How To Refinance Parent Plus Loans In 7 Steps

While the idea of refinancing your Parent PLUS Loans may seem overwhelming, its actually a fairly simple process. You can refinance your loans in just seven simple steps:

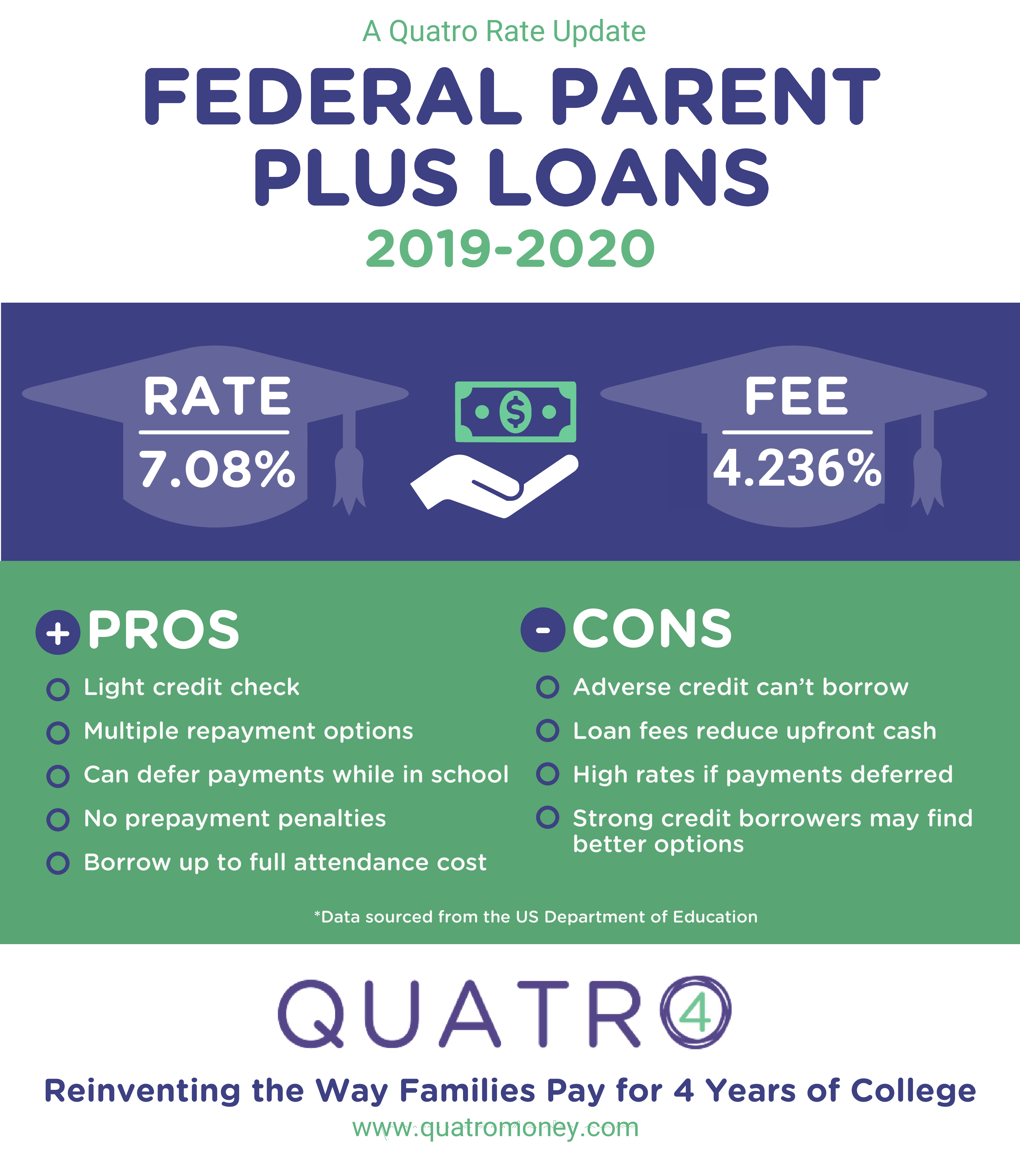

What Are The Interest Rates And Fees

The interest rates for Parent PLUS loans are fixed and updated annually by the Department of Education. You can view up-to-date interest rates on the link below.

There is also an origination fee which is a percentage of the total loan amount which is deducted before the loan is credited to your student’s billing statement. Please consider the origination fee when determining the amount of your loan request.

Parents Can Qualify For Student Loan Forgiveness Too Heres How

- Joanna Nesbit

As a public librarian, Wyscarver, 55, of Caldwell, Ohio had been vaguely aware of a government program that offers loan forgiveness to borrowers with qualifying jobs like hers. But she didnt explore her own participation in Public Service Loan Forgiveness until her oldest child suggested it.

Federal parent PLUS borrowers are the one of fastest growing segments of higher education borrowers. At the end of 2021, parents held $105 billion in PLUS loans, a 35% increase from five years earlier. The typical parent borrows about $24,400, but many borrow much more. Because these loans dont come with caps as student loans do, parents can get into trouble quickly by borrowing more than their income can support. With fewer years left in their working career and limited repayment options, a hefty PLUS debt can easily derail parents retirement plans.

Don’t Miss: Car Loan Calculator Usaa

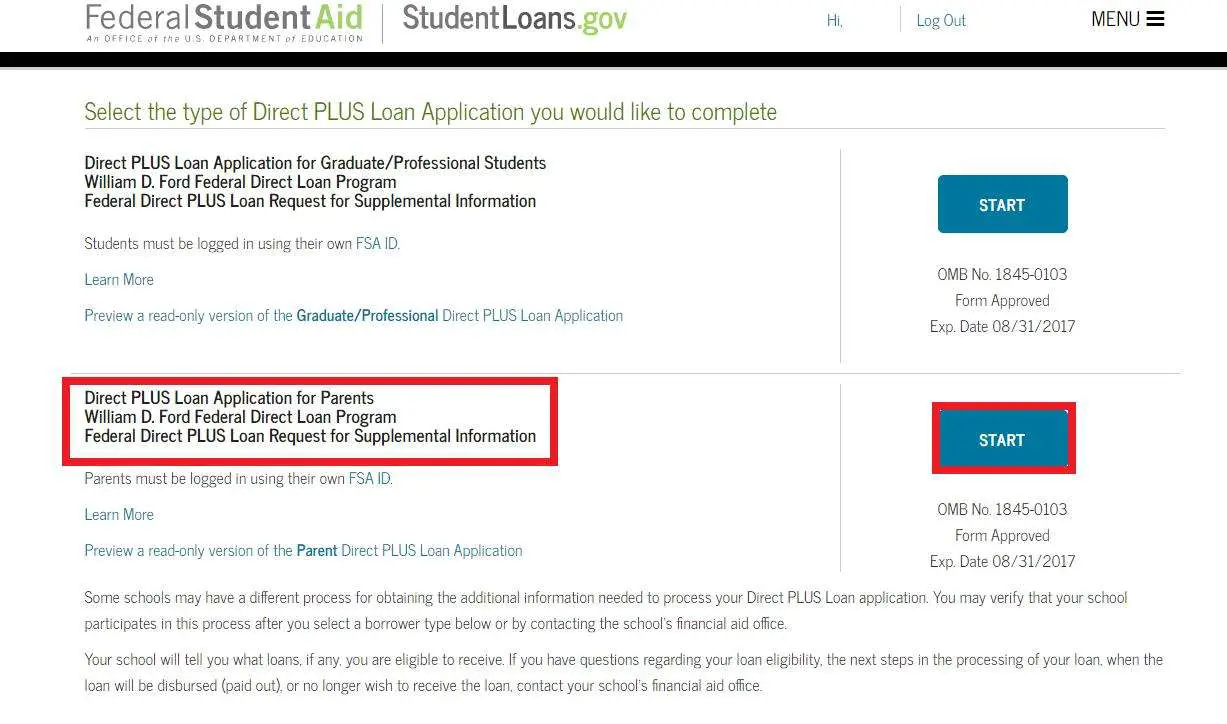

What Is A Direct Plus Loan

Federal Direct PLUS loan is a federal financial aid program for graduate/professional students and parents of dependent undergraduate students. Depending on the borrower, there exist two types of PLUS loans graduate and parent PLUS loans. Their interest rates, application, and repayment conditions are similar.

The main difference between these two programs is in the eligibility requirements. Besides, graduate PLUS loans are automatically deferred if the borrower is still in school. However, for parent PLUS loans, deferment should be required.

In the following sections, we will explain the different types of Direct PLUS loans.

Lenders That Refinance Parent Plus Loans

Not all refinancing lenders will work with Parent PLUS Loan borrowers. Even among those that do, only some allow parents to transfer their loans to their children.

If youre looking for a lender, here are the top companies that offer Parent PLUS Loan refinancing:

- College Ave: College Ave offers refinancing loans with variable and fixed interest rates. You can choose a repayment term as long as 20 years.

- Earnest: Unlike other lenders, Earnest allows you to refinance your parent loans before your child has graduated you can qualify as long as your child is in their last semester of their program. The lender offers fixed and variable rates, and has loan terms as long as 20 years.

- ISL Education Lending: ISL Education Lending only offers fixed interest rates on refinancing loans. It allows borrowers to refinance up to $300,000 in student loan debt.

- PenFed Credit Union: PenFed is one of the few lenders that allows parents to transfer their loans to their children through refinancing. And, it offers both fixed and variable interest rates.

- Education Loan Finance : ELFI is another lender that does allow parents to transfer their loans into their childs name by refinancing. ELFI also offers no maximum loan amount.

| Allows You to Transfer Loans to Child | No | ||||

| 5 20 years | |||||

| Loan Limits | $5,000 to $300,000 for those with medical, dental, pharmacy, or veterinary degrees | $5,000 to $500,000 | $5,000 to $300,000 | $7,500 to $300,000 | $15,000 to No Maximum Loan Limit |

Don’t Miss: How Much Car Payment Can I Afford Based On Salary

What Is Parent Plus Loan Forgiveness

Like other types of student loan forgiveness, parent PLUS loan forgiveness cuts short your repayment obligations. If you meet certain requirements, you can stop repaying your debt and have the remaining balance wiped away.

Parents who take out PLUS loans must qualify for loan forgiveness based on their own circumstances, not those of the child for whom they borrowed loans. For instance, the Public Service Loan Forgiveness program provides loan forgiveness after a certain time to borrowers who work in government and nonprofit jobs. To get parent PLUS loans forgiven under this program, the parentnot the studentmust work in a qualifying job.

Forgiveness for parent PLUS loans also often requires actively confirming your eligibility and submitting an application. In certain instances, though, the government may contact you to explain that youre eligible for a forgiveness program.

Use Chipper For Round

Paying off your student loans doesnât have to be a long and painful journey. Round-Ups are a way to directly pay off your loans with your everyday spending! By tracking your linked spending account, we will calculate the rounded up amount from each transaction in a week . We then initiate a payment towards your student loan for the weekly amount. Get chipping away on your student loans with Chipper today.

Don’t Miss: Does Capital One Do Auto Refinancing

How Are Funds Paid Or Disbursed

PLUS loan funds are sent via to the University for application to the student’s campus account. Accepted loan funds are divided so half the funding is provided for the Fall semester and the other half is provided for the Spring semester.

Once the funding has been sent to the University, the Office of Financial Aid will again verify the student’s eligibility for payment. Then the funds are applied to the student’s remaining campus balances, this would include Campus Tuition and Fees, as well as CSUF On-Campus Housing Charges. Once the student’s account has been paid in full, Student Business Services will mail a check for the remainder of the funds to the parent borrower. If the student owes money to the University there will be a temporary hold placed on the disbursement until the balance on the student’s account is paid in full.

Keeping The Car Outside Of Bankruptcy

The 2005 Bankruptcy Abuse Prevention and Consumer Protection Act eliminated drive through car loan agreements for bankruptcies. Before the act, consumers and car lenders could continue with whatever agreement they wanted, ignoring the bankruptcy. While drive-throughs are now against bankruptcy rules, it still happens and courts rarely enforce it. When no intention to reaffirm, redeem or surrender the car is filed by the deadline, a car loan is dropped from the bankruptcy. In many cases, the car owner and lender continue to do business and always, and courts rarely enforce it. Of course, this only works for the car owner if theyre making payments on time.

Since this option is counter to bankruptcy law, its not necessarily something youd want to pursue, and it provides a lot less protection than going with one of the routes allowed by law.

Also Check: Do Married Couples Have To File Bankruptcy Together

Don’t Miss: Typical Student Loan Debt

States Not In Navient Settlement

You do not qualify for the Navient student loan settlement if your mailing address on file with Navient as of June 30, 2021, was in one of these states: Alabama, Alaska, Idaho, Mississippi, Montana, New Hampshire, North Dakota, Oklahoma, South Dakota, Texas, and Utah.

You’re not eligible for relief because your state’s attorney general didn’t participate in the lawsuit against Navient. Although you do not benefit from the settlement, you and other residents of those states may file individual lawsuits against Navient to get relief.

How Parent Plus Loans Can Qualify For Pslf

Parent PLUS loans are not directly eligible for income-driven repayment plans, which are necessary to have some debt remaining to forgive after 120 qualifying payments.

However, if the Parent PLUS loans entered repayment since July 1, 2006 and are included in a Federal Direct Consolidation Loan, the consolidation loan is eligible for Income-Contingent Repayment , the oldest income-driven repayment plan. A Federal Direct Consolidation Loan that repaid a Parent PLUS loan is not eligible for the other income-driven repayment plans.

This provides a method for forgiveness of Parent PLUS loans through PSLF by consolidating the Parent PLUS loans and choosing an income-contingent repayment plan for the consolidation loan.

To count toward forgiveness, 120 qualifying payments must be made while the loans are repaid in the Direct Loan program, in a qualifying repayment plan , while the borrower works full-time in a qualifying public service job.

Temporary Expanded Public Service Loan Forgiveness allows payments made in graduated repayment or extended repayment to count, if the last year of payments are at least as much as they would have been in an income-driven repayment plan.)

All of these conditions must be satisfied simultaneously. Payments made prior to consolidation do not count, as consolidation resets the payment clock. Public service employment prior to the borrower entering repayment or prior to the loans being in the Direct Loan program does not count.

Recommended Reading: Usaa Car Buying Rates

Public Service Loan Forgiveness

The Public Service Loan Forgiveness program provides tax-free forgiveness to borrowers who work full-time for an eligible nonprofit or the government. Borrowers must make 120 qualifying payments before they can apply for forgiveness. While working towards PSLF, youll make payments using an income-driven repayment plan, which keeps monthly bills low and allows for the maximum possible forgiveness.

As a parent PLUS borrower whose job makes you eligible for PSLF, there are a few extra steps to take to participate. Youll need to consolidate PLUS loans into a direct consolidation loan, for example, and then choose ICR as your repayment plan. If you already work for a qualifying employer when your child leaves school and enters repayment, you could receive forgiveness in as early as 10 years, one of the shortest forgiveness time frames available.

People Are Also Reading

But there are relief valves available, including options to have your loans forgiven. Those who work in a public service job may be able to qualify for Public Service Loan Forgiveness, while parents with a low income can limit the size of their monthly payments.

Both options require enrolling in whats called the Income-Contingent Repayment Plan, which sets monthly payments at 20% of your income and forgives your balance after either 10 years or 25 years of qualifying payments.

Still, getting your loans forgiven through either of these strategies involves jumping through a few hoops, and the process can get complicated when youre borrowing for multiple children. Heres how to navigate the process:

Read Also: Can You Refinance An Upside Down Car Loan

Borrowing Limits And Costs

Like other student loans, there are limits on how much money a parent can borrow using a parent PLUS loan. Parents can get loans for up to the colleges total cost of attendance, minus any financial aid that the student they are borrowing for receives. This includes financial aid in the form of scholarships and grants as well as loans given directly to the student by the government.

For example, if a schools cost of attendance is $40,000 and the child receives a $20,000 scholarship and $10,000 in federal loans, their parent can borrow a maximum of $10,000 through a Parent PLUS loan.

You are not obligated to borrow the full amount offered by a parent PLUS loan. You can choose to refuse some or all of the loan amount offered.

The interest rate on parent PLUS loans varies over time and is based on market interest rates. The interest rate for loans disbursed between July 1st, 2020, and June 30, 2021 is 5.30%.

On top of the interest, parents must pay an origination fee when they receive the loan. This fee also changes from year to year. The fee for loans disbursed between October 1st, 2020 and September 30, 2021 is 4.228%

Parents can apply for PLUS loans each year their child is in school.

What Is Adverse Credit History

- A current delinquency of 90 or more days on more than $2,085 in total debt or

- More than $2,085 in total debt in collections or charged off in the past two years or

- Default, bankruptcy discharge, foreclosure, repossession, tax lien, wage garnishment, or write-off of federal student loan debt in the past five years

Also Check: Usaa Auto Loans

Denied A Parent Plus Loan

If you are found to have adverse credit history, you may still be able to borrow from the Parent PLUS Loan program. You have two options: submit a successful extenuating circumstances appeal for an exceptional circumstance, or reapply with a cosigner who does not have an adverse credit history.

If you want to appeal the decision, you must submit a request to appeal the decision and provide information regarding your denial decision. If successful, you may be required to completed loan counseling prior to receiving the Parent PLUS loan funds.

If you would like to apply with a cosigner who does not have adverse credit, the cosigner would need to complete an endorser application.

Now, if neither of these options works for you, your denial of a Parent PLUS Loan would actually make your dependent undergraduate student eligible for independent undergraduate student Stafford loan limits. Meaning, they will have access to additional loan funds they can borrow under their name to help pay their own college costs.

Who Is Eligible For A Direct Plus Loan

To receive a Direct PLUS Loan, you must

- be a graduate student enrolled at least half-time at an eligible school in a program leading to a degree or certificate, or be the parent of a dependent undergraduate student enrolled at least half-time at a participating school

- not have an adverse credit history and

- . If you are borrowing on behalf of your child, your child must also meet these requirements.

Recommended Reading: Conventional 97 Loan Vs Fha

How To Seek Parent Plus Loan Relief Via Refinancing

Your child must be the one who applies for student loan refinancing and gets approved, though you could act as a cosigner. Most lenders look for a steady source of income and a strong credit score before approving a refinanced student loan.

If your child has a creditworthy profile, they could qualify for a lower interest rate than the often high rate that Parent PLUS loans have. Plus, they could choose new repayment terms of shorter or longer lengths.

If refinancing isnt currently an option and forgiveness seems too far off, consider other changes to your repayment, such as

How Do You Qualify For A Parent Plus Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You can qualify for a parent PLUS loan if you meet the following eligibility requirements:

-

You don’t have adverse credit history.

-

You are the parent of a qualified undergraduate student.

-

You meet general federal aid requirements.

Heres more information about parent PLUS loan eligibility and what to do if you don’t qualify.

Also Check: Fha Maximum Loan Amount Texas

My Credit Was Not Accepted What Are My Options

- The borrower can re-apply for a PLUS loan with an endorser who does not have an adverse credit history. An endorser is someone who agrees to repay the Parent PLUS Loan if the parent does not repay the loan. The PLUS Loan endorser cannot be the student. The endorser will be required to obtain a FSA ID. The endorser will then need to use a unique PLUS Endorser Code and URL provided by the borrower to complete the Endorser Addendum for the Parent PLUS Loan at www.studentaid.gov.

- The borrower may appeal the adverse credit decision if they believe extenuating circumstances may exist. for more information.

- Federal Direct Unsubsidized Federal Loan. Students whose parents are denied a PLUS loan may qualify to receive additional Unsubsidized Federal Loan. Freshmen and Sophomores can receive an additional $4,000., and Juniors and Seniors can receive an additional $5,000.

Please note that if are approved through an appeal or through an endorser, you must also complete the PLUS Credit Counseling. Go back to the Home Page click on Complete PLUS Credit Counseling.

How To Get Parent Plus Loan Forgiveness Via Pslf

If you stayed on the standard 10-year plan, you wouldnt have any remaining balance left on your loans to forgive. And youre not eligible for most income-driven repayment plans with the exception of ICR, if you consolidate first.

So again, youll need to apply for a Direct Consolidation Loan and then get your loan on ICR. Assuming you have a large enough loan and work for a qualifying employer, this route could lead you to loan forgiveness.

| Latest news on PSLF for parent borrowers |

|---|

| Unfortunately, Parent PLUS loans were largely excluded from the PSLF waiver enacted in October 2021. |

If you work in public service, hold onto relevant documentation that you might need when you apply. You could fill out and submit the PSLF Employment Certification form annually, for instance, or more often if you change employers.

| Are there other forms of Parent PLUS Loan forgiveness? |

|---|

|

Though it goes by a different name, Parent PLUS Loan borrowers could receive a student loan discharge in rare situations, such as: School closure |

- Dentist

- Military

There are also more and more companies that pay off student loans for employees. Similar to a 401 match, these companies pay off their employees student loans up to a certain amount.

You May Like: How To Apply For Sss Loan