Selling A Car To A Used Car Dealership

If a car dealership will buy used cars without requiring that you buy one from them during the transaction, then the process will probably be pretty straightforward. The dealer will offer you a certain dollar amount and, if you agree, they will pay off the lender in exchange for getting the vehicles title.

If there is positive equity on the vehicle, then youll get the money that remains after the loan balance is paid off. If its a negative equity situation, then youd need to pay the difference between what the used car dealer is willing to pay and what it takes to pay off the loan.

For example, If a dealer offers $15,000 on a vehicle that has a $10,000 loan, then the dealer would take care of the loan payoff and provide the person selling the car the remaining money . In a negative equity situation, for example, if the vehicles value is $10,000 and the outstanding loan is $13,000, then the seller would need to chip in the difference to complete the sale and transfer the title to the buyer.

Recommended: Smarter Ways to Get a Car Loan

Buying Another Car Compare Car Loan Options

Make sure you lock in a great rate on your next car loan with the providers below. Check out details like loan terms, rates and credit score requirements. You can compare two or more providers side-by-side by clicking the compare box beneath each provider youre interest in.

| Total leftover after the car loan is fully paid | $2,200.00 |

Though Kelly had to pay a fee for discharging her loan early, she can now put an extra $125/month towards debt along with the money she was previously paying on gas and auto insurance. Plus, she has an additional $2,200.00 to use as she sees fit. In this case, it was a good idea for Kelly to sell her car even though she still owed money on it.

*The information in this example, including rates, fees and terms, is provided as a representative transaction. The actual cost of the product may vary depending on the retailer, the product specs and other factors.

Know What Your Car Is Worth

Next, youll need to research the current value of your vehicle. With the general supply-chain issues due to the Covid-19 pandemic, the industry is experiencing a scarcity of new carswhich means the market is hot for both new and used vehicles.

You can easily find out the present value of your car by visiting a vehicle valuation site like Edmunds, Kelley Blue Book or Cars.com. Youll need to know the year, make, model, your zip code and overall condition of the vehicle. Vehicles less than three years old hold greater value, but even vehicles up to five years old are in demand.

Read Also: Car Loan Balance Transfer

Take These Steps Before Selling A Car With A Lien

Follow these steps before selling a car you still owe money on:

Consider these factors before you decide to sell

Here are three factors to take into consideration before selling a car that has a lien on it:

- Depreciation. The value of your car can drop considerably in a few short years, so consider depreciation and how much money you can reasonably expect to get for your car.

- Trust. Most people are wary about buying a car with money owed on it.

- Risk of going underwater. If youre working with a dealership and want a car worth more than the value of your current vehicle, you might roll your old balance into a new loan. This can make it easy for your car loan to become upside down.

Selling a car with positive vs. negative equity

Selling a car thats worth more than your loan balance is generally easier than selling a car valued less than your balance.

Ask For A Voluntary Repossession

If you simply can’t afford your car payments any longer, you could ask the dealer to agree to voluntary repossession. In this scenario, you tell the lender you can no longer make payments ask them to take the car back. You hand over the keys and you may also have to hand over money to make up the value of the loan.

Voluntary repossession allows you to return a car you financed without being subject to the full repossession process. This could spare you some credit score damage, though a voluntary repo could still be reported to the credit bureaus.

Recommended Reading: Autosmart Becu

Some Debtors Have Figured Out How To Sell A Car With A Lien By Arranging A Private Sale Agreement In Advance Then Sending A Payoff Amount To The Bank

Many car owners don’t know how to sell a car when the bank has the title, which requires paying off your car loan and transferring the title to the new buyer . If you are still making payments and want to sell your used car, the title almost surely lists the bank as the legal owner and you only as the registered owner.

Are There Any Risks Linked With Trading In My Car With A Loan

There are some risks associated with trading a car with a loan. Considering the risks can help you decide if trading in your car is the right decision right now:

- Taking out another car loan could stretch your budget.

- Getting into more debt could put you into negative equity. The Federal Trade Commission explains negative equity in this article.

Don’t Miss: How Much Can I Qualify For A Car Loan

Have Someone Else Take Over Payments

Finally, you can try to find someone to assume your loan payments along with the car. You can advertise in market places such as Craigslist and eBay Motors to find potential buyers.

The person who buys the vehicle would assume ownership of the vehicle and they’d assume responsibility for the loan as well. But the dealership may require them to apply for financing, complete with a credit check, before they can take over the loan. If they don’t have solid credit, this option might not be doable.

How To Return A Leased Vehicle

If you’ve leased the car, you’re in a somewhat different situation. Obviously, you can’t sell it.You can return the vehicle to the dealer, but if it’s before the lease expires, you’ll likely face some stiff early termination fees. Plus, you will still owe the balance remaining on the lease andâto add insult to injuryâalso lose the upfront money originally paid.

However, drivers who want out of their contract ahead of schedule can take heart: There are a few options that allow you to circumvent the usually harsh termination penalties. One frequently overlooked pathâand often the least expensive choiceâis to transfer the lease to someone else.

It works like this. Suppose you have two years left on a three-year lease. Whoever buys your lease agrees to make the remaining monthly payments. While some finance companies donât allow such transfers, the vast majority do. The trick is finding someone interested in taking the reins from you.

Read Also: Is Firstloan Com Legit

Trading A Car Versus Selling It

When it comes to getting the most out of your used car, is it better to trade it in or should you try to sell it yourself? There are definite pros and cons to both.

Trading it in, as you can see above, is the simplest way to get rid of the car, especially with a lender’s lien still attached. The process is much faster, and the dealership handles the paperwork. Drive your old car in and drive away with a new car. Easy, peasy.

However, trading your car in usually equates to losing at least some money. The car dealer will never give you the true value of the car. He only makes money when he sells the car for more than he has in it. You stand to lose hundreds of dollars by trading in a vehicle instead of selling it yourself.

Even so, the 2020 pandemic saw a surge in the demand for used cars due to more folks foregoing ridesharing and looking for affordable vehicles of their own. This ongoing uptick in car dealerships need for used car inventory may give car owners bigger bargaining power when selling used cars.

In nearly every instance, you will get more for your car through a private party sale. Buyers are more willing to pay closer to the actual value of the vehicle than dealers since they don’t have to factor in any markup on the car.

Is It Smart To Trade In A Car With A Loan

Whether trading in a car with a loan is the right decision for you depends on your circumstances. Trading in a car with a loan might be the smartest thing if:

- Your car has high ownership costs. If your car uses a lot of gas, often needs repairs, or needs specialty parts, it can be financially savvy to trade it in. Choose a smaller car or a more modern one to save money in the long run.

- The dealership has great incentives. Dealers often have promotions that make trading in your vehicle more attractive, according to Birchwood Credit. For example, many dealers have end of financial year deals to clear old stock and make way for new models.

- You’ve done your research. If you’ve researched your options and know what you want, it’s often smarter to trade your car in rather than wait. Visit your dealer to crunch the numbers and see whether you can strike a deal you’re happy with.

Don’t Miss: When Can You Refinance Fha Loan

Talk With Your Lender

Your lender holds the title to your vehicle, so they should be your first point of contact. They want to see the outcome of this transaction come out smoothly for you as their customer, as well as for themselves as the lienholder on the vehicle. Your lender can help you get your payoff amount, navigate the steps to sell to a private party or see the interest rate you qualify for if you decide to trade for a new or used vehicle.

Personalize My Deal Recent Activity

Personalize My Deal tools are complete you’re ready to visit Buerkle Hyundai!

We’ll have this time-saving information on file when you visit the dealership.

- Access your saved cars on any device.

- Receive Price Alert emails when price changes, new offers become available or a vehicle is sold.

- Securely store your current vehicle information and access tools to save time at the the dealership.

- Access your saved cars on any device.

- Receive Price Alert emails when price changes, new offers become available or a vehicle is sold.

- Securely store your current vehicle information and access tools to save time at the the dealership.

Also Check: Refinance Usaa Auto Loan

A Receipt For The Buyer

In most cases, you need to provide the buyer with a bill of sale. A bill of sale acts as a receipt for the purchase of the vehicle and provides basic information needed to prove that the sale actually took place. You can download a bill of sale template on the Internet, or you can create your own. Whichever route you choose, just make sure the bill of sale contains the following information:

- Date of sale

- Selling price for the vehicle

- Odometer mileage readings

In most cases, the certificate of title and a bill of sale are the only documents you need to sell your vehicle to a private party. If you’re selling a vehicle to a dealership, the dealer may have other forms they require you to fill out before buying your car. Most states only require that you have the above documents when transacting the sale of a used vehicle.

How To Sell Your Car With An Existing Loan

The joy of buying a new car is a whole new level of achievement. When you get behind the wheel of your brand-new car for the first time and drive it out of the showroom, theres just no words to describe the happiness and excitement that you are feeling. But the headache of buying a new car lies in the process of selling your car or trading it in if it has an existing hire purchase loan. Dont let this stop you because we know some tips that make the used car with an existing car loan selling process a hassle free one!

Recommended Reading: Aiq Ellie Mae

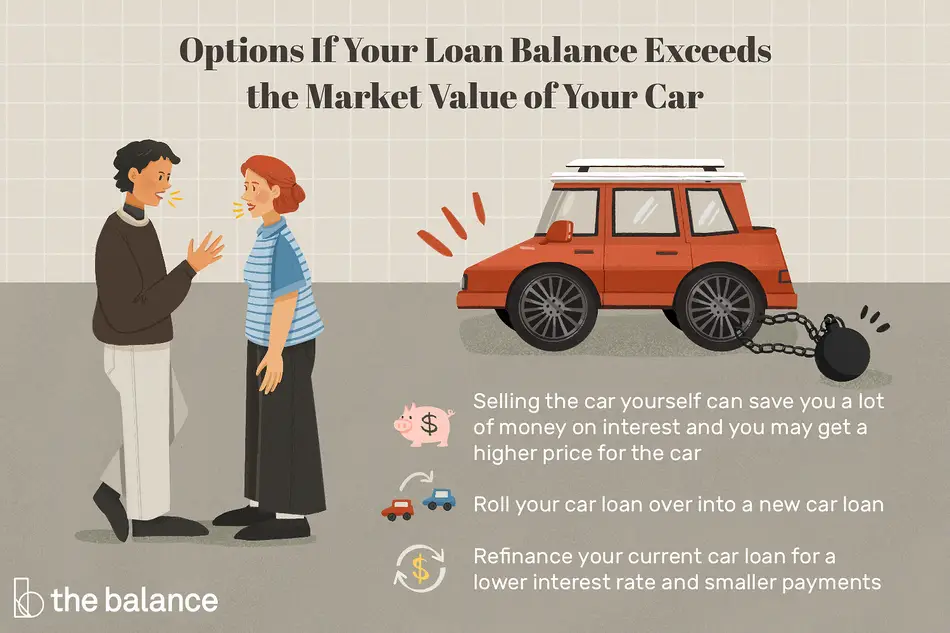

Refinance The Car Loan

If the issue with monthly payments is affordability you may want to look at refinancing your car loan. Qualifying for a new loan with a lower interest rate could save you money and potentially reduce your monthly payment.

It’s important to consider the new loan term, however. If you refinance into a longer loan term, your monthly payments may be lower. But you could still end up paying more in interest versus choosing a shorter car loan. Be sure to check the best car loan rates before going this route.

Trading In Your Still

As you can see, selling a car to an individual when you are still paying for the vehicle can be a complicated process, and that’s putting it mildly. It is much, much easier to trade in a car that’s still under a financing agreement to a dealer as opposed to selling it to a private party. When you trade your vehicle in, the dealership pays off the loan on your behalf, so you don’t have to worry about that awkward period between selling the car and getting the title. The dealer also handles the paperwork, including the transfer of the car’s title, so you don’t have that hassle to deal with either.

To trade in your still-financed car, you will need to bring a few things along with you on the day of your trade-in. Come prepared with your loan info, including your account number and the payoff amount. To transfer ownership, you’ll also need the vehicle’s registration, your driver’s license, proof of insurance, and the keys and remote key fobs for the car, if any. You should also know the odometer reading on the car.

Read Also: Nerdwallet Loan Calculator

Reasons For Returning A Vehicle

There are a number of reasons why you may need to return a financed vehicle. Returning a car could make sense in any of the following scenarios:

- You can no longer afford the monthly payments and want to avoid repossession.

- You purchase a new or used car only to realize shortly after that it’s a lemon.

- You believe you overpaid for the vehicle and would like to look elsewhere for a car.

- You move to a new city and no longer need the vehicle.

- You simply changed your mind about the purchase.

Trading the vehicle in for a less expensive car is something to consider if you still need a car but can’t afford the one you have. You’d still have a car loan payment. But if the vehicle is less expensive, the new payment may be more affordable for your budget than the previous one.

How To Deal With An Out

If the lender is not local, youll need to bring the bill of sale on the car to your state Department of Motor Vehicles. Youll want to obtain a temporary operating permit for the buyer. This will allow you to transfer the vehicle to the buyer, and then to deliver clear title to the buyer once the loan has been paid.

Obviously, you will not have the title until the loan is paid off in full, so there will be a delay of several days while that process is completed. You may have to pay a fee to your lender to expedite the title, a process that ordinarily takes several weeks. The risk of this delay will be a problem primarily for the buyer, since he or she will have a vehicle without having the legal title. However, there is no easier way to complete the sale, unless you have the personal funds to pay off the car loan prior to the sale of the car.

Read Also: How Long Does The Sba Loan Process Take

Can I Trade In My Car If Its Not Paid Off

In general, you can trade in your car for a new one even if youre still making payments on it. But first it helps to know how much equity you have in the vehicle. Thats the difference between your cars current value and the amount you owe on the loan. Depending on those two factors, you have either positive or negative equity.

Refinance Your Existing Car Loan

If your financial situation permits it, you can seek a refinancing loan for your car at a lower interest rate. Rather than getting a new car, you can discuss refinancing options. This option requires a good enough credit score from a credit bureau to obtain a beneficial interest rate. Lower interest rates can give you enough financial breathing room to pay off your loan.

Don’t Miss: Fha Refinance Mortgage Calculator