car-buying service, which not everyone might want to do.

Current Market Interest Rates And Key Factors That Affect Apr

As you may know, the current interest rate is always fluctuating. Think of it like the stock market. Economic factors and happening across the globe can have a huge impact on the interest rates. Depending on the type of loan you take out, your interest rate may or may not change as the federal rate changes. Along with the federal interest rate, there are lot of the components to the constantly changing APR and competitive rates. Finding a lower monthly payment can require real effort.;

test

What are current used car loan rates?

Used car loan rates have historically always been higher than loans for new cars. With a good credit score, rates start as low as 4%. Those with a poor credit score can expect to pay well over 10%.

What car loan rate based on credit score?

The annual percentage rate is based off your credit score. Lenders use your FICO score to determine the risk when issuing you a loan and your likelihood to pay it back.

What is good interest rate on an 84-month auto loan?

A good interest rate on an 84-month auto loan is 5%. Since the term length is longer than most other car loans, you can handle an interest rate slightly higher than a short-term loan due to the already low monthly payments.

When feds raise interest rates, does it affect car loan rates?

Yes, when feds raise the interest rates lending becomes more expensive for everyone. An increase in the interest rate wont affect you if you have a fixed auto loan.

What auto loan rate can I expect after ch.13?

Also Check: How Long Can You Finance An Rv Loan

Best For Tech Junkies: Carvana

Courtesy of;Carvana

Carvana offers a completely online shopping experience, from financing to delivery with no minimum loan amounts and is our choice as the best for tech junkies.

-

Prequalify with a soft credit check

-

No minimum credit score requirement

-

End-to-end online shopping experience

-

Financing for Carvanas vehicles only

-

$4,000 minimum annual income required

-

Only used vehicles

It seems like every industry is cutting out go-betweens these days and the car industry is no exception. If you would rather skip the dealership and the bank altogether, Carvana is the site for you. Without ever leaving your home, you can apply for a car loan, choose your car and get it delivered. If you want to trade your old car in, you can do so while youre at it. Carvana will give you an offer and pick it up from your home.

Best of all, these loans aren’t just easy to get; they are great deals for all kinds of borrowers. There is no minimum credit score, so anyone who is 18 years old, has no active bankruptcies and makes at least $4,000 per year is eligible.;

Car Loan Versus Car Lease

Financing and leasing are two methods through which people can get a new car. In both cases, the car owner/lessee would have to make monthly payments. The bank/leasing company would have a stake in the vehicle as well.

There are several differences between car leasing and car purchase through a loan. Listed below are some of the differences:

- People who like to change cars every 3-4 years may find it more advantageous to lease a car as opposed to financing it. This way, the hassle of maintenance is also taken care of by the lessor.

- When the lease period expires, the lessee can return the car to the leasing company. He/she does not have to go through the process of car valuation and sale, as would be the case if he/she owned the vehicle.

- In the event of leasing a car, there is a restriction on the distance you can drive it for. This kind of restrictions are not there when you are the owner of a financed car.

- Another disadvantage of leasing a car is the fact that you will be unable to customise the vehicle based on your personal preferences.

Also Check: Are Jumbo Loan Rates Higher Than Conventional

Best Credit Union Used Car Rates

Heres a roundup of some of the top;credit union loans for cars offering the lowest auto financing rates, the best terms, the best credit union auto loan rates and the overall;best auto loans;to its members.

Additionally, if you get a loan from a credit union you likely wont be surprised by any;hidden costs associated with auto loans. Use this chart to find the best credit union auto loan rates, including used car loan interest rates from local credit unions and federal credit unions all of which offer both new and used car loans.

| 12 Best Credit Unions for Car Loans |

| Rates accurate as of Nov. 23, 2018 |

Features And Benefits Of Car Loan

When it comes to car loans in India, in general, the following features and benefits are offered. Note that, the following is a generalized look at the advantages offered by car loans. Individually, car loan lenders may have highly customized and specialized offerings for their customer base.

- It helps you purchase a car even if you dont have all the money for it right now.

- Most car loans will finance the on-road price of the car.

- Some car loans will even finance 100% of the on-road price. This means no down payments.

- With some banks offering financing in the crores, you are not limited in your choice of cars

- Most car loan offerings in India are secured loans. This implies that the car serves as the security/collateral for the loan.

- Procuring a car loan is usually simple when compared to other loan products. Individuals with slightly unsavoury credit scores can also hope to procure one. However, this option differs from bank to bank.

- Car loans in India often offer fixed interest rate options. This means, you are always assured of a fixed amount that needs to be repaid monthly.

- Many lenders will offer interest rates based on your credit score so a high score to get you a cheaper loan.

- Car loans are not meant for just new cars. A used car loan can help you buy a pre-owned car.

Don’t Miss: How Can I Get An Rv Loan With Bad Credit