How Much Can You Borrow With A Heloc

The maximum amount of your home equity line of credit will vary based on the value of your home, what percentage of that value the lender will allow you to borrow against and how much you still owe on your mortgage. Two quick calculations can give you an idea of what you might be able to borrow with a HELOC.

Say you have a $500,000 home with a balance of $300,000 on your first mortgage and your lender will allow you to access up to 85% of your homes value. Multiplying the home’s value by the percentage the lender will allow you to borrow gives you a maximum amount of $425,000 in equity that could be borrowed. Subtract the amount you still owe on your mortgage to get the total amount you can borrow with a HELOC $125,000.

Or skip doing the math, and use the HELOC calculator below to see how much you might be able to borrow.

Transfer Your Balances To A Lower

Some credit cards allow you to transfer your balances over from other cards. This can make sense if you’re able to obtain a significantly lower interest rate on the new card. Many balance transfer credit cards also offer promotional periods of six to 18 months for which they charge 0% interest on the transferred balance. Moving a balance from one card to another won’t eliminate the debt, of course, but it can help you pay it off faster.

Backing Out Of A Loan

To avoid serious heartache later on, be sure to look over all the loan documents carefully before signing on the dotted line. You do have some recourse if you realize youve made a mistake, as long as you act quickly. Theres a federally mandated three-day cancellation rule that applies to both home equity loans and HELOCs, but you have to notify the lender in writing. That notice has to be mailed or filed electronically by midnight of the third day , or its void.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Your Homes Equity Can Make It Happen

HELOC features

Want lower rates? Put away the credit card and tap into your HELOC.

Only borrow what you need. It replenishes as you repay itand you choose fixed or variable rates.2

It takes minutes to apply and decisions are quick. Plus, a dedicated loan officer will be there to answer all your questions.

When you use it for home improvements, the interest you pay could be tax-deductible.3

How Long Are Home Equity Loan Terms

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

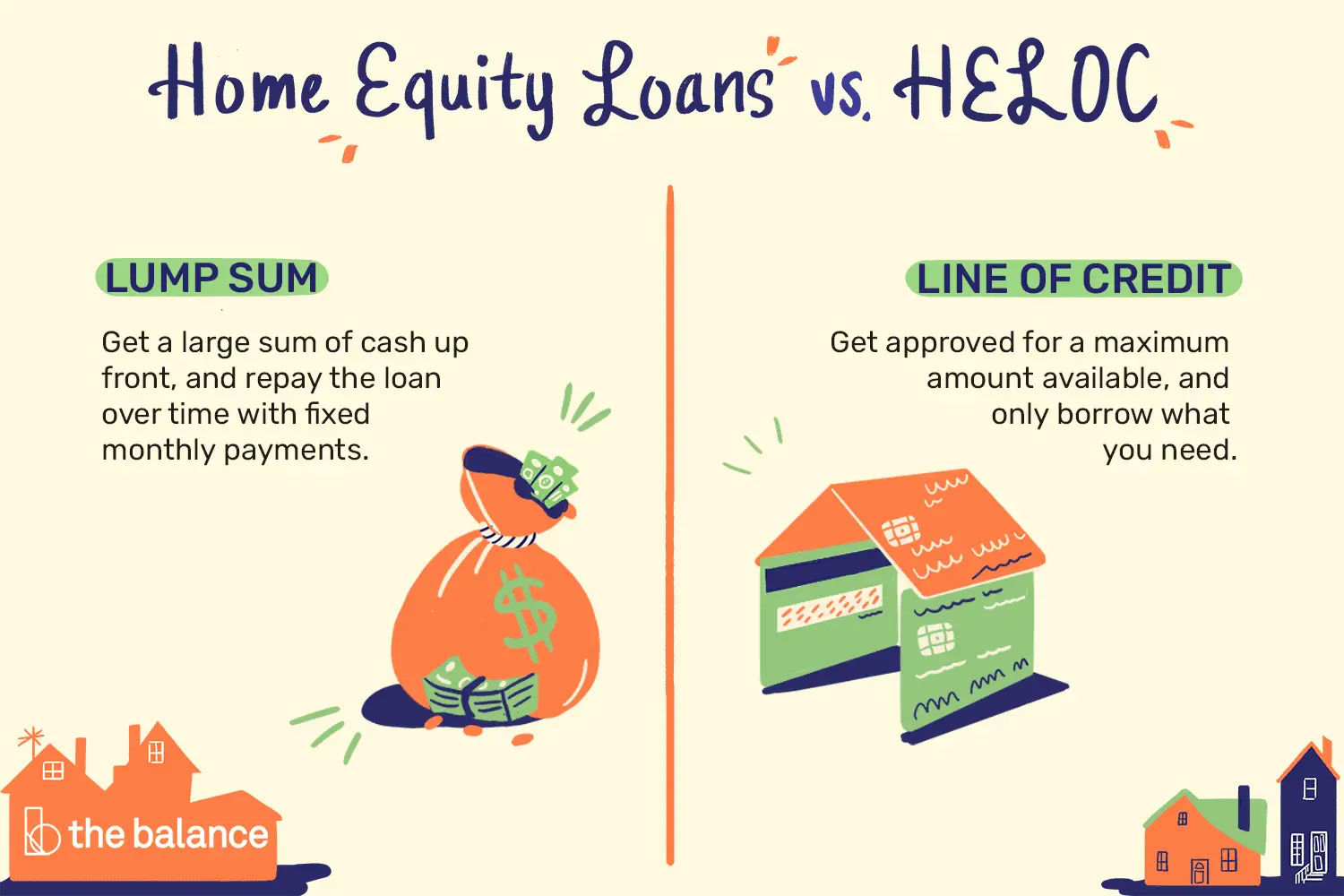

A home equity loan is a lump sum of cash paid to you and secured by your home. Depending on your lender, home equity loan terms can range from five to 30 years.

Homeowners across the U.S. have collectively gained more than $1.5 trillion in home equity during 2020, according to data from CoreLogic. Turning that equity into spendable cash sounds attractive if you need to consolidate high-interest debt, expand a business or replace an aging roof.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Avoid Two Mortgages With A Cash

With home equity loans, theres more predictability than with home equity lines of credit. Youll still be taking out a second mortgage, which means youll have two hefty payments to make each month.

If youre concerned about your ability to juggle two mortgages, you may want to choose a cash-out refinance instead. A cash-out refinance will pay off your primary mortgage and allow you to borrow against your existing equity. This loan option is particularly compelling if interest rates are currently lower than when you purchased your home, as it will replace your existing mortgage with a new loan that has a different interest rate and terms.

To learn more about cash-out refinances and find out how much money you can obtain from your home equity, create a Rocket Mortgage® account.

Get approved to refinance.

Cons Of Using Home Equity For Debt Consolidation

- Could lose the home. The biggest problem with either a HELOC or home equity loan is that you are converting an unsecured consumer debt , into a loan that does require collateral that you could lose.

- Cant be deducted. If an equity loan is used for anything else to pay off credit card or student loan debt or personal use it is not tax deductible.

- Potentially increase debt. If you take an equity loan or HELOC for more than you need to pay off your credit card debts, there always is the temptation to spend unwisely.

Read Also: Does Collateral Have To Equal Loan Amount

Interest Rates And Fees If You Borrow On Amounts You Prepaid

You pay either a blended interest rate or the same interest rate as your mortgage on the amount you borrow. A blended interest rate combines your current interest and the rate currently available for a new term.

Fees vary between lenders. Make sure to ask your lender what fees you have to pay.

You may not have to make any changes to your mortgage term.

Why Take Out A Second Mortgage

Homeowners can use their home equity loan or HELOC for a wide range of purposes. From a financial planning standpoint, one of the best uses of the funds is for renovations and remodeling projects that increase the value of your home. This way, you may increase available equity in your home while making it more livable.

Borrowers should be careful of cross-collateralization because it affects real estate lending terms.

You can also use the money to pay off other high-interest rate debt in an alternative type of debt consolidation. This could be especially helpful for paying off high-rate credit card balances. Youre effectively replacing a high-cost loan with a secured, low-cost form of credit.

Of course, you can also borrow to fund an overseas vacation, a new sports car, or possibly your childs education. Whether its worth eroding your equity is up to you and something to which youll want to give some serious thought.

You May Like: How Can I Refinance My Car Loan With Bad Credit

Why You Shouldn’t Tap Your Retirement

First of all, this money is meant for retirement, and it needs time to grow. If you borrow money from your retirement plan, youre essentially taking it out of whatever it was invested in and missing out on any potential interest or growth it might have otherwise seen. That could leave you with a savings shortfall when you retire.

Something else to consider is the impact if you leave or lose your job before the loan is paid off. Typically, 401 loans must be repaid in full on the due date for filing a federal income tax return for that year after termination. If the loan is not paid in full, it will be treated as a distribution. Distributions are taxable, and if youre under the age of 59½, they’re subject to an additional 10% early withdrawal penalty. That could result in an unexpected tax bill when you file your return.

An exception is if you have a Roth IRA. With this type of retirement account, you can withdraw your original contributions at any time, with no tax penalty. But again, you could end up sacrificing returns on your investment dollars for the sake of paying off debt.

How Does Borrowing From Home Equity Work

Whether youre looking to free up cash for a home renovation or find ways to consolidate debt, borrowing against the value of your home could be a good option. While you pay off your home, you build equity that you can later use for home equity loans or home equity lines of credit .

Because you can use equity for loans or tap into it when selling your home, its a great financial tool. The bigger your down payment and the more you pay toward your mortgage, the greater chance you have at increasing your total equity.

If youre considering using your home equity, keep the following in mind:

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Drawbacks Of Using Home Equity

Using home equity doesnt work for everyone in every situation. Drawbacks include:

- Borrowing costs. Some lenders charge fees for home equity loans or HELOCs. As you shop lenders, pay attention to the annual percentage rate , which includes the interest rate plus other loan fees. If you roll these fees into your loan, youll likely pay a higher interest rate.

- Risk of losing your home. Home equity debt is secured by your home, so if you fail to make payments, your lender can foreclose on your home. If housing values drop, you could also wind up owing more on your home than its worth. That can make it more difficult to sell your home if you need to.

- Misusing the money. It is best to use home equity to finance expenses that will pay you back, like renovating a home to increase its value, paying for college, starting a business or consolidating high-interest debt. Stick to needs versus wants otherwise, youre perpetuating a cycle of living beyond your means.

When You Cant Pay Back Your Loan

Sometimes, even if youre granted a loan, you may encounter financial problems later on that make it difficult to pay it back. Though losing your home is a risk if you cant pay back your home equity loan or line of credit, it isnt a foregone conclusion. However, even if you can avoid losing your home, you will face serious financial consequences.

If the real estate market takes a dip, those with higher combined loan-to-value ratios run the risk of going underwater on their loan.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

The Effect Of Mortgage Repayments On Your Ltv

Assuming youre remortgaging after five years, the repayments youve already made might have a greater effect than you realise.

Based on a £200,000 property, our calculations show that even if the value of your home has remained the same over five years, you could theoretically remortgage and pay off the equity loan while only increasing your LTV from 75% to 84%.

| Price increase after five years | Property value |

| £170,260 | 81% |

Note: Our calculations are based on a £200,000 home bought with a £10,000 deposit and £40,000 equity loan with a 25-year mortgage at a rate of 3%.

If your home has increased in value by significantly more than this in the first five years of ownership, you might find that you can pay off the equity loan when remortgaging and reduce your LTV level at the same time.

One word of caution its important to bear in mind that these figures are just estimates and will vary depending on the specifics of your property and your mortgage deal.

How It Affects Your Credit

Your credit score is unlikely to change much after paying off your mortgage. Your payment history and amount owed have already been factored into your credit score for years.

However, if youre paying off a large lump sum , the effect on your credit may be more noticeable. Your amounts owed, as shown on your credit report, will suddenly be much lower, and that metric is a big component of your credit score, accounting for about 30% of it. In that case, you might see a nice bump. But if you already have excellent credit, the effect may be negligible.

You also should check your credit report after 30 to 60 days to make sure it shows your mortgage was paid off. You can get free weekly credit reports from each bureau on AnnualCreditReport.com through April 20, 2022.

Read Also: How Do I Find Out My Auto Loan Account Number

Increase Your Monthly Payments

Perhaps the most straightforward and simple approach to paying back your home equity line of credit faster is to pay more than the minimum required amount on a monthly basis. Any additional funds made towards your credit payments reduce the principal on your debt. This, in turn, reduces the amount of interest generated from your loan and ensures that you can pay back the money you owe as quickly as possible.

This straightforward strategy lets you establish your own payment amounts that do not strain your budget. Although paying your monthly minimum is essential, taking a proactive approach and channeling additional funds towards this debt is at your discretion. You can skip a month or two if money is tight or add a more substantial amount to pare down the principal with a Christmas bonus or tax return if you choose.

How Fast Does A Home Build Equity

How fast your home builds equity depends on a number of factors. The easiest and most consistent way to build equity is by making your regular monthly mortgage payments. Each payment will build hundreds of dollars in equity. You can also get more home equity if your home appreciates in value, but this is less reliable, since home values fluctuate over time.

Don’t Miss: How Long For Sba Loan Approval

Why Use Our Home Equity Loan Payoff Calculator

Before you take on a new loan, it is always a good idea to see if the monthly payment will fit in your budget and safeguard against negative impacts on future plans. Using this calculator will help you see how long it will take to pay off a desired loan amount with your preferred monthly payment.

Please keep in mind that home equity loans and lines of credit generally have a 10-year maximum repayment period, although that can vary by financial institution and your financial condition.

Bad Credit Home Equity Loans

Lenders are looking for good to excellent credit when considering a home equity loan. You can find some with credit scores in the 620 range, but thats pushing it. Normally, lenders like to see something above 670.

Of course, every situation is different. Home equity loans could become available for borrowers who have lots of equity or a low debt-to-income ratio.

There are also scenarios where it pays to do whatever it takes to boost your credit score in the short term whether its opening a secured credit card, clearing up your collection history and getting on a schedule to avoid late payments so you can qualify for the home equity loan.

Recommended Reading: What Happens If You Default On Sba Loan

Then After Five Years You’ll Start Paying Interest On The Equity Loan Until You Pay It Back

If you don’t repay your equity loan within five years, you’ll start being charged interest on it. Interest is only charged on the original amount you borrow, but can add £100s or even £1,000s to your annual costs. In brief, here’s how it works:

- The initial rate in year six is 1.75%.

- That underlying rate then increases every April by the Consumer Prices Index measure of inflation plus 2%, until the loan is paid off. This is complex to work out, so see this example below…

Let’s imagine CPI stands at a constant 1%, so when you add two percentage points to it, it means the underlying interest rate will climb by 3% each year. If the interest rate in year six is 1.75%, then based on the 3% increase your equity loan interest rate for year seven would be 1.8025%. Getting geeky, that’s 3% of 1.75% which is 0.0525%. Added to 1.75% it gives you a new interest rate of 1.8025%.

| ANNUAL COST FOR EQUITY LOAN OF £40,000 |

|---|

| Year |

What Is Home Equity

Home equity is the difference between the value of your home and how much you owe on your mortgage.

For example, if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

Your home equity goes up in two ways:

- as you pay down your mortgage

- if the value of your home increases

Be aware that you could lose your home if youre unable to repay a home equity loan.

Also Check: What Is Chfa Loan Colorado

Interest In Home Equity Lines Of Credit

While second mortgages are more widely known, homeowners are showing greater interest in lines of credit. The use of HELOC accounts has risen steadily since 2012. As the housing market continues to rebound, interest in accessing a line of credit for the purposes of home improvement is of particular interest to many.

While taking second mortgages resulted in upside-down loans and contributed to the crash in 2007-2008, the HELOC offers a safer and more flexible choice to homeowners. The line of credit can be accessed as needed without having to fully repay the amount borrowed in advance.

Paying Off Your Help To Buy Equity Loan: Step

Whichever way you decide to pay off your loan, youll need to follow these steps:

Also Check: Genisys Auto Loan Calculator